CLP India is owned by the CLP Group, one of the largest investor-owned power businesses in Asia, and Caisse de dépôt et placement du Québec (CDPQ), one of Canada’s leading institutional fund managers. The power sector is a core business of CLP and India is one of its primary markets with a commitment spanning decades.

The CLP Group entered the Indian power sector when it acquired a stake in the 655 MW gas-powered Paguthan combined cycle power plant (formerly known as Gujarat Paguthan Energy Corporation) in Gujarat in 2002. Meanwhile, CLP’s journey in renewable energy started in 2005 as part of its climate commitment. Apart from this, a favourable policy environment for renewables provided attractive project opportunities. “Renewable energy has seen steady growth and is now the mainstay of our business. India is perhaps the most attractive renewable energy market in the world today, a position that has been achieved through a steady evolution of policies and expansion of scale,” says Mahesh Makhija, director, business development and commercial (renewables), CLP India.

Current portfolio

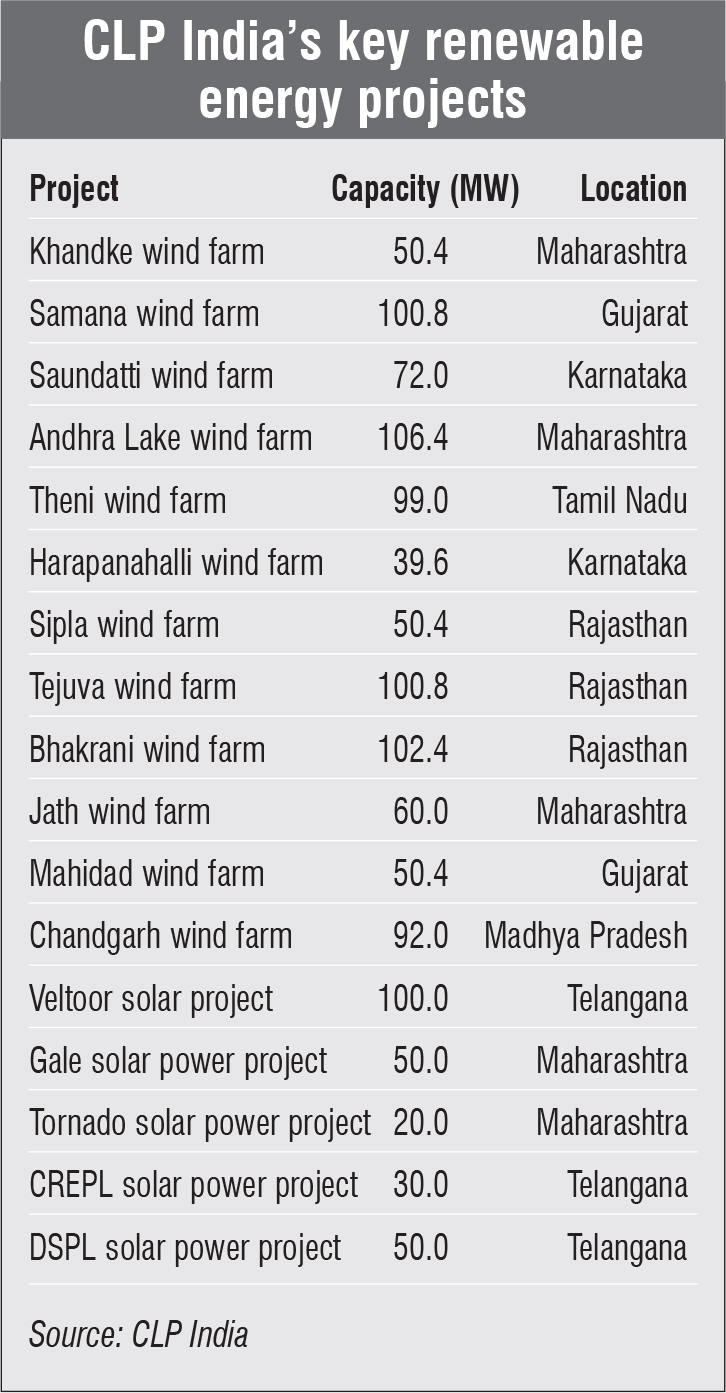

Since 2002, CLP India has witnessed a slow but steady growth of its portfolio. Currently, the company has a diversified portfolio of over 2,400 MW, which includes 200 MW of solar and 924 MW of wind power capacity, and a 1,320 MW supercritical coal-fired power plant. In 2019, CLP India diversified from its non-carbon business and entered the transmission sector by acquiring Satpura Transco Private Limited, an intra-state transmission project consisting of a 240 km double circuit 400 kV transmission line. On the company’s growth story, Makhija says, “Over 18 years of operating in India, CLP India has successfully developed a portfolio that achieves a balance between stakeholder expectations related to environmental protection, and affordability and reliability of electricity generation.”

Experience with green bonds

CLP India has been exploring the potential of innovative financial instruments such as green bonds. It was the first in the industry to announce a corporate green bond issuance from South Asia and Southeast Asia. It raised Rs 6 billion from green bonds to secure capex for its renewable energy projects in 2015. It was also the first power company in India to issue an asset-specific bond for its coal-fired plant in Haryana. In 2020, it was reported that CLP Wind Farms (India), a subsidiary of CLP India, raised Rs 2.96 billion through green bonds. The proceeds will be used to refinance loans used for renewable energy projects. According to the company’s statement, the funds will support the expansion of its renewable energy portfolio, which is in line with its objective to invest in businesses with a low carbon footprint.

CLP India is a leading IPP in the Indian wind industry, with operational wind assets in six states. It commissioned its first wind energy plant, of 50.4 MW capacity, at Khandke, Maharashtra, in 2009, and is selling the electricity generated from this plant to the Maharashtra State Electricity Distribution Company under a 13-year power purchase agreement (PPA). The company had set up many wind energy projects across India till 2015. Post-2015, it had to put a pause on its wind energy business due to disruptions in the industry caused by the transition from the feed-in tariff regime to competitive bidding. The company then participated in the Solar Energy Corporation of India’s Tranche VIII auction for 1,800 MW of interstate transmission system-connected wind energy in 2018-19, and won a capacity of 250.8 MW at the lowest tariff of Rs 2.83 per kWh.

According to Makhija, with a policy and market framework in place, most of the issues faced by the wind power sector have been addressed, and some technical challenges that remain too can be addressed. “As a resource, however, the highly variable nature of wind power could pose a challenge as we look at a future of schedule-based projects. This challenge is unavoidable, but it can be managed with adequate support from a solar mix and storage solutions,” he says.

Solar energy business

Considering the enthusiasm in the Indian solar power segment, CLP India entered the solar segment in 2016 by signing an agreement with Suzlon Energy to buy a 49 per cent stake in SE Solar, a special purpose vehicle (SPV) set up for implementing the 100 MW Veltoor solar power project in Telangana. For this solar project, the company signed a 25-year PPA with the Telangana Southern Power Distribution Company. The Veltoor solar plant started operations in 2017 and was awarded the DNV GL solar PV project quality certificate.

Later, in 2018, CLP India signed an agreement with Suzlon for two additional solar projects of 50 MW and 20 MW in Dhule, Maharashtra. It had agreed to acquire a 49 per cent stake in Gale Solarfarms Limited and Tornado Solarfarms Limited, the two SPVs set up by Suzlon. Recently, CLP India has entered into share purchase agreements with Mahindra Renewables Private Limited. “In 2020, we acquired Cleansolar Renewable Energy Private Limited, which has an operational 30 MW solar power project, and Divine Solren Private Limited, which owns a 50 MW solar power project,” says Makhija.

According to Makhija, while there are implementation issues, there are also many positives in the Indian solar power segment. One, solar energy is a reliable source of energy. Two, the policy environment has been conducive to its growth. Three, the government’s support has helped in the promotion of the sector. Four, there is tremendous political will to expand the solar power segment going forward.

CLP India’s experience in the solar power sector has evolved with the changing technologies and supply chains. “Our experience in setting up solar projects has evolved from two perspectives – technology and implementation. The evolution of technology and streamlining of products for India’s climatic conditions (heat, turbidity, humidity, etc.) received support from the supply chain. Now, most leading suppliers design products for Indian conditions,” adds Makhija.

Impact of Covid-19 and the outlook for the future

CLP India’s operations have been largely unaffected by the Covid-19 pandemic, even during the lockdown. On the generation side, the reduced demand led many thermal plants to lower their utilisation capacities although renewable energy generation remained unaffected. The power sector faced many challenges during the lockdown, but recovered significantly once the unlocking phase began. “The pandemic did, however, impact the commercial functioning of the industry owing to the reduction in demand by 25-28 per cent during peak months and the challenges in collecting payments from consumers,” he adds.

According to Makhija, the future of the renewable energy industry lies in schedule-based auctions, and CLP India’s plan is to focus on such auctions going forward. This segment will cover all renewable energy sources and storage technologies. However, CLP India’s portfolio size is quite small when compared to that of its peers in the utility-scale space. Many companies that entered the renewables space along with CLP India, or even later, have already built multi-GW portfolios through organic and inorganic routes. There are many challenges facing the sector, especially in terms of timely payment, land and transmission unavailability, and power offtake concerns. These challenging market conditions might make it difficult for the company to pursue its growth plans, especially in the face of stiff competition from its peers.

To safeguard itself from the challenges, the company is looking to diversify and is focusing on the transmission space. It has strong financial backing, which will help it achieve its growth plans. The company’s future business strategy will be based on its commitment to reducing the carbon intensity of its portfolio, which is in line with the vision of both its shareholders – the CLP Group and CDPQ. To keep this commitment, CLP India will continue to direct 100 per cent of its new investments into the low-carbon space. “CLP India will invest only in non-emitting businesses such as renewables and transmission. Of these, we will focus strongly on the renewable energy sector, which has evolved more from a market depth perspective and can achieve significant growth in the next three to five years to reach a platform size that can be listed,” he says.