The Indian renewable energy sector has witnessed a large influx of investments. The interest to invest in the sector has continued despite the pandemic and the global economic slowdown. The other parameters that have impacted, either positively or negatively, the investment trends in India include payment risks from discoms, curtailment of power, falling cost of technologies, innovative tender designing, introduction of more efficient technology, the cost of debt and the entry of foreign capital. All these parameters change the expectations of lenders and investors regarding the financial performance of renewable energy projects. To assess this, the International Energy Agency (IEA) and the Council of Energy, Environment and Water (CEEW) launched a report in November 2020, titled “Clean Energy Investment Trends 2020: Mapping Project-Level Financial Performance Expectations in India”.

According to the report, investments in India’s renewable energy sector have increased gradually in recent years, reaching almost $18 billion in 2019, surpassing the capital expenditure of the thermal power sector for the fourth consecutive year. The report draws insights from a database of utility-scale solar PV and wind power projects sanctioned between 2014 and the first half of 2020. The database indicates that 15.7 GW of solar PV capacity (including 1.4 GW of solar-wind hybrid capacity) was sanctioned in 2019. In the first half of 2020, 15.3 GW of solar PV capacity (including 1.6 GW of solar-wind hybrid and 8 GW of manufacturing-linked solar tender) was sanctioned.

Renewable Watch provides the key highlights of the report including the project-level terms of debt, interest rates, and the expected and realised equity internal rate of return (EIRR)…

Project-level terms of debt

Solar PV and wind projects are capital intensive and largely financed through debt. According to the report, on a capacity-weighted average basis, 74 per cent of solar PV capital costs were financed using debt in the first half of 2020. Meanwhile, 73 per cent of the capital costs of wind projects were financed through debt in 2019.

The report highlights that an expansive monetary policy and liquidity support for non-banking financial companies in view of the pandemic has had a moderating effect on benchmark rates, which could persist at these levels in the near term. Further, supportive policies and a maturing industry have helped reduce risk perceptions and improve the debt financing terms for solar PV and wind projects in India, enabling renewable investments at lower costs. In addition, the availability of long-term debt has been crucial in supporting higher levels of investments in the sector.

The report also lists the four key characteristics of most loans extended to the renewable energy industry. One, long-term debt is available for most for greenfield renewable energy projects. Two, loan tenors typically include a moratorium period of up to one year from the scheduled commissioning date of the project. The interest accrues over this period, but loan repayment commences only after the expiry of the one-year grace period. Three, the loans require sponsors to establish debt service reserve account provisions for up to six months of debt repayment. Four, a minimum debt service coverage ratio of 1.1 is expected.

The report highlights the varying rates of interest in the sector due to the differing risk perceptions of lenders. The interest rates provided to the central government offtakers such as the Solar Energy Corporation of India, NTPC Limited and Gujarat discoms were up to 50 basis points lower than discoms in other states, as per the methodology used in the report. Thus, these offtakers are perceived to be more creditworthy. The lenders have extended loans to projects located in states where the discoms’ financial and operational performance has been poor. However, for such projects, higher interest rates were expected.

In addition, interest rates were slightly

more competitive for projects located in solar parks vis-à-vis those located on land acquired or leased by developers. This has been linked to lower land and evacuation infrastructure risks.

Project-level expected equity returns

Project-level expected equity returns

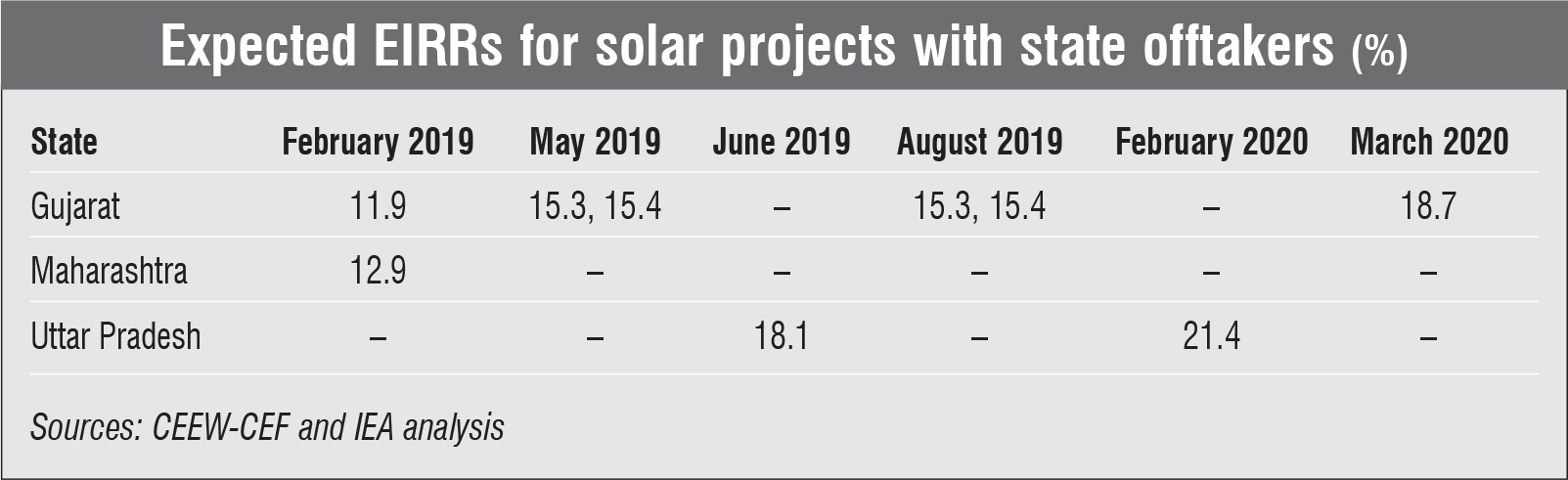

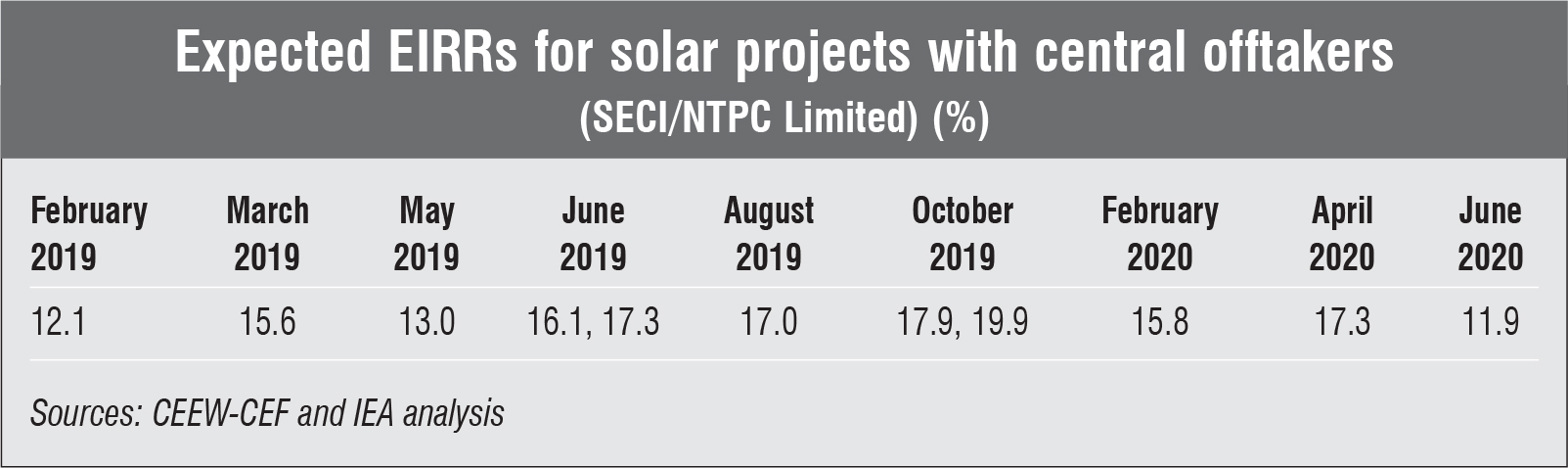

According to the report, equity financing accounts for around a quarter of the project costs of utility-scale solar PV and wind projects in India. The higher risk profile of equity financing increases the return expectations of shareholders. On the one hand, healthy equity returns are a strong signal for developers and investors to commit capital. On the other, perceived risks and barriers can increase return expectations and, in turn, financing costs, thereby limiting the pace of investments. The report also aims to study the variations in the EIRR according to the offtaker, project location and type of site, and policy developments for select projects (tenders). The EIRR is the internal rate of return for providers of equity capital at the project level. It is calculated through a discounted cash flow analysis of the net payments to debt holders. In this report, the post-tax EIRR was calculated.

According to the report, the expected EIRR of solar projects was 15.2 per cent in 2019 and 15.3 per cent in 2020 (estimated on a capacity-weighted average basis). These numbers are around 1.4 times lower than the cost of debt financing (10.5-11.2 per cent) during the period. All else being equal, the tenders that faced less competition were associated with higher EIRRs while those that faced greater competition were associated with lower EIRRs.

The report specifies five key developments that may have contributed to the increased risk perception in the renewable energy industry. One, the Andhra Pradesh government announced its plans to renegotiate renewable tariffs for already contracted renewable capacity in mid-2019. Two, the Indian government was planning to levy a basic customs duty on solar PV imports (the customs duty has now been imposed). Three, the safeguard duty has been extended by one more year (till July 2021). Four, there have been delays in the signing of power purchase agreements for tenders awarded in 2020 (due to SECI’s inability to sign power sale agreements with discoms). Five, there have been growing uncertainties regarding the sourcing of solar modules and other solar equipment amidst the pandemic.

Overall, projects with central and Gujarat discoms as offtakers had the lowest EIRRs, and less creditworthy states were associated with higher EIRR expectations. Moreover, according to the report’s methodology, projects to be installed in solar parks had lower EIRR expectations, due to limited land acquisition and transmission risks associated with them.

The report also calculated the actual realised EIRR. The realised EIRR depends on the offtaker risk (impact of payment delays), volume risk (curtailment, low electricity demand, underperformance of technology, faulty operations and maintenance, meteorological variations), and capex assumptions.

The impact of payment delays on the realised EIRR depends on two factors – the average delay in payments (number of months of receivables for developers) and the number of years for which the delay persists over the life of the contract. An average three-month delay over five years lowers the realised EIRR by 80 basis points as compared to the expected EIRR. In fact, a 12-month delay over the duration of the contract could lower the EIRR by around 500 basis points.

Meanwhile, the realised EIRR for solar PV projects is impacted by around 70 basis points for every 2.5 per cent of total production lost in the first five years. The realised EIRR will decline by around 160 basis points if the same level of production loss persists through the lifetime of the project.

As for capex assumptions, every 1 per cent reduction in the realised capex increases the realised EIRR by around 60 basis points for solar projects and 50 basis points for wind projects.

Outlook

The challenges with land acquisition and changes in land policies for renewable energy projects in Gujarat have already impacted investor confidence in the past. Going forward, the growing land-related constraints will have a greater impact on expectations on the financial performance of renewable energy assets. This will be a key trend to follow in the coming years.