By Dolly Khattar

A recent report by Fitch Solutions Macro Research states that a combination of various challenges – including land availability hurdles, grid access bottlenecks and viability concerns over low tender bids – will adversely impact the near-term growth momentum in India’s wind power segment. “This informs our view that India will add on average only 4.5 GW of wind capacity annually between 2019 and 2022, with the aforementioned challenges highlighting further downside risk,” the report states. At this pace, India is likely to install 54.7 GW of wind capacity by 2022 against the target of 60 GW set by the government.

According to a year-end review released by the Ministry of New and Renewable Energy (MNRE) in December 2018, the country seeks to tender a total of 20 GW of wind capacity by March 2020, with two-year implementation deadlines, in order to facilitate growth to meet the targets. However, delays in the implementation of tendered projects and subdued interest in new auctions present a major hurdle in fulfilling the envisioned expansion plans. Renewable Watch takes a look at the emerging trends in the segment and the way forward…

Auction journey

In 2015, the MNRE set a target of 60 GW of wind installations by 2022. While a sizeable 5.4 GW of capacity was added in 2016-17, the pace slowed down considerably the following year, with only 1.7 GW of projects being commissioned, against a target of 4.1 GW. Most of these installations (about 1.2 GW) came online only after December 2017 when the auction regime was introduced. The key reasons for the sharp decline in capacity addition in 2017-18 were the discontinuation of the feed-in tariff (FiT) system along with the withdrawal of generation-based incentives and accelerated depreciation benefits.

The Solar Energy Corporation of India (SECI) carried out the country’s first-ever wind power auction in 2017, and the segment benefited in several ways. Tariffs fell sharply, with the lowest tariff being quoted at Rs 2.43 per kWh in one of the auctions. This was lower than the L1 tariff quoted in any solar project auction. Discoms, which were earlier hesitant to purchase wind power, suddenly began turning to it. However, all is not well in the segment as indicated by the capacity commissioned in 2018-19. Only 1,480 MW of wind power capacity has been added during the year against the target of 4,000 MW set by the MNRE. This is even lower than the capacity that had been added in the preceding year.

What went wrong, especially given the competitive advantage brought in by the auction regime?

What went wrong, especially given the competitive advantage brought in by the auction regime?

To date, 10.6 GW of wind power projects have been auctioned and awarded, but the pace of implementation of these projects has been very slow. Of a total of 2,943 MW of wind projects allocated by SECI during 2017 in Gujarat and Tamil Nadu (where 42 per cent of the country’s total installed wind capacity is located), only 825 MW was commissioned as of March 2019. Concerns over the viability of the low tender bids and land acquisition issues in Gujarat were the key reasons for the slow implementation of projects, which were initially expected to be commissioned within 18 months. In Tamil Nadu, grid connection issues were a major problem for wind power developers.

In what can be termed as the first significant move towards resolving the issue of land constraints for renewable energy project development, in early 2019, the Government of Gujarat released a land policy for such projects. The new policy mandates that all future solar, wind and solar-wind hybrid projects would have to be built in parks allocated for such systems. Gujarat, which is home to several solar parks, intends to avoid scattered project development across the state, making evacuation feasible and convenient. However, neither has this helped the wind projects that were held up due to the state’s reluctance to release land for projects auctioned by SECI, nor has it elicited a better response to the state’s own wind auction.

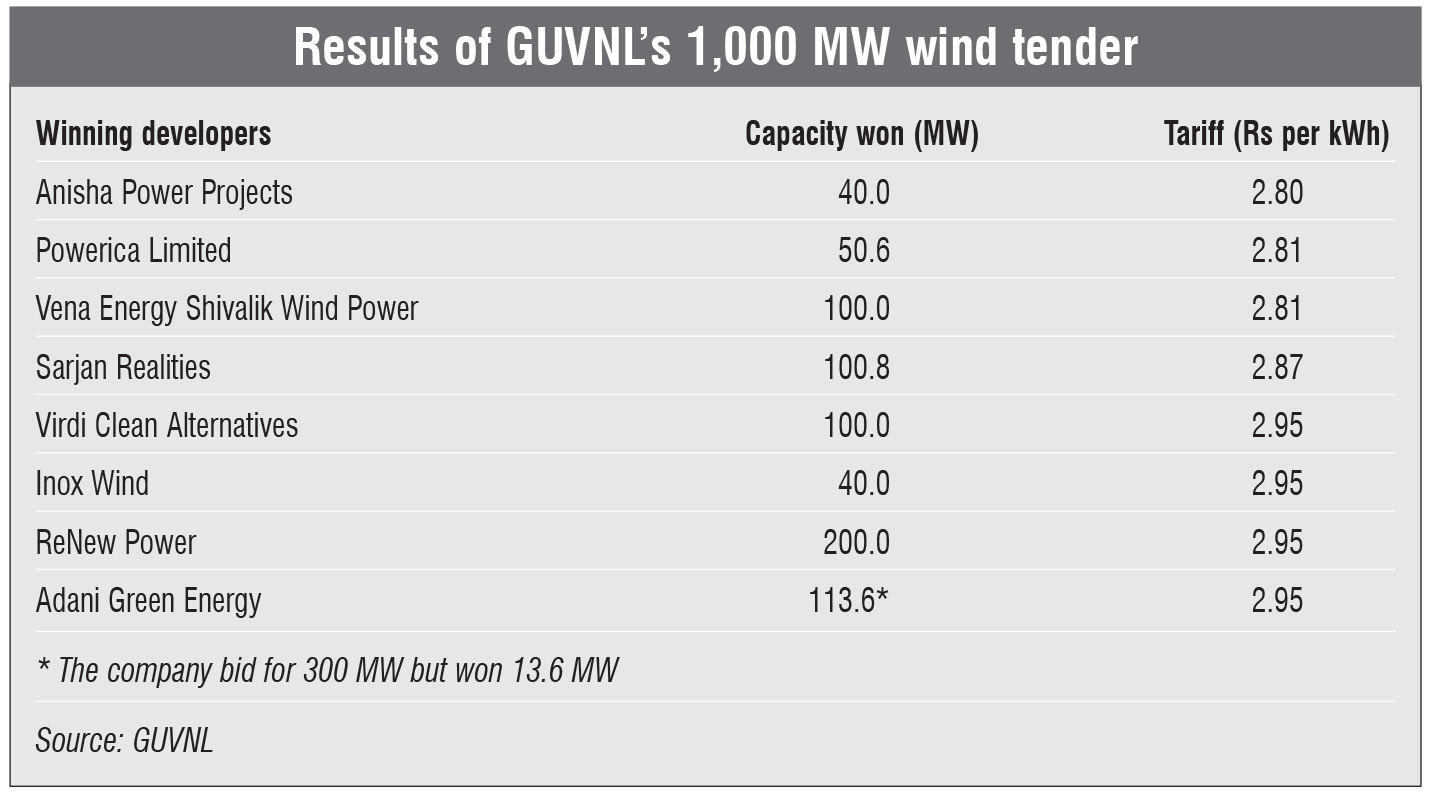

In March 2019, Gujarat Urja Vikas Nigam Limited (GUVNL) issued a request for selection for the purchase of power through competitive bidding from 1 GW of wind projects. The tender was under-subscribed by nearly 69 MW due to which GUVNL had to extend the bid submission deadline. However, this did not help garner any additional response. The nodal agency received bids totalling 931.4 MW and finally awarded 745 MW, that is, about 80 per cent of the amount bid for by the developers.

The winners were Anisha Power Projects, which quoted the lowest tariff of Rs 2.80 per kWh to set up 40 MW of wind projects; Powerica Limited, which quoted Rs 2.81 per kWh to develop 50.6 MW; Vena Energy Shivalik Wind Power, which also quoted Rs 2.81 per kWh to develop 100 MW of wind projects; Sarjan Realities, which bid Rs 2.87 per kWh to develop 100.8 MW of wind projects; Virdi Clean Alternatives, which quoted Rs 2.95 per kWh to set up 100 MW of wind capacity; Inox Wind, which bid Rs 2.95 per kWh to set up 40 MW of wind projects; ReNew Power, which bid Rs 2.95 per kWh to develop 200 MW of wind projects; and Adani Green Energy, which also bid Rs 2.95 per kWh to set up 300 MW of wind projects but was awarded 113.6 MW.

Notably, the L1 tariff quoted in this auction was Re 0.37 per kWh higher than the lowest-ever wind tariff of Rs 2.43 per kWh quoted in GUVNL’s 500 MW wind auction in Gujarat in December 2017.

A key reason for the tepid response to the latest tender and the higher tariff bids is that GUVNL had identified premium locations for setting up these projects. According to most developers, it would be difficult to execute and sustain projects at those locations at a tariff lower than Rs 3 per kWh. Land availability at these locations is also limited. Moreover, the Gujarat Electricity Regulatory Commission (GERC) had asked the bidders to declare pre-bid tie-ups with at least three original equipment manufacturers or engineering, procurement and construction contractors for executing the projects. Owing to these reasons, most of the large renewable energy players including Greenko, Sprng Energy, SB Energy, CLP, Sembcorp, Avaada and Hero Future Energies stayed away from bidding in this tender.

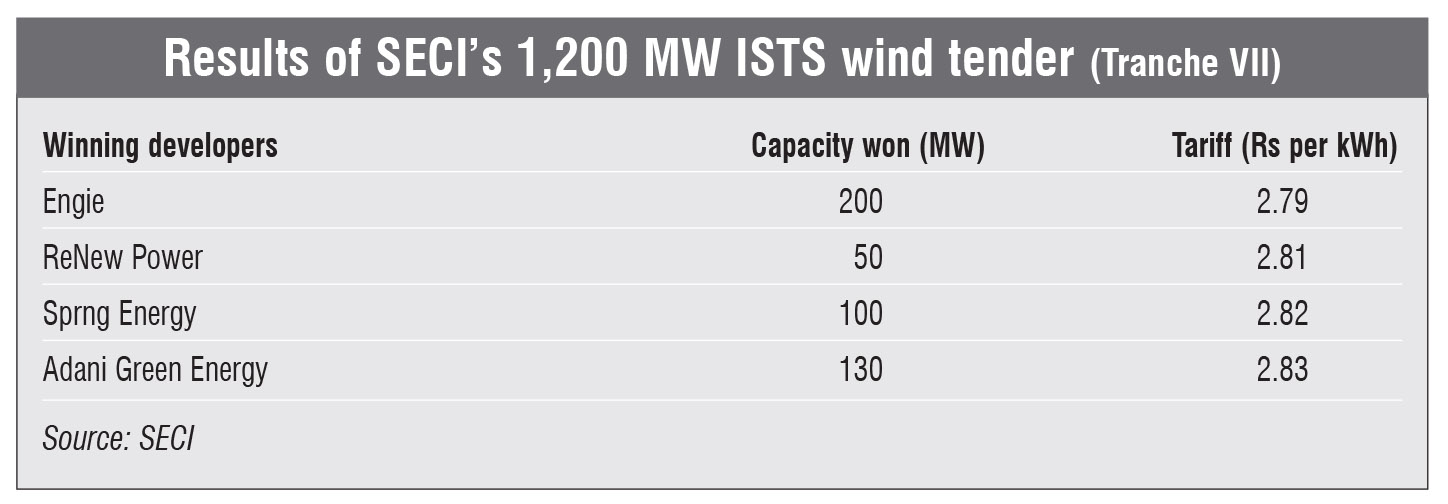

This is not the first instance of tender under-subscription in recent times. SECI’s 1.2 GW wind tender for interstate transmission system (ISTS)-connected wind power projects under Tranche VII, which was issued in February 2019, was undersubscribed by 50 per cent. Bids totalling 600 MW were submitted, against the tendered capacity of 1,200 MW. Engie bid for 200 MW, Sprng Energy for 100 MW, ReNew Power for 50 MW and Adani Green Energy for 250 MW. A key reason for the under-subscription was the upper tariff ceiling of Rs 2.83 per kWh set for the projects, which, it may be noted, is just one paise above the L1 tariff of Rs 2.82 per kWh quoted under semi-Tranche VI. Besides the fact that bidders could not opt for Gujarat to set up their projects due to the state’s new land policy, the prime reason for the under-subscription, industry experts believe, was that most banks were not ready to lend to wind projects with tariffs in the range of Rs 2.75 per kWh.

A key technological solution being explored on a large scale to address the prevailing land and cost economics issues of stand-alone solar and wind projects is wind-solar hybrids. Solar resources are available in abundance across the country. As such, the spare land between wind turbines can be optimally utilised for putting up solar modules. This would enable optimum land utilisation, better use of existing evacuation infrastructure, enhancement of the profile of energy generated and efficient utilisation of resources for project maintenance.

A key technological solution being explored on a large scale to address the prevailing land and cost economics issues of stand-alone solar and wind projects is wind-solar hybrids. Solar resources are available in abundance across the country. As such, the spare land between wind turbines can be optimally utilised for putting up solar modules. This would enable optimum land utilisation, better use of existing evacuation infrastructure, enhancement of the profile of energy generated and efficient utilisation of resources for project maintenance.

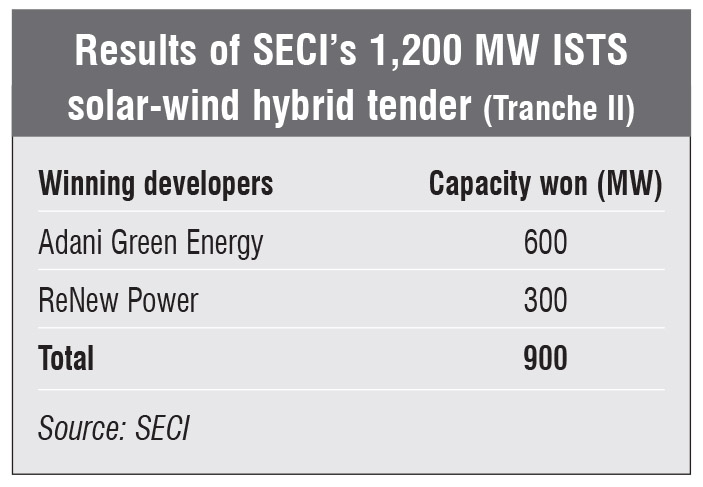

The first utility-scale commercial wind-solar hybrid was commissioned in the country in 2018. The MNRE, along with several states, has since released dedicated policies for such projects. However, the results of the latest auction for solar-wind hybrid projects are not very encouraging. SECI’s 1,200 MW tender for solar-wind hybrid projects received bids for just 900 MW of capacity from two developers. The tender had been issued in February 2018, but the detailed request for selection was made available only from March 8, 2019. Adani Green Energy submitted bids to develop 600 MW of solar-wind hybrid projects and ReNew Power mid for 300 MW.

This is the second time that India’s attempt to auction large solar-wind hybrid capacity has failed, with project developers submitting bids much lower than the offered capacity. In December 2018, in the first mega solar-wind hybrid auction conducted in the country, SB Energy emerged as the L1 bidder by quoting a tariff of Rs 2.67 per kWh. For this tender, the ceiling tariff had been fixed at Rs 2.70 per kWh. SECI had initially tendered 2,500 MW of ISTS-connected solar-wind hybrid power projects (Tranche I). Later, this capacity was reduced to 1,200 MW. The tender was under-subscribed by 150 MW and SECI awarded only 80 per cent (840 MW) of the 1,050 MW bid capacity.

The fact that there are only a small number of project developers that operate in both the solar and the wind energy segments could have played a role in the under-subscription of the hybrid project tender. Companies like Adani Green Energy and ReNew Power are the only private players that actively participate in solar as well as wind energy tenders. SB Energy recently entered the wind energy fray and has won only one project of 325 MW. Hero Future Energies is another company that operates in both the segments but has a rather conservative approach to bidding.

The under-subscription of the two hybrid tenders mirrors the recent trends seen in the solar and wind energy tenders issued by SECI as well as the state governments. In order to curb the increasing tariff bids by project developers, SECI set upper tariff ceilings for some of these. Some state governments went ahead and cancelled auctions, citing high tariff bids by developers. This, along with concerns about the lack of transmission capacity to support new projects, uncertainty regarding the general elections and future policy, and poor lender sentiment, has led to lower participation by developers in recent tenders.

The Indian wind energy segment stands at a crossroads today. Although its tariffs are similar to those of solar, there are questions about their sustainability. Over the longer term, the wind power segment’s competitive position vis-à-vis solar may weaken if the costs of solar PV systems drop faster and as the best wind sites are taken up. Regarding land and transmission-related issues, these are common across the two segments and will likely continue for some time before they can be resolved.

The main challenge today is that discoms expect developers to quote lower bids, despite growing project implementation challenges. The reverse auction procurement system in solar and wind was designed to award projects to the lowest bidder. But what the industry now has is a reverse auction where upper tariff ceilings are set and bids are expected to go in one direction only – down. Government agencies need to consult with developers and investors, and strike a balance between tariff, project quality and returns. Failing this, it will be challenging for the country to meet its renewable energy target.