By Khushboo Goyal and Anukriti

As the country moves towards achieving its 100 GW solar capacity target by 2022, the segment is beginning to witness increased capacity additions. The total installed solar power capacity has reached 23 GW as of June 2018, increasing at a compound annual growth rate of 20 per cent from 2013-14 to 2017-18. This rapid development is supported by aggressive competitive bidding and declining equipment prices, which have led to a rapid decline in solar power tariffs. To keep pace with these changes in the solar power segment, the engineering, procurement and construction (EPC) industry is also evolving rapidly.

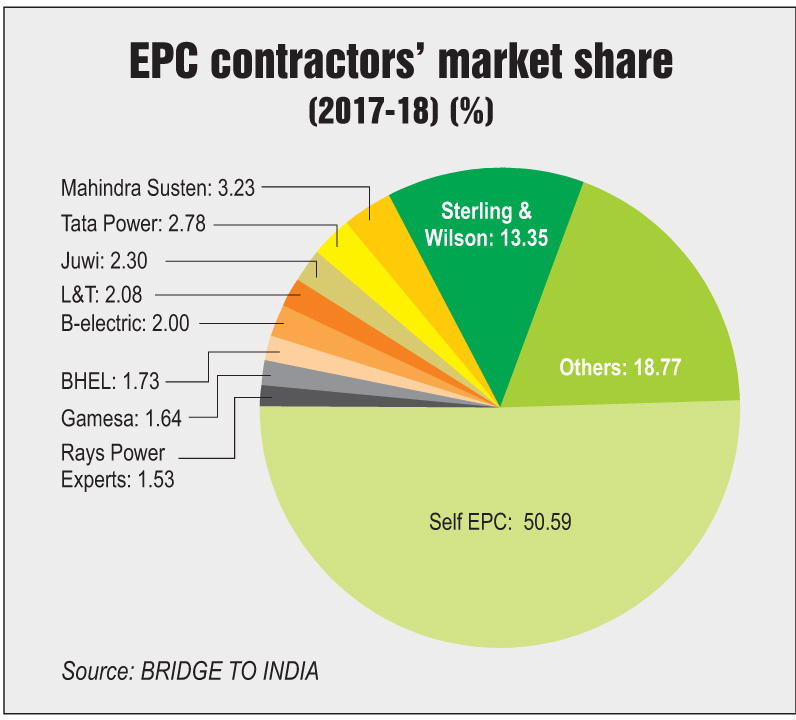

EPC market share

With the decline in solar tariffs, cost optimisation has become a major concern for developers. More and more developers are opting to carry out their own EPC, instead of hiring a contractor to do the same. As per BRIDGE TO INDIA, the share of self EPC installations was about 50.59 per cent in 2017-18, translating into 4,639.61 MW of solar capacity against the total of 9,171 MW installed during the period. Amongst EPC players, Sterling and Wilson has the largest market share of 13.35 per cent, accounting for 1,224.33 MW of installations in 2017-18. It is followed by Mahindra Susten with a market share of 3.23 per cent and Tata Power with 2.78 per cent. Interestingly, the installed capacity of Sterling and Wilson is significantly higher than the combined capacity of the other two players. A similar trend was seen in 2016-17 as well, with the three leading contractors remaining the same. However, due to the volatile nature of the solar EPC market, many contracting firms that held large market shares in 2016-17 are not even present in the top 10 ranking for 2017-18.

Solar EPC involves project design, civil works, procurement and installation of equipment, and construction, commissioning and handover of the project to the end user or owner. However, cost optimisation has broadened the scope of EPC contracts, so that EPC now overlaps with turnkey. Thus, apart from basic EPC services, the contractor is responsible for obtaining approvals and providing operations and maintenance (O&M) services as per the contract.

As per the Central Electricity Regulatory Commission, the cost of solar EPC for a utility-scale solar power project is around 79 per cent of the total project cost. EPC costs have also been declining as a result of the cost-cutting measures being adopted by developers to improve their margins. This decline in EPC prices can also be attributed to the rise in number of players in the market, all offering these services at competitive prices.

Stand-alone EPC firms are suffering due to a shrinking customer base as larger developers are building their own internal EPC capabilities to improve project viability. Therefore, stand-alone EPC firms are diversifying their operations to stay viable. The larger ones are building their own generation capacities to leverage their expertise in project implementation. This is a logical step for solar EPC players as the operational complexity of such projects is much lower than that of other power projects. The smaller EPC firms that do not have the financial capability for project development are focusing on rooftop solar projects and captive projects to sustain themselves.

Like in other mature segments of the power industry, the consolidation trend is a strong feature of the solar industry as well. The segment has witnessed several mergers of late as both developers and contractors try to expand their portfolio in this highly competitive environment. Going forward, EPC companies offering end-to-end expertise (from concept to commissioning) along with O&M services will be profitable ventures. Amongst these, the companies that focus on reducing costs and increasing scale will be able to sustain themselves in the years to come, while others face the inevitable risk of getting acquired by more profitable ventures.