In November 2020, the prime minister announced that the country’s renewable energy market offers business prospects of about $20 billion annually over the next decade. However, given India’s ambitious target to increase the existing installed renewable energy capacity fivefold up to 450 GW, it does not seem likely that any outlay from the government or domestic investors can be enough to finance this ambitious capacity. Thus, it is important to ask where the money is going to come from.

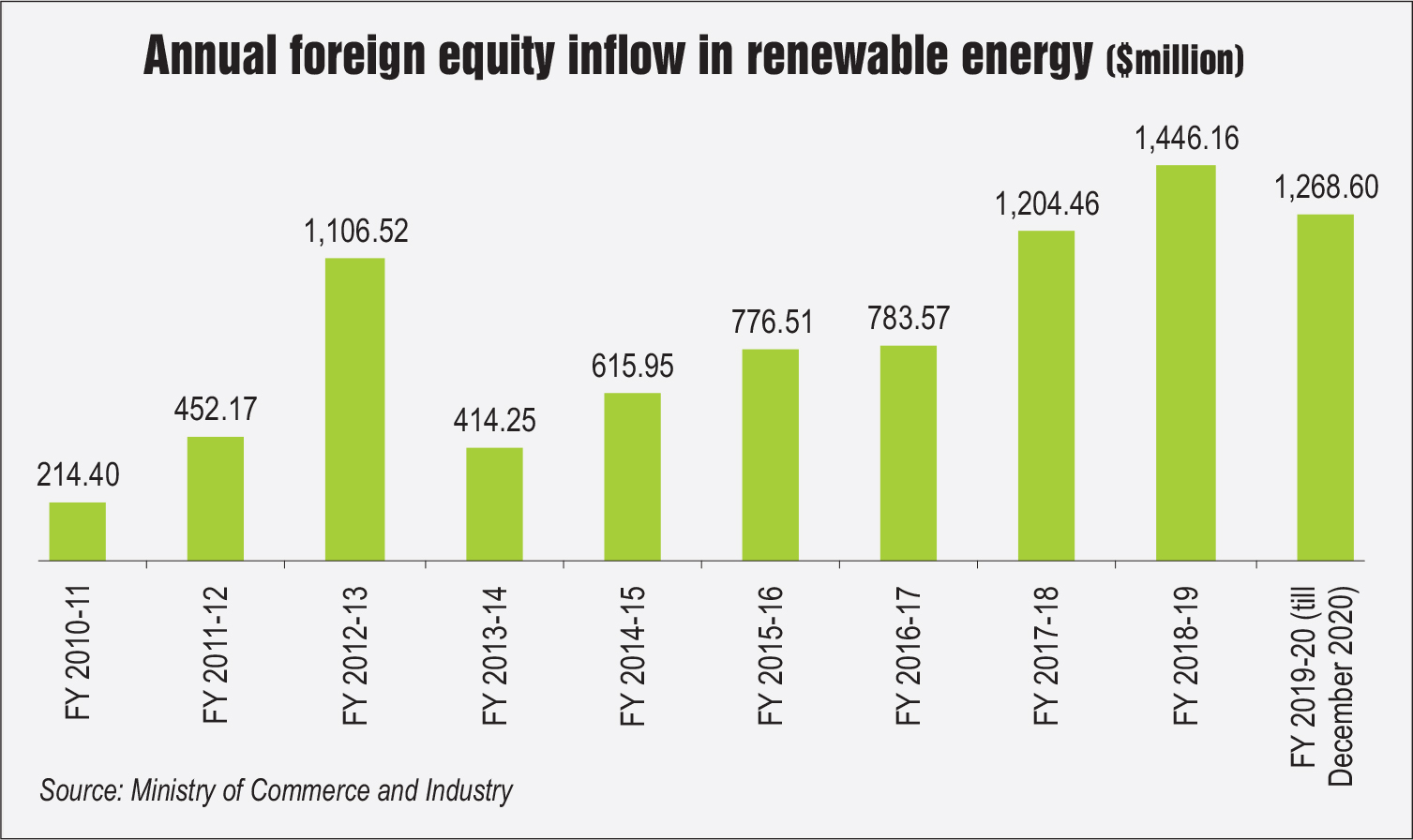

The biggest reason why India needs foreign backing is the existing gap in funding for renewable energy projects. In India’s renewable energy transition, foreign investors have played a key role. Since 2010-11, the renewable energy sector has received foreign direct investment (FDI) worth $8.28 billion according to data shared by the Ministry of Commerce and Industry. In the same period, the coal and petroleum natural gas sectors received FDI equity inflows of about $4.5 billion, highlighting a shift towards cleaner fuels.

India’s green energy sector has matured and is now the fifth largest in the world in terms of installed capacity. It has also shown trends of lower risks, predictable yields, and medium-to-high returns, which are great prospects for foreign institutional investors. Further, the sector offers higher risk-adjusted returns as compared to many other large and established markets.

Promising signs

In recent years, foreign investors have been showing a strong interest in the Indian renewable market. On the policy front, the doors are wide open for foreign investors with up to 100 per cent FDI allowed under the automatic route for the renewable energy sector. In June 2020, the Ministry of New and Renewable Energy (MNRE) announced the opening of an FDI cell to oversee foreign investments in the country.

In light of recent events, the foreign investment prospects in the Indian renewable energy sector seem promising. India’s current energy demands represent a third of the world average and are only expected to increase rapidly in the years to come. The Indian government has also been making efforts to facilitate the green energy transition by adding capacities. Further, policies are being consistently reviewed and revised to create investment opportunities.

During the nationwide lockdown due to the Covid-19 pandemic, renewable energy projects were given a must-run status, which ensured continuous power offtake. The renewable energy sector also proved to be extremely resilient due to its low running costs. The Power System Operation Corporation reports that between March and April 2020, renewable energy generation fell by only 4 per cent, whereas coal power generation fell by 25 per cent. The government also offered extensions to projects that faced construction delays due to labour and supply constraints.

The removal of tariff caps in auctions, consistent regulatory policies and concerted efforts to meet the country’s renewable energy targets have confirmed that India has both the potential and intent for renewable energy development. A big step was taken in October 2020, when the MNRE issued amendments to the tariff-based competitive bidding process to procure power from solar projects. The ministry reduced the lock-in period for the controlling shareholding from three years to one year. After this period, investors can sell their stake to make short-term gains. This can help attract investors with varying interests. Foreign investors will have the option of either participating in bids (for the short or long term) or acquiring well-established projects from domestic developers.

With these policy developments and the easing of lockdown restrictions, the participation of foreign investors in the Indian market has increased. In January 2021, French oil company Total SA announced a $2.5 billion investment in Adani Green Energy Limited (AGEL). Under the deal, Total will acquire a 20 per cent minority stake in AGEL and a 50 per cent stake in a 2.35 GW solar portfolio owned and operated by AGEL. More recently, in March 2021, a Japanese financial service company Orix Corporation announced the completion of a 21.8 per cent stake acquisition in Greenko Energy Holdings at an investment of $961 million.

Under the deal, Orix also secured a wind portfolio of 873 MW from Greenko. In the same month, Indian developer ReNew Power announced a merger with RMG Acquisition at an enterprise value of $8 billion. With this, ReNew Power will become a publicly listed company on the NASDAQ. These have been the three big announcements of this year, which represent strong interest in the growing Indian market.

Opportunities in solar manufacturing

For the timely achievement of its renewable energy targets, the Indian government launched the production-linked incentive scheme and increased customs duties on the import of solar to foster the creation of a manufacturing hub for renewable energy, particularly solar power, in India. The need for this is amplified due to trade restrictions with China and a mounting trade deficit. It has been estimated by Auctus Advisors that meeting the future demand for raw solar equipment, primarily through imports, could take India’s trade deficit to over $100 billion by 2030. However, the Indian solar manufacturing market, similar to the green energy generation market, fails to create sufficient investor confidence.

As per a study by the Centre for Study of Science, Technology and Policy, most domestically manufactured solar modules are not cost-competitive with those manufactured in China. That said, the cost of domestic modules in a vertically integrated set-up was only 9 per cent higher than those available in the well-established Chinese market.

There is a clear opportunity to develop upstream capacity and the government must step up efforts for foreign investment in the manufacturing sector. To attract foreign investment in manufacturing, the government can offer tax holidays with relaxations for wafer and ingot manufacturing facilities. In addition, ancillary infrastructure like inverters, glass and mounting structures can be developed to improve the supply chain. Going forward, the country must build R&D centres supported by capital grants, subsidies and tax exemptions.

Potential challenges and outlook

Potential challenges and outlook

The potential challenges in the sector pertain to grid stability, land acquisition, regulatory delays, and poor financial performance of discoms.

Despite large financing deals in recent months, it is impossible to ignore the level of the mounting debt of renewable energy developers in the country. This has been made worse by the ever-increasing dues of discoms. If projects are to generate sufficient returns for investors, these concerns must be addressed. Many problems can be solved by addressing discoms’ payment issues. To this end, a payment security mechanism can be developed to ensure timely payments to generators. For foreign investors, a foreign exchange hedging facility can help investors address concerns about currency volatility.

In April 2020, it was announced that all countries that share a border with India must contribute to FDI with prior government approval only. The effects of this were evident in the renewable energy sector with FDI from China in 2020 falling to a dismal 3.14 per cent of the average investments in the past five years, according to the Ministry of Commerce and Industry. Only time will tell whether the country can sufficiently compensate for the potential investments lost by the regulation.

Summing up, many factors contribute to making the Indian renewable energy market an attractive investment prospect. Foreign investors have been showing increasing interest in the sector; FDI equity inflows could hit an all-time high in the financial year 2021, despite the Covid-19 pandemic. India’s green energy developments have always been heavily dependent on foreign backing and will continue to be in the years to come.

By Rithvik Kumar