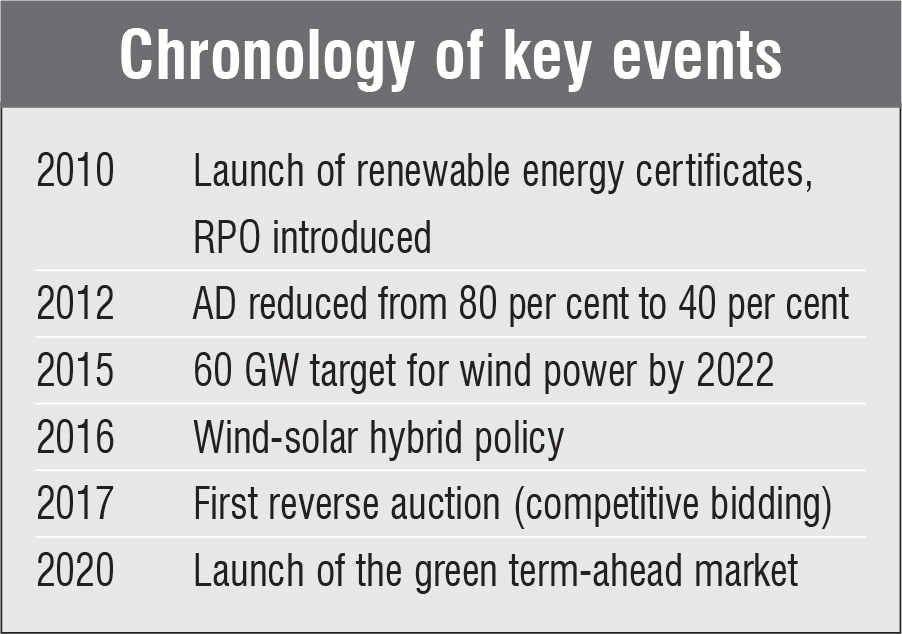

The past decade witnessed both positive and negative changes that impacted the wind power segment. The period saw a capacity addition of 26 GW with a high of 3,200 MW during 2011-12 and 5,000 MW during 2016-17. This was possible primarily due to the schemes of accelerated depreciation (AD) and generation-based incentive (GBI), both of which were withdrawn in 2017.

The evolution

The beginning of 2009 witnessed the entry of independent power producers (IPPs) with large appetites funded by overseas multilateral development banks and financial institutions, which supported investments in the renewable energy sector through debt and equity funding. Gauging the wind power market sentiment, the Ministry of New and Renewable Energy (MNRE) brought in GBI at Re 0.50 per unit with a ceiling of Rs 10 million per MW, as IPPs did not require AD. During this period, the wind market continued to grow majorly for captive consumers, group captive sale and to some extent sale to distribution companies.

A significant development at that time was the emergence of more efficient technology and entry of new players offering MW-size wind turbines. These included turbines with hub heights of over 130 metres, larger rotor diameters and turbine capacities reaching 3 MW. The MW-size turbines with the latest technology demonstrated high plant load factors (PLFs) even at low and medium wind sites. There was all-inclusive growth in seven wind-rich states and even a land locked state such as Madhya Pradesh was able to install 1,000 MW, while Andhra Pradesh became a wind investment destination with 2,000 MW capacity addition during 2016-17.

The government decided to introduce competitive bidding to ensure transparent discovery of tariff. Although the decision was good, it was not done in a phased manner. This left wind turbine manufacturers with big inventories and IPPs having to depend only on centralised power procurement. IPPs had no choice but to chase a small market with unviable tariffs. Since 2017, average capacity addition in the country has been around 1,700 MW per annum. The capacity tendered by SECI (Tranche I to Tranche IX) is 13,900 MW, awarded capacity is 10,300 MW while actual capacity commissioned is only 2,400 MW. The falling tariffs and aggressive bidding led to project development only in Gujarat and Tamil Nadu. The reluctance of the Gujarat government to give land for interstate sale further added to these woes. This may have been a prudent decision, but it led to severe delays in project execution. Moreover, both bidders and original equipment manufacturers were adversely impacted. Later, the MNRE, through SECI, rolled out a number of schemes on wind-solar hybrid, peak power, and round-the-clock power to improve capacity addition. After 2017, state procurement was not encouraged and, in fact, states curtailed policies on wheeling and banking. It is unfortunate that in some states there have been cases of severe curtailment of wind power and issues of payment delays. Since the bid size of states is 25 MW and that of central procurement is 50 MW, the retail segment will be eliminated. The retail segment had actually helped to build the first 20 GW of the wind power capacity.

The way forward

The government has set a target of 60 GW by 2022 and 140 GW by 2030 for the wind power segment. The manufacturing capability of the wind industry is over 10 GW per annum which can be ramped up. Several investors are interested in entering the Indian market, on the back of which the targets can be reached realistically. A bankable and viable national tariff, stable policy for the next five years and enabling wind states to participate in this national programme will give a major boost to the segment. Meanwhile, the falling power demand due to the pandemic has to be corrected with novel demand creation methods. The solution lies in strict enforcement of renewable purchase obligations and penalties for non-compliance. An investor-friendly policy for repowering will increase PLFs.

Our country is a signatory to the Paris Accord and the development of renewable energy is key to achieving the commitments. To this end, the wind power segment has a big role to play going forward, given that its environmental benefits, can outweigh the arithmetic of tariff, and the level of domestic manufacturing to achieve Atmanirbhar Bharat is already at 80 per cent.

By D.V. Giri, Secretary General, Indian Wind Turbine Manufacturers Association

(The views expressed in this article are the personal views of the author.)