Europe continues to be a leader in energy transition, which gets reflected in its ambitious renewable energy and decarbonisation targets. By 2030, renewable energy will constitute 50 per cent of the continent’s total electricity generation and by 2050, Europe’s electricity system will be fully decarbonised. It has been widely acknowledged by several European heads of states that a well-interconnected and integrated trans-European energy grid is a fundamental prerequisite for achieving the European Union’s (EU) energy and climate objectives in a cost-effective way.

Over the past few years, the European Commission (EC) has undertaken several measures in the form of legislations and policy initiatives to ensure that the pace of energy transition stays on track. A key legislation adopted recently in this regard was the “Clean Energy for All Europeans” package – one of the most advanced legal frameworks for clean energy transition enabling investments in the segment. To ensure that the development of Europe’s energy infrastructure continues in a timely manner to support this energy transition, the trans-European energy networks (TEN-E) framework was put in place.

Renewable Watch gives an update on the progress made so far in integrating and modernising Europe’s energy transmission networks as well as in achieving the interconnection targets (excerpts from EC’s “Communication on Strengthening Europe’s Energy Networks” published in November 2017). It also provides a synopsis on the level of investment expected to take place in electricity transmission over the next decade or so.

TEN-E policy, CEF and PCI

Since its adoption in 2013, the TEN-E framework has helped identify and realise projects essential for well-connected networks across member states and the internal energy market. Alongside, the Connecting Europe Facility (CEF) was created to financially support the development of the trans-European energy, transport and telecommunication networks. Under this, the EU will extend Euro 30.4 billion as funding over a period of six years (2014-20) to speed up projects and attract private investment in the energy (Euro 5.35 billion), transport (Euro 24.05 million) and digital infrastructure (Euro 300 million) sectors. Further, a list of projects of common interest (PCIs) was created in 2013 (to be updated every two years), comprising key infrastructure projects, especially cross-border projects, to help link the energy systems of EU countries. These projects benefit from accelerated planning and permit granting, improved regulatory conditions, increased public participation via consultations and increased visibility to investors. Select PCIs also benefit from the CEF funding.

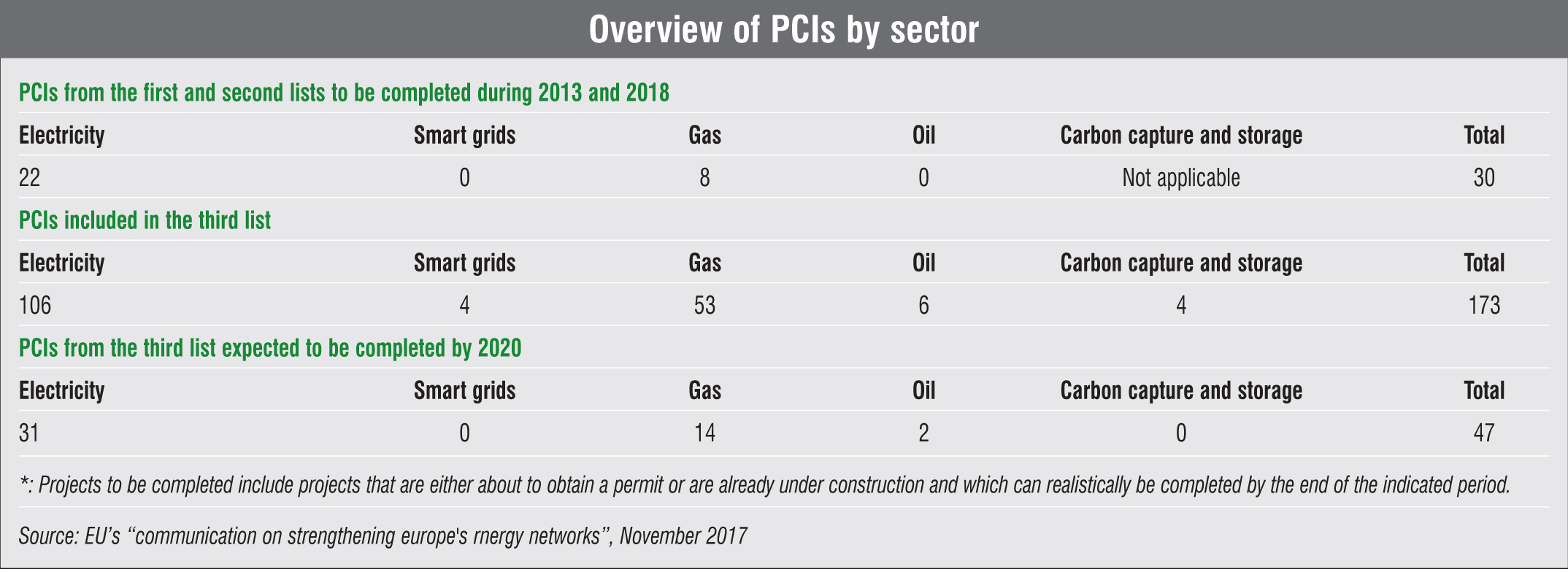

In November 2017, the EC published its third list of 173 PCIs – 106 electricity transmission and storage, four smart grid deployment, 53 gas, six oil and four cross-border carbon dioxide networks. The new PCI portfolio allows the integration of renewable energy and its transportation over longer distances while maintaining a high level of security of supply. The selected PCIs also include 15 electricity storage projects, including some based on compressed air technology. These projects will result in better interconnection, smarter grids and improved storage options, thus providing more flexibility and grid stability and allowing better management of peak loads, both locally and transregionally.

Around 30 energy infrastructure PCIs have been completed or are likely to become operational by end 2018. Further, of the 173 projects that are part of the third PCI list, 47 are scheduled to be completed around 2020.

A key priority that is yet to be achieved is the synchronisation of the electricity grids of the three Baltic states’ with the continental European network. Currently, a study in this regard is being carried out by the transmission system operators of Lithuania, Latvia, Estonia and Poland, along with the European Network of Electricity Transmission System Operators.

Another focus area for the EU energy market is the integration of the Iberian Peninsula with the European mainland. While the INELFE (Interconexión Eléctrica Francia-España) project between Spain and France was commissioned in 2015, a lot more still needs to be done. The Biscay Bay line – a new electricity interconnection between Spain and France comprising a 280 km submarine section and two converter stations – needs to be commissioned by 2025 and thus must be given the highest priority by the regulatory and permit granting authorities. In addition, development works on the proposed interconnector between Spain and Portugal must also continue to ensure its commissioning by end 2018. However, many PCIs (including both electricity and gas) are still not on track, with around half of the projects currently facing delays (in permitting process) or being rescheduled because of uncertainty related to commercial viability or future demand.

During the period 2014-16, 74 PCIs benefited from the CEF programme. Of the Euro 5.35 billion energy budget, grants for works and studies worth Euro 1.6 billion have already been allocated. Going forward, the CEF plans to concentrate more on electricity and smart grid projects, focusing on the integration of renewable energy across borders, as well as innovation, digitalisation and smartening of the grid.

The success of the TEN-E framework is now being witnessed. The TEN-E regulation has led to accelerated permit granting, and the approval of projects is now more streamlined and expedited. Further, the regulatory measures under the TEN-E framework have accelerated the implementation of important PCIs. So far, 18 gas and six electricity PCIs have benefited from the cross-border cost allocation decisions and three projects have received investment decisions issued by the national regulatory authorities. However, as per the EU, the potential of the TEN-E Regulation is yet to peak as national authorities need to further reinforce TEN-E rules to ensure the timely implementation of PCIs.

Interconnection targets

In 2002, the EC set a 10 per cent interconnection target (defined as import capacity over installed generation capacity in a member state) to be achieved by each member state by 2020. The implementation of PCIs has resulted in many member states achieving these targets. Today, 17 member states have already crossed the 10 per cent interconnection target. This has resulted in improving trade and lowering wholesale prices in these countries. Further, seven more member states – Bulgaria, Germany, France, Ireland, Italy, Portugal and Romania – are expected to reach the 10 per cent target by 2020 through the completion of PCIs currently under construction. However, several countries including Spain, the UK, Ireland, Poland and Cyprus are not expected to reach the 10 per cent target by 2020. These countries will achieve their targets as various interconnection projects (Portugal-Spain, Spain-France, Ireland-France, etc.) come online.

In May 2014, the EC extended the interconnection target to 15 per cent by 2030. Following this, an expert group was formed to advise on the achievement and operationalisation of the 2030 target. As per the report submitted by the group in November 2017, different metrices and thresholds are required to assess the need for interconnections, given the rapidly changing energy context. The new approach for setting interconnection targets is based on the underlying principle of maximising social welfare.

As per the report, the new interconnectors should help exploit the benefits of market integration by enabling better prices for customers, meet the electricity demand on the national markets and possibly offer to supply renewable power to the neighbouring member states. As per the report, the development of additional interconnections should be considered if any of the following three thresholds is triggered:

- Minimising price differentials: Member states should aim to achieve a yearly average of price differentials that is as low as possible. The expert group recommends Euro 2 per MWh between relevant countries, regions or bidding zones as the indicative threshold to consider developing additional interconnectors.

- Ensuring that electricity demand, even through imports, is met in all conditions: In countries where the nominal transmission capacity of interconnectors is below 30 per cent of their peak load, options for further interconnectors should be urgently investigated.

- Enabling export potential of excess renewable production: In countries where the nominal transmission capacity of interconnectors is below 30 per cent of their renewable installed generation capacity, options for further interconnectors should be urgently investigated.

The expert group recommends that any project related to interconnection capacity, which can help the member states reach any of the two 30 per cent thresholds, must apply for inclusion in the Ten-Year Network Development Plan (TYNDP) and future lists of PCIs. In addition, countries above the 30 per cent but below the 60 per cent thresholds with relation to their peak loads and renewable installed generation capacity are requested to investigate options for establishing further interconnections. The EC has also recommended that all member states take into account the new approach and thresholds in view of reaching the 15 per cent interconnection target when drafting their integrated national energy and climate plans.

Investment requirement

As per the EC’s report on “Investment Needs in Trans-European Energy infrastructure up to 2030 and Beyond”, around Euro 296 billion in capital expenditure is projected to take place in the domains of electricity transmission, gas transmission, storage, oil supply connections, carbon networks and power-to-gas grid injections in the EU28 region by 2030.

An expenditure of around Euro 188 billion in is expected to be undertaken in electricity transmission, of which Euro 36 billion is for projects slated for commissioning by 2020. Of the Euro 152 billion investment expected during 2021-30, about 50 per cent will be for projects that are at a very early stage of analysis are under consideration. Only 19 per cent has been invested in projects that have made clear progress and are in the permitting phase or even partly under construction.

In the EU28 region, about 35 per cent of the total investment forecast is for offshore projects, while the remaining 65 per cent is for onshore investments. Investment in electricity transmission is expected to peak in 2025 and 2030, due to the higher number of large projects to be commissioned in these years. In 2025, several interconnectors around Belgium, between France and Spain, and inside Germany are slated for commissioning. The 2030 investment requirement includes a substantial share of offshore interconnectors and large direct current corridor projects within Germany.

Conclusion

The timely creation of a well-integrated and modern energy infrastructure is the key to ensure that the EU’s energy transition progresses as envisaged. The policy and regulatory measures put in place by the EC to boost investment in building the physical energy infrastructure through initiatives such as TEN-E guidelines, PCI and CEF have started to deliver results. While progress has been promising, the majority of the critical infrastructure links are yet to be completed. To accelerate the delivery of these projects, commitment at all levels – political, technical and financial – needs to be ensured. Achieving the 2020 and 2030 electricity interconnection targets is also critical if Europe has to fully exploit its renewable energy potential while ensuring security of supply and competitiveness.

By Aanchal Mittal