India’s renewable power sector has witnessed increasing investments over the past few years, particularly in the solar and wind segments on account of their competitive advantage vis-à-vis other sources of power. By awarding contracts to multiple private developers over the years, a competitive industry structure has been created, with tariffs falling to less than Rs 3 per unit. Consequently, the solar power segment has grown rapidly, at a compound annual growth rate (CAGR) of 50 per cent between 2015-16 and 2019-20, as Indian players capitalised on the global decline in solar panel prices and bid aggressively in multi-GW mega auctions. Meanwhile, the wind power segment has witnessed moderate growth of 9 per cent between 2015-16 and 2019-20, with the uncertainties arising from competitive bidding continuing to impact growth even after over two years.

Recent months have seen a slowdown in annual capacity additions of both solar and wind power due to transmission and land constraints. Moreover, developers now have to face uncertainties regarding the sanctity of contracts and the issue of non-payment by distribution companies. Adding to their woes, the year 2020 has proved to be extremely challenging for all businesses, including renewables, owing to the coronavirus outbreak and the subsequent lockdown. Construction activities were halted during the initial days of the lockdown, virtually stranding millions of rupees of investments and thereby incurring incremental running costs. Although construction of renewable power projects was eventually permitted, many under-construction project sites remained completely shut down due to manpower unavailability and supply chain disruptions. Moreover, the signing of power purchase agreements (PPAs), government approvals, land acquisition and financial closures were delayed significantly. Although things have started to improve slowly, most under-construction solar and wind power projects are facing long delays, with their commissioning being pushed back by a couple of months. To provide some relief to developers, suitable extensions have been granted to them in all their timelines due to Covid-19, in line with the Ministry of New and Renewable Energy’s (MNRE) guidelines.

Against this backdrop, the Central Electricity Authority’s (CEA) recently released “Report of Under-construction Renewable Energy Projects” gives detailed, plant-wise status of the various solar and wind power projects as well as related transmission projects that are under construction. The renewable power projects covered in the report are those that have been allocated under the Solar Energy Corporation of India’s (SECI) auctions, with various details regarding their location, status, targets for completion, buyers and associated transmission systems collected from the developers, SECI and the MNRE.

Renewable Watch highlights the key observations based on a detailed analysis of the project-level data presented in the report…

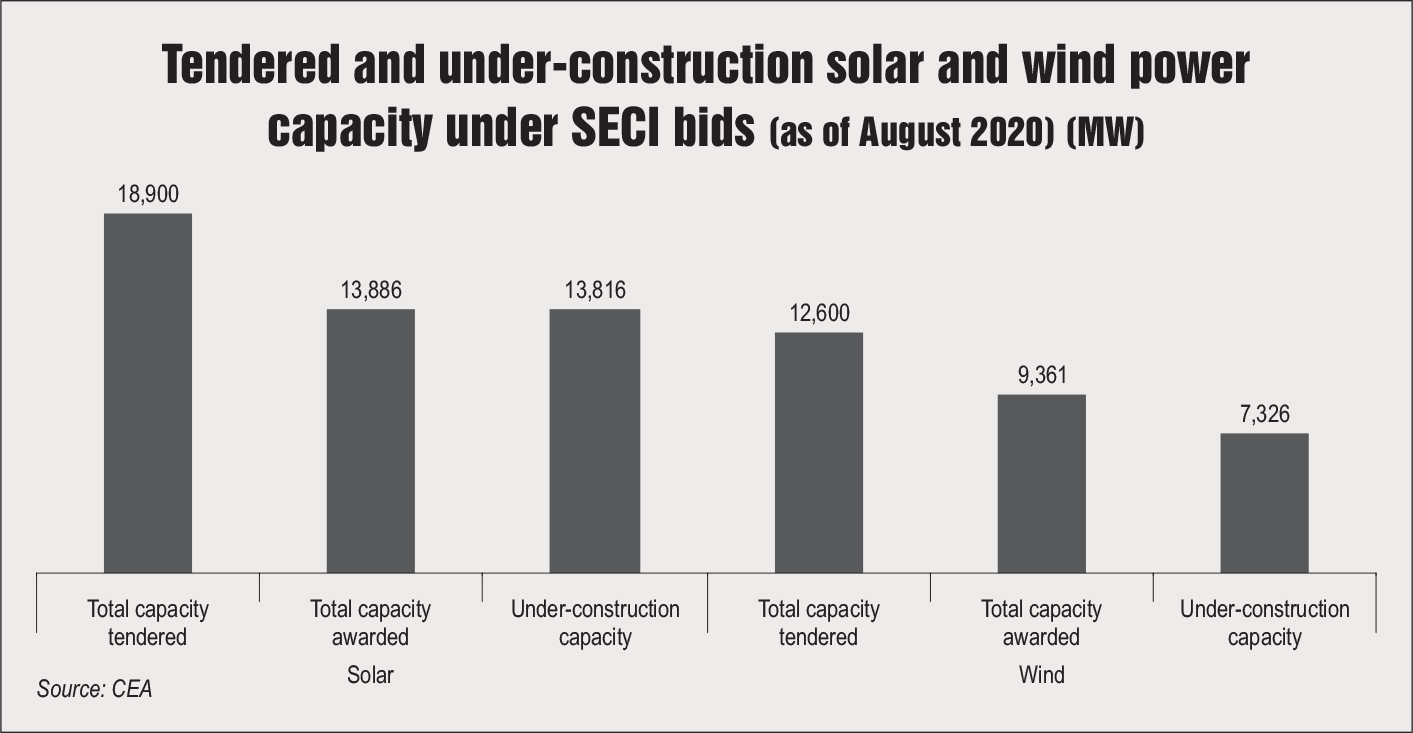

According to the CEA’s data, 18,900 MW of solar capacity has been tendered in 14 auctions, of which 13,886 MW has been awarded. Of this, 61 projects, totalling a capacity of 13,816 MW, are still under construction. In fact, the entire 2,000 MW of solar capacity awarded under Tranche I of SECI’s interstate transmission system (ISTS)-connected solar auction – for which the letters of award (LoAs) were issued more than two years back in July 2018 – remains incomplete. All the eight projects being implemented under this auction are coming up in Rajasthan, and their timelines have been extended due to the delay in the construction of power evacuation infrastructure and long-term access (LTA) operationalisation. Two more projects awarded in August in the same year under Tranche II of SECI’s ISTS-connected solar auction have also been delayed because of similar transmission constraints in Rajasthan.

Another major issue that is evident from the CEA’s project-level data is the delay in the signing of PPAs and power sale agreements (PSAs). In many cases where PPAs have been signed between developers and SECI, PSAs are yet to be signed by the end procurer. According to the report data, the signing of PPAs or PSAs or both is still awaited for about 5,400 MW of solar power capacity. Thus, roughly 39 per cent of the solar project capacity awarded over the past two years does not have proper power offtake arrangements. This is not very encouraging news for the segment, given that a few of these projects were awarded over a year ago and delays in offtake arrangements impact their entire financials. Meanwhile, land acquisition continues to be a problem for solar power plants, with only eight projects having completed their land acquisition.

For some projects, the situation is so dire that developers have been unable to progress beyond LoAs for months on end. For instance, all the three developers that have LoAs, signed in August 2018 for implementing the 750 MW Kadapa Solar Park project in Andhra Pradesh, are still awaiting the signing of PPAs, handover of land and construction of transmission lines. In addition, the recent tariff renegotiation episode in Andhra Pradesh wasted one entire year in tariff adoption and even after that there has been no progress on these projects. Moreover, with Covid-19 hitting solar imports and supply chains, projects have been delayed by about five to six months. However, considering the issues inherent in the segment, which pre-date Covid, a further pushback in commissioning deadlines can be expected.

Under-construction wind power projects are faring even worse. Of the total 12,600 GW of wind power capacity tendered, only 9,361 MW has been awarded as many wind power tenders were left unsubscribed and saw poor response from developers. At present, 49 projects, totalling 7,326 MW of wind power capacity, are under construction. More than 90 per cent of the upcoming wind capacity is going to be located in Gujarat. The state has been in the limelight for its strict land allocation policies. This has created issues in land acquisition for the developers, pushing back project timelines by months and stranding hundreds of megawatts of wind power capacity. Moreover, most of the capacity is going to be set up in the Rann of Kachch, where transmission infrastructure construction has been moving at a slow pace. In fact, construction work for many of the transmission lines in Gujarat is yet to be awarded, which will cause significant delays in commissioning and power evacuation for the upcoming wind power projects.

Like Gujarat, developers in other parts of the country are also facing major hurdles in land acquisition and transmission availability. Only six out of the 49 projects tracked in the CEA report have completed their land acquisition process. Moreover, the implementation of transmission systems is in progress for only a few projects; in many cases it has not even started. Thus, the task of placing orders for materials and project erection have been pushed out for these projects, which will lead to significant delays in their commissioning. The only positive for these wind power projects is that, compared to solar power projects, PPAs and PSAs have been signed for most of these.

The way forward

The project-level status of the under-construction solar and wind power capacities, as presented by the CEA, paints a gloomy picture of India’s renewable energy sector, which is targeting 175 GW of installed capacity by 2022. The majority of the under-construction projects have months to go before they actually start project erection work, provided they get land approvals and transmission connectivity. Even before that, these projects would need PPAs and tariff approvals to get their financial closure done in time. Covid-19 has exacerbated the situation and elongated the timelines of the already delayed projects.

Thus, based on the CEA data, the question that arises is – will the sector be able to achieve its ambitious capacity addition target? Much now will depend on the policy-makers, regulatory agencies and industry bodies, which would need to all work together and plug the gaps in order to resume sector growth.

By Khushboo Goyal