By Dolly Khattar

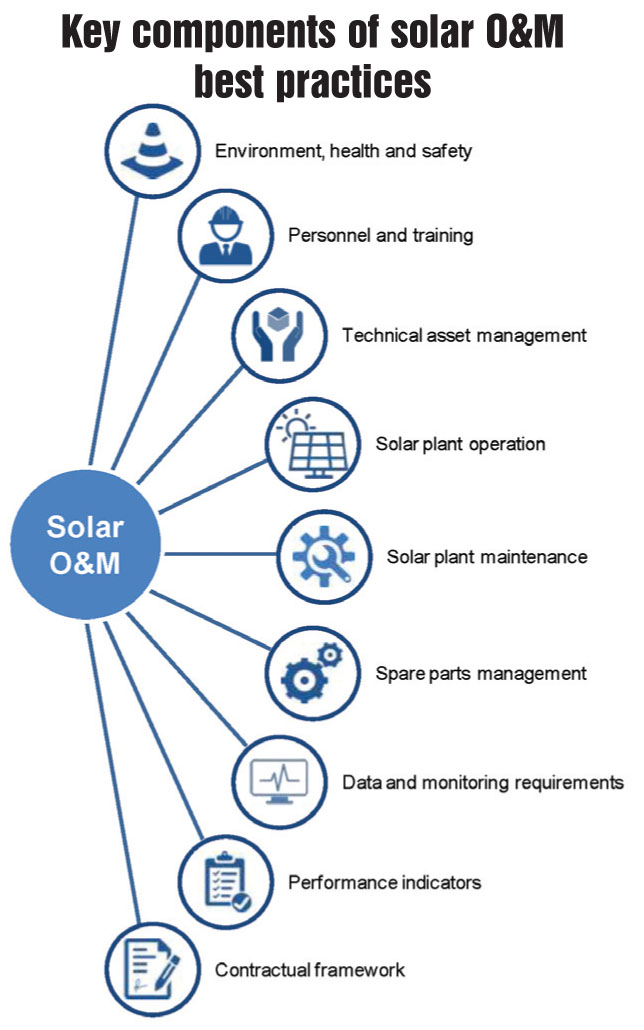

A solar project’s operations and maintenance (O&M) phase is the longest over its 25-year lifecycle and has a major impact on mitigating potential risks, improving the levellised cost of energy (LCoE) and power purchase agreement (PPA) prices, and the return on investment. Greater attention is therefore being given to this aspect of solar project operations by both developers and investors.

In the initial years of solar power development in India, O&M was often coupled with EPC and performed by the same vendor, but of late, solar O&M has emerged as a separate market with its own ecosystem, trends and dynamics. These trends are derived from the broader developments in the sector, which is growing at over 65 per cent per year. Project sizes are getting larger, tariffs are declining and large capacities are in the pipeline for development.

A key trend in the solar segment, therefore, has been the rise of third-party solar O&M service providers. As more sophisticated and structured approaches emerge in the solar O&M market, third-party players are able to deliver more value to solar investors and owners. Recognising the opportunity in this space, a large number of O&M-focused players have come up in India. These include vertically integrated players providing O&M services as part of a broader package, EPC players venturing into the O&M space and specialised/ stand-alone O&M contractors.

Meanwhile, O&M costs have been declining over the past few years and the downward trend is expected to continue. The decline is being driven by various factors including growing economies of scale, the larger role of digitalisation in various aspects of O&M, and evolving best practices across the industry.

The cost composition itself is changing due to greater automation and the use of advanced tools. While manpower costs comprise a significant part of solar O&M costs, its share is gradually declining. New technologies are being adopted for improving asset lifecycle management, predictive maintenance, remote sensoring and control, cloud computing, and visual imaging using drones. A number of companies have also already started using robotic solutions for cleaning modules. These will start replacing manual jobs to some extent. However, there are a number of challenges the segment faces as well. The day-to-day operations of solar power plants present unique challenges that differ vastly from other power generation technologies such as thermal, wind and hydro. Moreover, the maintenance methods and tools for solar power plants can vary significantly not just from other technologies but also across solar plants, depending on the local conditions. Hence, there is a need for a set of best practices as well as customised solutions across the industry.

A look at the key challenges in the O&M space and some possible solutions to address these….

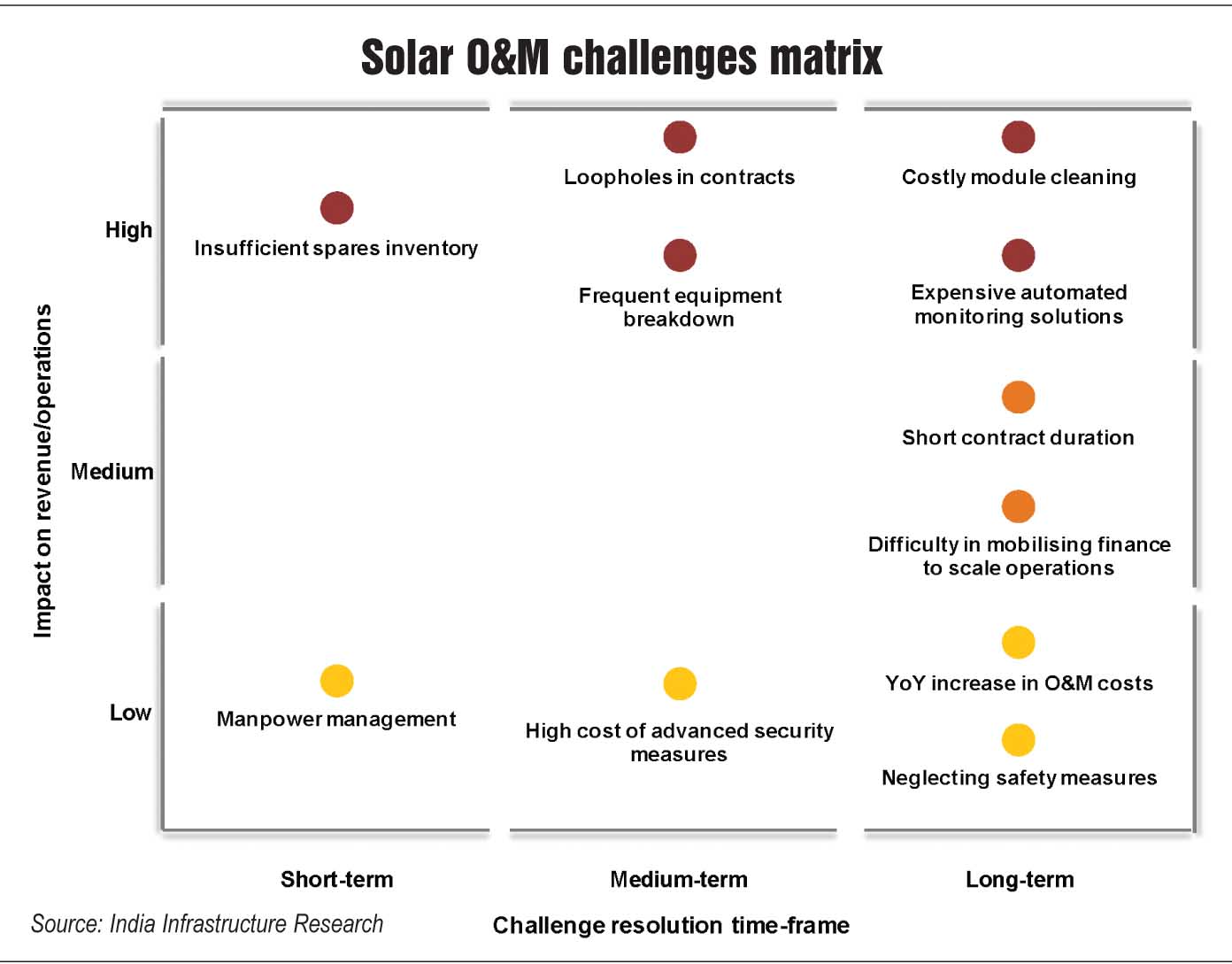

Costly module cleaning

Module cleaning can present three possible challenges for O&M contractors – increase in manpower costs due to frequent cleaning requirements; unavailability of adequate water; and expensive robotic/ water-less module cleaning solutions.

In Indian climatic conditions, dust is the primary cause of low plant performance. Often, rain or dew combines with this fine dust, resulting in “soiling” on a part of or the entire module surface. This is harder to remove as compared to dry sand or dust. Moreover, the dry desert areas of Rajasthan and Gujarat, which have high solar insolation, are known for frequent sandstorms that settle layers of sand on the panels. On the other hand, in colder northern climates, removing snow or ice accumulated on the panel surface, without damaging the coating, can be difficult.

The manpower required for daily cleaning of modules is expensive, especially in remote areas. In addition, water used for module cleaning needs to be demineralised for which reverse osmosis systems have to be set up at the plant, adding to the O&M costs. In many arid/semi-arid regions, water is a precious resource and due to non-availability of adequate reserves, plant operators are forced to either lower the frequency of module cleaning (and thereby compromise on plant performance), or opt for more expensive solutions that use advanced fibres and high pressure air to remove dust. The robotic module cleaning technologies available in the market currently are expensive and the investment is not justified by the improvement in output in most cases. Thus, innovation in technology is needed to bring down costs and promote widespread adoption by O&M contractors.

Expensive automated monitoring

Automated remote plant O&M solutions at the module level, inverter level, etc. provide real-time data to help identify exact errors and their location. In addition, they allow identification of possible issues so that preventive measures can be taken. However, wide-scale adoption of such technologies is inhibited by their high costs. According to Vikram Shetty, founder and chief executive officer, Inspire Clean Energy, “After the commissioning of the project, the IPP or developer does not have additional funds to invest in automation. Also, the financial model given by the developer to the bank does not include the cost incurred for automation. Tight bids make it very hard for the developer to take out margins for investment in automation.”

Over a three- to five-year period, improvements in technology and an increase in the scale of manufacturing are expected to bring down costs and make these technologies affordable.

Frequent equipment breakdown

As a result of increasing competition and rapidly declining solar equipment costs, some manufacturers are compromising on the quality of their products. There are growing instances of manufacturers producing equipment of “just enough quality”. Such devices are made to perform satisfactorily within the warranty period. However, thereafter, their performance often deteriorates rapidly, impacting the overall project performance over a 25-year period.

Thus, the most common issues faced at solar plant sites relate to product performance and warranty execution. This includes power warranty for modules, defects involving glass breakages, micro cracks, hot spots and snail trails. Some of the other issues encountered involve the transformers and inverter card failures. While selecting the equipment, developers should look for products that follow international certification standards. In addition, they should obtain references on device performance from industry peers already using the equipment/device. Moreover, investing in extended warranties can safeguard them from taking on equipment repair or replacement works themselves, and ensure hassle-free operations.

Loopholes in contracts

The agreements between solar project developers and O&M contractors contain provisions to protect the interests of both parties. In case one of the parties does not fulfil its obligations, it should be held accountable for the same. For example, while O&M contractors need to maintain minimum power generation levels, any loss in generation on account of the developer/IPP not providing reserves or warranties for the equipment should not be penalised. In addition, the developer should ensure that the O&M contractor does not face any hindrance in project operations due to incomplete EPC work, connectivity issues, lack of spares, expired warranties, inadequate working space for employees, etc.

Insufficient spares inventory

Contractually, project developers or owners are bound to provide equipment spares that can be deployed by O&M contractors to replace faulty equipment such as inverters, modules and cables to replace faulty equipment and prevent loss in generation. However, the developer may not provide sufficient inventory of these spares at the project site, leading to a time delay in resuming plant operations. This is a major challenge for O&M contractors as they are liable to pay penalties for generation losses below a certain limit, which could be unavoidable if the spares are not made available within a reasonable time frame.

O&M contractors should notify the type and number of spares necessary to ensure smooth operations of the plant. There should be a periodic check to ensure that an adequate spares’ inventory is available at the plant location. In addition, a reasonable time limit should be set within which spares should be made available to the contractor.

Difficulty in mobilising finance

Most O&M firms currently are subsidiaries of developer companies, EPC contractors or IPPs involved with the project’s design and development. These companies have sufficient resources to undertake in-house O&M of their projects for a longer duration and do not face difficulties in increasing their scale of operations as their portfolio expands. There is another category comprising third-party O&M contractors, which provide solar O&M as a service. Such organisations may find it difficult to scale up their operations due to inadequate financial backup, short contract periods and transfer of resources from project to project as per new contracts.

Shorter duration contracts allow developers to renegotiate O&M service rates at lower costs or change contractors if the service is not up to the mark, thus maintaining their profit margins. While this helps protect developer interests and contributes to lower tariffs, very short contracts may not be sustainable for third-party O&M service providers. Due to frequent changes in plant operators, improper or incomplete information may be passed on to the next contractor, creating issues with data management and transparency of information transfer.

Short O&M contracts can be damaging to the contractors as they may not be able to break even on their investments. For any new O&M contract, a certain period of time is required to bring about innovation and implement automation solutions. The investment in implementing these solutions should be justified by the returns, which may be seen only after a few years as the upfront technology costs are usually high. If the contracts are for a very short duration, the O&M service provider may not be able to implement the best solutions for the plant’s operation or may not be able to achieve break-even for the technology cost. In many cases, the automation solutions implemented by the contractor may be specific to a project and on completion of the contract, may not be used at solar power plants in other locations.

Longer-term contracts have the advantage of lowering the per year project operation cost for a contractor due to the risks being distributed over a longer length of time than in the case of shorter contracts. However, with older assets not functioning as efficiently as new assets, the liabilities of the O&M contractor may increase. Therefore, while low costs are essential for making a project bankable, the O&M agreements should allow contractors to deploy solutions and mitigate risks over a sufficient time frame. Both parties should also ensure strict enforcement of these contracts. Over time, the O&M contract design is likely to evolve and protect both developer and contractor interests.

Increase in O&M costs

While average solar tariffs are plummeting with each auction, the year-on-year costs of operating and maintaining a solar plant are increasing by a small fraction, mostly due to the increase in salaries of skilled as well as non-skilled resources. As a result, the already-low margins for O&M players are reducing further.

Automation has been a proven tool in reducing operational costs and increasing efficiencies across industries. The same can be adopted by O&M players to reduce their overheads. For example, manual equipment checks and readings can be replaced by remote sensors and SCADA systems, for monitoring by a few resources. In addition, manual module inspection and cleaning can be replaced by robotic cleaning, which can be programmed to operate at intervals as desired by the O&M player. While the upfront costs of these technologies are high, their operational costs are quite low or negligible. Thus, innovative solutions should be considered as a one-time investment and a cost-benefit comparison should be done between an automated solution and deploying manual labour over the project’s lifecycle.

The absence of basic facilities such as roads, sitting facilities for engineers, temperature regulated monitoring rooms as well as safety devices such as hats, belts and shoes can be a hazard for O&M contractors. Minimum attention is being paid to environment, health and safety (EHS) measures for O&M staff, often resulting in accidents. Most importantly, in a bid to cut costs, O&M companies relax safety measures. Safety parameters should be clearly defined and followed for all projects. The workers should be trained to use safety devices to prevent accidents as well as take necessary measures for managing contingencies. Adequate first-aid provisions should be available at all sites.

Solar plants spread over vast areas and/or situated at remote locations also need to be monitored for unwanted activities such as theft and equipment tampering. Copper wires are often at risk of being stolen due to their high resale value. Political instability and terrorism, especially in Naxalite-affected areas of the country, also call for greater security. Most plant operators employ security guards, use perimeter fencing and security cameras, etc. to prevent undesirable activity on their plant premises, which may not be effective.

More effective tools are available in the market, which can reduce the manpower requirement of surveillance and help cut down costs. These include security fasteners to prevent lifting of panels from their mounting structure, movement detection lights and sensors coupled with automatic alarm systems to notify the police for faster response, and real-time SMS or email alerts in case of equipment/wire disconnections that are not part of the scheduled maintenance. The implementation of these technologies requires high upfront investments, which may not be feasible for developers.

Manpower management

Skilled and unskilled manpower is essential to operate plants, as well as to analyse and resolve maintenance issues. O&M companies need to train their staff to perform these activities while following safety protocols. However, providing regular training to unskilled manpower can be a major challenge for O&M companies. The segment also faces high attrition rates due to the fact that most solar plants are located in remote areas. Thus, continuous investment is needed to train and hire human resources.

O&M contractors can hire unskilled manpower from local areas on a short-term basis to lower attrition rates as well as lower costs. In addition, automated solutions can be used to replace unskilled manpower to a large extent, while a team of highly skilled resources can be set up to develop and deploy low-cost automated solutions across a wider range of projects.

The way forward

A number of steps can be taken to address the aforementioned challenges. Deploying key process and structural interventions along with appropriate IT tools can enable the right mix of centralisation/decentralisation to drive efficiencies. Further, there are some specific levers for optimising O&M costs. For instance, there should be a parameterised approach to module cleaning, which includes the impact on tariff, soiling rate at the location, cleaning cost using various technologies, and cleaning efficiency of these technologies. Higher productivity technologies like robotic cleaners, drone-based thermography and camera surveillance with perimeter motion detectors need to be considered, especially in far-flung areas. Further, a cluster model can be used to pool resources such as the crew and spares. Finally, there needs to be a greater adoption of predictive and prescriptive analytics based on large sets of operational data to help improve asset performance and reduce unplanned outages.

As O&M evolves into a specialised segment with stand-alone service providers offering these services at competitive rates, the scope of O&M is already expanding to include grid management and power quality control. As the government becomes more stringent in its implementation of the Forecasting, Scheduling and Deviation Settlement Mechanism Regulations, grid management will become a key component of O&M players’ deliverables. Integration of energy storage with existing plants will also lead to a greater play for O&M companies. As all these pose new challenges on the O&M front, there will be a greater need for specialised O&M players making greater use of automation, adopting an appropriate degree of process centralisation and deploying better control tools for granular troubleshooting.