India’s installed renewable energy capacity currently stands at a little over 60 GW. While technological advancements and a progressive policy and regulatory framework have played a key role in achieving this capacity, the financing community has also been instrumental in driving growth in the sector. There has been considerable progress on both the equity and debt financing fronts. The sector witnessed a spurt in green/masala bond issues and direct multilateral financing, along with fund-raising through capital market products like infrastructure investment trusts, especially in the past one year.

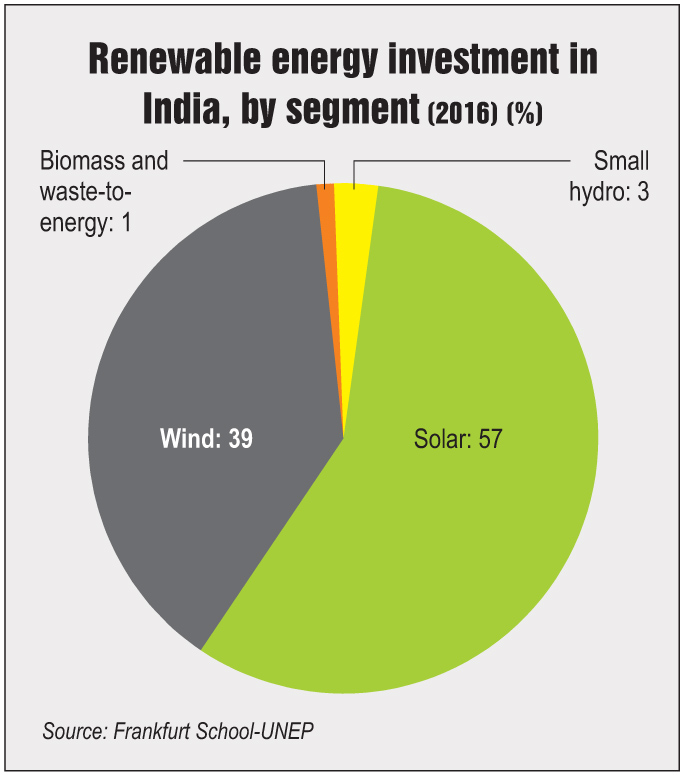

There has been a sizeable growth in the overall investment quantum as well. A report by the Frankfurt School-United Nations Environment Programme (UNEP) has estimated that in 2016, about $9.7 billion was invested in the Indian renewable energy sector. Of this, the solar segment received the highest share of 57 per cent ($5.5 billion), while the share of wind energy stood at 39 per cent ($3.8 billion). These were followed by the small-hydro segment with 3 per cent share ($300 million) and biomass and waste-to-energy, which cumulatively accounted for 1 per cent ($100 million).

According to Mercom India, the first three quarters of 2017 (January to September) witnessed an infusion of about $4.2 billion of funds into the renewable energy sector through corporate funding, project funding and merger and acquisition deals. This is more than double the investment made during the same period in 2016.

Equity financing

Private equity (PE) funding has given the much-needed push to the renewable energy sector and continues to be the dominant source of financing, despite the introduction of new financial tools. For the first nine months of 2017, India recorded a 47 per cent spike in private equity financing over that in 2016 for the wind and solar energy segments. This is in contrast to the low capacity addition expected this year. However, due to a strong pipeline from the previous year and significant capacity additions in the first quarter of 2017 (January-March), the overall investment trend has improved.

The sector saw nine key deals totalling $920 million during the period January-September 2017. In comparison, there were 10 deals for $630 million during the corresponding period in 2016 and 14 deals aggregating $979 million during the corresponding period in 2015.

The key PE deals in the wind and solar energy segments were a $250 investment in Hindustan Power Projects, a $200 million capital influx by IDFC Alternatives in First Solar, JERA’s investment of $2,500 million in ReNew Wind Power, Warburg Pincus’ investment of $108 million in Cleanmax Enviro Energy Solutions, and the Abraaj Group’s $100 million investment in Engie Abraaj, a joint venture with the France-based Engie.

IDFC Alternatives exited Mytrah Energy while the Piramal Group invested $18 billion in the company in the form of non-convertible debentures. It also exited Sembcorp Industries Limited’s renewable energy arm by selling its 28 per cent stake for Rs 25 billion, nearly 3.2 times its initial investment and the largest exit for the company so far. However, with the internal rate of return at 19 per cent, the company’s exit is considered to be in the low to medium category of returns.

Other notable deals include the Dino Energy Corporation’s acquisition of Prestige Ocean Holding and Investment’s upcoming 100 MW solar power project in Haryana, the purchase of Inox Wind’s 260 MW wind power portfolio across Rajasthan, Maharashtra, Madhya Pradesh and Tamil Nadu by Leap Green Energy for an undisclosed amount, and the Abu Dhabi Investment Authority’s investment in ReNew Power Ventures.

Speaking about the emerging equity instruments, C.M. Khurana, chief general manager, India Infrastructure Finance Company Limited (IIFCL) says, “Quasi-equity instruments are also on the table, by way of which we fund 10 per cent of the project cost. When the borrower is unable to raise equity, we provide debt on which interest is charged but not recovered for the first five years. Credit enhancement is also available to wind project developers. Through this instrument, we help them in tapping the bond market for more capital. Further, IIFCL provides a guarantee whereby the developer’s rating automatically becomes ‘AA’ or ‘AAA’, which makes it investible, enabling it to borrow from the bond market.”

Green bonds have emerged as an attractive new debt financing tool, with the renewable energy sector raising $2.1 billion through various bond issues in the first seven months of 2017. This has placed the country firmly on the green bond map of the world, which has seen issuances of $180 billion since the inception of the concept in 2007. India’s first green bond was issued by YES Bank in 2015 for $3,300 million with a term of seven years. Over the past two years, several companies have issued green bonds including NTPC, NHPC and Axis Bank. Primary among these are masala rupee bonds worth Rs 20,000 million issued by NTPC in October 2016. These bonds have a five-year maturity and an interest rate of 7.48 per cent. NHPC issued corporate bonds worth Rs 45,000 million, while Axis Bank issued maiden green bonds of $500 million in June 2016. The market grew to cumulatively reach $2.7 billion in 2016, making India the seventh largest green bond market in the world. However, green bonds need to be issued carefully with a strong portfolio of customers. Continuum, backed by Morgan Stanley, issued a $400 million bond, but failed to raise any capital due to the poor profile of its customers, which primarily comprised the financially stretched discoms.

There is increasingly a trend of multilateral banks and non-banking financial institutions (NBFCs) getting into the commercial lending space, which was earlier dominated by domestic banks. In the past year, 24 debt deals from multilateral banks and NBFCs were recorded in the segment. The Asian Development Bank (ADB) gave a $390 million loan to ReNew Power and Rs 11,375 million to Mytrah Energy Limited (on a project finance basis). ADB also provided a $1 billion loan to Power Grid Corporation of India Limited (Powergrid) to strengthen grid infrastructure. In an institution-to-institution deal, ADB loaned another $200 million to the Indian Renewable Energy Development Agency, which provides low-interest capital for renewable energy development. The World Bank Group has provided $1.02 billion worth of loans to the government, in addition to $625 million to the State Bank of India as a long-term loan exclusively for the development of the renewable energy sector. Germany-based government bank KfW has given loans worth Rs 3,000 million to the state governments of Kerala and Maharashtra for the development of two large floating solar park projects with a capacity of over 40 MW. It has given another $1 million as a soft loan to the central government for investing in green projects. In addition, the New Development Bank (erstwhile BRICS Development Bank) has provided Canara Bank with loans worth $250 million for investing in the sector.

Outlook

While the renewable energy industry is looking at huge investments to meet its yearly targets, there is also a cautious sentiment among lenders and investors, owing to the rapidly changing business dynamics. The steep fall in tariffs and consequent decrease in profit margins, the reneging of power purchase agreements (PPAs) by discoms and grid unavailability are some of the key challenges facing the sector. Rupesh Singh, senior manager, larger corporate-credit, Axis Bank, says, “Although there is a sense of caution in the wind energy segment, which can be attributed to a number of factors such as renegotiation of PPAs, delays in payments and inconsistency of power generation, we remain positive that the segment will become stronger.”

The wind power segment, which was once considered a safe investment, has now become a riskier proposition. Sitesh Kumar Sinha, vice-president, PTC India Financial Services Limited, says, “Before the introduction of bidding, wind was considered a more secure segment than solar, not only in terms of generation but also in terms of construction and operation. However, with the tariff decline and the resultant PPA renegotiation issues, the longevity of these issues has become our biggest concern. The central and state governments must work towards settling these issues for the wind industry to get back on track.”

Streamlining of policies and a target-based approach to the renewable energy sector will be needed to attract larger investments. While the government will need to work towards it, the market is also expected to play a significant role as it stabilises over the next two years, bringing back the investor confidence that is necessary to achieve the targets.