The adoption of solar photovoltaic (PV) technology in India is set to grow exponentially given the country’s ambitious target to install 100 GW of solar capacity by 2022. In November 2016, the installed solar capacity crossed the 10 GW mark, but the country still has a long way to go to position itself amongst the key solar-powered nations such as China, Germany, Japan and the US, that have over 25 GW of solar installed capacity. However, the technology-agnostic targets set by the government have created new competition for different solar technologies, thin-film and crystalline silicon (c-Si).

Meanwhile, the supply of solar cells has exceeded the demand, thus providing bargaining power to the customer-driven market. As a result, solar cell prices have declined significantly over the past five years, which in turn has increased their uptake, as well as the manufacturing capacity. Overall, the market for c-Si has surpassed that for thin-film technology.

Thin-film technology

Thin-film cells are made of semiconductor compounds such as cadmium telluride (CdTe), copper indium gallium selenide (CIGS) and amorphous silicon (a-Si), deposited on low-cost substrates like glass, plastic or fine sheets of metal. Thin films were in demand at the beginning of this decade, when other technologies were scarce and more expensive. However, with the launch of c-Si technology and its increasing adoption, thin-film became the market of an exclusive set of players.

While c-Si may be the popular solar PV technology choice, thin-film technology has multiple advantages over the former. Although the earlier cost advantage of thin-film owing to expensive c-Si technology has now been offset, the emerging thin-film technologies are expected to reduce costs due to their low consumption of raw material. Meanwhile, technologies like copper zinc tin sulphide (CZTS) are gaining traction (though they are still at the research stage) as they use non-toxic materials that are abundant in nature and therefore cheaper. In addition, the new flexible thin-film technology has achieved efficiencies of over 16 per cent.

Their low weight makes thin-film technologies ideal for huge installations, especially in the rooftop solar segment, without putting excess weight on the building structure. On the other hand, heavy c-Si panels require bulky mounting structures. In addition, with the advancement of technology, it is now possible to paste thin-film modules on structures, opening up several opportunities for their application, particularly in building integrated photovoltaics.

Global context

Globally, the market share of thin-film solar PV technology fell from around 13 per cent in 2011 to less than 7 per cent in 2014. It later rose to about 8 per cent in 2015 (Fraunhofer ISE, November 2016), and is likely to remain at 7-8 per cent through 2019-20. Around 57 GW of solar modules were produced in 2015, of which thin-film modules accounted for nearly 4.2 GW. Among thin-film technologies, CdTe was the most prevalent with about 60 per cent production, followed by CIGS at 26 per cent and the remaining was a-Si. The preference for c-Si technology can be attributed to the fact that globally, most of the installed solar capacity and module manufacturing comes from c-Si-dominated countries such as China, Japan, Germany and the US.

Only a few thin-film manufacturers have been able to sustain the rise of c-Si solar technology. These include US-based First Solar, Japan-based Solar Frontier and China-based Hanergy. While Hanergy has grown inorganically by acquiring smaller companies like Miasole and Global Solar, the other two have achieved economies of scale.

The Indian context

In India, the adoption of thin-film technology has been higher as compared to the global average given that the country has only recently achieved large-scale adoption. Since the module manufacturing capacity for thin-film technology was not as high as c-Si’s, it was exempt from the domestic content requirement clause under Phase I Batch I of the Jawaharlal Nehru National Solar Mission. Moreover, attractive financing options from international lending institutions made the technology inexpensive for Indian solar project developers, leading to its increased adoption. After the initial success of thin-film modules, cheaper alternatives from China and Taiwan, mainly based on c-Si technology, captured the market and the share of thin-film modules in the country reduced. However, its adoption has assumed an increasingly niche status in India, with some states and locations preferring thin-film to c-Si technology.

As per a state-wise analysis of a select set of projects tracked by Renewable Watch Research, thin-film is the preferred choice of technology in many solar-rich states such as Rajasthan, Odisha and Tamil Nadu, with a share of 64, 58 and 71 per cent respectively. The share is nearly equal in Gujarat while it is exactly half in Uttarakhand. In Uttar Pradesh, Maharashtra and Haryana, more than 30 per cent of the projects use thin-film technology. In contrast, c-Si is the prevalent technology in the rest of the world.

Renewable Watch Research also analysed the quarterly performance of select projects employing thin-film and c-Si technologies. The project performance, which has been tracked for four years, shows that plants with thin-film technology perform with greater consistency as compared to those based on c-Si technology. Typically, project performance drops during the third quarter of each year with the onset of the monsoon season. However, for plants deployed with thin-film technology it can be seen that the fall is lower and plants continue to perform at comparatively higher efficiency as compared to those based on c-Si. Overall, the performance of the two technologies was largely at par with each other during the study period for the projects tracked.

The comparative success of thin-film technology in India and its early adoption is based on the location of the plant more than the efficiency, operations and maintenance or the policy framework, which remains technology-agnostic. India is yet to scale up its manufacturing capacity of thin-film modules as most domestic players manufacture the more popular c-Si-based solar modules. In 2016, only three companies supplied thin-film modules, First Solar, Solar Frontier and Hanhwa Solar. The lack of manufacturing capacity has been one of the prime reasons for its recently declining adoption in the country.

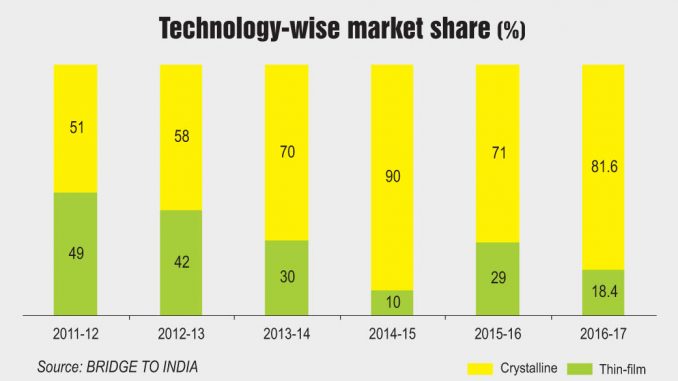

In India, the market share of thin-film technology in module manufacturing has decreased over the years. As per BRIDGE TO INDIA, it stood at 29 per cent in 2015, and fell to 18.4 per cent in 2016. Historical data suggests that the adoption of the technology in the country peaked in 2011 at 49 per cent, but gradually declined to 10 per cent in 2014. However, with revised solar energy targets, the share of thin-film modules is expected to grow in the coming years.

The way forward

Thin-film technology has considerable advantages over c-Si. The lab efficiency of thin-film has reached 21 per cent (Fraunhofer ISE, November 2016), which brings it at par with existing c-Si technologies. If deployed on a large scale, thin-film technology could address India’s space crunch problem for solar installations as the low weight and flexibility of thin-film modules allow them to be layered on rooftops or integrated into building designs, without the bulkiness of a c-Si system. It has the potential to surpass solar parks and help India achieve its target of 40 GW of rooftop solar capacity by 2022. Hybrid cells, a combination of thin-film and c-Si technologies, also known as heterojunction with intrinsic thin-film layer modules, are another key emerging technology solution.

However, the technology entails higher costs as compared to c-Si module prices that are rapidly declining due to mass production and cheaper imports from China and Taiwan. This has also severely affected the adoption of thin-film technology in India. Since the returns for developers are declining as solar tariffs continue to decrease, cheaper c-Si modules have become the preferred technology choice of developers for new projects.

Thin-film technology has applications beyond power generation that extend to transportation as well. Deploying thin-film solar panels along with a storage battery on trucks, buses and trailers can power cabin functions of these vehicles, and as technology advances, power the engine as well. This technology can also help reduce the fuel consumed for powering refrigerators.

Thin-film has clear advantages over other technologies deployed in India, in terms of performance, applications and flexibility. However, c-Si has the popular mandate owing to its cheaper application. As India moves towards achieving its solar capacity target by 2022, it will need to employ all available technologies including thin-film, especially to achieve its rooftop solar targets. Research and development needs to be undertaken to customise thin-film technology as per the Indian requirements, scale up its domestic manufacturing, enable greater adoption, and bring down its cost.