Solar photovoltaic (PV) glass is among the most critical components of solar power plants, as the glass and its backsheets act as the first point of contact with solar irradiation. The glass sheet protects solar cells from damage and transmits the incoming irradiation to them. Therefore, selecting the right solar panel with high quality glass is critical to avoid generation losses in the future. Solar glass

sheets can become cloudy over time if they are of low quality, which impacts the level of solar irradiation. Further, they become more prone to defects such as cracks, which can cause water seepage and increase fire hazard risks in the panel.

Tempered glass, which is a toughened glass sheet with up to six times the strength of a normal plate glass, is increasingly being used to tackle these issues. Meanwhile, typical glass sheets used in making solar panels have a high reflective index. So, an anti-reflective coating is often added to the glass before it is tempered to reduce the amount of reflected light. Another emerging trend in the solar PV glass space is the use of glass-glass panels, which has gained traction with the launch of bifacial modules. These panels have glass sheets in both the front and rear ends. Thus, they are different from the typical backsheet-based solar panels, allowing better transparency on both ends of the panel and generating more energy.

Demand and supply

The demand for solar PV glass has gone up in recent times with the increasing deployment of bifacial panels that use glass to coat both the top and bottom of the module. Further, there is a growing preference for larger panels that require more glass. These two factors have increased the demand for solar glass to a large extent. In fact, there has been a visible shortage in solar glass availability for module manufacturers in China, which is the world’s largest producer of solar raw material, including solar cells, glass, backsheets, frames and junction boxes. The Covid-19 pandemic and consequent lockdown shut down glass factories in China in the early part of 2020. While they reopened later, paucity in glass availability continued as the entire domestic solar industry rushed to make up for the lost time and install projects quickly. This shortage in supply raised glass prices significantly, which is expected to continue into 2021 as well, according to industry experts, and the shortage will continue until the planned glass factories come online to meet the rising demand.

Meanwhile, large solar markets around the globe, including India, which depend on China for not only glass but modules as well, have also been impacted by module scarcity and upward pressure on pricing. The bottleneck in effective glass processing capacity has increased the average landed price of modules imported to India. Solar power projects that had delayed the procurement of modules due to the Covid-19 pandemic and then trade restrictions with China would have been affected by this the increase in prices. Since modules make up roughly 50 per cent of the cost of a solar project, this means a significant impact on the overall cost economics. Meanwhile, domestic module manufacturers that import solar PV glass have been impacted by the supply shortage as well as jacked up prices.

Promoting domestic manufacturing

The Indian solar glass manufacturing industry is small and insufficient to deal with the demand. Thus, there is a need to scale up and align it with the massive capacity additions expected in the near future. To encourage local manufacturing and incentivise domestic manufacturers, the government has imposed various duties on glass imports to create a level playing field with foreign manufacturers. For instance, in December 2020, the Directorate General of Trade Remedies, Ministry of Commerce and Industry, imposed a countervailing duty of 9.71 per cent of the cost, insurance and freight value on textured and tempered glass imports from Malaysia. This duty is applicable for a period of five years. This textured glass (coated or uncoated) has a minimum of 90.5 per cent transmission and a thickness not exceeding 4.2 mm. Further, a countervailing duty of 10.14 per cent exists for such glass from any other country. Moreover, media reports indicate that a countervailing duty may also be imposed on clear float glass imports from Malaysia.

Similar duties are already in place on tempered glass imported from China by way of antidumping duties of $64.04-$136.21 per million tonne. The duty range is 11-26 per cent. In August 2017, the Government of India imposed a five-year anti-dumping duty on textured and tempered glass imported from China and used in solar PV and thermal applications. A similar safeguard duty has also been imposed on solar cell and module imports.

India’s solar PV glass manufacturing industry has bright prospects on account of the huge demand expected for these critical components, once the local manufacturing of solar cells and modules gains traction. In fact, a leading Indian manufacturer of solar glass used in PV panels, Borosil Renewables Limited has recently raised Rs 2 billion from Convergent Finance LLP and other investors as a qualified institutional placement of equity shares. Borosil manufactures low iron solar glass for application in PV panels, flat plate collectors and greenhouses. It caters to large solar panel manufacturers in India and abroad with its 450 tonne per day (tpd) production capacity. This new investment will help the company in expand its production lines to manufacture another 500 tpd.

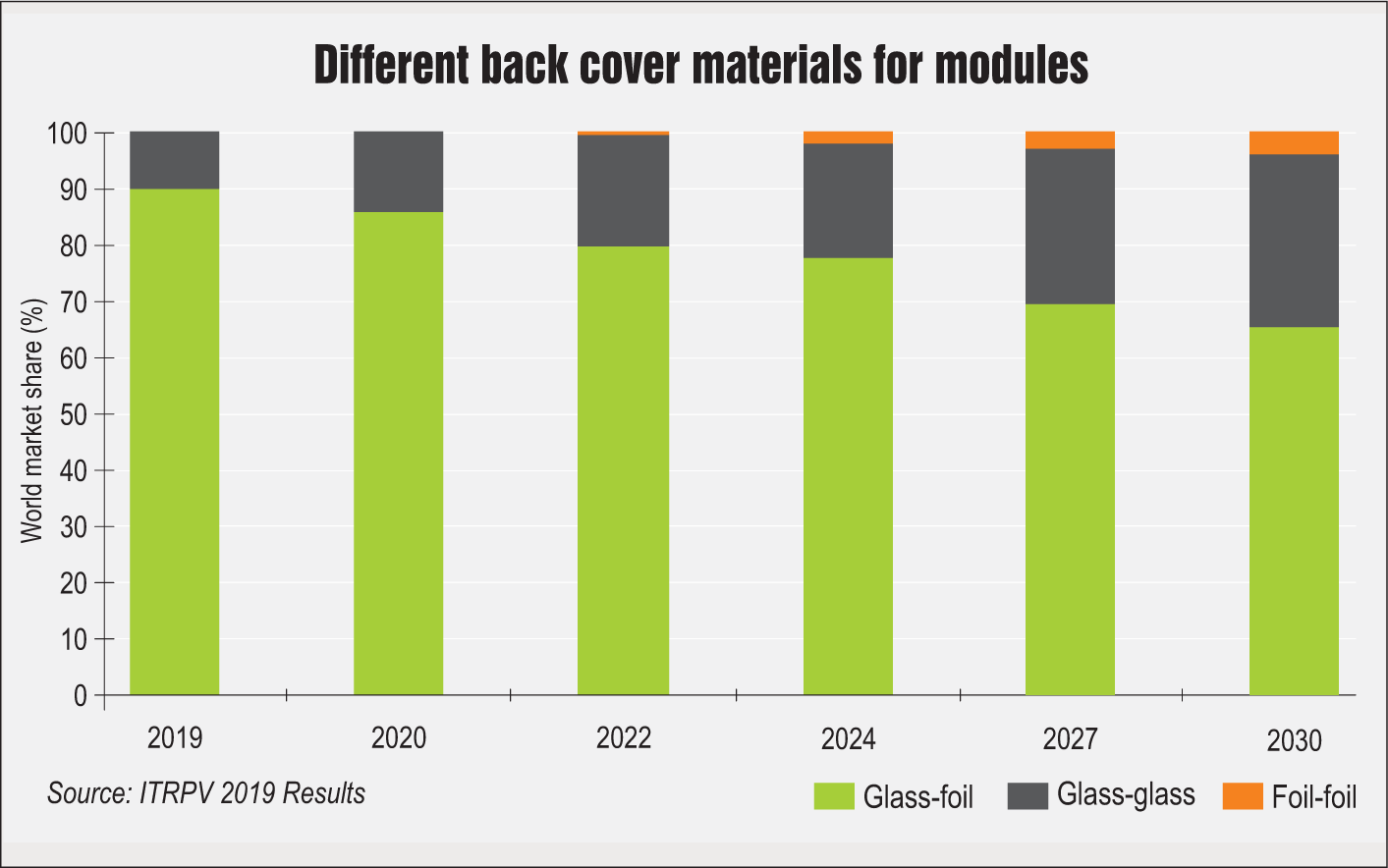

Solar glass is an important contributor to module costs and the front glass is especially critical as it determines the module weight as well. To improve cost efficiencies, an important trend in this space has been to reduce the thickness of the front glass. The International Technology Roadmap for Photovoltaic 2019 Results expects a thickness below 2 mm to appear in the market from 2022 onwards. Further, anti-reflective coating is projected to remain the dominant front glass cover material to improve the transmission of light. Moreover, front glass efficiencies will continuously improve over the years so that they are able to transmit more than 95 per cent of the light by the end of the decade. Meanwhile, for the back side of the module, foil is expected to remain a major back cover material in the near future as well. However, with the growing popularity of bifacial modules, glass is projected to gain greater market share in the future.

With similar trends expected in India as well, domestic capabilities for PV glass production have to improve both in scale and efficiency. Imported glass and even solar modules are exposed to risks of supply shortage and high fluctuations in prices depending on the market and policy conditions of the country of origin. Further, the subject of imports is also surrounded by uncertainty regarding applicable customs duty and taxes that keep changing frequently. Thus, overall, as the country marches towards installing 300 GW of solar power by 2030, it would do well to scale up its glass production facilities early on in order to meet the expected high demand for efficient solar PV glass.

By Khushboo Goyal