Recent power capacity addition trends indicate that India is embarking on a massive transformation of its electricity sector. At the end of 2017-18, the country’s total installed generation capacity stood at 345 GW, with renewables accounting for 70 GW, occupying a share of 20.32 per cent. This was a 2.8 per cent increase in share over 2016-17, which witnessed cumulative renewable energy installations of 57 GW, or 17.5 per cent of the total installed energy mix.

Among renewable energy sources, while wind continues to dominate the market, it is solar power that is driving the majority of new installations. The solar capacity share in the total installed power base grew from 3.76 per cent as of March 2017 to 6.59 per cent as of March 2018. A number of factors indicate that this trend is only going to continue. According to industry reports, the pipeline for large-scale solar projects stood at about 10 GW (tendered and pending auction) as of March 2018. The first quarter of 2018-19 further witnessed new solar tenders for 14-15 GW. This is aside from the capacity that has been tendered for rooftop solar projects.

According to the US-based Institute for Energy Economics and Financial Analysis, five of the world’s largest solar parks under construction are located in India. These are the Bhadla Industrial Solar Park (2.2 GW), the Pavagada Solar Park (2 GW), the Ananthapuramu–I Solar Park (1.5 GW), the Kadapa Ultra Mega Solar Park (1 GW) and the Rewa Solar Park (750 MW). When it comes to operational solar plants, two of the world’s top ten plants are in India, as per the report. These are the 1 GW ultra mega project in Kurnool, Andhra Pradesh and the Adani Group’s 648 MW Kamuthi project in Tamil Nadu. The country has also commissioned the world’s largest rooftop solar plant (19 MW) in Punjab .

Given the various factors working in favour of solar power, the government’s 2018 National Electricity Plan aims to increase India’s renewable energy capacity to 275 GW by 2027, with solar accounting for two-thirds of the total. This target may be revised if the government decides to increase the renewable energy target to 227 GW by 2022. As the market transitions towards solar power, a number of interesting trends can be observed across the solar value chain.

One of the biggest talking points in the developers’ space is the tariff quoted by players under various tenders at any given point in time. In the past, factors such as greater economies of scale, the entry of global players, the availability of foreign funding and a fall in module prices led to a dip in tariffs. The lowest tariff quoted so far has been Rs 2.43 per kWh for the 500 MW tender released by the Solar Energy Corporation of India (SECI) for the Bhadla Phase IV project in Rajasthan. However, since then the tariffs have been moving upwards. The latest tender results saw ACME Solar winning 75 MW of solar projects in Parasan Solar Park, Uttar Pradesh, by quoting the lowest tariff of Rs 3.32 per kWh.

While there are several factors leading to this upward tariff trajectory, the fundamental issue lies with the country’s dependence on foreign equipment. Currently, about 85 per cent of solar photovoltaic (PV) modules used in India are imported from China, Taiwan and Malaysia. The 20 per cent increase in the average selling price of Chinese modules between the quarter ended June 2017 and the quarter ended December 2017 led developers to quote higher tariffs. Further, several Chinese suppliers became wary of shipping to India with the uncertainty around the safeguard duty, anti-dumping duty and port duty. While the issue of a port/customs duty on solar imports has been resolved, matters pertaining to anti-dumping and safeguard duties are still in the grey.

These factors have not only led to an increase in bid prices but have also resulted in market activity remaining frozen. According to Renewable Watch Research, about 17.5 GW of tenders were re-issued with bid due date extensions in the month of May 2018 alone. This trend of tender activity being delayed started in early 2018, and is only growing steadier. According to market experts, the actual duties are less of an issue than the uncertainty around them. The government needs to come clear on whether it wants to impose duties and at what level.

A ray of hope for project developers has been the recent policy announcement by the Chinese government, which has decided to impose installation caps and reduce solar feed-in tariffs (FiTs) to slow down solar installations in China. This could mean a massive oversupply situation, which creates an optimistic scenario for Indian solar developers that could start bidding lower. However, for domestic manufacturers, the policy is a further dampener. The tussle between domestic and foreign vendors has turned into a never-ending saga with the former lobbying hard for the imposition of safeguard and anti-dumping duties against the latter. With this background, there clearly does not seem to be an end in sight as far as the rift amongst manufacturers is concerned. However, this does not mean that it will hinder the development of the solar power segment; it will only slow it down for the time being. The country is targeting an installed solar capacity of 100 GW by 2022, up from around 21 GW currently. It is also chasing an overall renewable energy capacity of 175 GW by 2022. The strong government push and a range of market factors will continue to drive capacity addition.

A ray of hope for project developers has been the recent policy announcement by the Chinese government, which has decided to impose installation caps and reduce solar feed-in tariffs (FiTs) to slow down solar installations in China. This could mean a massive oversupply situation, which creates an optimistic scenario for Indian solar developers that could start bidding lower. However, for domestic manufacturers, the policy is a further dampener. The tussle between domestic and foreign vendors has turned into a never-ending saga with the former lobbying hard for the imposition of safeguard and anti-dumping duties against the latter. With this background, there clearly does not seem to be an end in sight as far as the rift amongst manufacturers is concerned. However, this does not mean that it will hinder the development of the solar power segment; it will only slow it down for the time being. The country is targeting an installed solar capacity of 100 GW by 2022, up from around 21 GW currently. It is also chasing an overall renewable energy capacity of 175 GW by 2022. The strong government push and a range of market factors will continue to drive capacity addition.

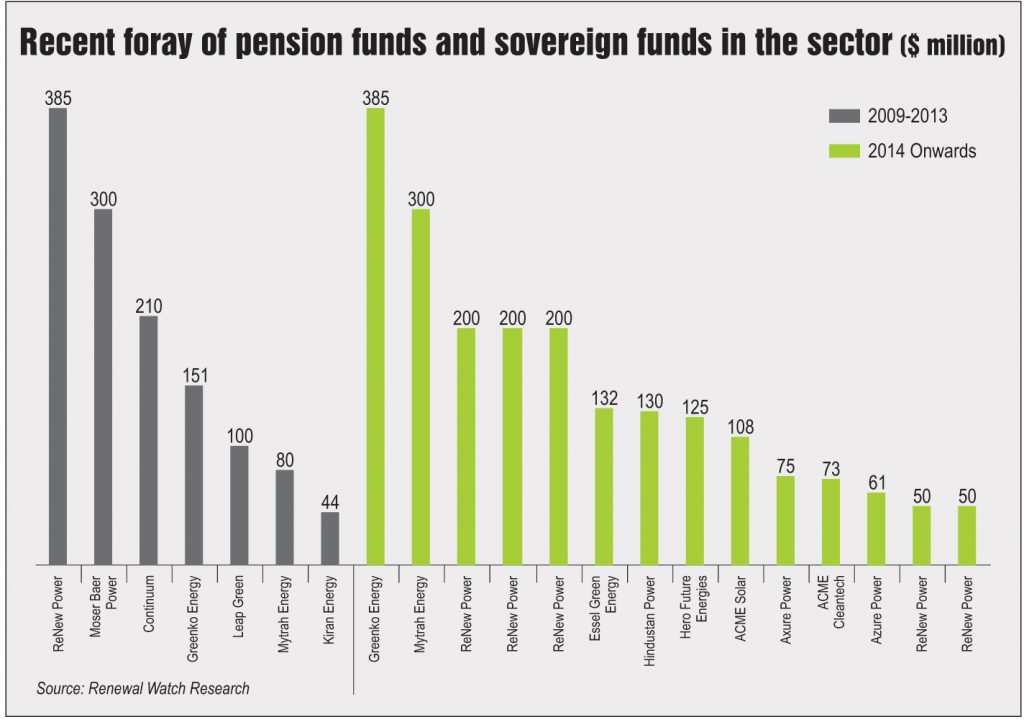

India has already pioneered the concept of ultra mega power plants (UMPPs) in a single solar industrial park, as mentioned above. This approach has been instrumental in driving economies of scale and procuring global capital. Initially, when the solar power segment was at its nascent stage, the majority of investors in the sector comprised venture capitalists or private equity firms. As the industry matured and achieved scale, global pension funds and global and Indian utilities have started providing funds to the sector. This is expected to continue, in addition to the opening of newer avenues of financing such as green bonds, masala bonds, infrastructure investment trusts (InvITs) as well as capital market listings.

Another positive development has been the compliance with renewable purchase obligations (RPOs). Based on the current solar RPO targets set by the state electricity regulatory commissions (SERCs), compliance at a pan-Indian level is as high as 85-90 per cent. This is largely on account of states such as Rajasthan, Andhra Pradesh and Madhya Pradesh over-achieving their RPO targets with a large existing renewable base and rapid capacity additions. The RPO targets have now been set at 8 per cent by 2022 as per the National Tariff Policy (NTP). Already, a number of states have issued orders (and some are at the draft stage) for an upward revision of their RPO trajectory in line with the NTP.

The spike in activity has made solar power cheaper than coal-based power and has helped with capacity addition – though more so in the utility-scale solar space and much less in the rooftop segment. Rooftop solar is severely lagging behind its target of 40 GW by 2022. At the end of December 2017, only about 1.6 GW of rooftop solar projects had been installed cumulatively across the country. Most of this capacity has come up recently. In 2017, approximately 995 MW of rooftop solar capacity was installed. Rooftop capacity additions are largely being driven by government tenders. However, the commercial and industrial (C&I) segments are also increasingly adopting rooftop solar as it becomes more viable. Meanwhile, the residential rooftop market is still very small with a number of small, inexperienced players setting up projects, leading to questionable quality. In addition, the delay in subsidy disbursements by government agencies has affected growth in installations, especially in the residential rooftop space.

In order to ramp up rooftop solar capacity, various governmental agencies have recently come up with a spate of tenders. For instance, the Airports Authority of India (AAI) and Indian Railways have begun tendering and implementing rooftop solar projects at a fast pace. C&I customers have also started to realise the economic viability of rooftop solar. This user category is now driving growth in the segment without relying on government subsidies to set up projects. Some states have removed the cap of 1 MW for rooftop solar projects. Even the Ministry of New and Renewable Energy (MNRE) has tried to encourage discoms to participate in the rooftop solar segment by providing them with incentives based on the capacity of rooftop installations in their region of distribution. As a result, rooftop installations are picking up pace and are likely to register much stronger growth in the years to come.

While rising solar power levels could change the power sector dynamics within the next five to seven years, there are a number of factors that may lead to different outcomes. A key element supporting the rise of solar is the evolution of storage technologies. If the pace of evolution slows down, it could impact the ability of the system to absorb vast amounts of time-variable renewables. While significant investments are being directed towards developing storage technologies, they are at a relatively early stage compared to solar PV or wind, and hence there is more uncertainty in their cost trajectories. Another possible barrier is the ability of the grids to handle large amounts of intermittent generation in the near term. While investments are being made in the transmission infrastructure at both the national and state levels, the timely execution of these projects, especially at the state level, is an important factor in ensuring the smooth growth in solar capacity additions.

The majority of solar project installations are dependent on imports. A significant depreciation in the rupee would lead to a rise in solar costs relative to other sources such as coal, which would delay the implementation of solar power projects. Hence, it is important for the government to provide a hedge against currency fluctuation risk by encouraging localisation and the creation of a domestic ecosystem.

Outlook and the way forward

After considering the positive and negative developments so far and taking into account factors such as the feasibility of tariffs, financial health of discoms and potential execution delays, RPO targets and the 2019 general election, the decision to scale up the renewable energy target to 227 GW by 2022 seems a bit too ambitious. However, that seemed to be the general perception amongst industry stakeholders at the time the 175 GW target was announced too. Nevertheless, renewable energy capacity has reached 75 GW already and its share in the total energy mix is growing rapidly, while that of thermal power is reducing significantly.

Going forward, the government will have to take several steps to ensure healthy growth and achieve the ambitious solar power generation target. One of these is to achieve a balance between the creation of domestic capacity and the swift ramp-up of capacity through imports and foreign direct investments. To a certain extent, this has started happening with Tier 1 manufacturers investing in scaling up their capacities. Waaree Energies has tripled its solar PV module manufacturing capacity with a new 1 GW facility in Vapi, Gujarat. This is in addition to its existing 500 MW plant in Surat. Meanwhile, encouraged by the growing demand from panel makers for solar glass in India and abroad, Gujarat Borosil plans to raise solar glass production by 6 per cent, or 10 tonnes per day, in the current financial year. Gujarat Borosil manufactures consumer-ware glass products and glass-based products used in laboratories. It plans to set up a solar glass sheet production facility for use in PV panels by March 2019. Other important factors are the augmentation of supporting transmission infrastructure and the strict enforcement of RPO compliance.

Last but not the least, a factor that can change the scenario in favour of renewable energy development is the evolution of storage technologies. It can herald an all-new clean energy paradigm for the power sector. Battery technology costs are on a rapid decline and investments are already under way to develop smart and sustainable electricity grids. Solar power combined with cost-effective technologies will lead to the electrification of transport, and the convergence of sectors such as power and transport. This will not only generate significant efficiency gains but will also help reduce fossil fuel import bills.