The rooftop solar segment in India has witnessed sluggish growth over the past year, with the installed capacity reaching only 1.2 GW as of June 2018. To achieve the installed capacity target of 40 GW by 2022, roughly 10 GW of capacity additions will be required each year. However, with the current pace of growth, only 10.8 GW of rooftop solar capacity is expected to be installed by 2021, as per BRIDGE TO INDIA estimates. In contrast, in the utility-scale ground-mounted solar power segment, 21.1 GW of capacity has already been installed against the targeted capacity of 60 GW. Roughly, 9.6 GW of ground-mounted solar capacity was added in 2017-18, whereas in the rooftop solar space, a small capacity addition of 352.8 MW was recorded during the same period.

Current status

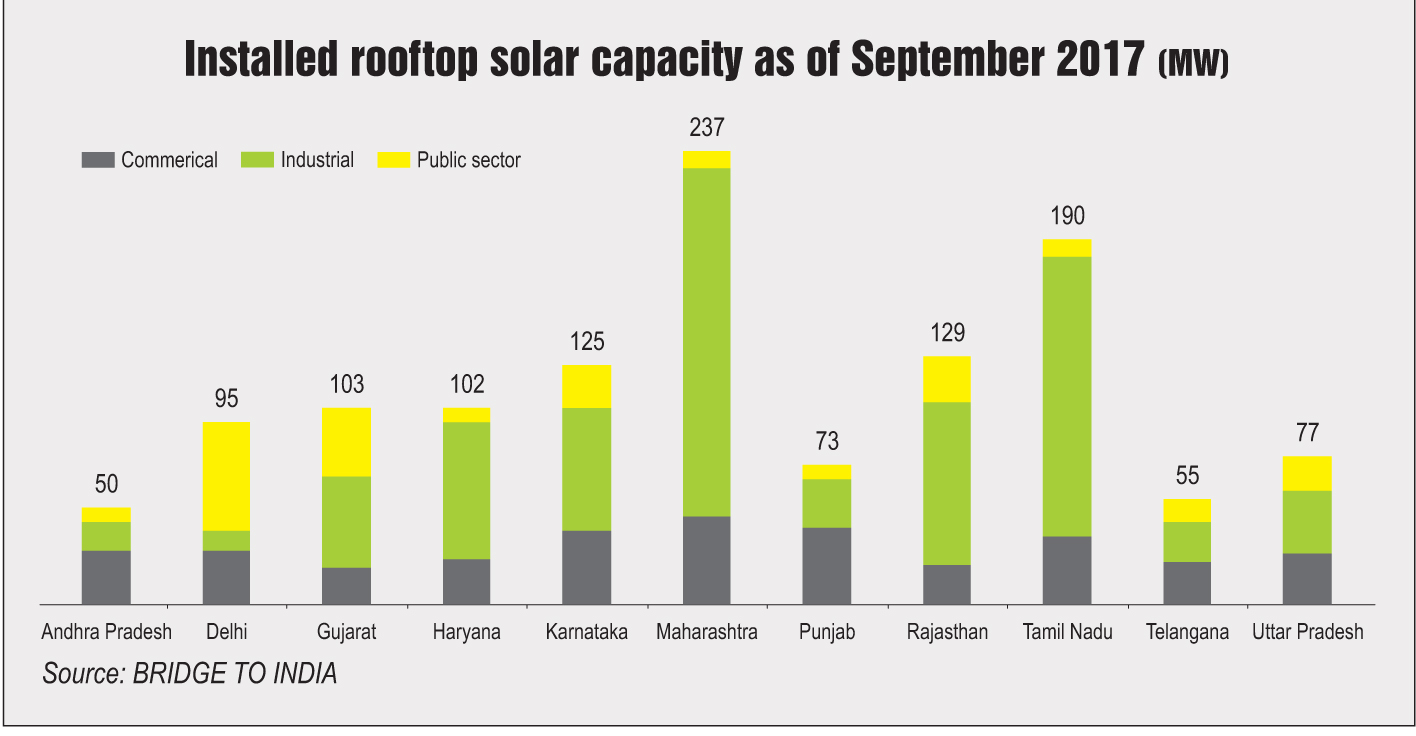

Maharashtra has emerged as the leader in the rooftop solar space, followed by Tamil Nadu, Rajasthan and Karnataka, while Andhra Pradesh, Punjab, Telangana and Uttar Pradesh lag far behind. It is interesting to note that the commercial and industrial (C&I) sectors form the biggest consumer segment in the rooftop space. The public sector has not seen much growth despite strong mandates and incentives from the government. The only exception in this case is Delhi, where the public sector is the largest consumer, most likely due to the strong central government presence. The present trend of low capacity addition in rooftop solar is surprising, considering that the majority of the states have comprehensive rooftop solar policies. In addition to this, almost all states have net metering regulations for rooftop solar installations, and a few have both gross metering and net metering regulations in place. Hence, it is not the lack of policies and regulations but a lack of proper implementation that is impeding the growth of rooftop solar in the country. Further, significant delays in obtaining approvals for net metering connections are driving even willing customers away from installing large systems, with many of them now opting for smaller systems only to reduce their bills. The financially weak state-owned discoms are reluctant to provide approvals for rooftop projects and net metering for C&I customers as they are the highest revenue earners for the discoms. At the same time, residential consumers are often discouraged by the high upfront costs of these projects.

Government interventions

The Ministry of New and Renewable Energy introduced the SRISTI (Sustainable Rooftop Implementation for Solar Transfiguration of India) scheme as part of Phase II of the rooftop solar scheme. The government is making efforts to address the challenges plaguing the rooftop solar segment and streamline the process of rooftop solar installation. Under this scheme, central financial assistance (CFA) subsidies have been withdrawn for high-paying customers that is, the commercial, industrial, government and social sectors. Interestingly, the C&I sectors have been assigned the highest rooftop solar target of 20 GW, against the total of 40 GW by 2022, while a small target of 5 GW each has been determined for the other sectors.

The way forward

State governments have begun to take interest in this segment as seen from the recent string of tenders announced by various government agencies. This is a deviation from the general trend seen previously, where the majority of the rooftop solar capacity was tendered by a central organisation. No major tender activity has happened in the C&I space as the economic feasibility of rooftop solar for this consumer category makes tenders immaterial. With access to low-cost capital and growing project viability, rooftop solar development is slowly picking up pace. However, for rapid growth, the operational processes need to be better streamlined and standardised for customers. Further, the central and state governments should focus on outreach and capacity building programmes for greater participation, and develop different target strategies for various consumer segments and clusters. Going forward, an enabling policy and regulatory environment is needed to promote innovative business models.

Based on a presentation by Balawant Joshi, Managing Director, Idam Infrastructure Advisory