Sunil Wadhwa, Managing Director, GE T&D India Limited

Sunil Wadhwa, Managing Director, GE T&D India Limited

As the Government of India (GoI) continues the momentum on rapid industrialisation for driving development for to be amongst the top three economies globally, the demand for electricity will continue to rise in the coming decades. Industry experts expect India to account for 30 per cent of the growth in global energy demand between now and 2040.

On the supply side, India is marching forward with renewable energy transition, which now accounts for over 13 per cent of the electricity mix, with an installed capacity of over 70 GW – mostly coming from variable renewable energy sources.

As renewables in India continue on a strong growth trajectory to hit the GoI’s target of 175 GW by 2022, the key concerns are a growing need to address the intermittency/grid instability issues that arise with an increasing proportion of Variable renewable energy penetration into the grid, and the cost of balancing renewables, which, if not contained, would impact retail tariffs in future.

Making coal-based generation flexible enough with faster ramp rates can be an immediate solution to balance renewables in order to continue the momentum on renewable energy capacity addition. With most of the coal plants currently operating at low plant load factors (PLFs), balancing renewables through flexible coal-based generation will also be cheaper than other alternatives. However, as the largest contributor to India’s total greenhouse gas emissions, coal-based power generation, even if made flexible to balance renewables as mentioned above, will remain a key concern for policymakers, who are addressing the challenge of climate change, unless it is made emissions compliant.

The good news is that the government has taken several initiatives to transition towards sustainable, clean coal-based generation by imposing mandatory emission norms to be achieved within a specified period, which will need capex on equipment like flue gas desulphurisation (FGD) to make these plants emissions compliant. While it will lead to a reduction in emissions and protection of the environment, this would come at a cost to end consumers as the capex will be passed through to retail tariffs. It should be noted that Indian consumers as it is pay tariffs that are not fully cost reflective as determined by the state electricity regulatory commissions (SERCs) on a socialised basis. So the question to be asked here is: “While discoms would have to bear the additional PPA tariff due to capex on emissions compliance, would they be able to recover the same from consumers?” Therefore, to avoid even greater losses for discoms, there is a need to find better mechanisms to finance the much-needed capex on coal-based generation plants to make them emissions compliant.

The following steps are urgently required:

- Making coal-based generation plants flexible enough (with faster ramp rates) to balance renewables to continue the momentum on renewable energy capacity addition,

- Transition to cleaner coal-based generation, and

- Remain tariff- neutral while achieving both these much-needed objectives.

Can we do it?… I think so, and this is how:

The solution

As is commonly known, a clean energy cess of Rs 400 per tonne of coal used for power generation is levied across the board on generators, irrespective of the quality of coal used or the emission levels of coal-based generation. This results in the end consumer paying an additional 25-30 paise per kWh, which is hardly known to consumers at large.

Initially, a part of the National Clean Energy Fund (NCEF) was used to meet the viability gap funding of renewable projects but now, solar and wind generation tariffs are affordable without any subsidies. Now, there is a need to fund the capex required for making thermal generation more flexible and with faster ramp rates to balance and absorb such affordable renewable generation at a faster pace and to simultaneously make the generation from such thermal plants cleaner and compliant with emission norms. Thinking further, rather than collecting cess from coal-based plants and then using the collected amount to fund the aforesaid capex, given the changed scenario on the utilisation trend of the NCEF, a more logical funding solution could be as follows:

- The clean energy cess (carbon tax), which started at Rs 50 per tonne, has gradually been increased to Rs 400 per tonne. This cess was introduced to discourage the use of coal for power generation, thereby protecting the environment. Now, when coal-based plants start becoming emissions compliant, these plants can legitimately expect no levy of cess (carbon tax) or rebates in the cess rate prospectively depending on the extent of compliance. Such a rebate scheme would incentivise coal plants to become cleaner. This ask from policymakers is fully justified and fair given that if the rebate/exemption to emission-compliant plants is not allowed, end consumers will continue to pay 25-30 paise per kWh by way of cess and very soon, an additional 25 paise per unit for the capex on making the generation emissions compliant – a double whammy for them.

- This exemption from cess may be clubbed to similarly fund the capex required to make coal-based generation more flexible in order to address the issue of balancing renewables at no additional cost to end consumers.

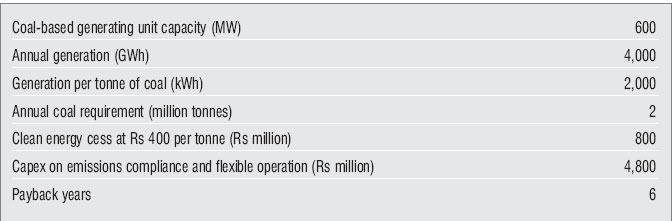

The above scheme for exemption from cess should rather apply only if both modifications (for making coal generation emissions compliant as well as flexible) are carried out simultaneously. The capex to make coal-based generation both emissions compliant (using equipment like Flue-gas desulfurizations) and flexible can be paid off in six years’ time if the cess was to be exempted.

The above scheme for exemption from cess should rather apply only if both modifications (for making coal generation emissions compliant as well as flexible) are carried out simultaneously. The capex to make coal-based generation both emissions compliant (using equipment like Flue-gas desulfurizations) and flexible can be paid off in six years’ time if the cess was to be exempted.

In essence, what is being said above is that India clearly needs more renewable energy and a smart way to integrate this renewable energy will be to leverage the existing coal-based generation by funding capex to make these plants both emissions compliant and capable of flexible operation, in a way that the end consumer does not pay any additional tariff and the entire capex is absorbed by the cess exemption for such plants, going forward.

We hope the policymakers will find such a framework balanced, logical and fair, as being in the best interest of the environment and end consumers, and will accelerate the pace of emissions compliance and balancing support to upcoming renewable energy capacity.