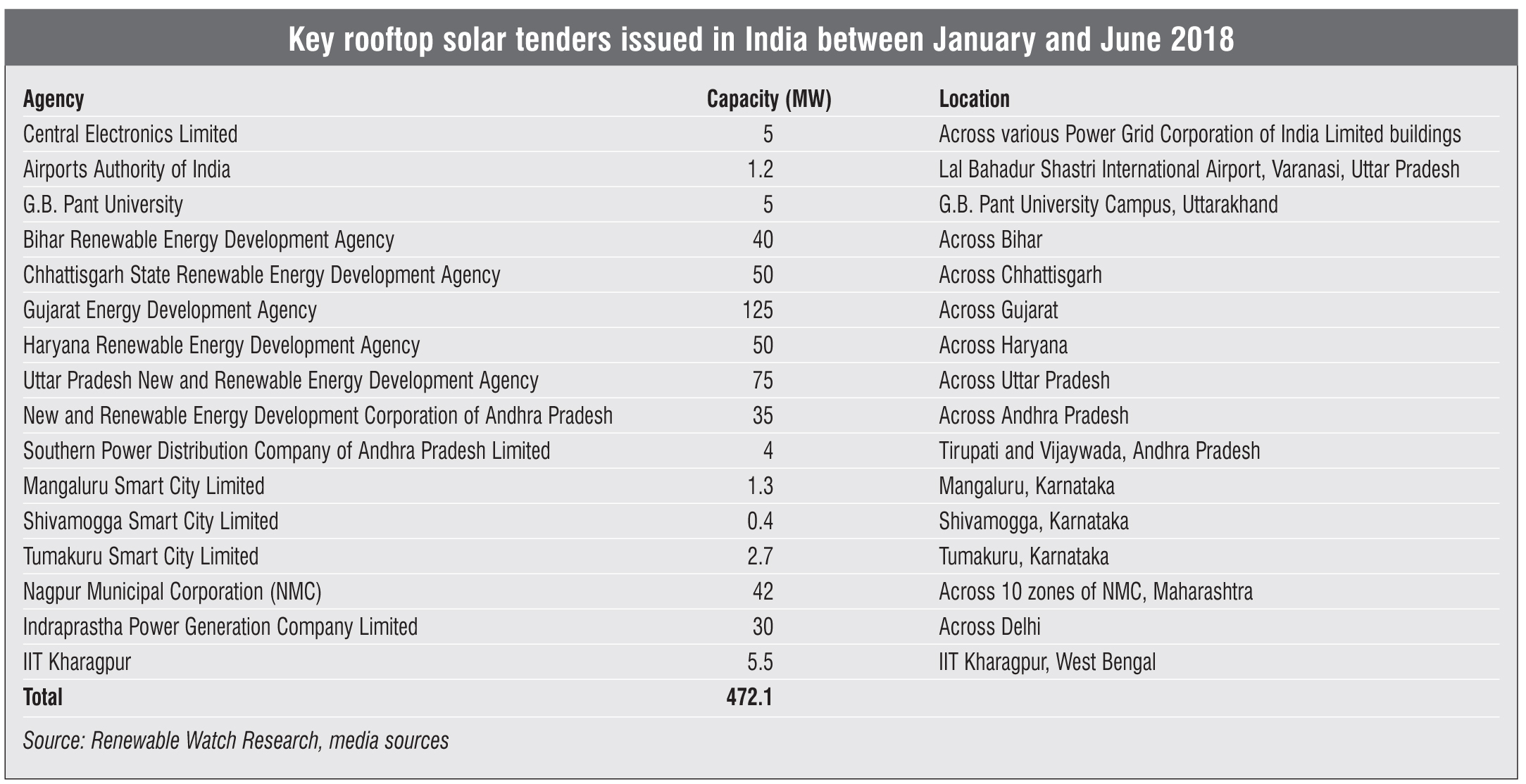

India’s biggest solar parks are being built in states like Karnataka, Telangana, Rajasthan and Gujarat – essentially, in regions with sunshine and vacant arid land. But across the country, transit systems, airports, hospitals, campuses, malls, industrial units and office complexes are looking to set up their own solar power plants, mostly on rooftops. So far, the growth in rooftop solar installations has been modest, with only 352.8 MW of capacity being added in 2017-18, against a revised and scaled-down target of 1,000 MW. Now however, with a number of positive policy and technology developments taking place, the pace of installations is expected to pick up. The country’s total installed rooftop solar capacity has crossed 2 GW. In terms of scale too, the size of rooftop projects, at least in the commercial and industrial (C&I) segments, is increasing steadily. In Amritsar, Punjab, a 19 MW project across the 82 acre RSSB Educational and Environmental Society campus is currently the largest rooftop solar project anywhere in the world. In Kochi, the international airport has a 12 MW solar plant, making it the first fully solar-powered airport in India. With favourable project economics, a progressive regulatory scenario and easier availability of finance, segment growth is clearly picking up. Since January 2018, over 500 MW of rooftop capacity has been tendered in the country. Unlike previous years, a large share of tendered capacity has been announced by state agencies instead of central organisations, indicating state governments’ new-found interest in the segment. The largest tender this year was announced in June 2018, by the Gujarat Energy Development Agency, to set up 125 MW of capacity. Meanwhile, Uttar Pradesh, Haryana and Bihar have also issued rooftop solar tenders, marking a shift in policies. These tenders are largely focused on government and institutional players. Rooftop solar uptake in the C&I spaces, in contrast, has not been dependent on any tender pipelines and is being totally driven by commercial aspects. Urban homes and residential societies, however, have not been as enthusiastic owing to the lack of awareness as well as the high upfront cost of these projects. With this background, Renewable Watch analyses the key recent developments in the rooftop solar segment and their impact on future capacity addition…

Market overview

As per BRIDGE TO INDIA estimates, Maharashtra had the largest rooftop solar capacity with about 237 MW in September 2017. Tamil Nadu and Rajasthan followed closely with about 191 MW and 129 MW of capacity respectively. The maximum installations in these states were in the industrial sector followed by the commercial and public sectors. In contrast, in Delhi, the public and commercial sectors had the largest share of rooftop capacity (95 MW) due to a lack of industries. As per Mercom India Research, Tata Power was the top rooftop player in 2017, accounting for nearly 5 per cent of the total installations. It was followed by Cleanmax and Fourth Partner Energy, which were responsible for a 4 per cent share of rooftop installations respectively. The Indian rooftop solar market remained fragmented in the past year as the top 10 companies in the segment accounted for a total market share of only 27 per cent, leaving the majority share (73 per cent) open for smaller players. The current rooftop solar market still consists of mostly C&I projects, and residential installations remain quite scarce. Moreover, the segment is largely supported by subsidies to drive down costs for customers. Late subsidy disbursement, however, is negatively impacting developers that face cash flow constraints, making it difficult for them to sustain themselves in a highly competitive market.

Policy and regulatory landscape

Policy and regulatory landscape

In its efforts to encourage the implementation of rooftop solar projects, the government has rolled out a number of schemes and regulations. The Sustainable Rooftop Implementation for Solar Transfiguration of India (SRISTI) scheme was proposed by the Ministry of New and Renewable Energy (MNRE) to target residential rooftop owners. Under this, the government has earmarked Rs 234.5 billion as financial assistance to be given for rooftop solar installations to discoms on a performance basis. To address the quality issues associated with installations, the MNRE has invited suggestions for setting standards for grid-connected and off-grid rooftop solar projects. In addition, the MNRE has brought battery energy storage systems under the purview of the Solar Photovoltaics, Systems, Devices, and Component Goods (Requirement for Compulsory Registration under the BIS Act) Order, 2017. This will be beneficial for the rooftop and off-grid segments as many consumers rely on batteries to meet their peak load and regulate the photovoltaic (PV) module output. Following the trend set by the central government, the state agencies have announced their own schemes for improving rooftop solar deployment to meet their renewable purchase obligation targets. For example, the Uttar Pradesh government is planning to provide a subsidy of Rs 15,000 per kW for rooftop solar projects in the state; this amount would be capped at Rs 30,000 for projects exceeding 3 kW. Added to that, a financial subsidy of 30 per cent or Rs 21,000 per kW could be provided by the centre to the state. In Assam, a 70 per cent financial subsidy will be given for projects under its programme to develop 14 MW. Jharkhand has a programme to provide a 30 per cent subsidy, with an additional 20 per cent subsidy for rooftop solar installations by educational institutions on their campuses. The state also has subsidies in place for residential and commercial consumers.

The rooftop solar implementation model can find greater success with the inclusion of municipal corporations, as they are in direct contact with consumers. A recent report by the Climate Policy Initiative highlighted the benefits of solar municipal bonds to aggregate capacity and raise low-cost funds for residential rooftop projects in municipalities. Recently, the South Delhi Municipal Corporation (SDMC) gained Rs 960,000 by selling the excess solar energy generated on 55 of its buildings in a short period of three months. SDMC is now planning to install solar systems on 400 rooftops by 2019. While most discoms have been opposed to their customers’ shifting to solar, some discoms have been promoting the segment through community-based projects. In January 2018, BSES Rajdhani Power Limited announced its Solar City Initiative under which it plans to set up solar installations in apartment complexes in Delhi. More recently, Coastal Gujarat Power Limited announced a collaboration with the Tata Power Community Development Trust for the Suryodaya project to bring solar power to all households in Tunda village in Gujarat. Many upcoming smart cities such as Mangaluru and Shivamogga have also started tendering solar projects.

Financing flows

The year 2017 witnessed considerable investment by banks and financial institutions in the segment. Domestic lenders reportedly received $1,375 million as concessional loans from global development banks and institutions to fund rooftop solar projects. The list of global investors includes the World Bank, the Asian Development Bank and the New Development Bank, with the funds being made available to the State Bank of India, Canara Bank and Punjab National Bank for disbursement. In March 2018, it was announced that the National Bank for Agricultural and Rural Development would receive a $100 million loan from the Green Climate Fund for the development of rooftop projects in the country’s commercial, industrial and residential sectors. Many private rooftop players have also raised funds from financial institutions to expand their scale of operations. Recently, Azure Power received $135 million in debt financing to develop about 200 MW of rooftop capacity.

While a large rooftop solar capacity has been tendered in the first half of the current calendar year, it is likely to be commissioned only in financial year 2019-20. The target for 2018-19 has been reduced from 6,000 MW to 1,000 MW. And only 1.83 MW of rooftop capacity was added in April 2018. Given this, it is very likely that the rooftop solar target will not be met in the current financial year. In addition, it is still unclear how the government will finetune its yearly targets in order to achieve the 40 GW rooftop solar target by 2022. On a positive note though, the government is constantly improving its regulations and schemes, which will hopefully facilitate segment growth.