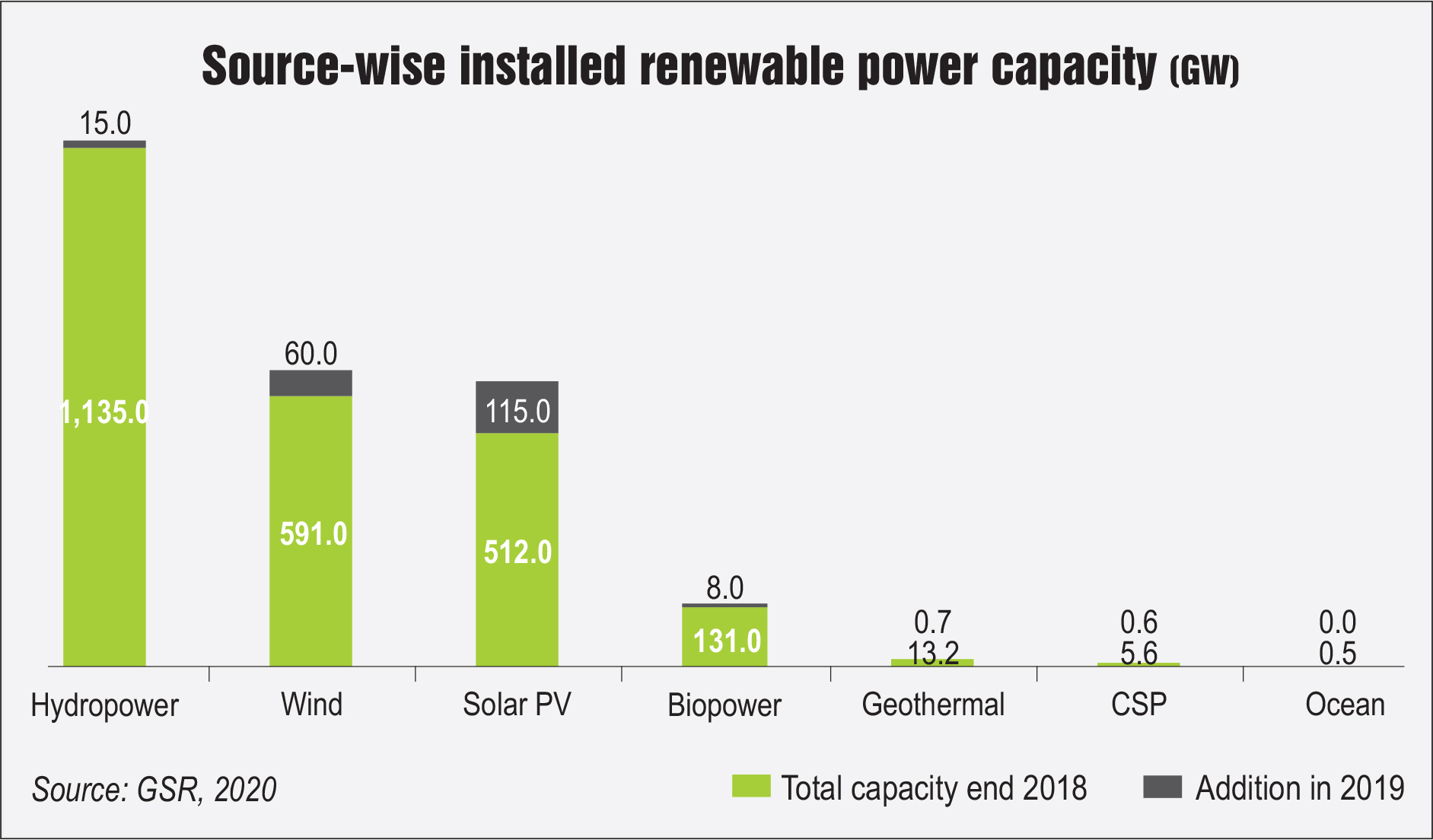

Renewable energy has established itself as a preferred source for meeting energy needs across countries. Having added an unprecedented 200 GW of renewable capacity through the year, the total renewable power capacity (including hydropower) stood at 2,588 GW at the end of 2019, as per REN21’s Global Statistics Report, 2020. This translates into an increase of almost 8.4 per cent over the previous year. Across the globe, 32 countries recorded an installed renewable power of over 10 GW in 2019. This is a significant increase from only 19 such countries a decade ago. Moreover, over 27 per cent of the total electricity generation in 2019 was based on renewable energy sources. Further, net additions of renewable power generation capacity outpaced net installations of fossil fuel and nuclear power capacity combined for the fifth year in a row.

Climate action goals have provided an impetus to the renewable energy sector in an effort to reduce carbon dioxide and other greenhouse gas emissions. Setting of targets has played an important role in the commitment to renewable energy, most of them being directed towards the power sector. At the end of 2019, 166 countries had renewable power targets, compared to 49 countries for heating and cooling and 46 for transport. Thus, renewable power continues to grow, mostly led by solar and wind, but with other resources also playing key roles.

Renewable Watch presents the key development trends and outlook for various segments within the renewable energy space…

Solar power

Solar power growth continued to dominate renewable energy growth, with an unprecedented level of capacity installed in the year 2019. As per REN21, about 115 GW of solar generation capacity was added in 2019, a growth of 22.5 per cent over 2018. At the end of 2019, the total installed solar PV capacity across countries stood at 627 GW. In 2019, an estimated 18 countries added at least 1 GW of new capacity, up from 11 countries in 2018. Further, by the end of 2019, at least 39 countries had a cumulative capacity of 1 GW or more, up from 31 countries one year earlier. Countries that ranked among the top 10 for new solar PV installations added 3.1 GW or more. During the past year, corporate purchasing also expanded considerably. Distributed solar systems increased significantly, especially with the increasing viability of battery storage. The global concentrating solar thermal power (CSP) capacity has also been growing, even though restricted to some pockets. Solar CSP capacity of about 600 MW was added during the year, taking the net global capacity to around 6.2 GW.

Conducive policies and evolving technologies are enabling cheaper access to capital in leading markets. In addition, sharp cost reductions over the past decade have led to solar PV becoming increasingly cheaper than the new fossil-fuel-based power in most countries, and solar projects now offer electricity at the lowest cost ever seen. The solar market is extremely competitive. This sometimes leads to thin margins for developers and manufacturers, although competition drives innovation and efficiency. In terms of upcoming capacity, the demand for solar in Europe, the US and other emerging markets continues to grow, while it has slowed down in China. Despite a mild slowdown in internal demand, China continues to dominate the world market as well as manufacturing.

Wind power

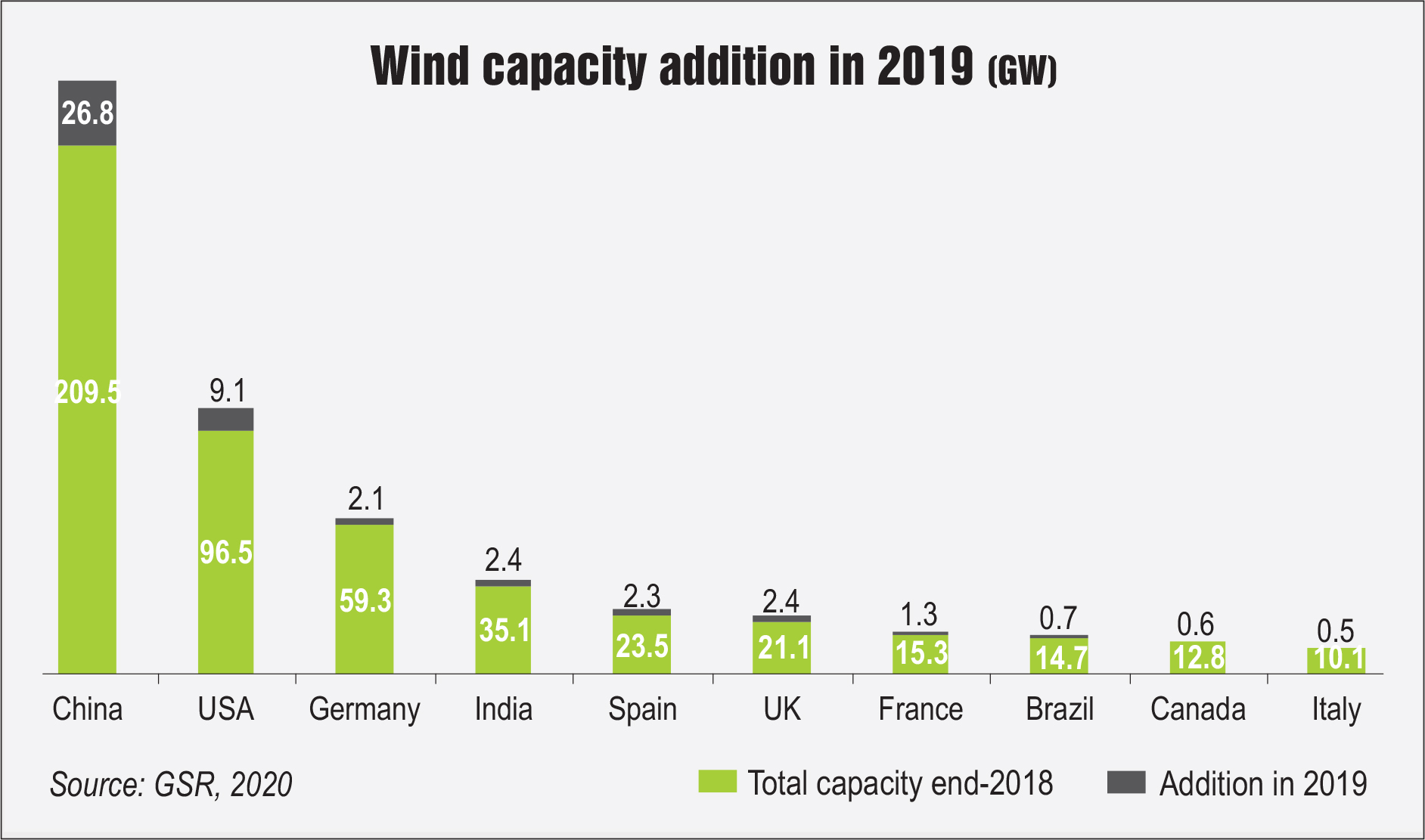

Wind power witnessed an upturn in 2019 with its second highest annual increase in capacity. Offshore wind has a crucial role to play in this as it contributes to about 10 per cent of the additions. Wind added a capacity of about 60 GW in 2019 to reach a total of 650 GW at the end of the year. This growth has been due to surges in China and the US in policy changes, and a significant increase in Europe despite continued market contraction in Germany. By the end of the year, at least 102 countries had significant wind power capacity, contributing about 5.9 per cent to global power generation. Of these, 35 countries had more than 1 GW in operation each. Countries with the highest contribution are Denmark, Ireland, Uruguay and Portugal.

Although capacity additions have been increasing, wind power prices have been falling, primarily due to a shift to competitive bidding regimes. This has resulted in tough competition and a few developers dominating the space. Further, low tariffs are putting pressure on turbine manufacturers. Poorly designed tenders, permitting delays and lack of available land and grid access are other challenges being faced by wind power developers. However, wind is still on a promising growth path. According to the latest market outlook published by Global Wind Energy Council Market Intelligence, 71.3 GW of wind power capacity is expected to be installed in 2020, despite the Covid-19 impact.

Bioenergy

Bioenergy forms a very large part of energy supply across the world. It accounts for 70 per cent of the global renewable energy supply and 10 per cent of the total primary energy supply. In 2019, bioenergy’s contribution to the electricity increased to a total of 503 TWh. This was an increase of 9 per cent over the previous year. While China continued its lead in this segment, the EU, Japan and Korea were other countries of note in terms of bioelectricity growth. Wood pellet production and investment in hydrotreated vegetable oil production also continued to grow. Modern bioenergy contributed to 5.1 per cent of the total global final energy demand in 2018, accounting for around half of all renewable energy in the final energy consumption.

In 2019, trends and developments varied widely across the solid, liquid and gaseous biomass industries. Bioenergy provides around 9 per cent of the industrial heat demand and is concentrated in bio-based industries such as paper and board. Biofuels, mostly ethanol and biodiesel, provide around 3 per cent of the transport energy. In 2019, global biofuel production increased by 5 per cent, while ethanol production grew by about 2 per cent in spite of the main producer, the US, experiencing a decline in production. There already exist many well-established bioenergy pathways at a commercial level that are technically proven and for which systems are available. In addition, new routes are at early stages of development, demonstration and commercialisation.

Hydropower

Growth in the hydropower segment remained slow, with a capacity addition of only 15.6 GW in 2019. This raised the total installed capacity to about 1,150 GW at the end of the year. While capacity addition over the previous year increased by about 1.4 per cent, generation of hydropower increased by 2.3 per cent. The total estimated power generation through hydro was about 4,306 TWh in 2019. In addition to more capacity, this reflects variations in local weather conditions and other operational factors. In 2019, Brazil took the baton from China in new capacity addition. China has been displaced from this title for the first time since 2004. Other countries with high capacity additions include Lao PDR, Bhutan and Tajikistan.

A very small increase was recorded in pumped storage capacity in 2019. Most of this addition was due to a new 300 MW project in China, which raised the total world capacity for pumped hydro storage to 158 GW. However, there is a healthy pipeline of upcoming pumped storage projects. Some of the new pumped storage projects are being optimised to ensure fast response to changing grid conditions. Hydropower facilities can aid the effective integration of variable renewable energy sources, such as solar PV and wind power. Even then, the segment continues to face a variety of challenges such as upgradation of existing old hydropower plants, their relationship with new renewable energy sources and socio-environmental concerns regarding the establishment of new plants.

Geothermal energy

As per REN21, in 2019, the total geothermal electricity generation was about 95 TWh, while the direct useful thermal output reached around 117 TWh. An estimated 0.7 GW of new geothermal power generating capacity came online in 2019, bringing the global total to around 13.9 GW. Most of this capacity addition happened in resource-rich areas such as Turkey and Indonesia, followed closely by Kenya. All these countries together represented close to 75 per cent of new installations. Other countries that added new geothermal power facilities were Costa Rica, Japan, Mexico, the US and Germany. Europe and China are active markets, with China picking up pace in recent years. China, Turkey, Iceland and Japan account for about three-quarters of the total direct geothermal use in the year 2019.

The global geothermal industry had mixed results in 2019, as in many previous years. The geothermal segment continues to face challenges of high project costs and lack of adequate funding. More research is needed in new and innovative technologies and processes to further develop geothermal energy. A recent report by the International Renewable Energy Agency (IRENA) highlights the high geothermal potential in the East African Rift Region. This region represents an untapped source of geothermal energy, which can provide the area with sustainable electricity production and direct use.

Ocean energy

Ocean energy is currently being developed in various regions across the globe, but it is concentrated around Europe. This region generated 15 GWh of energy in 2019 through tidal stream devices, recording a 50 per cent increase from 2018. Ocean power has also been gaining traction in Canada, the US and China. The main drivers of the segment are revenue support as well as research and development programmes. The total addition in 2019 amounted to about 3 MW, pushing the cumulative capacity to 535 MW by the end of the year. Most of the ocean or marine energy projects are small-scale demonstrations of less than 1 MW or are at the pilot stage. Tidal stream and wave power are the main focus of development efforts. Although the potential of ocean power is enormous, these technologies are still in early stages of development. The ongoing technological progress and development activity are encouraging, with the industry moving beyond pilot projects, towards semi-permanent installations and significant investments and deployments planned for 2020 and beyond.

Investments in renewables

Global investment in renewable energy in 2019 (excluding hydro projects larger than 50 MW) amounted to about $301.7 billion, an increase of 5 per cent over the previous year, according to REN21. With the addition of large hydro projects, this figure would increase by about $15 billion. Investment in renewables exceeded that in coal, natural gas and nuclear energy. It accounted for almost 75 per cent of the total investment flows towards the addition of power generating capacity. Developing and emerging economies outweighed developed countries in renewable energy capacity investment for the fifth year running. India and China recorded a slight slowdown in these investments, but other developing countries could more than offset this slowdown. Investment in renewables continued to focus on wind and solar power, with wind power outweighing solar PV for the first time since 2010. Together, these two segments accounted for $230 billion during 2019.

According to IRENA’s estimates, annual investments in renewables must triple to $800 billion by 2050 to fulfil key global decarbonisation and climate goals. Pension funds, insurers, sovereign wealth funds and other institutional investors represent an enormous global capital pool that could be harnessed for energy transition.

Distributed renewable energy

The number of people without energy access has been declining significantly over the years. From about 1 billion such people in 2017 (13 per cent of the population), the number dropped to 860 million in 2018 (11 per cent of the population). Distributed renewable energy is a key way of increasing electricity access in remote areas. These systems can help areas not served by grid connection or with unreliable grid connectivity through solutions such as solar PV, biopower, hydropower minigrids and stand-alone solar PV. Distributed renewable energy is managed to benefit around 150 million people across the world in 2019. The key areas where distributed renewable energy systems have gained momentum are in Asia and Africa.

Off-grid solar solutions, which include solar lighting systems and solar home systems, accounted for nearly 85 per cent of distributed renewable systems worldwide in 2019. More than 180 million off-grid solar units have been sold since 2010, including 150 million pico solar products and 30 million solar home systems. The market for off-grid solar systems grew by 13 per cent in 2019, which has been the highest growth in the past five years. The market for clean cooking solutions has also been growing, although the sector is yet to be scaled to the level of off-grid solar PV.

While investments from institutions continued to flow in, corporate investments in the segment dropped to $468 million in 2019, down from $512 million in 2018. Meanwhile, capital flows in minigrid start-ups recorded an addition of $113 million. Development finance institutions, international organisations, philanthropic foundations and non-state actors provided significant support in many countries by addressing policy barriers, enhancing the enabling framework and offering technical assistance and financing to governments and companies.

Integration of renewables

Renewable energy has been growing fast with a large amount of yearly capacity additions. However, given the variable and uncertain nature of renewable power sources, grid integration becomes particularly challenging. In order to address this challenge, power system flexibility is being enhanced through a variety of solutions. These include strategic market design that rewards or promotes flexibility, direct procurement of flexibility services from generation sources, demand and energy storage, improved electricity demand forecasting and grid infrastructure improvement. Many types of technologies are evolving to support renewables’ integration. This is usually done by promoting linking of energy supply and demand across electricity, thermal and transport applications. Technologies such as heat pumps, electric vehicles (EVs), and various types of energy storage can be applied to this aid.

The global market for energy storage of all types reached 183 GW in 2019. Beyond constantly evolving battery storage technologies, emerging energy storage options also include pumped hydro storage and renewable hydrogen. The energy storage industry saw significant cost improvements, increased manufacturing capacity, large investments and ongoing research and development during 2019.

Outlook

According to IRENA, global wind and solar capacity is expected to double over the next five years. Further, renewables are expected to overtake gas-based power capacity in 2023 and coal in 2024. Beyond wind and solar heavy growth, bioenergy can play a key role in energy supply in the coming years due to its versatility, as per IRENA. Overall, renewable energy could contribute to 63 per cent of the industry’s total final energy consumption by 2050, of which 24 per cent could be sourced from biomass.

Despite efforts to curb emissions, the world is not on track to limit global warming to well below 2 °C, let alone 1.5 °C, as stipulated in the Paris Agreement. Renewable energy is growing as an important means to combat climate change. However, the sector needs to first battle a slew of challenges that it faces internally. Even though renewables have weathered the Covid-19 storm relatively well, policy uncertainties continue to be an obstacle for continued growth. Notably, some of the key policies coming to an end are China’s offshore wind and solar subsidies, as well as the solar and onshore wind production tax credits in the US.

Further, power infrastructure is a challenge for many developing countries with a rapidly expanding renewable energy sector. There is a need to scale up the adoption of smart grids, energy storage and energy management to help integrate variable renewable energy. For renewable energy to grow sustainably, capacity additions need to be stacked on a firm foundation of policy, regulations and infrastructure.

By Meghaa Gangahar