As the renewable energy sector matures, the government is gradually cutting back on various incentives such as capital subsidies, accelerated depreciation, generation-based incentives, free transmission and zero value-added tax. At the same time, charges are being imposed on the sector in order to address the growing challenge of integrating variable, intermittent power into the grid.

With the scaling up of renewable energy capacity, more stringent forecasting and scheduling restrictions as well as high deviation settlement charges are being introduced. A number of states are contemplating withdrawing the wheeling and banking benefits given to renewable energy producers over conventional power generators. The must-run status of renewables is also under threat. All these measures may create challenges, both economical and technical, at least in the short run. However, in the long term, as the sector moves towards achieving the 2022 target, these charges will help ensure better grid management.

Renewable Watch takes a look at the emerging regulatory scenario pertaining to grid management in the renewable energy sector as it progresses towards achieving the target of 175 GW of capacity by 2022…

Penalties for deviating from scheduled power

Penalties for deviating from scheduled power

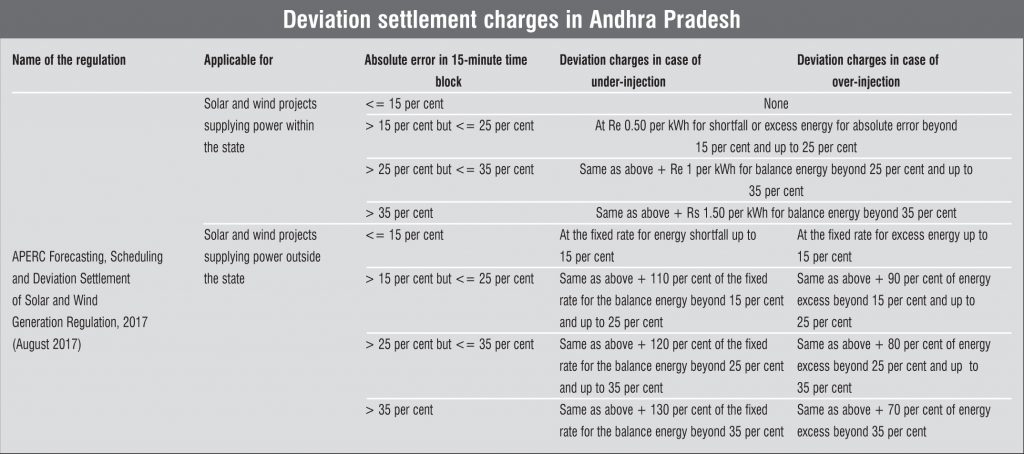

Under the deviation settlement mechanism, if a solar or wind power generator deviates from the schedule, the generator is required to pay deviation charges to the state pool account in the case of under-injection of power. In the case of over-injection of power, deviation charges are paid from the state pool account to the solar or wind generator. Regulations for deviation settlement charges are seen as necessary because they provide a redressal avenue for both power procurers and generators.

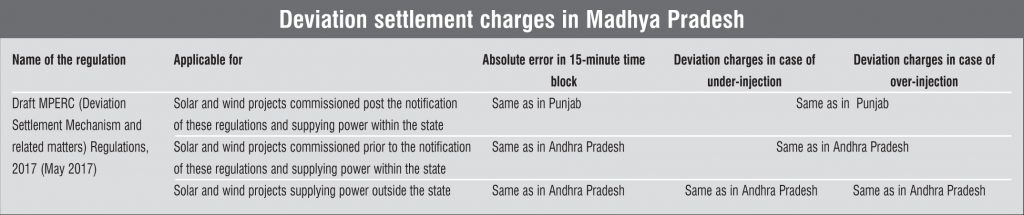

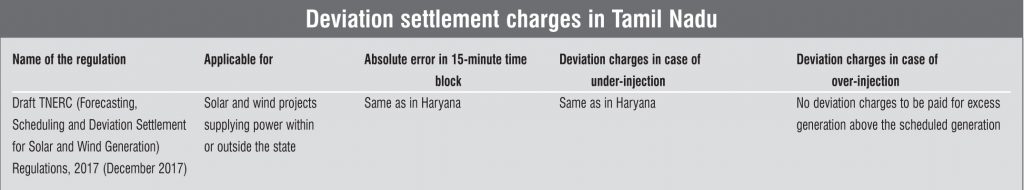

The Central Electricity Regulatory Commission (CERC) first announced a regulation for a deviation settlement mechanism in 2014. Subsequently, it brought in three amendments. A number of states have since either notified their forecasting, scheduling and deviation settlement regulations for solar and wind power generation or have announced draft regulations. These include states like Andhra Pradesh, Punjab, Madhya Pradesh, Tamil Nadu, Haryana, Gujarat, Karnataka, Chhattisgarh, Jharkhand, Uttarakhand, Odisha, Manipur and Rajasthan.

While there are some minor variations in the state regulations, they essentially follow the CERC regulation and have a common primary objective – to make generators more accountable through enhanced forecasting requirements and penalising them for deviation.

A common feature among these regulations is that they all specify deviation settlement charges for projects connected to the transmission/and distribution system within the state, including those using the power generated for self-consumption or for sale within or outside the state. However, the charges vary significantly, with some states exempting projects from deviation settlement if they are selling/consuming power within the state and others maintaining high charges for all project categories.

The Punjab State Electricity Regulatory Commission (PSERC) is the latest to announce draft regulations for deviation charges for solar and wind power generation. The regulations are designed to help maintain grid stability and security when integrating both solar and wind. The next state expected to release guidelines for forecasting, scheduling and deviation settlement is Maharashtra.

Renewable energy currently enjoys must-run status across the country to ensure grid integration and better returns for developers. This is important in light of the fact that solar and wind power is not available all the time. Further, given that thermal projects are difficult to shut down and start up instantly, renewable projects could be the first to be backed down in case of demand falling below schedule. Must-run status prevents state utilities from backing down renewable energy projects whenever they wish to. Merit order despatch, on the other hand, is a principle followed for conventional generation sources that essentially ranks available sources of generation based on the ascending order of prices and sequences them accordingly. A shift to the merit order despatch system would push costly solar and wind power down the pecking order.

In August 2017, the Madhya Pradesh Electricity Regulatory Commission (MPERC) floated a proposal stating that power generated from cogeneration and renewable energy sources should be subject to scheduling and merit order despatch principles as decided by the commission from time to time. This implied withdrawing the must-run status from renewable energy projects in the state.

MPERC’s proposal faced strong industry opposition leading to the regulator cancelling its order in December 2017 and asking the state power utilities to retain the must-run status for wind, solar, small-hydro and municipal solid waste power generation.

While the industry heaved a sigh of relief post MPERC’s decision, existing investors in the sector are now wary of discoms in states such as Rajasthan and Tamil Nadu that have been curtailing solar and wind generation and randomly issuing backing down instructions. In light of these developments and the growing share of renewables in the energy mix of various states, investors must now start accounting for the risk associated with the discontinuation of must-run status in the coming years.

Wheeling and transmission charges

In mid-February 2018, the Ministry of Power issued an order stating that no interstate wheeling and transmission charges would be levied on solar and wind power projects commissioned up to March 31, 2022. The waiver will apply to solar and wind projects for the entire duration of their power purchase agreements (PPAs) with discoms as well as other entities. The announcement effectively extends the existing inter-state transmission system (ISTS) charge waiver for solar projects beyond its previous expiry date of December 31, 2019. It likewise extends an existing exemption for wind projects that was to expire on March 31, 2019.

The move, which has provided long-term visibility, will enable states to procure solar power at competitive rates. It is currently very challenging for project developers in lower solar insolation areas to match the bids placed for projects in high insolation states. The Solar Energy Corporation of India has already tendered approximately 4 GW of wind and 2.75 GW of ISTS-connected solar projects in January and February 2018, which are all expected to benefit from the new order.

At the state level however, the trend is changing with state regulators moving away from the concessions currently being provided to renewable energy projects for wheeling and transmission of power. The Karnataka Electricity Regulatory Commission (KERC) has recently released a discussion paper that calls for increasing the wheeling and banking charges for solar, wind and other renewable energy projects developed under a non-REC (renewable energy certificate) route in the state. In the consultation paper, KERC has noted that major reductions in the cost of wind and solar in recent years have made these renewable energy sources competitive with conventional sources of energy, hence strengthening the case for imposing charges. KERC also observed that most renewable energy-rich states have moved away from concessional charges to normal wheeling and banking charges. According to KERC, the power-deficit situation in the state has improved and solar generation, which stood at just 41 MW in 2014 when the previous order was issued has gone up to almost 1,700 MW as of November 2017. KERC has proposed levying a 25 per cent tariff on the normal transmission charges and/or wheeling charges. The tariff will be payable as determined by KERC in its tariff orders for all renewable energy sources transmitting or wheeling electricity through the network of the state’s transmission company or a discom.

KERC has also proposed the deduction of applicable losses, as approved by it from time to time, from the net energy injected to arrive at the total wheeled energy. Wheeled energy is less than the net energy injected. The regulator has proposed to keep banking charges at 2 per cent for injected energy. No cash would need to be paid for these energy charges and instead, companies would inject the amount of electricity into the grid free of cost. For REC route projects, the charges specified in KERC’s October 9, 2013 order would continue and the banking charges for such projects would be 2 per cent for the energy injected.

In a related development, MPERC, which, after a lot of pressure from the industry, decided to keep the must-run status intact, did not digress from its decision to impose wheeling charges, cross-subsidy charges, additional surcharges on the wheeling charges, if any, on renewable energy projects in the state. According to its order, these charges will be imposed under Section 42 of the Electricity Act, 2003 at the rate decided by the commission from time to time in its retail supply tariff order for all power projects, including conventional and non-conventional power plants. This may hurt the growth of the renewable energy sector in the state as the low bids received in past years were because it offered exemptions on the additional charges borne by renewable energy producers.

Outlook

Forecasting, scheduling and deviation settlement regulations exist in most western countries as part of their grid management strategies. As India’s renewable energy sector also moves towards effective grid management, stricter enforcement of forecasting, scheduling and deviation settlement mechanisms will create significant opportunities for data analytics and grid technology companies. There is an abundant and growing expertise in technical and statistical modelling techniques globally, which can be replicated in India.

For developers, while compliance with these regulations will entail investments in new systems, upgradation of IT infrastructure and potential penalty costs, the net benefits will be much larger. Industry experts believe that the compliance cost for a single project, including penalties, may be just around Re 0.02 per kWh.

Summing up, the renewable energy sector is moving from an incentive-led regime to a levy-based one. While the regulations may be seen as a new operational and financial burden on the sector, they are also an acknowledgement of the growing maturity of renewables. Developers should be ready to bear this compliance cost rather than face the greater risk of curtailment.