The availability of contiguous tracts of land has always been a pain point in the development of large-scale solar power projects. Delays in various land acquisition processes have in the past led to the postponement of tenders and extension of project commissioning timelines, as witnessed in the case of the Bhadla Solar Park, the Pavagada Solar Park and many other large projects. Moreover, land prices have skyrocketed in many parts of the country and landholdings are small and scattered, making the process of securing land approvals an arduous task for developers. With 1 MW of solar power capacity requiring 4-5 acres of land, the land availability situation is only going to worsen with time, as India moves ahead with the 100 GW solar plan.

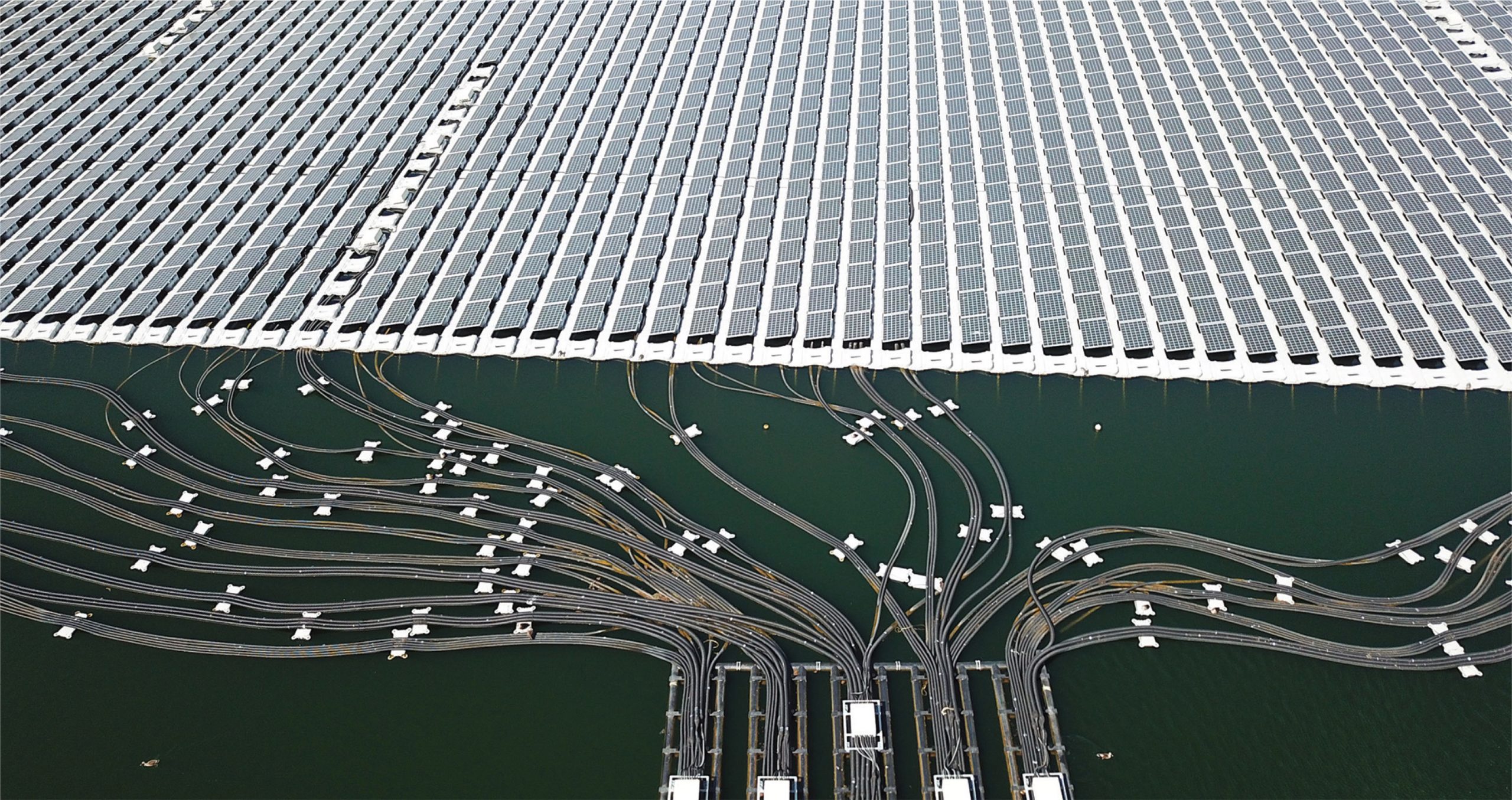

One solution to bypass the red tape surrounding land acquisition and save significant costs is to install floating solar or canal-based solar plants on or along waterbodies, instead of on land. The floating solar segment has emerged as a popular choice for the public as well as private sector, owing to attractive techno-commercial benefits, with a slew of projects at advanced stages of completion and more being tendered at a rapid pace. Meanwhile, canal-based solar, which has been present for a decade, has lost some steam due to execution- and cost-related challenges, with only a few small projects in the pipeline.

Surge in floating solar projects

The installed capacity of floating solar projects is quite minuscule compared to canal-based solar, with less than 10 MW of installations so far. The largest of these is the 2 MW project on the Mudasarlova reservoir in Visakhapatnam. However, unlike canal-based solar, India has an extensive pipeline of floating solar plants with frequent announcements of new projects. NTPC alone has more than 150 MW of capacity under implementation on reservoirs at its thermal power sites. Further, Renewable Watch Research has tracked a total of 2,750 MW of new project capacity announcements in the current financial year alone.

Amongst recent developments, the largest project has been announced by the Damodar Valley Corporation (DVC). In September 2020, DVC proposed 1.7 GW of floating solar projects along four of its dams – Maithon, Tilaya, Konar and Panchet – located in West Bengal and Jharkhand. Prior to that, in August 2020, NHPC Limited and the Madhya Pradesh government, through their joint venture (JV), NHDC Limited, reissued a tender for a 25 MW floating solar project to be implemented at the Omkareshwar reservoir in the Khandwa district of Madhya Pradesh. The tender was first floated in July 2019, but was cancelled due to right-of-way issues being faced by bidders.

In July 2020, the Solar Energy Corporation of India (SECI) floated a tender to develop 15 MW of floating solar projects at the Nangal Pond in Bilaspur district of Himachal Pradesh. In the same month, Singareni Collieries Company Limited announced its plans to develop floating solar power plants with a cumulative capacity of 500 MW in Telangana, on large water bodies in Karimnagar and Warangal, among other districts. Further, NHPC signed an MoU with Green Energy Development Corporation of Odisha Limited to form a JV for developing 500 MW of floating solar projects in Odisha. The first phase work of the project is likely to commence by March 2022. Finally, in March 2020, West Bengal Power Development Corporation Limited issued a tender for a 10 MW grid-connected floating solar project to be set up at the Sagardighi thermal power project in Murshidabad.

In July 2020, the Solar Energy Corporation of India (SECI) floated a tender to develop 15 MW of floating solar projects at the Nangal Pond in Bilaspur district of Himachal Pradesh. In the same month, Singareni Collieries Company Limited announced its plans to develop floating solar power plants with a cumulative capacity of 500 MW in Telangana, on large water bodies in Karimnagar and Warangal, among other districts. Further, NHPC signed an MoU with Green Energy Development Corporation of Odisha Limited to form a JV for developing 500 MW of floating solar projects in Odisha. The first phase work of the project is likely to commence by March 2022. Finally, in March 2020, West Bengal Power Development Corporation Limited issued a tender for a 10 MW grid-connected floating solar project to be set up at the Sagardighi thermal power project in Murshidabad.

While most floating solar projects are being tendered for engineering, procurement and construction (EPC), tariff-based competitive bidding is also gaining traction in this space. In January 2020, SECI issued a tender for 4 MW of floating solar projects with 2 MWh of energy storage in Andaman on a competitive bidding basis. This followed the successful 150 MW Rihand dam floating solar project auction conducted in 2018, which saw tariffs of Rs 3.29 per kWh. Thus, the cost economics for floating solar is comparable to that for ground-mounted projects, as proved by Tata Power Solar’s low bid of Rs 35 per Wp for EPC of the 70 MW floating solar project at NTPC Kayamkulam in September 2019. There have been improvements in technology, a reduction in solar module and float costs, economies of scale and an increase in competition, resulting in an overall decrease in project costs over the years.

In addition, floating solar projects require less time for execution than their ground-mounted counterparts, as there is no need for civil work such as land levelling. Further, they are believed to have better energy yields due to lower module temperatures on account of the cooling effect of water and reduced soiling losses owing to less dust. For India particularly, a vast capacity of floating solar projects can be set up at abundant large unutilised reservoirs at hydro and thermal power plants, thereby providing synergies by using existing power evacuation and transmission systems. In fact, according to Renewable Watch Research, more than 500 GW of floating solar projects can come up at the reservoirs of hydro and thermal power plants alone.

Canal-based solar faces a lull

The first canal-top solar power project was a 1 MW plant installed at the Mehsana district of Gujarat in 2012, conceptualised as a means to save unnecessary delays associated with land acquisition through utilisation of the space above canals. Thereafter, 66 MW of canal-top and 50 MW of canal-bank solar projects have been commissioned across seven states. Many of these projects were sanctioned by the Ministry of New and Renewable Energy under the 2014 scheme titled “Pilot-cum-Demonstration Project for Development of Grid Connected Solar PV Power Plants on Canal Banks and Canal Tops”. The target under this scheme has been achieved and no new policy has been introduced since then.

The canal-based solar segment has a vast potential owing to the country’s huge network of irrigation canals. However, recent months have witnessed very few announcements regarding new canal-based projects. In July 2020, Shivamogga Smart City floated a tender for the development of 25 MW of canal-top solar projects on the Upper Tanga canal stretches passing through the Shivamogga city in Karnataka. Prior to that, a tender was announced almost a year back in June 2019 by Haryana Power Generation Company Limited for a 12 MW solar project at the Western Yamuna Canal in Yamunanagar. Apart from these, two large canal-top solar projects have been proposed, with a capacity of 100 MW each in Uttar Pradesh and Gujarat. The project in Gujarat is planned on the Narmada river to be implemented by Sardar Sarovar Narmada Nigam Limited, while in Uttar Pradesh, projects are proposed to come up at the Narainpur Pump Canal, Mirzapur district (50 MW); Augasi Pump Canal, Banda district (30 MW); and LGC and PLGC, Bulandshahar district (20 MW).

Thus, there are only a few canal-top solar projects and no canal-bank solar projects in the pipeline despite India’s vast potential for these projects. This is owing to both commercial as well as technical reasons. The project costs for both canal-top as well as canal-bank solar are significantly higher than those for ground-mounted solar projects, owing to greater civil work and larger mounting structures. Thus, tariffs for these projects are also high, affecting the power offtake from them. Technical issues are mainly on account of the difficult access to project site and the requirement of extensive civil work. Moreover, project implementation is cumbersome due to coordination requirement with local government agencies and irrigation departments.

The way forward

Both canal-based and floating solar segments have small installed capacity bases at present but huge potential for development. Floating solar, in particular, is commercially and technically viable, with a gradually emerging but competitive market. With the entry of large independent power producers and investors, along with domestic manufacturing bases being set up by float manufacturers such as Ciel Et Terre and Yellow Tropus, the outlook is largely positive. Even if there is no policy support for these projects, it is enough to have favourable market dynamics to sustain this segment. This is supported by various technology advancements to make floats lighter with less material costs, especially in Southeast Asian countries. This will further help improve the cost economics of these projects, going forward. However, the same does not hold true for canal-based projects, which suffer from both technical as well as commercial issues. Going forward, strong policy intervention would be needed to give a boost to this segment.

By Khushboo Goyal