To maintain its lead in the power sector, Bharat Heavy Electricals Limited (BHEL) is actively diversifying its operations. The engineering and manufacturing company has been a major provider of multiple solutions for the energy, industrial and infrastructure sectors for over five decades. In 2018-19, BHEL achieved a milestone with the commissioning of over 1,000 utility sets. Over 53 per cent of the country’s total conventional power capacity has been installed using BHEL-made power equipment. Being India’s largest integrated power plant equipment manufacturer, BHEL has a capacity of 20,000 per annum. With the changing dynamics of the power sector and the decreasing role of thermal power, BHEL is realigning its strategies and looking at non-thermal businesses for future growth.

At the company’s annual general meeting held in September 2019, Dr Nalin Shinghal, chairman and managing director, BHEL, said, “BHEL is working on a range of new products/systems for diversification into areas such as transportation, defence, e-vehicles, water and coal-to-methanol to develop new growth drivers. The company is geared up to maintain its share in the power business, and is upgrading its product profile to harness new opportunities in emission control equipment/systems, digital technologies and optimisation of natural resources like fuel and water.”

Order book

In 2018-19, BHEL received orders worth Rs 238.59 billion, a decline of 41.71 per cent over the Rs 409.32 billion recorded in the previous year. This can be attributed to subdued ordering in the thermal utility segment in recent years owing to a decline in capacity addition. The power sector, which accounts for 65 per cent of BHEL’s total order inflows, contributed to orders worth Rs 154.9 billion in 2018-19, a 53.54 per cent decline over the previous year. Overall, BHEL’s order book has seen a fluctuating trend on a year-on-year basis. During the quarter ended September 2019, BHEL recorded order inflows of Rs 74.04 billion, as against orders worth Rs 38.92 billion booked in the quarter ended June 2019.

The company’s total order book stood at Rs 1,086.03 billion as of September 30, 2019. Of this, the power sector accounted for Rs 879.24 billion (81 per cent), the industrial sector for Rs 112.05 billion (10.3 per cent), while the remaining orders worth Rs 94.74 billion (8.7 per cent) came from export projects. The major contributors to the order book of the industrial sector are from the solar and transportation segments.

Diversification strategy

In 2018-19, BHEL added 2,130 MW of capacity in the conventional power segment, down from 3,738 MW commissioned in the previous year. In November 2019, the company commissioned two pumping units each under Package 6 (7×116 MW) and Package 8 (7×139 MW) of the Kaleshwaram Lift Irrigation Scheme (LIS) in Telangana. With this, it has successfully commissioned all 14 pumping units under these packages in a record period of six months and well within the scheduled time. Notably, the Kaleshwaram LIS is the world’s largest multistage multipurpose irrigation project being implemented by the Telangana government.

The company also aims to increase its share in non-coal businesses. To this end, it is taking diversification initiatives in several areas including e-mobility, hydropower and solar power. BHEL provides engineering, procurement and construction (EPC) services for ground-mounted and rooftop solar power plants. So far, it has executed over 1,100 MW of solar projects. Its solar portfolio includes solar cells and modules, power control units, and passive solar tracking modules. BHEL received its largest single EPC order for 129 MW of solar PV power plants in Telangana from Singareni Collieries Company Limited. The company has also signed an MoU with GAIL for cooperation in the development of solar-based power projects.

Meanwhile, BHEL is also setting up a 1.7 MW pilot solar power plant for Indian Railways for directly feeding power into the traction system. This is a first-of-its-kind project in the world. The company is also setting up three floating solar plants for NTPC – a 100 MW plant at the Ramagundam power station, a 25 MW plant at the Simhadri super thermal power station and a 22 MW plant at the Kayamkulam unit. BHEL has also been a key supplier for the solarisation of agricultural feeders in Maharashtra. In March 2019, BHEL signed an MoU with GAIL for the development of solar power projects.

BHEL is also foraying into manufacturing of electric vehicle (EV) chargers, electric buses and related critical components. It is setting up a network of solar-based EV chargers on the Delhi-Chandigarh highway. Five charging stations in the series were inaugurated in August 2019. In 2018-19, the company received its first order for the supply, installation and commissioning of 40 DC-001 chargers from Energy Efficiency Services Limited. BHEL has also contributed to India’s space mission by supplying propellant tanks, batteries and solar panels to ISRO for the prestigious Chandrayaan 2 project.

To build an international presence, the company is actively pursuing opportunities in the neighbouring countries as well as in the African market. In 2018-19, BHEL received an electromechanical package order for the 900 MW Arun-3 hydroelectric project, which will be the largest hydropower plant in Nepal. Other overseas orders were secured from Indonesia, Japan, Oman, Sri Lanka, Australia, Belarus and Bhutan. This is expected to strengthen BHEL’s position in the overseas market, opening up new growth avenues. Meanwhile, BHEL has been bidding for solar projects in international markets.

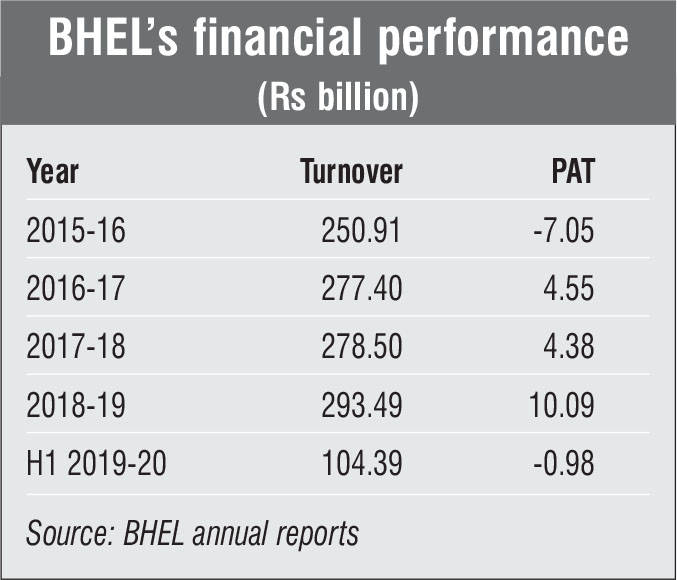

Financial performance

BHEL recorded growth during 2018-19 despite a decline in demand for the company’s traditional product lines and subdued performance of the domestic capital goods industry. The company recorded a turnover of Rs 293.49 billion as against Rs 278.5 billion in the previous year, an increase of 5.4 per cent. It also recorded a consolidated income of Rs 310.29 billion in 2018-19 as against Rs 295.07 billion in 2017-18, an increase of 5.16 per cent. Its net profit increased 130.3 per cent to stand at Rs 10.09 billion in 2018-19 as against Rs 4.38 billion in 2017-18.

However, the company’s financial performance has been subdued in 2019-20. For the half-year ended September 2019, BHEL’s consolidated income declined by over 15 per cent to Rs 110.33 billion as compared to Rs 130.5 billion in the corresponding period in 2018-19. The decline in income can be attributed to the slow execution of orders and the subsequent delay in revenue realisation. The company posted a net loss of Rs 979.8 million for the April-September 2019 period, as against a net profit of Rs 1.25 billion in the corresponding period in 2018. CRISIL’s long-term bank ratings for BHEL have slipped from AA+ to AA owing to weaker-than-expected operating performance and continued to decline in net cash levels in the first half of 2019-20.

Key challenges and the way forward

The domestic thermal power segment has remained subdued for the past three years and this is expected to continue in the near term owing to the growth of renewable power. Despite a dominant market share, BHEL faces the risk of diminishing order inflows, stiff competition and declining margins. As per a recent report by Edelweiss, thermal power equipment orders of 6-7 GW per annum is expected even if power demand grows 6 per cent in the next seven years. Other challenges for the company include delays in the payment of dues by utilities. In order to tide over these challenges in the thermal power sector, BHEL is diversifying into new business areas such as solar, railway transportation, defence and aerospace, and e-mobility. The diversification efforts are likely to improve revenues from non-power businesses in the medium to long term. The company is also focusing on fast-tracking project execution. “In the coming year, the company is focused on strengthening the foundations for future growth by reviewing and tightening the execution methodology for the expeditious completion of projects, putting in renewed efforts for recovery of long-due payments to improve the working capital position and generate funds for future growth, and enhancing BHEL’s competitive strength by improving the quality of its products and systems, among others,” says Dr Shinghal.

Renewables are expected to account for an increasingly large part of BHEL’s portfolio in the future. With its vast, experience, a large engineering and manufacturing base and technological expertise, BHEL is well positioned to leverage the existing and emerging market opportunities.