CLP India is a wholly owned subsidiary of China Light and Power (CLP) Holdings Limited, one of the largest investor-owned power businesses in Asia. CLP entered the Indian power market in 2002 and has since expanded its portfolio to over 3,000 MW, comprising supercritical coal, gas-fired, wind and solar power plants.

CLP’s journey in India started when it acquired a stake in the 655 MW gas-powered Paguthan combined cycle power plant (CCPP) in Bharuch, Gujarat. The plant has received NOSA 5-star accreditation for safety, an ISO 14001 certification for its environment conservation initiatives, and “NOSCAR” company status for occupational risk management. Apart from the Paguthan gas power plant, CLP India operates a 1,320 MW supercritical coal-fired power plant located in Jhajjar, Haryana.

Greening its portfolio

CLP’s climate change journey began in 2004 with the introduction of the Climate Vision 2050, its manifesto on climate change. Over the years, CLP’s commitment and the associated targets have been reviewed several times to ensure that they are adequately progressive and can contribute to the transition to a low carbon future. In 2017, CLP announced a set of new targets for carbon emissions intensity, and renewable and non-carbon emitting energy capacities. CLP’s energy transition targets for 2030 include increasing its renewable and non-carbon portfolio by 30 per cent and 40 per cent respectively.

CLP India is aligned with the parent company’s commitments and is working towards expanding its renewable energy portfolio as it transitions towards a low-carbon future. Currently, CLP India has about 1,100 MW of renewable power projects, which account for a third of the company’s total power portfolio of over 3,000 MW.

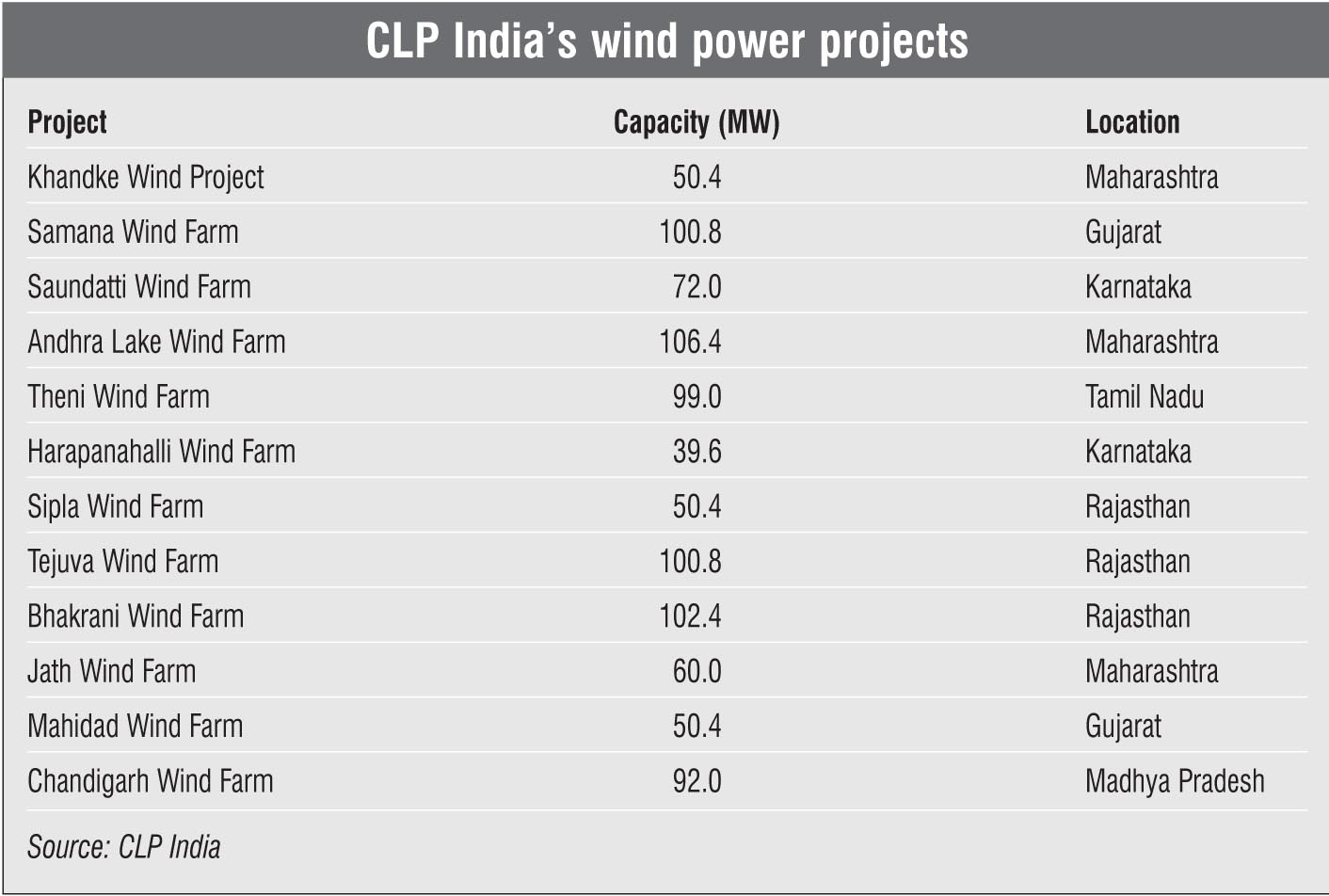

CLP India commissioned its first wind energy plant at Khandke in Maharashtra in 2009 and it is one of the largest Independent Power Producers (IPPs) in the Indian wind industry, with operational wind assets in six states. CLP India has long-term Power Purchase Agreements (PPAs) with state discoms instead of short-term third-party agreements for selling wind power generated from these wind projects. This strategy has been useful in improving the credit profile of the company among lending institutions, which prefer a predictable revenue flow typically from government-backed utilities.

Encouraged by the unprecedented growth in the Indian solar segment, CLP India forayed into the solar segment in 2016 by signing an agreement with Suzlon Energy to buy 49 per cent stake in SE Solar, a special purpose vehicle set up for implementing the 100 MW Veltoor solar power project in Telangana. Similar to its practice in the wind power segment, CLP India signed a 25-year PPA with state discom, Telangana Southern Power Distribution Company, for this solar project. CLP India further strengthened its position in the Indian solar sector, by signing an agreement with Suzlon for two additional solar projects of 50 MW and 20 MW in Dhule, Maharashtra. It has agreed to acquire 49 per cent stake in Gale Solar arms Limited and Tornado Solar farms Limited, the two special purpose vehicles (SPV) set-up by Suzlon.

Measured steps

While no new wind project has been commissioned by CLP India since 2015, possibly due to the changing market dynamics, the company plans to participate in the future auctions. This is most likely an outcome of the stabilisation of wind tariffs and resolution of issues related to competitive bidding. However, for solar, it prefers acquiring operational projects instead of participating in the auctions owing to rapid fluctuations in the segment. The company’s present stand regarding new asset development is no different from its usual stance of “playing safe”. The company has been known for its policy of security over expansion. CLP India is not aggressive in expanding its portfolio and chooses to wait for the market to stabilise before taking on new projects.

The parent company, the CLP Group, is one of the key power utilities in China with a major presence in transmission. The Indian subsidiary is also now exploring opportunities in this space. It is participating actively in the ongoing tenders for the expansion of the Green Energy Corridors project as well as the interstate transmission system. It is also looking for acquisition opportunities in the transmission segment.

Quality certification

The Veltoor solar power project made history recently when it became the first project in the world to get a solar photovoltaic (PV) project quality certificate from DNV GL. This quality certificate was awarded based on the service specification DNV GL SE 0078, which incidentally is the only global certification guideline for solar PV projects.

This certificate is a testimony to CLP India’s highest-quality and operational standards across all facets of its work. It certifies all requisite safety features and technical capabilities of the project along with its compliance with global standards.

CLP India has always been a trendsetter and has led several innovations. CLP India was the first in the industry to announce a corporate green bond issuance from South Asia and Southeast Asia. It raised Rs 6 billion from green bonds to secure capital expenditure for its renewable energy projects in 2015. It was also the first power company in India to issue an asset-specific bond for its coal-fired plant in Haryana.

Outlook

Being one of the largest IPPs in the wind segment, CLP India has a lot to gain from the improving market dynamics. The company’s slow and steady rule works in its favour. Its plan to participate in the auctions when tariffs have stabilised and become more realistic, unlike some of its aggressive peers, is an example. Its stand to not participate in the solar auctions is also a testament to this fact.

Going forward, CLP India intends to keep a close watch on both the generation and transmission markets, and remain cautious while bidding. The company’s safe approach towards expanding its portfolio combined with a more favourable regulatory environment will keep its balance sheets healthy even if it is not among the top players in the Indian power market.

By Khushboo Goyal