The turbulence in the wind power segment is getting worse by the day as the industry is at loggerheads with the government regarding multiple issues, most of which stem from the ongoing process of migration from the feed-in tariff (FiT) regime to a competitive bidding-based project allocation mechanism. The process has not only brought down tariffs to an all-time low but has also brought the industry to a standstill, even as project visibility remains bleak.

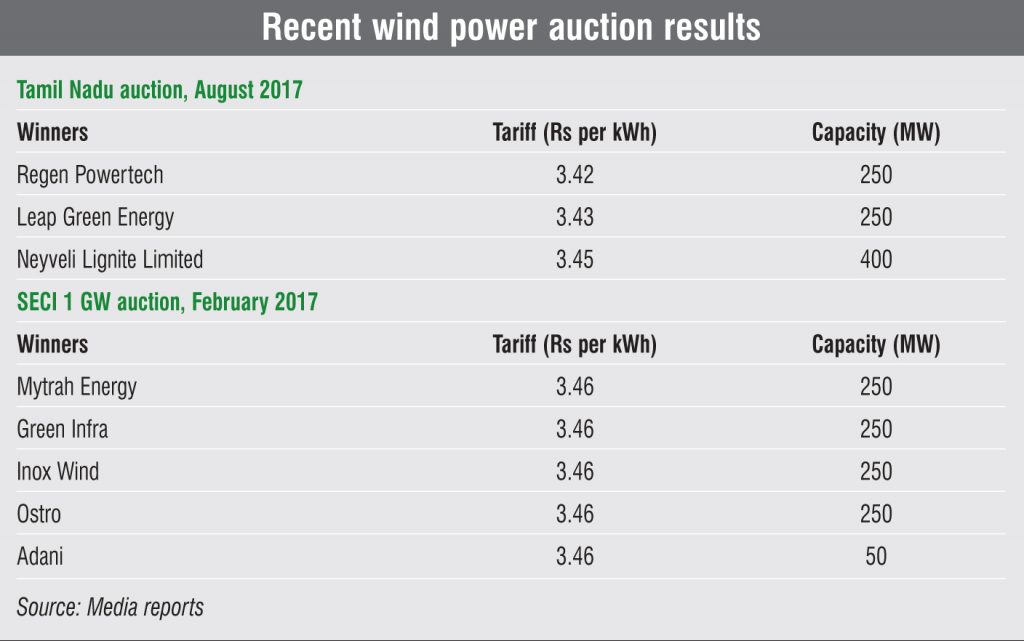

Financial unsustainability has become a prime concern for the industry as the ongoing project development has been jeopardised due to the state discoms demanding a renegotiation of power purchase agreements (PPAs) at lower tariffs, comparable to the winning bid of Rs 3.46 per kWh achieved in India’s first wind auction in February 2017. Discoms are known for discouraging wind power offtake through grid curtailment and payment delays to compel developers to offer a discount. As a result, the pace of capacity addition has slowed down significantly. Over 5,400 MW of wind power capacity was added in 2016-17, but it was barely 228 MW for the first quarter ended June 2017.

As a trickle-down effect, wind turbine-makers are staring at a slowdown even as the government looks to boost renewable energy. A case in point is ReGen Powertech, one of the country’s top five wind turbine-makers, which has recently shuttered a factory in Udaipur, Rajasthan, and laid off workers. “We all have extra capacity, so it was a good decision to restructure to stay lean. We operate from the 1 GW factory in Andhra Pradesh and have reduced staff strength from 1,700 employees to 1,300,” said Madhusudan Khemka, managing director, ReGen Powertech, to a news daily recently.

In yet another instance, in May 2017, turbine-maker Inox Wind stated that it had stopped all manufacturing after 700 MW of orders won under the previous FiT regime became a “piece of paper” when states stopped signing PPAs.

Other manufacturers have also been impacted. Suzlon Energy Limited’s revenue fell by 46 per cent in the quarter ended June 2017 compared to the previous quarter. Siemens Gamesa, the biggest wind turbine supplier in India for the last three years, saw a 7 per cent drop in revenues in the quarter ended June 2017.

All these are indications of the challenges facing wind turbine manufacturers as they adjust to an auction system that is putting a question mark on how much wind energy will actually get built. According to D.V. Giri, secretary general, Indian Wind Turbine Manufacturing Association, roughly 2 GW of wind turbines will probably be produced in 2017-18 against the earlier expectation of 6 GW, leading some manufacturers to idle their facilities.

The auction saga

The trouble started when the government shifted from the FiT regime, which guaranteed price protection, to competitive bidding. The bid tariff of Rs 3.46 per kWh quoted in February 2017 was 17 per cent lower than the lowest FiT of Rs 4.16 per unit in the country. This prompted several discoms to openly voice their reservations on honouring the PPAs and letters of intent (LoIs) for nearly 3 GW of capacity in the pipeline. These include Andhra Pradesh discoms, which have cancelled 1.1 GW of capacity, Gujarat 250 MW, Karnataka 900 MW and Tamil Nadu 500 MW. All these discoms had signed PPAs/LoIs at FiTs that were much higher than the recent bid tariffs.

If the discoms do have their way, a downward revision in PPA tariffs would adversely impact the returns of wind power projects that are already constructed but are awaiting power offtake. It is estimated that a Re 0.10 per kWh reduction in tariff impacts the equity internal rate of return by 80-90 basis points. It could also lead to a spate of court cases and litigations, and hence more expenses. Financial institutions too will become more cautious about lending to these projects, considering the fact that even relatively well-performing discoms are renegotiating PPA tariffs, without any legal grounds or force majeure conditions.

Above all, these developments cast a doubt on the enforceability of contracts signed by government entities. At a recent Renewable Watch conference on “Wind Power in India”, Anand Kumar, secretary, Ministry of New and Renewable Energy, acknowledged, “The entire issue of dishonouring of PPAs and revisiting PPAs affects the confidence of investors. Actions like what happened in Karnataka have shaken the confidence of investors, which is not good for the industry. The ministry is very clear that all contracts must be honoured.”

For now, the government has put on hold the auctions for 1 GW of capacity, which were to be held by the Solar Energy Corporation of India (SECI) on September 19. While this may, at first, seem to be a negative development, the industry is viewing it in a positive light as it gives it time to calibrate a more rational bid, given the prevailing issues and market conditions. In the meantime, the Central Electricity Regulatory Commission will also decide on a petition filed by Power Grid Corporation of India Limited (Powergrid) on the unavailability of bays for grid connectivity for wind and solar projects. The industry wants grid connectivity to be ensured before getting into the reverse bidding process.

According to industry sources, a crisis seems to be brewing in the wind segment owing to the slow pace at which Powergrid is granting connectivity. If this continues, it may be several months before the logjam is eased. Firms that won projects in the wind auction held in February have also been hit by the lack of interstate transmission access. While wind power producers like Mytrah and Orange have been granted transmission access for only 300 MW of capacity each in the top two substations of the country, located in Tamil Nadu and Gujarat, equipment manufacturers such as Suzlon and Inox have transmission access for 1,400 MW and 1,500 MW respectively in the same substations though they have no immediate need for the connectivity. The connectivity applications by Green Infra, one of the winners in the February auction, are still under process with Powergrid. If transmission points continue to be allotted on a first come, first served basis rather than on project readiness, many wind IPPs would be deprived of access to Powergrid’s bays, while several firms that do not currently have operational capacity have access to the grid.

Getting the fundamentals in place

While there is no denying that the industry is going through a tough phase as there are multiple problems regarding the upcoming wind power capacity, the supporting infrastructure and domestic manufacturing, this may be looked upon as a transition phase that may bring in greater transparency and efficiency in the segment.

The auction process will ensure that bids are at a realistic level, bringing value to the whole process. For instance, earlier project sizes were in the range of 25-50 MW, with a few projects going up to 150 MW. With the new auction-based allocation route, project sizes have gone up to 250 MW, which brings in efficiencies of scale. Moreover, there are emerging means of financing that provide capital at a lower cost. In addition, newer technologies and evolving wind turbine generators have increased plant load factors, all of which translates into a lower levellised cost of electricity.

Regarding the issue of payments, the Ujwal Discom Assurance Yojana has so far been working well. If the scheme delivers positive results, the issues of payment delays and defaults will be taken care of. For wind power curtailment, an encouraging trend of increased emphasis on scheduling and forecasting is being witnessed. This would certainly address the issue of curtailment. “Whenever there is an issue of curtailment, developers have the right to protest because curtailment cannot be done without due reason,” said Kumar, reiterating the government’s stance on providing must-run status to all forms of renewable energy. In a recent debate on must-run status in Madhya Pradesh, the government took cognisance of this matter and issued an advisory to all state governments that must-run status has to be honoured.

Regarding the issue of payments, the Ujwal Discom Assurance Yojana has so far been working well. If the scheme delivers positive results, the issues of payment delays and defaults will be taken care of. For wind power curtailment, an encouraging trend of increased emphasis on scheduling and forecasting is being witnessed. This would certainly address the issue of curtailment. “Whenever there is an issue of curtailment, developers have the right to protest because curtailment cannot be done without due reason,” said Kumar, reiterating the government’s stance on providing must-run status to all forms of renewable energy. In a recent debate on must-run status in Madhya Pradesh, the government took cognisance of this matter and issued an advisory to all state governments that must-run status has to be honoured.

A key aspect that needs to be addressed is the lack of project visibility. To this end, the bidding pipeline should be made more transparent so that companies can plan their finances and strategies accordingly. Also, there should be guidelines for states to help them conduct the bidding with clear dos and don’ts. Similar to the central-level bids, PPA risks also need to be addressed for state-level bids as well as through robust payment security mechanisms.

Given the recent developments in the wind space, 2018 could well be the worst year for new wind installations in more than a decade in India, as there is hardly any new capacity under construction. The projects won under the first SECI auction are hugely delayed due to transmission issues, ongoing FiT-based PPAs are up for renegotiation and projects under the second auction conducted by SECI will be awarded only post-October 2017. The only projects to see the light of day will be the 950 MW of capacity auctioned in Tamil Nadu and that too, only if transmission infrastructure does not become a hurdle. Fortunately, the industry has withdrawn its petition against the Tamil Nadu auction, otherwise that could have put even these projects in jeopardy. The developers had contested the holding of the auction when a price of Rs 4.16 per kWh had already been set by the state regulator in its tariff order and was valid till April 2018.

Against this backdrop, it is expected that the Indian wind industry will see a revival only in 2019; that too, if 2-3 GW of wind projects are auctioned in the next six months, as project development is a 12-18-month-long process.

Once the initial hiccups are over, going forward, project allocation through auctions is likely to prove to be a favourable policy change for the industry.