Most of the public listed companies have released their financial results for the quarter ended September 30, 2018. The depreciation of the rupee, the stay order on renewable energy certificates (RECs) and disinvestment of portfolios were the key variables that affected the balance sheets of renewable energy companies. Renewable Watch takes a look at the financial results of select listed renewable energy companies and analyses the key developments that could impact their financials in the future…

Azure Power

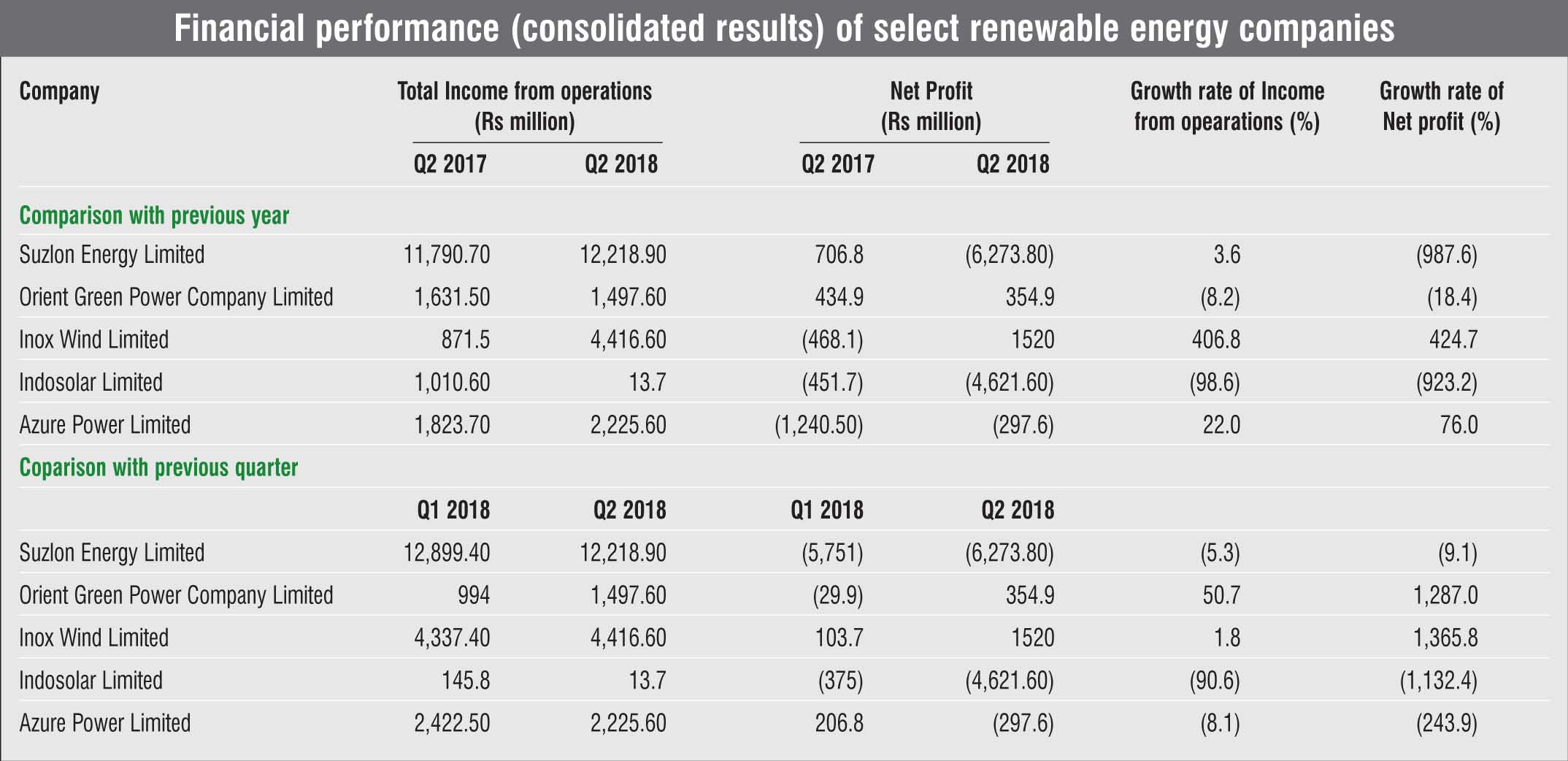

The company’s revenue for the second quarter ended September 30, 2018 was Rs 2,225.6 million, an increase of 22 per cent over the corresponding quarter in 2017, but a decrease of 8.1 per cent over that in the first quarter ended June 30, 2018. The depreciation of the rupee against the US dollar impacted the company’s financials. The rupee depreciated by Rs 4 during the period June 30-September 30, 2018, against Re 0.60 during the same period in 2017. This depreciation resulted in a foreign exchange loss of Rs 236.8 million for the company, as compared to a forex loss of Rs 43 million during the same period in 2017.

The net loss during the quarter ended September 30, 2018 was Rs 297.6 million compared to a net loss of Rs 1,240.5 million in the same quarter in 2017, an improvement of 76 per cent. This was primarily due to an increase in revenue from the company’s recently commissioned projects.

Indosolar Limited

In October 2017, the Union Bank of India had approved Indosolar’s proposal for a one-time settlement of debt outstanding for over nine years after its accounts became non-performing assets. Therefore, long-term borrowings had been classified as current liabilities, except borrowings from the Union Bank of India. The quarter ended September 2018 continued to paint a grim picture with the company’s current liabilities exceeding its current assets by Rs 14,027.9 million.

Indosolar’s net losses rose from Rs 375 million in the quarter ended June 2018 to Rs 4,621.6 million in the quarter ended September 2018, an increase of 1,132.4 per cent. Meanwhile, the company’s total income decreased by 90.6 per cent during this period. A likely reason for the high losses is the lower demand for Indian modules as compared to foreign ones. However, this situation is expected to improve with the imposition of a safeguard duty on solar cell imports.

Inox Wind Limited

The company has shown a tremendous improvement in its financials over the past year. Its total income increased from Rs 871.5 million for the quarter ended September 2017 to Rs 4,416.6 million for the quarter ended September 2018, marking an increase of around 407 per cent. Also, from a net loss of Rs 468.1 million in the quarter ended September 2017, the company registered a net profit of Rs 103.7 million and Rs 1,520 million in the quarters ended June 2018 and September 2018 respectively.

Continuously winning new projects seems to be a reason behind the company’s strong balance sheet. Since December 2017, the company has won bids to develop over 600 MW of wind power projects in various central and state tenders.

Inox Wind’s performance is remarkable given that it had been severely impacted by the transition from the feed-in tariff to the competitive bidding regime in the wind energy segment. It had reported a net loss of Rs 1,876.1 million for the year 2017-18 against a net profit of Rs 3,032.9 million in 2016-17, a decrease of over 161.86 per cent in its profit after tax.

Orient Green Power Limited

Orient Green Power Limited (OGPL) posted better results in the quarter ended September 2018 compared to those in the previous quarter, owing to the successful implementation of its plans to disinvest its eight biomass subsidiaries to Janati Bio Power at a price of Rs 490 million.

The company’s consolidated total income rose 50.7 per cent from Rs 994 million in the quarter ended June 2018 to Rs 1,497.6 million in the quarter ended September 2018. It, moreover, reported a net profit of Rs 354.9 million in the second quarter of 2018 against a net loss of approximately Rs 30 million in the preceding quarter.

Meanwhile, OGPL has not yet made a provision for receivables from unsold RECs of up to Rs 207.2 million. The Central Electricity Regulatory Commission’s decision to reduce the floor price of RECs from Rs 1,500 per REC to Rs 1,000 per REC, coupled with the Supreme Court’s stay order on the trading of solar RECs, has taken a toll on the company (as well as other industry players), since it has become difficult to clear unsold certificates at high prices.

Suzlon Energy Limited

The company reported a net loss of Rs 6,273.8 million in the quarter ended September 2018, which was 9.1 per cent higher than that in the previous quarter. Its total income too declined by 5.3 per cent to Rs 12,219 million during the same period. However, compared to the September 2017 quarter, its income rose by 3.6 per cent.

A key highlight for Suzlon during the quarter was the successful completion of India’s first wind power project tendered by the Solar Energy Corporation of India. Suzlon supplied 119 units of its 2.1 MW S111-120m wind turbine generators for the 250 MW project being developed by Sembcorp Energy India Limited at Chandragiri in Tamil Nadu.

On the solar front, the company agreed to sell its 49 per cent equity stake in two special purpose vehicles (SPVs) – Gale Solarfarms Private Limited and Tornado Solarfarms Private Limited – to CLP India Private Limited. The SPVs were created for the development of a 70 MW solar power project in Maharashtra. As the first part of the transaction, CLP agreed to acquire 49 per cent stake in both SPVs for Rs 234.9 million and Rs 155.7 million respectively. As the second part of the transaction, CLP would have the option to acquire the remaining 51 per cent stake one year of after the commercial operation date. With this, Suzlon will sell its entire portfolio of solar projects by March 2019.

The company installed and commissioned India’s tallest wind turbine generator with a hybrid concrete tubular tower at a height of 140 metres at Tirunelveli in Tamil Nadu. The company’s focus on research and development and advanced technologies will help improve the performance of wind projects, leading to increased sales volumes for the company in the future.

Like all industry players, Azure Power was hit hard by the depreciation of the rupee. Despite the setback, the company is expected to do well, owing to its growing solar portfolio.

Despite poor results, investments in new technologies by Suzlon in the wind energy space may help it sail through despite turbulent times. The company’s plan to diversify into the solar power space did not quite work out. The focus on its core wind energy business bodes well for the company and its stakeholders.

Indosolar continues to fare poorly despite the one-time settlement with the Union Bank of India. Therefore, the imposition of safeguard duties on imported modules offers some hope for the debt-ridden company.

Only two companies, OGPL and Inox Wind Limited, reported sound financial results in the quarter ended September 2018. While the reason for the former’s performance was the disinvestment of its biomass business, the latter’s turnaround is impressive and a good example for industry peers.