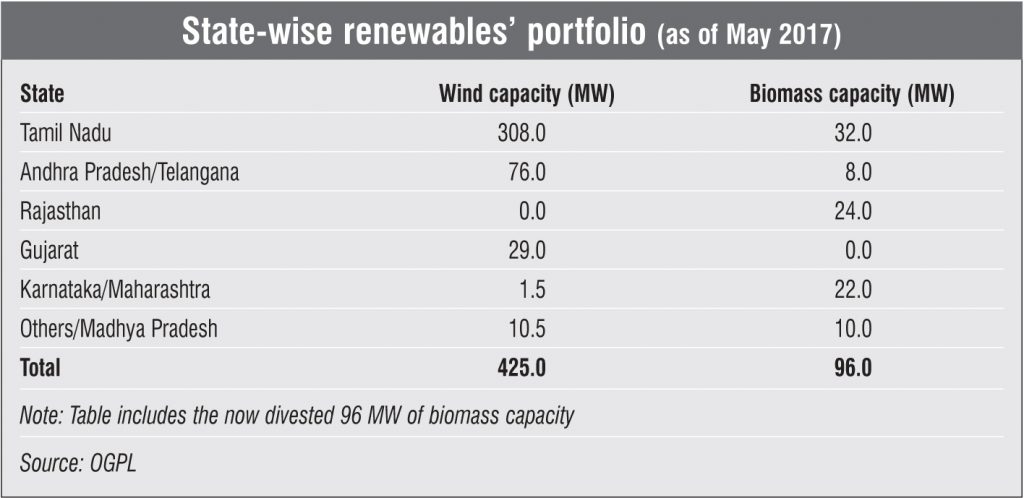

Orient Green Power Limited (OGPL) is an independent power producer (IPP) in the Indian renewable energy sector and a part of the Shriram Group. The company was incorporated in 2006 and is based in Chennai. It has an overall portfolio of 425 MW of wind and 38 MW of biomass capacity which is in final process of sale. Its assets are spread over Rajasthan, Tamil Nadu, Andhra Pradesh, Gujarat, Maharashtra and Madhya Pradesh. In addition, it operates a 10.5 MW wind power plant in Croatia. In 2017, the company decided to demerge its loss-making biomass business as it aims to operate solely as a wind power company.

Divestment of biomass assets

In the past few years, OGPL has incurred 30-40 per cent of the consolidated losses owing to issues with its biomass-based power generation segment. The division contributed overall negative earnings before interest, taxes, depreciation and amortisation (EBITDA) of 3 per cent, primarily because of the levy of unviable tariffs due to high biomass-based fuel prices. Hence, OGPL decided to separate these assets from its profit-making wind segment.

The company had initially planned to demerge its wind and biomass business as two separately listed entities, with shareholders receiving one biomass share for every 10 wind shares. However, the plan was discarded by the company’s board on the grounds that the proposed biomass entity would not offer any value addition to the shareholders. Therefore, a new plan was formulated to divest the biomass business to Janati Bio Power Private Limited, a subsidiary of OGPL’s holding company SVL Limited. Out of the overall 96 MW, 38 MW of biomass units in Rajasthan and Maharashtra are in the final process of sale. The remaining 68 MW of capacity was sold for about Rs 2,720 million to the group’s holding company. This will result in the moving around of Rs 3,300 million of debt and Rs 500 million of accumulated losses out of OGPL’s books.

Upon completion of the entire demerger, OGPL will operate only as a wind power company. Its wind power project portfolio comprises a 29.2 MW plant in Gujarat, with a 25-year long-term power purchase agreement (PPA) at Rs 4.15 per kWh, and a 50.4 MW plant in Andhra Pradesh with a 25-year long-term PPA at Rs 4.70 per kWh. Both projects receive a generation-based incentive of Re 0.50 per kWh each. The company’s largest wind farm with a capacity of 308.28 MW is located in Tamil Nadu and based on a group captive model. Constituting 74.5 per cent of OGPL’s total portfolio, the plant has an average price realisation of Rs 5.5 per kWh.

In the recent past, OGPL along with other IPPs was forced to back down generation from its assets due to the inability of the Tamil Nadu Generation and Distribution Corporation (TANGEDCO) to offtake the wind power generated in the state. According to S. Venkatachalam, managing director and chief executive officer, OGPL, the last four years saw backdown levels ranging from 25 to 40 per cent. However, the situation is gradually improving as the state is making targeted efforts to solve the grid availability issue in tandem with wind associations and TANGEDCO. Sustained efforts have led to evacuation levels of over 95 per cent in the current year, he adds. The problems have been largely overcome by systematic scheduling and forecasting, shutting down of thermal power plants during the wind season, sale of power to other states in the southern grid and strengthening of the grid corridor.

However, the challenges for OGPL are not restricted to operational grid infrastructure. With the introduction of competitive bidding, the tariffs have fallen sharply and so have the margins for power producers. Venkatachalam believes that while competitive bidding is here to stay, the bidders who have quoted such low tariffs have made unreasonable assumptions in terms of plant load factors, capital costs and interest rates. Despite these assumptions, the returns are quite low and unattractive. He further adds that the success of the competitive bidding architecture would also depend on the government’s compliance with its obligation for signing PPAs on time, evacuating power in full, paying on time and meeting its RPOs. Further, there should be strict penalties/bans on bidders who do not put up their projects. The government should strictly refrain from renegotiating PPAs as it would erode invester confidence.

OGPL’s investor base consists of SVL Limited, Bessemer Venture Partners and Olympus Capital Holdings Asia. Over the past few years, the company has raised about Rs 3 billion in investments from its promoters. In addition, the promoters have extended loans of about Rs 5,500 million to the company. In 2015, the Edelweiss Group invested Rs 1,500 million in OGPL.

The financial performance of the company has seen a turnaround owing to its efforts to emerge as a profit-making business. Coupled with this, improving the renewable energy industry market conditions and the divestment of its biomass business have played a major role in the realisation of this goal. Although the increase in OGPL’s revenues for the first three quarters of 2017-18 as compared to the nine months ended December 2016 was only about 1 per cent, its EBITDA increased by almost 6 per cent and profit before tax (PBT) grew by a staggering 106 per cent. This shows that OGPL is on a positive growth trajectory and taking the right steps to emerge as a profit-making business.

Moreover, increased grid availability (95 per cent and above in Tamil Nadu) in the past few quarters has provided buoyancy to the revenue performance of the company. This has enabled OGPL to evacuate nearly all of the power generated from its wind assets, thereby significantly narrowing the gap between the potential and actual performance. In addition, the wind industry has received significant support from electricity regulators, state electricity boards and discoms, thus contributing to a favourable outlook for the industry. Meanwhile, November and December 2017 saw a sharp increase in renewable energy certificate (REC) trading. The company sold about 19 per cent and 47 per cent of the RECs issued for sale in the respective months against the usual levels of 4 to 5 per cent, which further added to OGPL’s revenues.

Over the past year, finance costs for renewable energy have decreased considerably owing to increased competition and improved capital availability. Further, refinancing initiatives have enabled the company to reduce its financing costs by 11.06 per cent, furthering the company’s efforts to improve its bottom line.

Future plans and targets

OGPL is rapidly moving into expansion and diversification mode. It plans to increase its wind power capacity to 1,000 MW, in addition to completely selling its biomass portfolio. While the company is planning to explore brownfield investments in the domestic market, it is also seeking investment opportunities to expand its international footprint, especially in the Southeast Asian markets.

As of now, OGPL does not have plans to enter the solar power segment. The company has conducted various feasibility studies and does not see project viability at the recently discovered competitive bidding tariffs. However, Venkatachalam says, “We will enter the solar space when tariffs improve to levels where the internal rate of return figures are workable.” As operational constraints like grid unavailability get sorted, the company will be better positioned to pursue its expansion plans. Moreover, with the sale of its biomass assets, its revenue stream will be driven largely by the performance of its wind business, making the company increasingly profitable. The overall outlook for OGPL’s growth, therefore, remains positive.