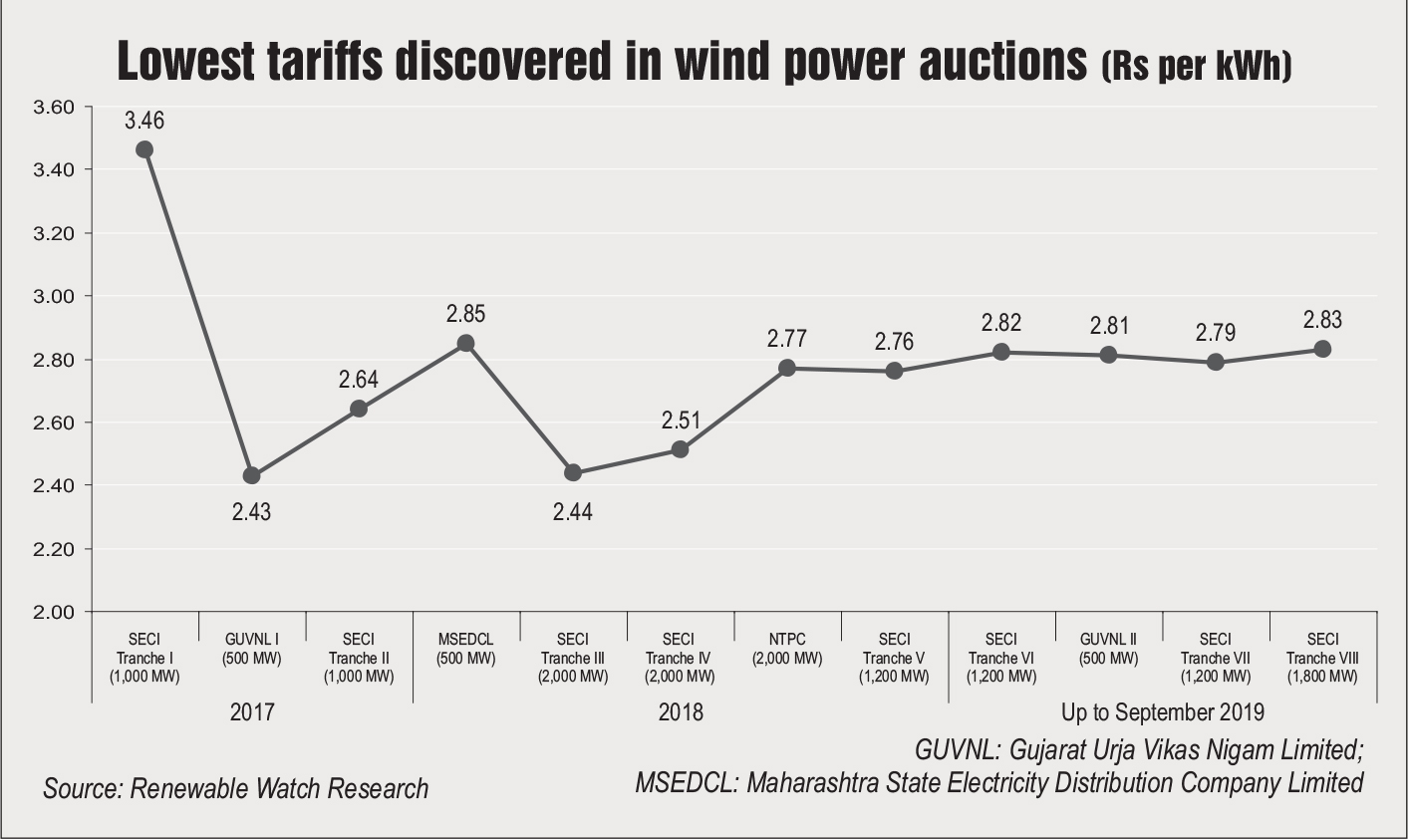

Ever since competitive bidding was introduced in 2017 for allocating wind power projects, the segment has been in a constant state of flux. While the period of transition was initially expected to last a few months, the uncertainties left in its wake continue to hinder growth even after almost two years. It is true that wind power tariffs have gone down considerably since the move from the feed-in tariff (FiT) regime to the auction regime. However, annual capacity additions have slowed down significantly due to transmission and land constraints, putting the entire wind power ecosystem at risk. In addition, developers now have to face uncertainties regarding sanctity of contracts and the issue of non-payment by discoms. These factors are further dampening investor sentiment. Although efforts are being made to tackle these pain points, time is running out for India to achieve its 60 GW wind power target with just 36.93 GW of installed wind power capacity as of September 2019.

Slowdown in capacity addition

During the FiT regime, much of the power was concentrated in the hands of a few players, as they installed projects based on their requirements and available land. Thus, competitive bidding was introduced with the aim to create a fair and transparent environment for setting up wind power projects in the country, do away with the monopoly of a few players, and ensure cost-effective power generation. While mega auctions have certainly opened up the market for new developers and investors, now their entire businesses depend on the auctioned capacities. However, just winning projects in auctions is not enough. Developers need to overcome a number of hurdles before their projects can actually be commissioned and start feeding power into the grid. They have to acquire land, get the required regulatory permits and ensure connectivity to the grid before they can start generating power and get paid in return. In the Indian scenario, these three critical factors are the major causes for project delays.

With the increasing unavailability of wind resource-rich sites and the rising cost of land, the land acquisition issue has magnified, causing delays in project commissioning. Buying land is usually not a major issue, but the factors associated with land such as environmental clearances and getting right of way for last-mile connectivity to the nearest substation pose a challenge. The recent land allocation problems in Gujarat caused by state authorities resulted in the stranding of thousands of megawatts of wind power capacity. These projects were allocated under the Solar Energy Corporation of India’s (SECI) Tranche III and Tranche IV wind power auctions, where most wind power developers had opted to set up their projects at wind-rich sites in Gujarat. Although, the issues have been resolved to an extent, they did delay the commissioning of a large wind power capacity by eight to nine months, thereby hurting developers’ revenues.

Meanwhile, there is a lot of precious time getting lost in securing regulatory clearances, which further limits capacity addition. For instance, the 800 MW of wind power capacity allocated by NTPC Limited in 2018 as part of a 2 GW auction is still at the approval stage, as per media reports. NTPC has not been able to get regulators’ consent for the adoption of quoted tariffs, leaving the entire capacity at risk. This has forced some developers to withdraw from the tender because of unavailability of long-term loans from banks in the absence of proper regulatory clearances.

Further, transmission capacity has not increased in sync with renewable energy capacity. Wind projects are usually commissioned within 18 months, while transmission systems typically take 24-36 months for implementation. Even the green energy corridors project, which aims at grid integration of solar and wind power, has not been implemented at the required pace. This mismatch between generation and transmission has caused major delays in project commissioning, leading to low developer and investor confidence, and undersubscription/cancellation of tenders.

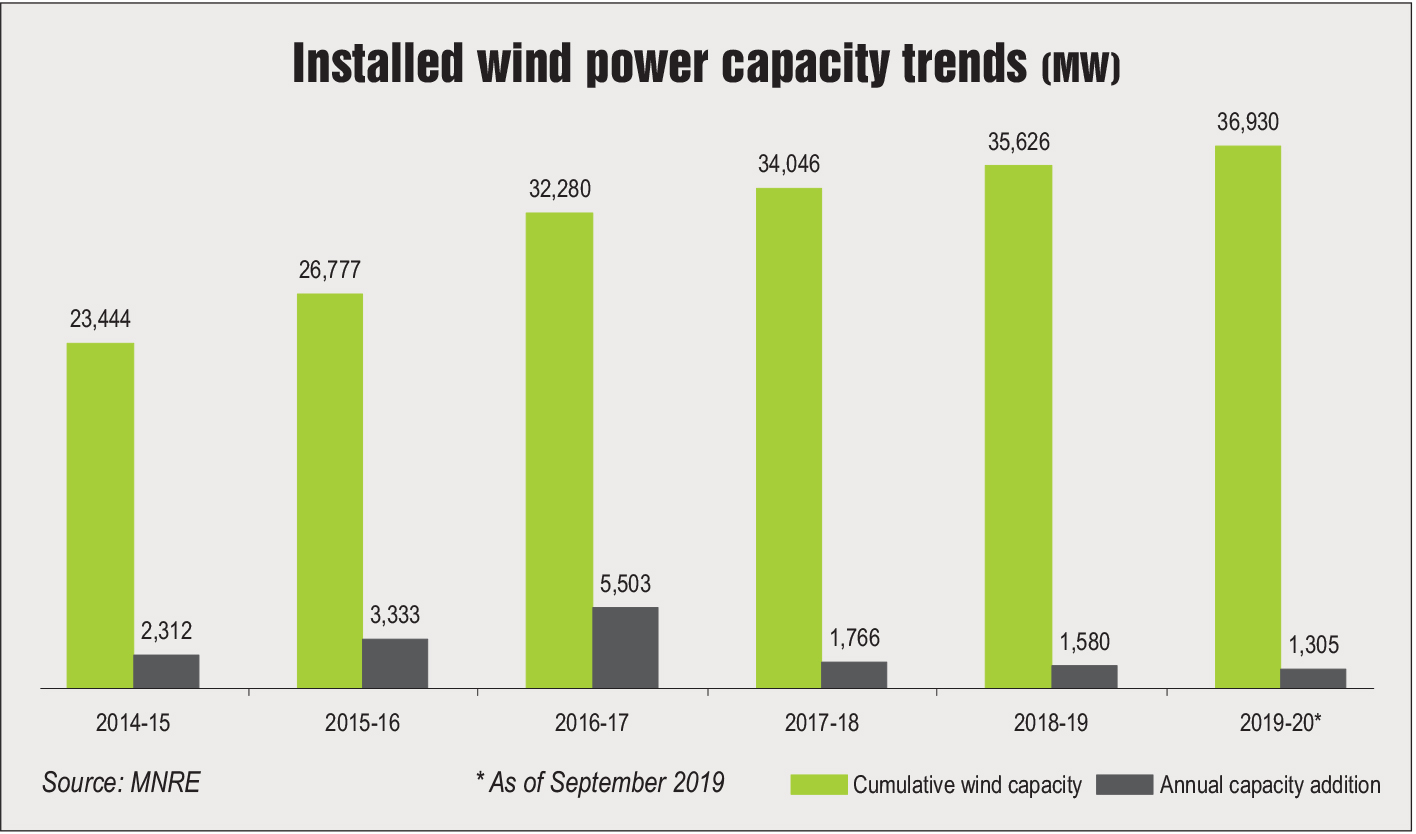

The net result of all these issues is that capacity additions have dropped from 3.3 GW and 5.5 GW in 2015-16 and 2016-17, respectively, to less than 2 GW per year from 2017-18 onwards. Even in 2019-20, only 1.3 GW of new wind power capacity has been added as of September 2019. This is despite the fact that 11.4 GW of new capacity has been auctioned by SECI along with 2 GW by NTPC and 1.5 GW by the states of Gujarat and Maharashtra since the advent of competitive bidding. Thus, the major challenge for the government at present is to address these issues in order to bridge the huge gap between the capacity auctioned and executed.

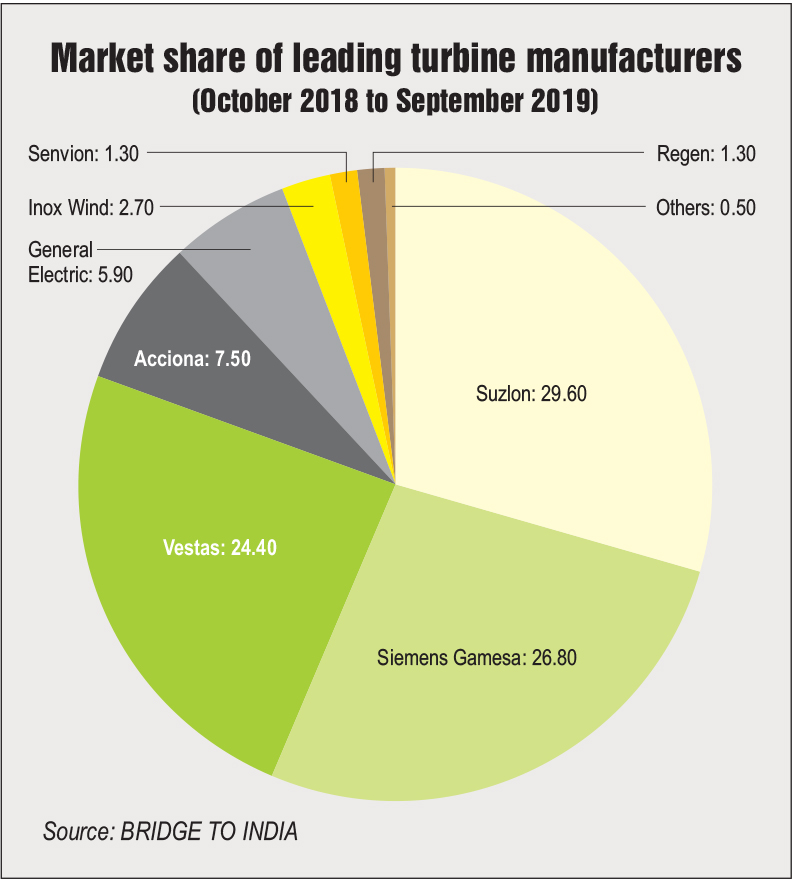

Due to various challenges at the implementation level, there is limited wind power capacity available for execution. This has significantly impacted both developers’ and manufacturers’ businesses. While bidders bear losses due to project delays, manufacturers suffer as they have to stock inventory for a prolonged duration. India at present has 18 wind turbine manufacturers with a total production capacity of about 13.5 GW per annum. However, the industry is currently able to add only about 2 GW of wind capacity per annum, which means a reduction in sales volume for manufacturers. Further, tariffs have declined considerably in the past three years and the upper cap on tariffs in tenders means that developer revenues will have to take a further hit. Many a time, these are passed on to manufacturers, who have to keep equipment prices low to stay competitive. According to media reports, developers such as ReNew Power and Sembcorp have even started carrying out their own operations and maintenance to cut down losses, instead of relying on manufacturers.

Although competitive bidding was meant to create a level playing field, the auction of large capacities and demand for low tariffs has made it a big players’ game. Hence, only players with deep pockets will be able to stand their ground, while smaller players will have to explore other business models to stay afloat. Various private entities have reported heavy losses in the past few months, with some even winding up their businesses and selling their entire portfolios to bigger players. Although the market share of these companies might not be impacted, their financial statements have certainly taken a hit. For instance, Suzlon Energy missed the repayment of an outstanding $172 million principal on notes due in July owing to less orders drying up its cash flow. Similarly, another big manufacturer, Inox Wind Limited has posted losses in the past two financial years.

Revenue depletion due to inadequacy of available capacity for execution is not the only concern for the wind power segment. A bigger issue at play is the lack of contract sanctity in various states that is threatening the future of many gigawatts of installed and upcoming wind capacity, thereby putting at risk millions of dollars of investments. A recent instance is that of Andhra Pradesh, where the new government announced its decision to review and renegotiate power purchase agreements (PPAs) made during the previous government’s regime under the FiT mechanism. This decision put nearly Rs 210 billion of debt of renewable energy companies at risk of default, as about 5.2 GW of renewable capacity, which includes nearly 3.9 GW of wind capacity, was put in jeopardy. In addition, wind power was curtailed in the state. Although the Andhra Pradesh High Court has intervened in the matter, the issue has set a bad precedent for the entire segment and made investors wary.

Another state that has received a lot of flak from the industry is Uttar Pradesh, which kept procuring power from wind power developers through the interstate transmission system in the past one year without taking the required approvals. When a warning was issued by the state regulator, state discoms stopped power procurement till approvals were in place, thereby putting these projects at risk.

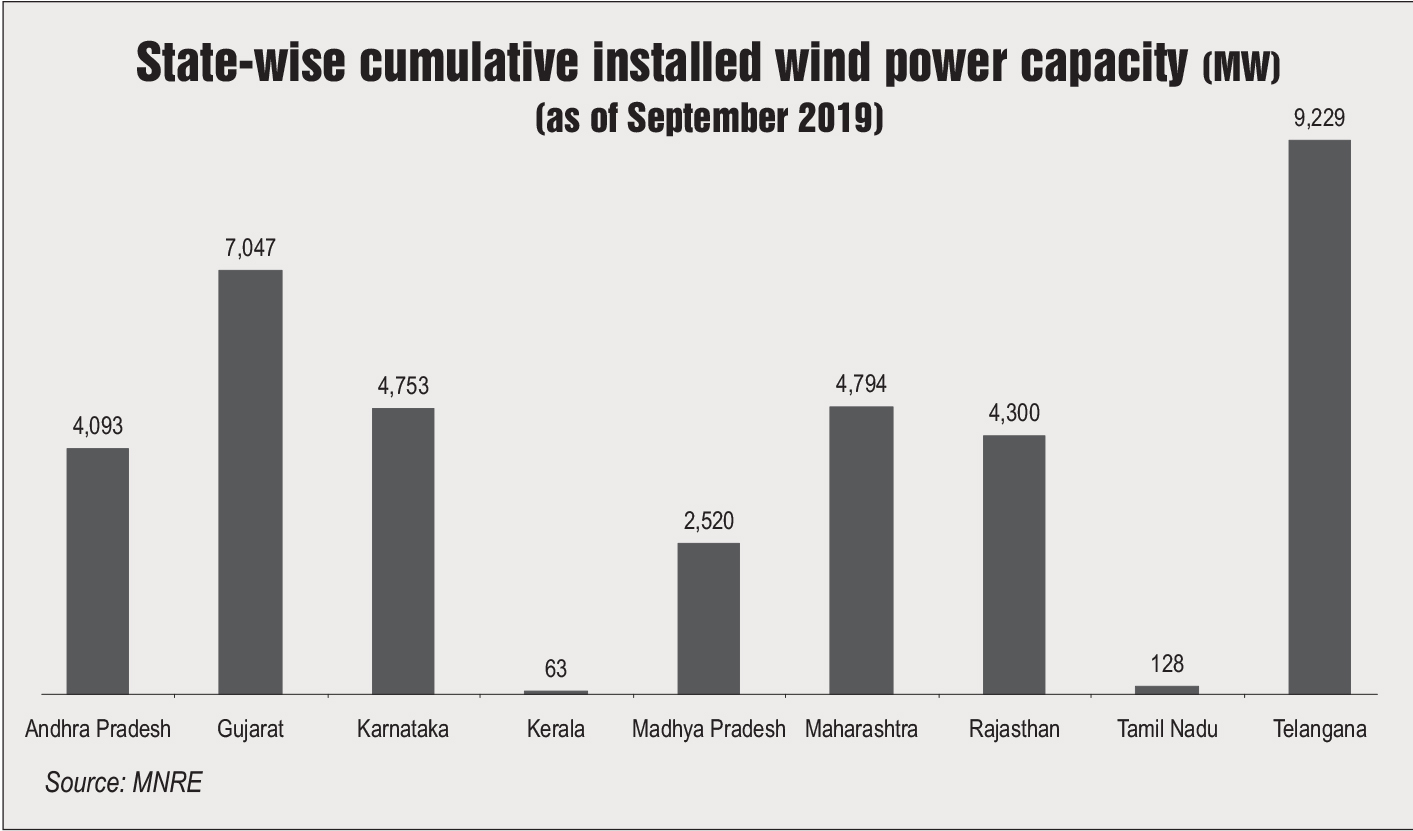

Finally, the most critical issue is discoms’ inability to pay developers for the power procured from them. The delay in payments has gone up to 12 months in the case of certain discoms. As of July 2019, dues by discoms to renewable energy generators had spiralled to almost Rs 82 billion, as per the Central Electricity Authority. This figure would have been a staggering Rs 100 billion if Greenko’s dues of Rs 17 billion were also included. This issue of non-payment of dues has added to developers’ woes in states such as Telangana, Tamil Nadu, Andhra Pradesh and Karnataka, all of which are wind-rich states and have large wind projects selling power to discoms.

The uncertain environment has made banks wary of granting loans to wind power projects, and even the State Bank of India has reportedly decided not to extend financing for projects with tariffs below Rs 3 per unit. Consolidation activity has increased due to a liquidity crunch and large investors are exiting the market owing to concerns regarding project viability. For instance, Morgan Stanley Infrastructure Partners is planning to exit the wind power business in India by selling the entire operational wind portfolio of over 700 MW of Continuum Wind Energy. Similarly, PTC India is planning to sell its subsidiary PTC Energy’s 290 MW wind assets.

The adverse impact of these challenges has become evident in the results of recent auctions. Three wind power capacity auctions were conducted by SECI and one by Gujarat Urja Vikas Nigam Limited (GUVNL) in 2019. While SECI’s Tranche VI auction in February 2019 for 1.2 GW of wind capacity was oversubscribed by 1,125 MW, both of its later auctions, Tranche VII in May 2019 and Tranche VIII in August 2019, were significantly undersubscribed. In Tranche VI, Ostro Energy, Adani Renewables, Srijan Energy Systems and Powerica Limited quoted Rs 2.82 per unit while SB Energy and Ecoren Energy quoted a tariff of Rs 2.83 per unit to emerge as winners. Under Tranche VII, only 480 MW of wind power capacity was allocated, as against the 1.8 GW that was tendered, to Engie, ReNew Power, Sprng Energy and Adani at Rs 2.79 per unit, Rs 2.81 per unit, Rs 2.82 per unit and Rs 2.83 per unit respectively. Similarly, under Tranche VIII, only 439.8 MW was allocated to CLP India and Avikaran Energy (Enel) at Rs 2.83 per unit and Rs 2.84 per unit respectively. The GUVNL auction for 1 GW of wind power capacity in May 2019 was also undersubscribed by 69 MW and witnessed the lowest tariff of Rs 2.80 per unit. Thus, the wind power tariff, which had plummeted to Rs 2.43 per kWh under SECI Tranches III and IV, moved up to stabilise at Rs 2.80 per kWh in 2019 as developers internalised various risk factors.

Despite challenges, about 95 per cent of the projects under SECI Tranche I have been commissioned, while 50 per cent of the projects have been commissioned under Tranche II, according to SECI. Tranches III and IV ran into major roadblocks due to land issues in Gujarat. Even so, about 10 per cent of the capacity has been commissioned before schedule under SECI Tranche III. However, there may be a time lag in the commissioning of 5-10 per cent of the capacity. Overall, a delay of three to four months is expected in SECI Tranche III, while there is still ample time for projects allocated under later auctions.

In order to address some of the concerns plaguing the segment, the MNRE revised the bidding guidelines for wind projects in July 2019, allowing developers 18 months’ time to sort out land clearances. The new guidelines permit the sale of power at full PPA tariff in case of early commissioning. The risk of project delay has been mitigated by starting the project execution timeline from the date of PPA signing. Under the new payment security mechanism, SECI will ensure payment to developers as per their PPAs at least for a year even if discoms do not pay SECI. If this continues, SECI will sell that power to other discoms. To address transmission issues, the MNRE has submitted a transmission plan for 66 GW of additional renewable energy capacity across solar and wind regions to the power ministry, of which 12 GW is at the bidding stage, while work has begun on some projects by Power Grid Corporation of India Limited.

That said, for continued growth of the segment, it is imperative that discoms’ health improves so that they can pay developers on time as the majority of power procurement is done by discoms. In addition, open access for wind power procurement should be permitted and auctions by state agencies should be conducted for more capacity allocations, instead of depending only on SECI auctions. While transmission and land issues will get resolved in due course, it is of utmost importance to maintain the sanctity of contracts so as to not drive away developers and investors. There should be strict penalties for parties not adhering to contract conditions and renegotiating PPAs. No bids should be allowed to be cancelled on account of tariffs, and discoms and tendering agencies should put more emphasis on quality of power rather than price of power.

Summing up, there have been consistent efforts from central government agencies and tendering authorities to resolve the issues and get the segment back on track. However, the question remains whether the gap between policy and execution will be bridged in time to achieve India’s tall target of 60 GW of wind power capacity by 2022.

By Khushboo Goyal