By Khushboo Goyal

A large amount of electricity is required to power the extensive metro rail networks in various cities. These include not only trains, but also stations, depots and service areas, which require continuous power supply. At present, more than 10 Indian cities have high speed metro rail systems while construction work is being carried out in at least another 15 cities. The energy demand of these intra-city urban mass transit systems is increasing continuously. Further, the new metro services are expected to put huge pressure on the country’s urban power supply networks. Even the existing metro rail networks are being expanded to cover more area or a higher frequency in order to service a greater number of passengers.

Like any bulk commercial and industrial (C&I) power consumer, metro rail corporations pay significantly high power tariffs to their local discoms. Thus, for an entity like the Delhi Metro Rail Corporation (DMRC), which consumed 1,100 MUs of energy in 2018-19, power costs can contribute to more than 30 per cent of the total input costs. These expenses are only likely to increase in the future with energy demand and grid tariffs constantly rising.

Case for solar

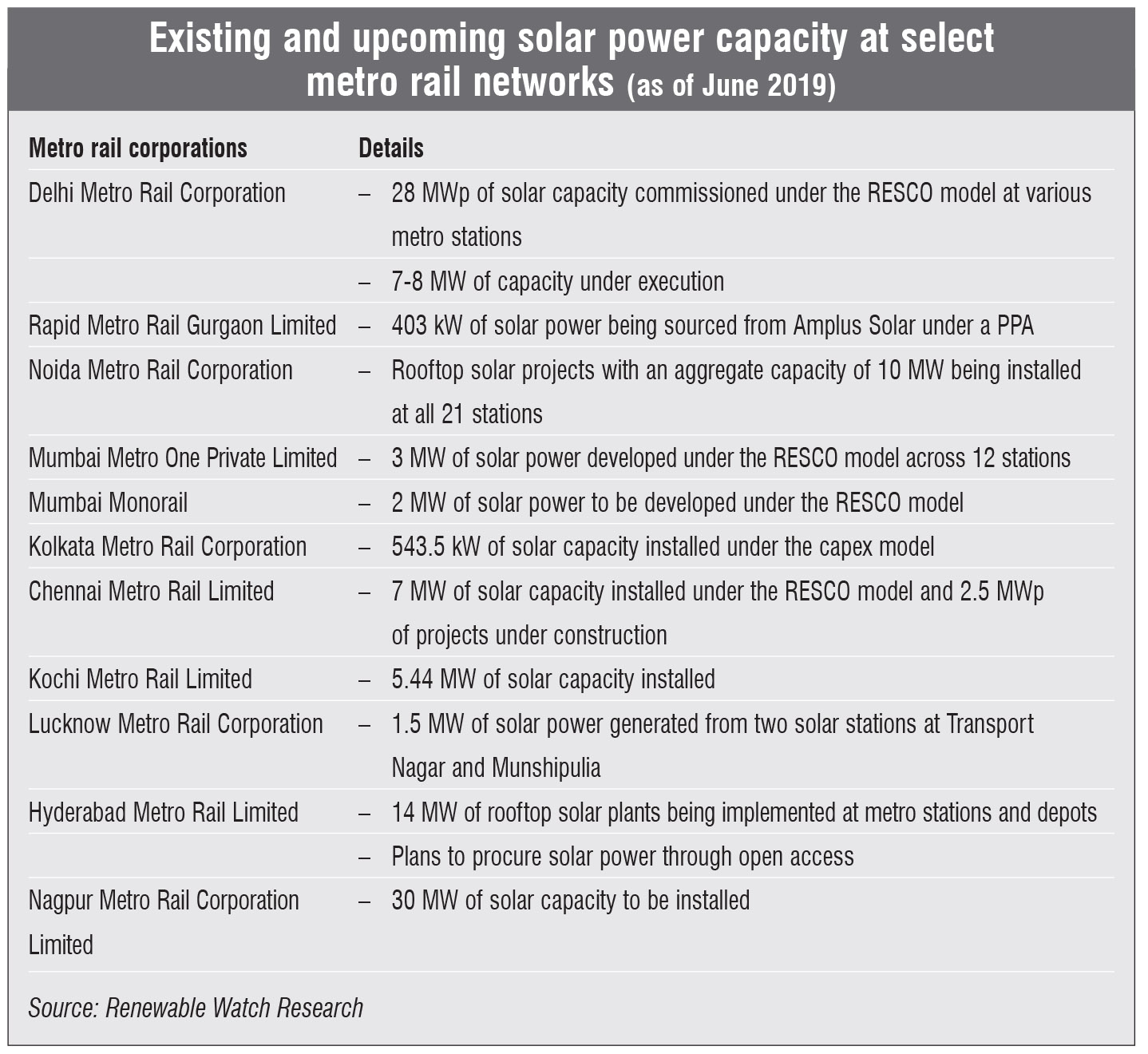

To reduce their operating costs, several metro rail corporations are now actively procuring solar energy for meeting their power requirements. The renewable power consumed by metro rail corporations comes largely from rooftop solar plants deployed at metro stations, depots, parking spaces or other buildings on the metro premises. DMRC has installed 28 MWp of rooftop solar capacity as of June 2019, and has plans to install another 50 MWp by 2022. In fact, all the metro stations and depots on the Magenta Line have rooftop solar projects. Meanwhile, the Noida Metro Rail Corporation (NMRC) is implementing rooftop solar projects at all its 21 stations. Kochi Metro Rail Limited (KMRL) is also planning extensive solar deployment, and expects to install solar capacity on an additional 2.5 hectares of land by 2020. The power generated will be used for all the stations and depots as well as the 13 buildings of the metro corporation.

Notably, most of the metro rail corporations opt for the renewable energy service company (RESCO) model for setting up rooftop solar capacity, which requires zero capital investment from them. The developer is selected through an open e-tender to ensure transparency. It is also responsible for the plant’s operations and maintenance for 25 years. Thus, metro corporations are free from the hassle of setting up and operating these projects. The target rooftop solar capacity is tendered in stages to benefit from the continuously decreasing solar tariffs. NMRC will be reportedly charged Rs 3.25 per unit of solar power by the developer, Sukhbir Agro Energy Limited, according to sources. This is much lower than the C&I tariff charged by discoms and can generate significant savings for the discom in the future. Chennai Metro Rail Limited (CMRL) pays around Rs 8 per unit to the Tamil Nadu discom. According to sources, CMRL’s 410 kWp solar plant at Koyambedu, commissioned in October 2018, generates around 55,350 units per month saving around Rs 1.45 million per year. DMRC pays a special tariff of Rs 6.80 per unit to Delhi discoms, and expects to achieve total savings of more than Rs 75 million per MWp in its electricity bill through its rooftop solar plants.

DMRC’s initiatives

DMRC deserves a special mention for going the extra mile to integrate renewables in its operations. While other metro corporations have more or less stuck to RESCO-based rooftop solar projects, DMRC has become the first commercial consumer of its scale and size to procure solar power from another state through the open access route in a landmark deal. In April 2019, DMRC started its procurement of 99 MW or 345 MUs of solar power from the Rewa Ultra Mega Solar Park in Madhya Pradesh. The 345 MUs of solar power being procured from the solar park is being used to meet the energy demand of DMRC Phase III. After incorporating the applicable open access charges, DMRC expects to pay a tariff of around Rs 4.50 per unit, resulting in significant savings for the bulk consumer. Though DMRC had to overcome many hurdles before the project finally took off, it has opened up avenues for other metro rail corporations to procure renewable power through open access arrangements.

To further reduce its carbon footprint, and explore other renewable energy options, DMRC started procuring about 2 MW of power from a 12 MW waste-to-energy project in June 2019. The project has been set up by East Delhi Waste Processing Company Limited (EDWPCL) in Gazipur, Uttar Pradesh, and is based on a public-private partnership among the Delhi government, the East Delhi Municipal Corporation and EDWPCL. DMRC will procure about 17.5 MUs of power per year from this facility, which will be used by its Vinod Nagar receiving substation. The total energy consumed through this arrangement may vary depending on the real-time output of the project.

KMRL is set to source 40 per cent of its power requirements from solar energy, and efforts are under way to increase its reliance on solar power to 60 per cent by 2020. Nagpur Metro Rail Corporation Limited (NMRCL) is also planning to install 30 MW of solar capacity to cater to 40 per cent of its power requirements. DMRC has increased its solar power consumption to 34 per cent, and is exploring new opportunities to add more renewables to its power mix. Like DMRC, CMRL is looking to procure solar and wind power at competitive prices through the open access route.

Owing to the increasing power costs, metro corporations will continue to switch to solar power to reduce their operational expenses. Another reason why solar power is suitable for metro corporations is that the majority of metro services are operational during the daytime, which coincides with solar power generation. Complications might arise in the future, when it might not be possible to integrate more variable solar power into the energy mix of these metro operations. To avoid this, large corporate consumers will have to move towards energy storage systems, which can manage the intermittency and provide balanced generation. However, this will significantly impact the cost economics as energy storage systems are quite expensive at present, and will not generate significant savings when compared to grid power. Meanwhile, open access has become an acceptable means of procuring cheap renewable power provided that the stakeholders are able to navigate the various regulatory barriers.

In sum, metro rail networks are all set for a green ride with cost-effective renewable-powered solutions to decrease their enormous operational costs.