Offshore wind power has emerged as a rapidly developing source of energy across the world, with increasing maturity and a promising future. The year 2017 saw high capacity additions in many countries, low price bids, the removal of subsidies and a rapidly changing technological landscape. The realisation of multi-fold advantages of offshore wind energy over its onshore counterpart has given the segment a major boost.

Current status

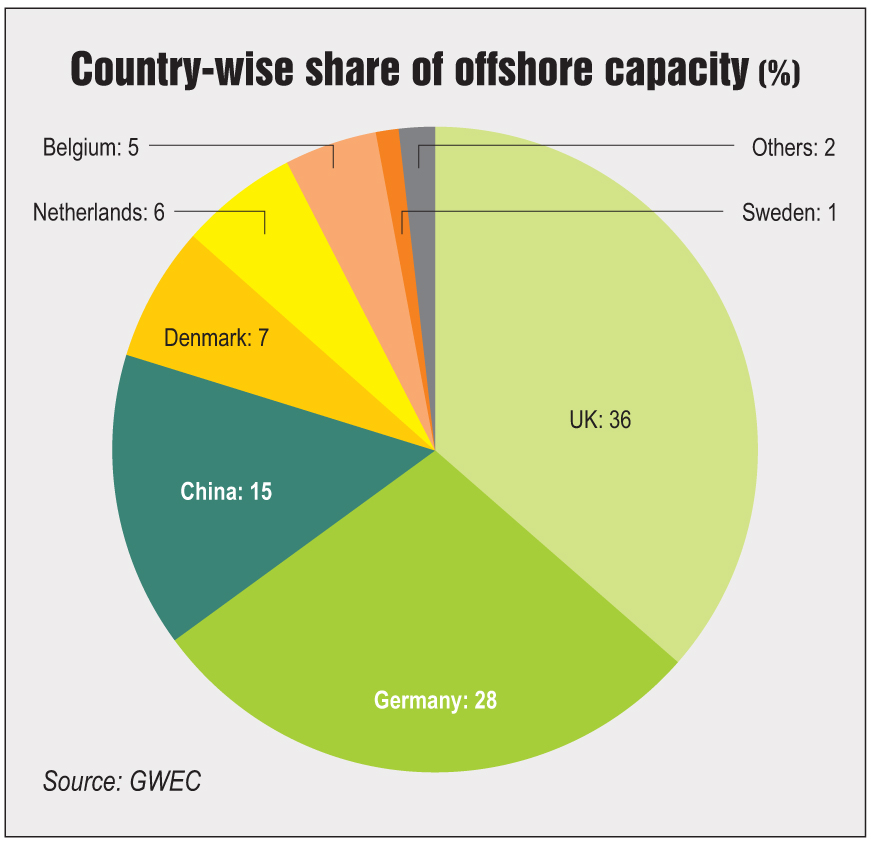

The global offshore wind sector has expanded significantly in the past two years. Having grown by over 357 per cent in the past seven years, the segment experienced pivotal changes in 2017 across the globe. The year saw a capacity addition of around 31 per cent, bringing the global cumulative capacity to nearly 19 GW as of December 2017. The capacity is spread across 17 countries with the UK having the largest installations, accounting for 36 per cent of the total capacity. While European countries dominate this market with 84 per cent share, countries such as China, Vietnam, Japan, South Korea, the US and Taiwan, which account for the remaining 16 per cent, are rapidly increasing their share. It is interesting to note that the global onshore wind power leader, China, was lagging behind in the offshore wind power segment until 2016. However, it took off in 2017 with an increase of 71 per cent in offshore installations, bringing China’s total offshore capacity to 2,788 MW. Another world leader in wind power development, the US is emerging as a significant offshore wind market.

The US is the world’s second largest wind power producer, with 89,077 MW of cumulative (onshore and offshore) installed capacity as of December 2017. Offshore accounts for only 30 MW of this capacity. Abundant low-cost wind resources, falling prices, favourable regulations and land availability have all been responsible for the high wind power capacity in the country. Considering the technological, environmental and land use limits, the technically feasible potential for offshore wind power is estimated to be 2,000 GW. While there was no new capacity installed in 2017, there was active state-level planning to tap the enormous potential and enable development in the sector in the coming years.

As a result, there are 28 projects currently under development with a total capacity of 23,735 MW, and 18 projects with an aggregate capacity of 14,784 MW at the site identification and control stages, primarily in the North Atlantic region. The eastern and north-eastern parts of the country along with northern California and Oregon have the highest quality of offshore wind. Rhode Island, New York, New Jersey and Massachusetts are emerging as hubs for wind power development in the country. The US’ first offshore wind farm, the 30 MW block Island project, is located in Rhode Island. New York has released its Offshore Wind Master Plan that sets an offshore wind power target of 2.4 GW, to be achieved by 2030.

The plan also analyses different factors that affect the state’s ability to achieve its target. In Massachusetts, a law has been created that requires utilities to procure 1.6 GW of offshore wind capacity by 2027. Similarly, in New Jersey, the state government has set a target of 3.5 GW of offshore wind by 2030. Moreover, there is a new lease sale by the US Bureau of Ocean Energy Management for two additional areas off the coast of Massachusetts for commercial wind power development scheduled for September 2018. Besides these, North Carolina has created lighter regulatory processes and established stricter project timelines to ensure streamlined development of the segment.

Offshore transmission systems provide connections between the offshore wind farm and the onshore electricity network. Considering the plans of various states, the US offshore wind segment is expected to require substantial transmission infrastructure. It is estimated that the cumulative 8,000 MW of committed offshore wind development in Massachusetts, New York and New Jersey will require 600-1,200 miles of offshore transmission plus onshore reinforcements. Offshore transmission can be carried out in two ways through transmission lines to individual offshore wind plants, and via offshore grids that integrate power from multiple wind plants. Transmission from individual wind plants is more cost effective for smaller offshore projects with limited wind turbines that are closer (within 30 miles) to the shore. In this case, the process of commissioning individual wind turbines is independent of the accessibility to common transmission infrastructure, and can be developed according to exclusive timelines. On the other hand, for large wind farms that are located far from the shore, transmission through offshore grids is more cost effective. As the offshore grid integrates several individual wind plants, it ensures better coordination with the onshore grid.

The cost of offshore wind power has been consistently declining around the world, which creates further opportunities for the sector. With larger projects and advancements in technology, the sector enjoys the benefit of economies of scale, thereby reducing costs. GE has recently launched the Haliade turbine series for the offshore wind segment with a capacity of 12 MW. Such technological advancements are likely to reduce the investments required for offshore wind power development, thus increasing the offtake of power and improving the risk profile of the segment. In a nascent market such as the US, the cost of generating offshore wind power is higher relative to the mature markets of European nations. In Germany, 1,610 MW of capacity was recently auctioned at $55 per MWh. The cost for similar capacity will be much higher in the US, where prices are expected to remain high at around $100 per MWh in the short term. Prices are expected to decline as the benefits of reducing costs start showing.

Global scenario and the way forward

There has been a stream of investments pouring into the offshore segment in all major renewable energy-focused countries in the world. This has helped not only in boosting investor confidence but also in making offshore wind a potential mainstream source of energy. According to the Global Wind Energy Council, offshore wind had its first subsidy-free bids for offshore projects in 2017 in Germany and an entire subsidy-free tender in the Netherlands, with winners of new offshore capacity receiving no more than the wholesale price of electricity. As the industry matures, technological advancements and growing investor confidence will help reduce the capital costs of offshore projects. Projects to be completed in the next five years are estimated to cost half of what projects installed in the past five years did. Interestingly, definitive roadmaps for offshore wind power development are emerging across the world. Despite its low installed capacity, the US is making persistent efforts to tap its enormous offshore wind power potential. Meanwhile, China’s offshore segment has grown significantly, making it the world’s third largest producer after the UK and Germany. At this pace, China’s national target of 5 GW of offshore wind power to be achieved by 2020 might be realised well ahead of time. Among the newcomers in this space are India, Australia, Brazil and Turkey. In India, the nodal agency for offshore wind energy invited expressions of interest for the development of the country’s first commercial offshore wind energy project of 1,000 MW in April 2018. Australia, Brazil and Turkey too have initiated the process of developing their offshore wind power potential. With global opportunities being increasingly tapped, offshore wind power provides a promising alternative to conventional sources of energy, and also enhances competition amongst onshore renewable energy sources.