By Sarthak Takyar

The Solar Energy Corporation of India (SECI) recently concluded the auction of Tranche VI of Inter State Transmission System (ISTS)-connected wind power projects worth 1,200 MW and grid-connected solar projects of 750 MW to be developed in Rajasthan. Two state tenders were also issued. Gujarat Urja Vikas Nigam Limited (GUVNL) auctioned 500 MW of grid-connected solar projects while Maharashtra State Electricity Distribution Company Limited (MSEDCL) tendered 1,000 MW of grid-connected solar projects.

The four tenders had one common trend – their technical bids were oversubscribed. Renewable Watch takes a look at the auction results and the reasons for the enthusiastic response to the tenders…

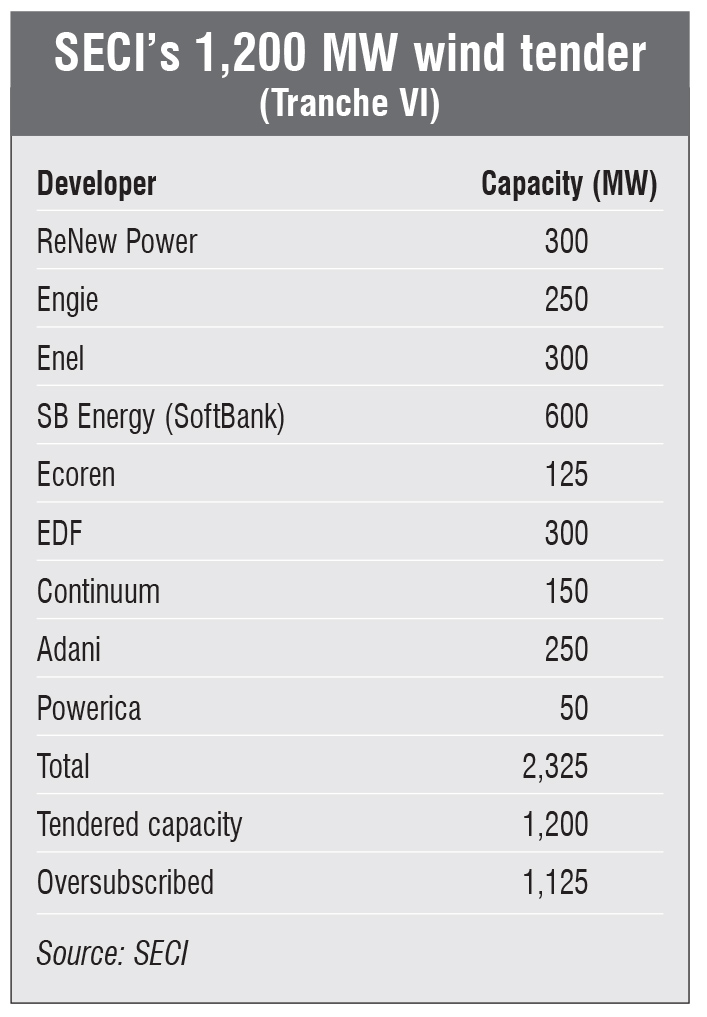

In February 2019, SECI received bids for 2,325 MW of capacity against the tendered capacity of 1,200  MW. The tender was oversubscribed by an aggregate capacity of 1,125 MW. The nine companies in the fray for Tranche VI were SB Energy (600 MW), ReNew Power (300 MW), Enel Green Power (300 MW), EDF Energy (300 MW), Adani Green Energy (250 MW), Engie (250 MW), Continuum Wind Energy (150 MW), Ecoren Energy (125 MW) and Powerica Limited (50 MW). Of these, six won the bids. Ostro Energy (a subsidiary of ReNew Power), Adani Renewables, Srijan Energy Systems (a special purpose vehicle of Continuum Wind Energy) and Powerica Limited won 300 MW, 250 MW, 150 MW and 50.6 MW of capacity, respectively, by quoting the lowest tariff of Rs 2.82 per kWh. Ecoren Energy India won the bid to develop 125 MW of capacity at a tariff of Rs 2.83 per kWh while SB Energy, which had bid for 600 MW, was awarded only 324.4 MW at Rs 2.83 per kWh.

MW. The tender was oversubscribed by an aggregate capacity of 1,125 MW. The nine companies in the fray for Tranche VI were SB Energy (600 MW), ReNew Power (300 MW), Enel Green Power (300 MW), EDF Energy (300 MW), Adani Green Energy (250 MW), Engie (250 MW), Continuum Wind Energy (150 MW), Ecoren Energy (125 MW) and Powerica Limited (50 MW). Of these, six won the bids. Ostro Energy (a subsidiary of ReNew Power), Adani Renewables, Srijan Energy Systems (a special purpose vehicle of Continuum Wind Energy) and Powerica Limited won 300 MW, 250 MW, 150 MW and 50.6 MW of capacity, respectively, by quoting the lowest tariff of Rs 2.82 per kWh. Ecoren Energy India won the bid to develop 125 MW of capacity at a tariff of Rs 2.83 per kWh while SB Energy, which had bid for 600 MW, was awarded only 324.4 MW at Rs 2.83 per kWh.

In the solar segment too, three solar photovoltaic (PV) tenders for Rajasthan, Gujarat and Maharashtra were oversubscribed. As many as 13 companies submitted bids totalling 2,370 MW for SECI’s 750 MW solar PV tender for Rajasthan. This was more than three times the auctioned capacity and the tender was oversubscribed by 1,620 MW. The bidding companies were Palimarwar Solar Project (LNB Group) (40  MW), Azure Power (100 MW), ReNew Power (360 MW), Juniper Green Energy (AT Holdings) (50 MW), Mahindra Susten (200 MW), the Shapoorji Pallonji Group (250 MW), Tata Power (150 MW), Fortum Solar (250 MW), Duroc Solar (Eden) (300 MW), ACME Solar Holdings (250 MW), UPC Solar (100 MW), Rays Power Infra (120 MW) and Sembcorp Energy India (200 MW).

MW), Azure Power (100 MW), ReNew Power (360 MW), Juniper Green Energy (AT Holdings) (50 MW), Mahindra Susten (200 MW), the Shapoorji Pallonji Group (250 MW), Tata Power (150 MW), Fortum Solar (250 MW), Duroc Solar (Eden) (300 MW), ACME Solar Holdings (250 MW), UPC Solar (100 MW), Rays Power Infra (120 MW) and Sembcorp Energy India (200 MW).

Five companies won the bid. Fortum Solar, ACME Solar, Sitara Solar Energy (a subsidiary of UPC Renewables) and Palimarwar Solar House won the bid for developing 250 MW, 250 MW, 100 MW and 40 MW of capacity, respectively, at the lowest tariff of Rs 2.48 per kWh. ReNew Power, which had bid for 360 MW of capacity, was awarded 110 MW at Rs 2.49 per kWh.

Meanwhile, GUVNL’s 500 MW solar PV tender received technical bids from seven companies for an aggregate capacity of 1,045 MW – an oversubscription of 545 MW. The bidding companies were Avaada Power and ReNew Power (which bid for 250 MW each), Adani Green Energy and Tata Power (each submitted bids for 150 MW), Juniper Green Energy (120 MW), Gujarat State Electricity Corporation Limited (GSECL) (75 MW) and UPC Solar (50 MW).

UPC Solar emerged as the lowest bidder by quoting a tariff of Rs 2.55 per kWh for developing a capacity  of 50 MW. GSECL, Juniper Green Energy and Adani Renewables emerged as the other winners by quoting a tariff of Rs 2.67 per kWh for developing 75 MW, 120 MW and 150 MW respectively. ReNew Power, which had bid for 250 MW at a tariff of Rs 2.68 per kWh, was awarded only 105 MW.

of 50 MW. GSECL, Juniper Green Energy and Adani Renewables emerged as the other winners by quoting a tariff of Rs 2.67 per kWh for developing 75 MW, 120 MW and 150 MW respectively. ReNew Power, which had bid for 250 MW at a tariff of Rs 2.68 per kWh, was awarded only 105 MW.

The 1,000 MW solar PV tender floated by MSEDCL under Phase II was oversubscribed by 900 MW. Seven companies participated in the bid. These were Juniper Green Energy (100 MW), Aqua Pumps (50 MW), ReNew Power (300 MW), Avaada Power and Adani (each bidding for 500 MW), Tata Power (150 MW) and ACME (300 MW).

Shiv Solar and ACME Solar won the bid to develop 50 MW and 300 MW of capacity, respectively, by quoting the lowest tariff of Rs 2.74 per kWh. The second lowest bidders were ReNew Power and Avaada Power, with both quoting Rs 2.75 per kWh for developing 300 MW and 350 MW of capacity respectively. Avaada Power, which had bid for 500 MW, was awarded 350 MW only.

The bid results are a big positive for the sector, which had been experiencing a lull in the past couple of months. The primary reasons for this were uncertainty over GST and safeguard duty, transmission infrastructure and land acquisition issues on the developer side, and the adverse impact on the sector owing to the extension of bid submission dates for most tenders. The situation seems to be improving with several steps being taken at both the central and the state level to  resolve the issues. In a significant move to address the issue of land constraints for renewable energy project development, the Gujarat government released its land policy in January 2019. The state intends to avoid scattered project development, and make evacuation feasible and convenient. According to industry experts, this could be a possible reason for the oversubscription of GUVNL’s 500 MW tender. Policy stability with the finalisation of the GST rate and developers’ push to expand their portfolios for improving their balance sheets could be the other drivers.

resolve the issues. In a significant move to address the issue of land constraints for renewable energy project development, the Gujarat government released its land policy in January 2019. The state intends to avoid scattered project development, and make evacuation feasible and convenient. According to industry experts, this could be a possible reason for the oversubscription of GUVNL’s 500 MW tender. Policy stability with the finalisation of the GST rate and developers’ push to expand their portfolios for improving their balance sheets could be the other drivers.

In the case of the three grid-connected solar tenders, the oversubscription could be on account of the states being pre-determined, which helps developers to better plan their projects. In addition, greater certainty regarding power purchase agreements in Rajasthan, Gujarat and Maharashtra vis-à-vis many other states helped.

Net, net, the positive response to the recent tenders spells hope for the wind and solar segments and all the stakeholders in the industry.