In the decade spanning 2010-20, several countries shifted away from feed-intariffs (FiTs) to the process of auctions for allocating projects. With an increasing number of countries making this move, India too adopted the new paradigm of reverse auctions for both solar and wind projects, resulting in greater competition and driving down solar and wind tariffs significantly as compared to the beginning of the decade. For instance, from an all-time high of Rs 10.95 per kWh in 2010, tariffs fell roughly to the Rs 4.30 per kWh range in 2016 and reached as low as Rs 1.99 per kWh in December 2020. New entrants have also been discovered in the market, with greater participation of public sector units in clean energy auctions.

The market has also witnessed a rising number of auctions for wind-solar hybrid projects in recent years. The tariffs discovered in these auctions are highly competitive and much lower than coal and thermal tariffs. Auctions in the wind segment have, at the same time, been stagnant and limited. The segment had already been witnessing slow growth over the past few years. This was exacerbated by the supply chain disruptions and mobility constraints caused during the Covid-19 pandemic. To give a fresh boost to the segment, the government is rapidly encouraging hybrid-wind and round-the-clock projects. However, with the ongoing policy changes, it is crucial to analyse the tariff trends across various segments and understand the various factors affecting them.

Solar tariff trends

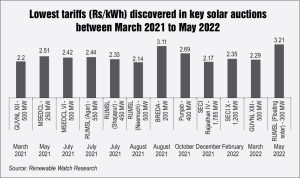

The year 2021 witnessed many successful solar auctions. The lowest tariff of the year was discovered at Rewa Ultra Mega Solar Limited’s (RUMSL) auction for 500 MW of projects at the Neemuch Solar Park in Madhya Pradesh in August 2021. TP Saurya won the bid for 170 MW at a tariff of Rs 2.14 per kWh and for 160 MW at a tariff of Rs 2.149 per kWh, while AlJomaih Energy and Water Company won a capacity of 170 MW at Rs 2.15 per kWh. The lowest tariff in the year was higher by nearly 8 per cent than the lowest tariff in 2020 in Gujarat Urja Vikas Nigam Limited’s (GUVNL) Phase XI auction for 500 MW of solar projects. This was followed by the Solar Energy Corporation of India’s (SECI) auction for 1,785 MW of solar power projects (Tranche IV) in Rajasthan in December 2021. ReNew Solar Power and ACME Solar also won 600 MW and 375 MW respectively, at a quoted tariff of Rs 2.18 per kWh. The third highest tariff was discovered in GUVNL’s auction to purchase power from 500 MW of grid-connected solar projects (Phase XII) in March 2021, where Sprng Ujjvala Energy won a capacity of 120 MW quoting Rs 2.20 per kWh.

Among the solar auctions that have been undertaken so far since the beginning of 2022, the lowest tariff discovered has been Rs 2.29 per unit in GUVNL’s auction for 500 MW of solar projects (Phase XIII) in March 2022. Most recently, in May 2022, three winners were declared in RUMSL’s auction for the 600 MW floating solar park in the Omkareshwar reservoir in Madhya Pradesh. The auction was undertaken for the first phase of the project, encompassing a capacity of 300 MW. Amp Energy was awarded 100 MW at a quoted tariff of Rs 3.21 per kWh, NHDC was awarded 100 MW at a quoted tariff of Rs 3.22 per kWh and SJVN was awarded the remaining 100 MW capacity at Rs 3.26 per kWh. This is the highest discovered tariff in the past 15 months, and may be attributed to the higher costs of floating solar technology compared to ground-mounted projects. Further, the recently imposed basic customs duty on imported cells and modules, and the implementation of the Approved List of Models and Manufacturers have also impacted tariffs.

Wind tariff trends

Wind tariffs are relatively higher than those discovered in solar and wind-solar hybrid auctions. In May 2022, NTPC renewables, Halvad Renewables, JSW Neo Energy and Torrent Power won SECI’s auction for the 1.2 GW interstate transmission system (ISTS)-connected wind power projects (Tranche XII). NTPC Renewables quoted a tariff of Rs 2.89 per kWh while the rest quoted Rs 2.94 per kWh. The lowest tariff of 2021 was discovered in SECI’s auction for 1,200 MW of ISTS-connected wind power projects (Tranche XI) in September 2021. ReNew Power, Green Infra Wind Energy and Anupavan Renewables won capacities of 300 MW, 180 MW and 150 MW respectively at a quoted tariff of Rs 2.69/kWh. The tariff was roughly 2.9 per cent lower than the lowest tariff discovered in SECI’s previous auction of 1,200 MW of ISTS-connected wind projects (Tranch X), held in March 2021, in which Adani Renewable Energy, which won 300 MW of capacity, had quoted a tariff of Rs 2.77 per kWh. The highest bid over the past one year was quoted by Sembcorp, which won the entire capacity of 50 MW in REMCL’s auction for power consumption of the railways for traction in Maharashtra at Rs 3.11 per kWh.

Solar-wind hybrid tariff trends

The number of wind-solar hybrid project auctions has increased over the past few years. Recent tariffs discovered at these auctions are highly competitive with the present level of solar tariffs. During 2021-22, the lowest tariff discovered for hybrid projects stood at Rs 2.34 per kWh, found in SECI’s auction for 1,200 MW of ISTS-connected wind-solar hybrid power projects (Tranche IV) in August 2021. The discovered tariff was 3 per cent lower than the lowest bid of Rs 2.40 per kWh quoted in the wind-solar hybrid auction in December 2020. NTPC and Ayana Power won a capacity of 450 MW each, while NLC India was awarded a capacity of 150 MW at the same quoted tariff of Rs 2.34 per kWh. Azure Power was also awarded a capacity of 150 MW out of 300 MW under the bucket filling method, at a quoted tariff of Rs 2.35 per kWh.

In May 2022, Tata Power, Amp Energy, NTPC and SJVN won SECI’s auction to develop 1,200 MW of ISTS-connected wind-solar hybrid projects (Tranche V) across India at a quoted tariff of Rs 2.53 per kWh. Since 2020, the highest tariff discovered in hybrid auctions has been Rs 3.01 per kWh, quoted by Hindustan Thermal Projects at SECI’s auction for supply of 2.5 GW of round-the-clock (RTC) power from grid-connected renewable energy projects, complemented with power from coal-based thermal projects.

Outlook

A recent report by JMK Research and the Institute for Energy Economics and Financial Analysis suggests that solar tariffs in India may increase by over one-fifth of current tariffs over the next one year as a result of the imposition of a 40 per cent basic customs duty on imported solar modules, and 25 per cent duty on solar cells from April this year. Surging commodity prices, if not curbed, may also lead to such a rise in tariffs. As compared to India’s record low solar tariff bid in 2020 at Rs 1.99 per kWh, 2021 saw a slight rise in tariffs due to higher freight charges and raw material costs.

Moreover, the implementation of the Approved List of Models and Manufacturers may also create supply- and price-related challenges in the short to medium term. The report states that in order to maintain low solar tariffs, the duration of the basic customs duty imposition as well as its expected trend (increase or decrease) on a year-on-year basis should be clearly stated by policymakers and government regulators. Moreover, while hybrid projects are witnessing an uptick in the market, independent wind auctions must also take off in order to meet India’s ambitious target of installing 500 GW of non-fossil fuel-based energy by 2030. At present, the tariff rates discovered in the wind auctions are largely viable only in states such as Gujarat and Tamil Nadu, which currently hold high power load factors. Furthermore, streamlining land acquisition for wind projects and speedy environmental approvals may also help bring down wind tariffs.

In the coming months, bids are also expected to be issued for installing offshore wind energy projects, following the announcement by the Union Minister for Power and New and Renewable Energy in June 2022 at a meeting on transmission planning for offshore wind energy projects in India. As per the statement, bids for offshore wind energy blocks of 4 GW off the coasts of Tamil Nadu and Gujarat will be issued every year for the next three years.

Going forward, to successfully meet India’s renewable energy targets, ensuring the competitiveness and sustainability of renewable energy tariffs is crucial. Policymakers must emphasise developing a greater understanding of the various determinants of tariffs such as financing costs, module prices, import duties and other equipment- and raw material-related aspects, instead of aspiring for unsustainably low prices, to ensure quality projects that can last for 25 years.

By Kasvi Singh