According to the International Energy Agency, India’s transport sector accounts for about 12 per cent of the country’s energy-related carbon dioxide emissions, while 92 per cent of these emissions are from road transport. As the country works towards its net zero emissions target by 2070, decarbonising road transport has emerged as a key priority. Electric mobility will play a important role in this transition, with the shift to electric vehicles (EVs) seen as crucial to reducing dependence on imported fuel, cutting greenhouse gas emissions and improving air quality. As per NITI Aayog, India aims to achieve a 30 per cent share of EVs in the total vehicle sales by 2030, up from just 7.6 per cent in 2024. However, achieving this target will require a significant ramp-up in EV adoption over the next few years, supported by a robust and accessible charging network. There has been a strong policy push via the government through targeted interventions, financial incentives and mission-driven programmes to accelerate EV adoption. The availability, distribution and utilisation of charging infrastructure remain key enablers of future EV growth. Developing a well-distributed, scalable and technologically advanced EV charging infrastructure will be essential for accelerating adoption and ensuring that the transition to electric mobility keeps pace with India’s climate and energy goals.

This article provides an overview of the policy initiatives, current scenario, challenges and the way forward for the EV charging infrastructure sector….

Policy initiatives

India’s electric mobility landscape has been undergoing a rapid policy evolution, with the government introducing a series of schemes and guidelines to accelerate EV adoption, support domestic manufacturing, and strengthen charging and battery-swapping infrastructure. Over the past two years, key initiatives by the Ministry of Heavy Industries (MHI) and the Ministry of Power (MoP) have sought to provide demand incentives, enable a connected charging ecosystem and address industry concerns over policy continuity and localisation. The following section outlines major developments shaping India’s EV policy framework from 2024 to 2025.

In March 2024, MHI launched the Electric Mobility Promotion Scheme (EMPS) 2024 to accelerate green mobility and strengthen the domestic EV manufacturing ecosystem.

In September 2024, the MoP issued the Guidelines for Installation and Operation of Electric Vehicle Charging Infrastructure 2024, setting standards for a connected and interoperable charging network across public, semi-public and private stations. These guidelines allow public charging stations on public land at subsidised rates under revenue-sharing models and introduce a single-part tariff, with reduced rates during solar hours.

At the same time, MHI unveiled the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-Drive) scheme with an outlay of Rs 109 billion, replacing the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) programme and subsuming EMPS 2024. The PM E-Drive scheme, initially effective from October 1, 2024 to March 31, 2026 and later extended till March 31, 2028, offers demand incentives for electric two-wheelers (e-2W), three-wheelers (e-3W), trucks and ambulances, along with grants for electric buses, setting up of EV public charging stations and upgradation of testing agencies.

Meanwhile, the FAME-II scheme was implemented from April 1, 2019 to March 31, 2024, after which MHI launched EMPS 2024, with an outlay of Rs 7.78 billion for six months from April 1, 2024 to September 30, 2024 to ensure continuity in incentives for e-2W and e-3W. State governments are expected to complement PM E-Drive through tax exemptions, reduced parking fees and registration waivers.

To increase the adoption of battery swapping as an alternative to traditional EV charging and encourage battery-as-a-service models, the MoP issued final guidelines for the installation and operation of battery swapping and charging stations in January 2025. These apply to all entities providing such services, including owners and operators of battery charging stations and battery swapping stations, allowing them to use existing electricity connections and enabling the use of liquid-cooled swappable batteries for larger vehicles. The guidelines focus on safety, extend existing EV infrastructure provisions to swapping facilities, and include measures such as subsidised public land, regulated tariffs and network planning to cut downtime and improve convenience for EV owners.

In August 2025, MHI announced a major amendment to the PM E-Drive scheme, extending its duration until March 31, 2028. This extension came amidst industry concerns over the scheme’s impending expiry and its localisation requirements under the Phased Manufacturing Programme. By providing nearly two additional years of policy continuity, the move is expected to boost investors’ confidence, enable long-term planning for manufacturing and supply chains and maintain the EV adoption momentum.

Current scenario

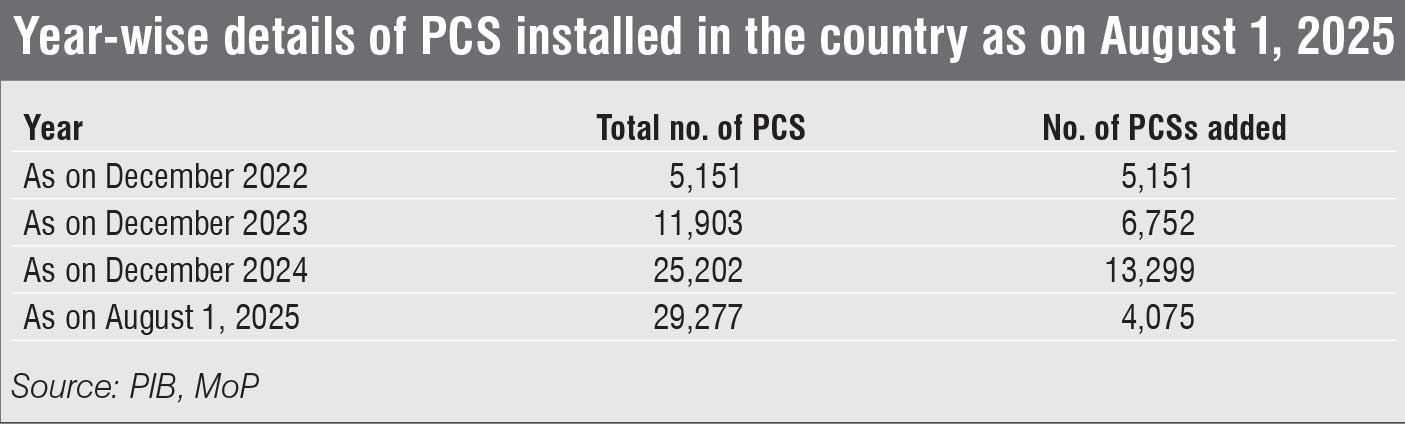

India’s public charging station (PCS) network has expanded at an exceptional pace in recent years, driven by strong policy initiatives and rising EV adoption. As per the MoP data, the total number of PCSs grew from 5,151 in December 2022 to 11,903 in December 2023, recording a year-on-year growth of about 131 per cent. Installations more than doubled again in the following year, reaching 25,202 by December 2024, an increase of nearly 112 per cent. The upward trend has continued in 2025, with the count rising to 29,277 by August 1, 2025, representing a further 16 per cent growth in just eight months.

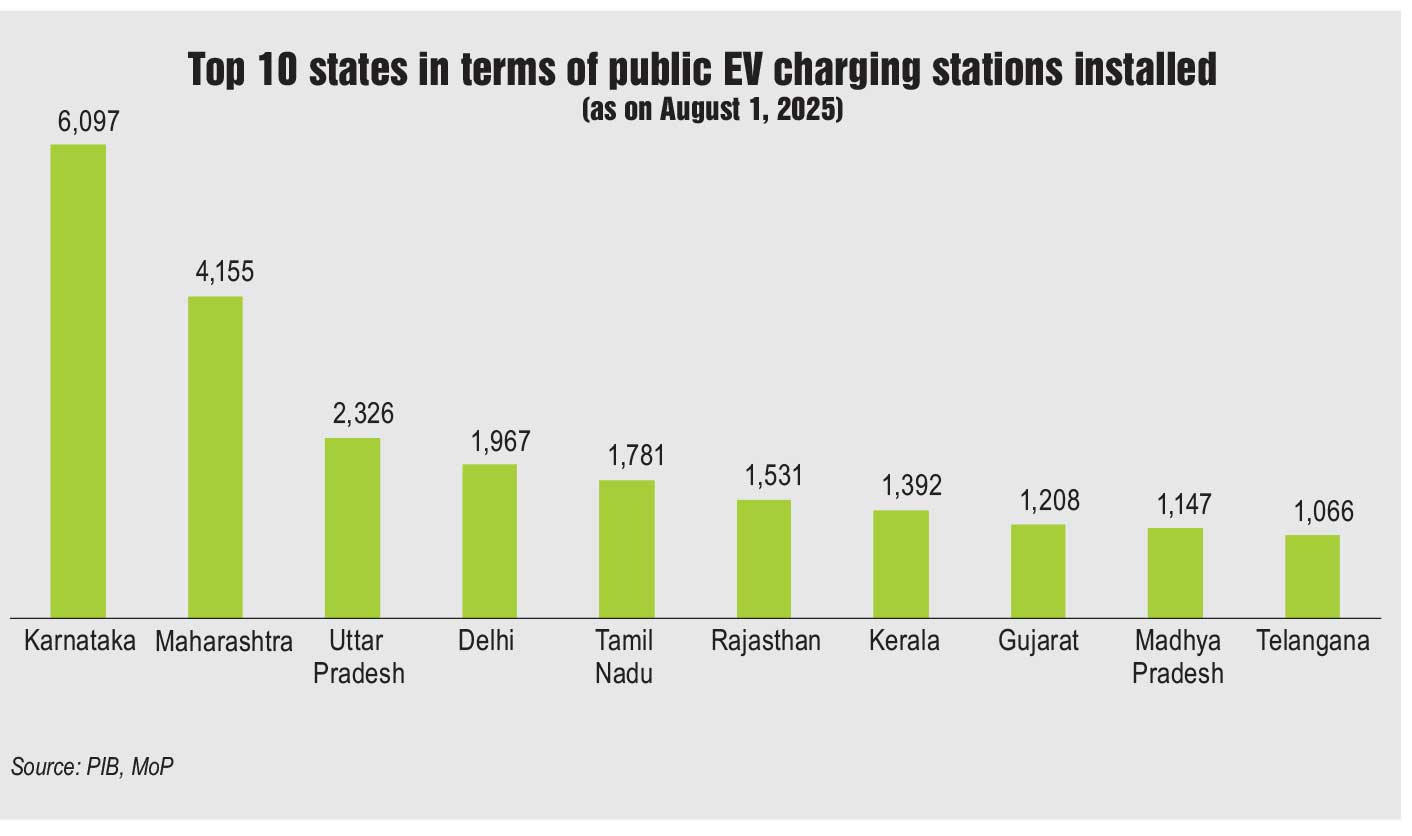

As of August 2025, Karnataka leads with 6,097 PCSs in the country, followed by Maharashtra with 4,155, Uttar Pradesh with 2,326, Delhi with 1,967 and Tamil Nadu with 1,781. These states together account for nearly 56 per cent of India’s total PCS network. The PM E-Drive scheme is expected to further accelerate this growth, with plans to install 22,100 fast chargers for four-wheelers, 1,800 for buses and heavy commercial vehicles, and 48,400 for e-2W and e-3W. These installations will be strategically located in cities with high EV penetration and along priority highways. The scheme allocates Rs 20 billion for charging infrastructure, signalling the government’s intent to create a dense and reliable national charging network to support India’s EV transition.

Challenges and the way forward

Despite the growth in EV sales in recent years, several challenges continue to hinder the pace of adoption in India. EV sales increased from 50,000 units in 2016 to 2.08 million in 2024, yet penetration in 2024 stood at only 7.6 per cent of the total vehicle sales, far short of the 30 per cent target set for 2030. The lack of required charging infrastructure is a key bottleneck for this slow uptake. While public chargers are being installed, their coverage is still inadequate, and many of the existing ones are underutilised. Poor location planning, lack of standardisation and limited user awareness contribute to this gap.

Further, rapid growth in EV charging can also strain local power grids, especially if many vehicles charge at the same time. Without proper load management and smart charging, this could lead to peak demand spikes and affect power reliability. Moreover, setting up charging stations is expensive. The costs include land, equipment, grid upgrades and other supporting infrastructure. In crowded cities, finding suitable space for chargers is difficult and expensive. Landownership issues and reluctance from property managers add to the challenge. High electricity tariffs in some states make it harder for charging station operators to remain profitable. The lack of reliable market data and proven business models further discourages investment, as high upfront costs and uncertain returns make financiers cautious.

A fundamental yet often overlooked challenge is the lack of data transparency in the EV charging ecosystem. Non-availability of data around charger availability, operational status and wait times discourages users from relying on public charging networks. Without reliable and easily accessible information, user trust remains fragile.

Addressing these challenges requires a multi-pronged approach. Strengthening charging infrastructure through better distribution planning, interoperability standards, integration with renewable energy sources and open data-sharing mechanisms will be critical to improving utilisation and user confidence. Going forward, public awareness campaigns and capacity-building initiatives for fleet operators, financiers and state agencies can help bridge information gaps. Importantly, developing robust data systems, closing regulatory gaps, and embedding transparent governance will enable targeted interventions and long-term policy consistency.