As the world progresses to a cleaner, greener, carbon-free future, countries across the globe are undertaking a host of initiatives to meet these goals. These include shutting down thermal plants, promoting electric vehicles, restoring grasslands and tapping into renewable sources of electricity. In some ways, this amounts to a complete overhaul of the existing systems, and thus requires huge amounts of funding. Green bonds have emerged as an important financial instrument for obtaining funds.

Quite like traditional bonds, green bonds, or climate bonds, are debt-based fixed income instruments designed to raise money for projects. However, as the name suggests, these projects offer environmental benefits. The bonds carry the same rating as the other debt of the issuer and are often structured under the issuer’s medium-term notes. Since the issue of the first green bond in 2007, the market has grown considerably, owing to the growing awareness about climate change.

Overview

Green bonds can broadly be categorised into four types. The first is use-of-proceeds bonds, wherein the proceeds are used for green projects but are backed by the issuer’s balance sheet, so that investors are not solely exposed to the risk of the bonds’ underlying projects. The second type is known as use-of-proceeds revenue bonds, wherein the bondholders receive coupon payments from a specific revenue stream (not limited to the project). The third type, project bonds, goes one step further by giving bondholders access to the proceeds from a particular green project. The last type is securitised bonds, wherein the revenue stream is generated by a set of green projects or assets.

While this broad categorisation exists, there is no legal definition of a green bond. Ever since the issue of such bonds, issuers have merely determined whether their bonds were green and have marketed them accordingly. Recently, however, several countries, including China and India, have released issuance guidelines for their green bond markets.

The first green bond was issued by The European Investment Bank in 2007; it was issued as a “climate awareness bond” for renewable energy projects. During the following years, more investors and institutions showed interest in this financing instrument. With this, the market for green bonds grew considerably. It witnessed steady growth until 2012, and then grew exponentially. The Climate Bond Initiative reports that as of July 2021, $1.273 trillion worth of green bonds have been issued globally, of which bonds worth $242.3 billion have been issued in the current year.

Green bonds in India

Renewable energy is playing a prominent role in helping India meet its climate goals. However, the need for alternative financing mechanisms has been evident for some time, stemming from some of the fundamental challenges in renewable energy finance in the country: high interest rates, short loan tenors, and competition with conventional power. In 2013, the United States Agency for International Development (USAID) Partnership to Advance Clean Energy-Deployment (PACE-D) Technical Assistance Program prepared comprehensive reviews of financing mechanisms for renewable energy and energy efficiency in India, and suggested that green bonds could provide domestic renewable energy developers scalable, long-term, low-cost debt capital from institutional investors. In 2015, Yes Bank launched the country’s first green bond issue for $50 million to finance renewable energy projects. Shortly after this issue, the International Finance Corporation launched the first rupee-backed green bond (masala bond) to finance solar and wind projects in India. The average coupon rate for domestic issuers is significantly higher, at 7.5-10 per cent, than the 2.8-8.5 per cent rate for international issuances. This significant difference is linked to the currency risk of the Indian rupee.

The issuing of green bonds opens up options for liquidity, which is much needed in the Indian market. One of the main advantages of green bonds is that they provide funding at relatively low rates for renewable energy projects, which developers have struggled to get in recent years. Second, investing in these projects can help companies fulfil their corporate social responsibility targets. Finally, green bonds often offer a number of tax breaks for investing in these projects.

Recent developments

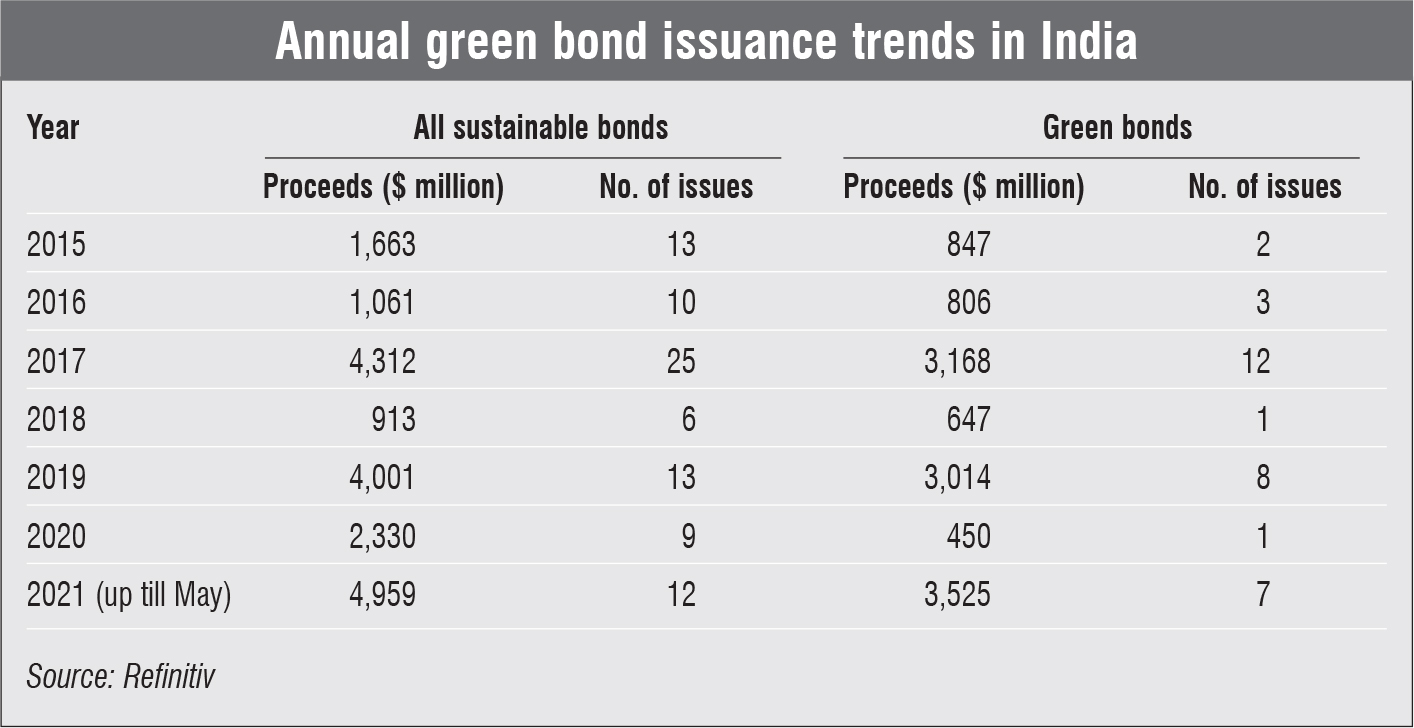

The current year has been noteworthy for India’s green bond market. The amount of funds raised via green bonds in the first half of 2021 is significantly higher than that raised in all of 2020. The most prominent of these has been the green bonds issue launched by CLP India Private Limited’s wind energy arm, CLP Wind Farms (India) Private Limited, for Rs 2.96 billion. The bonds have been issued in two tranches of Rs 1.96 billion and Rs 1 billion. The proceeds will be used to refinance loans for renewable energy projects. In May 2021, JSW Hydro Energy announced that it had raised $707 million through green bonds. The bonds were issued by JSW to repay the existing debt on its two operational hydro projects.

In July 2021, ACME Solar raised $334 million in a debt investment through the issuance of offshore green bonds. In the same month, Adani Electricity Mumbai Limited raised $300 million through green bonds as a part of its $2 billion global medium-term note programme. The bonds also generated massive global interest and were oversubscribed by 9.2 times.

Key risks and challenges

Despite the strong growth in India’s green bond market, the financial instrument constitutes a mere 0.7 per cent of all the bonds issued in the country. In other words, the growth in green bonds so far could have just been a proportionate response to the rapid increase in renewable energy development over the last few years. With bank lending to renewable energy projects accounting for only 7.9 per cent of the lending to the power sector, the sector continues to be funded predominantly through equity, adding to the liquidity problems of companies. Further, India’s current sovereign rating of BBB- is not attractive, especially for risk-averse investors.

In addition to this, an average investor could be wary of investing in green bonds as it has only been six years since they were first issued in the country. Moreover, it is difficult to measure the credibility of these bonds if they are for unconventional investment sectors such as forestry and marine conservation, innovative transport, and emerging renewable energy technologies. Above all, there is no way to determine the “greenness” of a project, and different agencies and countries have different interpretations of this.

The way forward

The risk perception notwithstanding, the green bond market in India has shown great promise, especially in the past eight months. However, there is still scope for improvement in compensating for the liquidity problems of developers. By improving transparency, independent verification and reporting, the green bond market can offer attractive opportunities to investors. From 2022-23, it will be mandatory for Indian companies to file a new disclosure report – the Business Responsibility and Sustainability Report. This could drive investments in green bonds by offering greater transparency in the disclosure of environmental, social and corporate governance-related information.

The Government of India operationalised the International Financial Services Centre (IFSC) at the Gujarat International Finance Tec-City (GIFT) Multi Services Special Economic Zone in April 2015. Since then, the IFSC has taken some progressive steps and is working towards bringing in a new regulator and regulatory framework. GIFT is becoming the preferred platform for listing green bonds, and with the IFSC’s infrastructure and strategic location, these financial instruments may get a well-needed boost. There is also scope for the participation of state and central governments in the issuance of green bonds. As mobilising funds for climate action is a major challenge for the central and state governments, these entities can look towards green bonds or state loans to attract diverse investors that are willing to support them in meeting developmental targets.

In addition to green bonds, other sources of finance for renewable energy have emerged. Notable among them are infrastructure investment trusts, wherein investors are called upon to invest in a new asset class that would provide them a yield over a long-term period, usually over the life cycle of the project. This has gained traction in the renewable energy market and can help address some of the concerns related to long-term finance.

In sum, the green bond market in India has grown considerably, and is still growing. Targeted efforts to improve the transparency, regulations and attractiveness of the instrument can go a long way towards addressing some of the biggest financial challenges in India’s green energy sector.

By Rithvik Kumar