By Preeti Wadhwa

India’s wind energy sector is aiming to meet the ambitious target of setting up 140 GW of wind capacity by 2030 and progress towards its 2070 net zero goal. To achieve this, roughly over 15 GW of wind capacity will need to be installed each year. However, the country faces several obstacles in setting up projects, which are being addressed with the government’s policy push and the technology advancements from the private sector. Renewable Watch provides an overview of the wind power sector in India, encompassing current installations, tariff trends, recent policy initiatives and the way forward…

Current status of installations

Current status of installations

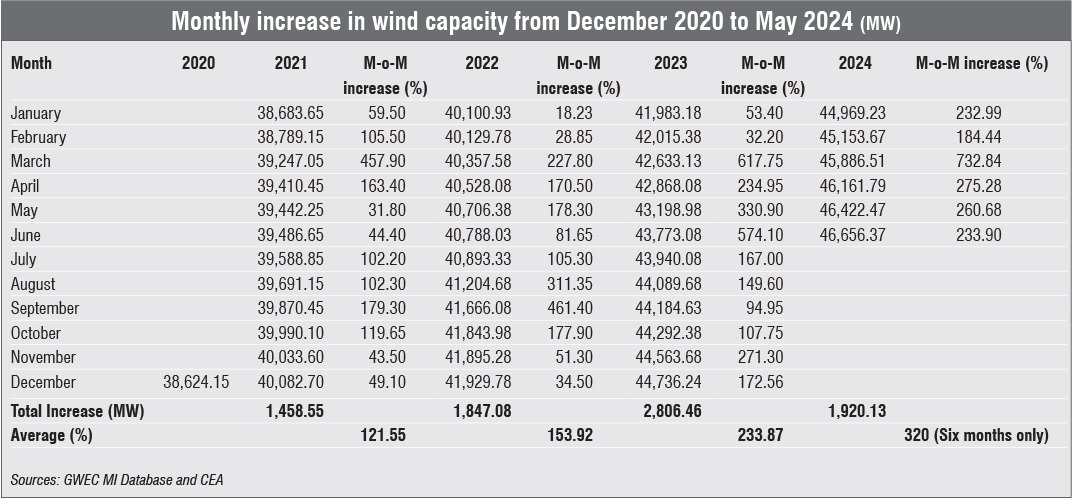

As of July 2024, the total wind power capacity in India stood at 47,075.43 MW comprising 23.8 per cent of the total renewable energy capacity (excluding large hydro). The wind segment experienced a notable uptick in capacity addition during FY24, with 3.3 GW of new installations. This growth was primarily driven by the commissioning of projects awarded by the Solar Energy Corporation of India (SECI) under Tranches VIII, IX and X, as well as the wind component in hybrid and round-the-clock (RTC) projects. According to JMK Research and Analytics, during January-June 2024, about 1,920 MW of wind capacity was installed in the country, with Karnataka leading in wind installations, adding 158 MW of capacity in June 2024. As per the Council on Energy, Environment and Water, in the first quarter of FY25, India added 770 MW of wind energy capacity, a decrease from the 1,140 MW added in the first quarter of FY24.

The sector has suffered due to slow commissioning rates compared to the capacity awarded. Several factors have contributed to the sluggish pace. Land acquisition issues remain a significant hurdle, with developers struggling to secure suitable sites with high wind potential. Transmission connectivity problems have also affected many projects, delaying their integration into the grid. Furthermore, the sector faces the challenge of low investor confidence due to unviable tariffs being bid in e-reverse auctions. The issue may be mitigated with the transition to a closed bidding process.

To keep pace with the annual wind capacity addition needed to achieve the 2030 goals (over 15 GW per annum till 2030), the sector is witnessing a shift from setting up stand-alone wind projects to hybrid and RTC projects. These innovative project structures offer several advantages over stand-alone wind or solar installations. Hybrid projects allow for more efficient utilisation of common infrastructure, potentially improving project economics. RTC projects, which combine wind, solar and energy storage, address the intermittency issues associated with renewable energy, making them more attractive to grid operators and power purchasers. Additionally, the expected decline in energy storage costs, particularly for battery systems, could be a game changer for the wind sector. As storage becomes more affordable, it will enhance the ability of wind projects to provide firm, despatchable power, opening up new revenue streams and improving the overall project viability.

According to ICRA Limited, tariffs for hybrid and RTC projects range between Rs 3 and Rs 4.7 per unit, depending on the specific requirements of the tender. This competitiveness, combined with the ability to provide more stable power output, positions these projects as a promising avenue for future growth in the renewable energy sector. Meanwhile, stand-alone wind energy tariffs have also yielded tariffs above Rs 3 per unit. The most recent stand-alone wind auction for SECI’s 1,350 MW interstate transmission system (ISTS connected wind tender (Tranche XVI) conducted in July 2024 resulted in the lowest bid of Rs 3.60 per unit. According to Girish Kumar Kadam, senior vice-president, ICRA, this upward pressure on tariffs can be attributed to the increasing risks associated with securing high-potential sites and the challenges in sourcing wind turbines from original equipment manufacturers at viable costs.

Policy initiatives

Policy initiatives

India has taken proactive steps in policymaking to boost the wind energy sector. Key initiatives include setting a 10 GW target for annual onshore wind bids from 2023 to 2027, revising bidding regulations, waiving ISTS charges until June 2025 and implementing wind-specific renewable purchase obligations from 2023 to 2030. Other indirect measures involve announcing tenders for firm and despatchable renewable power, ensuring timely payment disbursements by discoms and planning transmission capacity for both onshore and offshore wind capacity in advance. Additionally, the updated National Repowering and Life Extension Policy for Wind Power Projects, 2023 aims to encourage the replacement of older wind turbines with more efficient ones at high wind sites where low capacity wind turbines were previously installed.

For the offshore wind segment, the revised strategy paper for offshore wind energy projects has been released, which outlines three models for allocating 37 GW of capacity by 2030. In addition, in February 2024, SECI announced the leasing of an offshore wind seabed with a 4 GW capacity in Tamil Nadu. Offshore wind lease guidelines have also been issued, along with an ISTS waiver until 2032 and viability gap funding for the first 1 GW of offshore wind capacity.

The way forward

India’s wind energy sector is at a crossroads, witnessing both significant challenges and promising opportunities. The opportunities are driven by the technological advancements in the sector, particularly in turbine design and efficiency. Larger rotor diameters, taller towers and more sophisticated control systems are enabling wind farms to generate more electricity from lower wind speeds, expanding the range of viable project sites. While these advancements often have higher upfront costs, they can significantly improve project economics over the long term. While execution delays, rising tariffs and financing concerns present immediate hurdles, the sector’s long-term prospects remain strong. The combination of supportive government policies and innovative projects such as hybrids and RTC provides a pathway to overcome the current obstacles of slow capacity additions.

Going forward, to fully realise its potential, the wind sector will need to address land acquisition and transmission connectivity issues more effectively. Streamlining approval processes, improving wind resource assessment techniques and fostering a more competitive turbine manufacturing ecosystem will be crucial. The sector’s future cost trends will depend on how effectively these challenges are addressed and how new technologies, particularly in energy storage, are integrated with the wind sector. Additionally, continued focus on reducing costs will be essential to maintain the sector’s competitiveness. It will be interesting to see how the sector shapes its trajectory in the coming years as it faces a complex landscape of opportunities and obstacles.