By Khushboo Goyal

Rajasthan witnessed the country’s lowest ever solar power tariffs of Rs 2.44 per kWh in May 2017, in an auction for 500 MW of solar power for the the Bhadla Solar Park, Phase III. While a few subsequent auctions have been able to discover the same tariff, none has crossed this record low mark. With the Rs 2.48 per kWh tariff quoted in a recent 750 MW solar power auction, Rajasthan once again came close to equalling the historic low tariffs of May 2017. The state has the highest levels of solar irradiation in the country, leading to an estimated solar power potential of 142 GW. This massive solar resource and the state’s enabling polices have made Rajasthan one of the leaders in the solar power segment.

A look at the recent developments, key policy measures and outlook for the renewable energy sector in the state…

Solar over wind

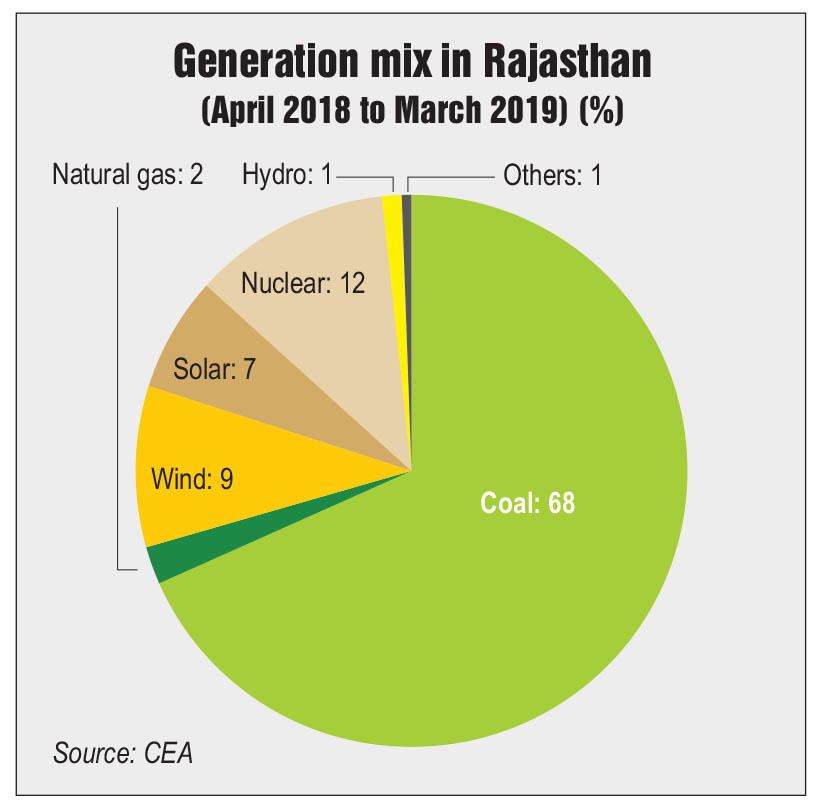

One of the early movers in the solar power segment, Rajasthan ranks third amongst all the states in terms of its installed solar power capacity. Its solar capacity has consistently grown at an average rate of 35 per cent between 2013-14 and 2018-19, to reach 3,227 MW in March 2019. The year 2018-19 was good for the solar power segment in the state, which witnessed large capacity additions of 980 MW in just one year. However, the present installed capacity is barely 2.3 per cent of the immense solar power potential of the state, and contributes to 7 per cent of its total energy generation. To further enhance its solar power uptake, the state has set a target of meeting 17 per cent of its total energy consumption through solar power by 2021.

The completion of the Bhadla Solar Park will help achieve this target. With a total capacity of 2,255 MW, the park spreads across 4,500 hectares. The solar park is being developed in four phases. As of October 2018, 1,365 MW of the total solar power capacity has been commissioned, with only 880 MW left for commissioning. The remaining capacity is facing delays due to issues in land allocation and transmission constraints. Besides Bhadla, Rajasthan is implementing other solar parks including the 750 MW Pokhran-Phalodi, 1,500 MW Phase 1B of Fatehgarh and the 1,000 MW Nokh-Jaisalmer.

Apart from solar power, Rajasthan has a high potential for wind power development, which is estimated at 18,770 MW. The state initially made significant efforts for its uptake through attractive feed-in tariffs for developers. In fact, Rajasthan already had 2,785 MW of installed wind power capacity in 2013-14, when its solar power capacity was barely 725 MW. It witnessed capacity additions as high as 942 MW in 2015-16, enabled by strong policies. However, its growth has declined in recent years owing to competitive bidding and transmission constraints in the state. Rajasthan has not conducted any auction for wind power, unlike its neighbouring state, Gujarat. Further, during the Solar Energy Corporation of India (SECI)-conducted auctions, most developers preferred the high wind sites of Gujarat or Tamil Nadu, instead of Rajasthan. Thus, the state saw a total of only 18 MW of capacity additions in 2017-18 and 2018-19, leading to 4,300 MW of cumulative wind power capacity as of March 2019.

However, the Rajasthan government has been revamping its renewable energy plan to increase the uptake across all segments by strengthening policies. To this end, it has agreed to provide land for 19,000 MW of renewable energy projects in response to the Ministry of New and Renewable Energy’s announcement on the development of renewable energy parks to address land and transmission facilities for developers. These identified land parcels with adequate transmission infrastructure will help alleviate developers’ concerns and make the state an attractive location for them, aided by its immense potential for both solar and wind.

In recent months, Rajasthan has given a fresh impetus to tackle some of the policy and regulatory issues, that are hindering renewable energy uptake in the state. In March 2019, the state government amended its net metering regulations for rooftop and other smaller solar power plants. In these regulations, the Rajasthan Electricity Regulatory Commission (RERC) has focused on domestic rooftop solar owners and proper energy accounting and settlement for all consumer categories. Domestic consumers are paid Rs 3.14 per kWh if net energy injected into the grid by them exceeds 100 units during the billing month; otherwise, they are paid in the next month once their total net energy generation reaches 100 units. The RERC has put a daily cap of 4.8 kWh of energy generation per kW of the approved installed capacity of rooftop solar systems for all consumer categories.

During the same month, the RERC released amendments to regulations for the determination of tariff for renewable energy. Under these regulations, the RERC will determine project-specific tariffs, for solar photovoltaic (PV), solar thermal, wind and other renewable energy projects in the state. This will be done on a case-to-case basis, provided a petition is filed, accompanied by a fee and a detailed project report along with the cost break-up of the debt and equity components.

The RERC released another regulation in March 2019 on renewable energy certificates (RECs), which brought respite to developers of more than 500 MW of renewable power projects. As per this regulation, the effective electricity component price payable by discoms to developers of REC projects commissioned before March 31, 2019 is pegged at Rs 3.14 per kWh. This is equal to the pooled cost of power purchase, which has been capped at an average of power purchase cost for Jodhpur Vidyut Vitran Nigam Limited for the period 2011-12 to 2016-17. The said price is applicable for the remaining useful life of the projects for which power purchase agreements (PPAs) will be executed, and discoms will monitor and contest this price when the need arises. Developers of these projects can also use the generated power for captive consumption or sell it to other entities through the open access.

Rajasthan also witnessed a few orders to clarify certain issues for both developers and discoms and expedite the respective processes for the future. In May 2019, the RERC clarified that captive renewable power plants should fulfil the rule of proportionality of power consumption to the percentage share of ownership. Renewable power plants not supplying power in the aforementioned manner become liable to all the applicable open access charges as per the state’s regulations. In April 2019, the RERC clarified that for projects delayed beyond their commissioning timeline, the tariff applicable will be the one that was chosen for the year in which the commercial project actually became commercially operational and not that of the earlier expected commissioning date.

Apart from this, the RERC issued draft amendments to the 2017 regulations on the deviation settlement mechanism for grid-connected power in January 2019. These regulations, aimed at maintaining grid security, were formulated in line with the deviation settlement regulations put in place by the Central Electricity Regulatory Commission. Under these regulations, the deviation charges will not exceed the billed energy charges for the previous month, for projects whose tariff is determined by the RERC. For other projects, deviation charges, irrespective of the fuel source, will not exceed Rs 3.03 per kWh.

In March 2019, SECI invited bids for the development of the second tranche comprising 750 MW of grid-connected solar power projects in Rajasthan on a build-own-operate basis. SECI will sign a PPA for a period of 25 years with successful bidders and the power procured from the project will be sold to Rajasthan Urja Vikas Nigam Limited. Developers must bid for a minimum capacity of 10 MW under this tender, and the project capacity also has to be developed in multiples of 10 MW. The plant will be designed for interconnection with the nearest substation of the state transmission utility at the voltage level of 33 kV or above. The upper ceiling tariff has been set at Rs 2.68 per unit under this tender. The last date for bid submission was May 6, 2019.

Prior to this, in February 2019, the first tranche of SECI’s auction for 750 MW of grid-connected solar power projects across Rajasthan led to an oversubscription of the tender by 1,620 MW at the same upper ceiling tariff of Rs 2.68 per unit. The auction witnessed a total of five companies winning bids, from Fortum Solar Plus Private Limited, Palimarwar Solar House Private Limited (LNB Group), ACME Solar Holdings Limited, Sitara Solar Energy Private Limited (UPC Renewables) and ReNew Solar Power Private Limited. Fortum Solar, Palimarwar Solar, ACME Solar and Sitara Solar won bids for the development of 250 MW, 40 MW, 250 MW and 100 MW of capacity respectively, by quoting a tariff of Rs 2.48 per kWh. ReNew Solar had submitted bids to develop 360 MW of capacity, but it won only 110 MW by quoting Rs 2.49 per kWh. SECI will sign PPAs with the successful bidders for a period of 25 years. The bids for the projects were invited by SECI in August 2018, and the tender was postponed twice before it received a successful response. This was despite the fact that the upper tariff ceiling was reduced from Rs 2.93 to Rs 2.68 per kWh during this time.

In January 2019, NTPC Limited invited bids for the development of a 20 MW floating solar PV project at its Anta gas power station in Baran district of Rajasthan. The scope of work included design, engineering, manufacturing, supply, packing and forwarding, transportation, unloading, storage, installation, testing and commissioning. It also included operations and maintenance of the plant. NTPC Limited intended to finance the project through its own resources. Unlike other similar tenders, the solar PV cells and modules for this project can be sourced from anywhere in the world. The last date for bid submission was February 13, 2019.

Interestingly, none of these tenders have been issued by the state entities, which are actually targeting huge capacity additions in the future. Similarly, no new rooftop solar tenders have been announced in this solar resource-rich state. The last large rooftop solar tender in the state was in December 2017, when Rajasthan Renewable Energy Corporation Limited issued a tender for the installation of 18 MW of grid-connected rooftop solar projects across the state. This capacity was tendered under the Rooftop Solar Power Generation Programme 2017-18. Prior to this, Rajasthan Electronics and Instruments Limited had tendered 950 kW of grid-connected rooftop solar to be developed atop buildings owned by Rajasthan University in Jaipur in June 2017.

Rajasthan has not added any significant wind power capacity in recent years, despite the massive potential. Its upcoming solar power capacity is also due to tenders issued by SECI, while the state agencies have taken a back seat in the bidding activity. The state revised its renewable purchase obligations (RPOs) in January 2019 and its new RPO targets are quite less compared to those prescribed by the Ministry of Power (MoP). The RERC has specified a non-solar RPO of 8.6 per cent and a solar RPO of 4.75 per cent for 2018-19, against the MoP’s targets of 10.25 per cent and 6.75 per cent respectively.

A possible explanation for these measures could be Rajasthan’s cautious approach towards new renewable power capacity addition as the state has faced a lot of criticism in the past for generation curtailment and unavailability of adequate land and transmission facilities. Thus, the state agencies might now prefer to undertake planned development of renewable energy projects, and transmission capacities. This is evident from the large number of enabling regulations notified by the state agencies in recent months to remove uncertainties regarding the present policy scenario in the state.

Summing up, Rajasthan is positioning its power sector for greater renewable energy uptake by aligning itself with the right set of policies and regulations. Though this might hit its capacity pipeline in the short term, it will certainly promote a more sustainable growth in the future. n