With energy security becoming a priority for all economies, investments in the energy sector have largely remained stable. This is especially true for large utilities, as most countries have regulatory frameworks that ensure low risks for these utilities and safeguard their investments. However, the past few years have seen a major change in this trend due to fuel price uncertainty, massive renewable energy deployments, increasing energy efficiency and the integration of energy storage technologies.

A report titled “Energy Investments in an Uncertain World”, published by KPMG in India in December 2018, explores the various reasons for the increasing uncertainty in energy investments. It analyses the key difficulties being faced by investors, utilities, developers and contractors, based on insights from international experiences. The report, moreover, recommends key action areas for preventing such disruptions and uncertainties in the energy sector. Renewable Watch presents a summary of the report…

Global energy trends

Global energy consumption has been growing at an average annual growth rate of 1.7 per cent for the past decade, except in 2017, which saw a growth of 2.2 per cent. Natural gas has seen the largest share in this energy consumption followed by renewable energy and oil. However, the changing expectations on the demand side as well as the disruptions on the supply side have led to a decline in global energy investments. In 2017, global energy investments declined by 2 per cent. Investments in electricity contributed the majority share in overall energy investments for 2017, of which network upgrade followed by renewable energy addition were responsible for the largest electricity investments.

While technological advancements and energy efficiency measures affect energy demand, renewable energy dominance, the adoption of energy storage, increasing digitalisation and a growing preference for distributed energy sources are influencing the supply side. All these factors are creating significant disruptions and giving rise to uncertainties regarding the allocation and risk mitigation of large energy investments.

Risks and challenges

With increasing digitalisation and a thrust on energy efficient practices, consumer preferences are changing with users adopting smarter appliances and energy saving technologies, and moving towards captive generation. As consumers become “prosumers” with the adoption of solar rooftop systems and distributed generation sources, they will have a greater role in demand response. Consequently, energy demand will become more decentralised, which will severely impact the business models adopted by utilities.

With increasing global consciousness of climate change mitigation, there is a worldwide transition towards greater utilisation of renewables. This is aided by fluctuating fuel prices and an expected shortage of fossil fuels in the future. Meanwhile, a few countries are backing out from their climate change commitments. As a result, a lot of uncertainties have been created in fossil fuel investments, and this is impacting the entire global energy supply mechanism. Apart from electricity, the transport sector has a major share in energy investments. As most countries move towards increasing the penetration of electric vehicles, with charging stations using solar rooftop systems for charging batteries, the entire global energy supply chain and related investments will be impacted.

Rapidly declining costs of solar power plants and wind power plants along with a favourable policy and regulatory mechanism have spurred greater investments in renewable energy. However, there have been instances of generation curtailment in many countries due to grid instability, which leads to disruptions in renewable energy returns. Declining costs of energy storage systems are further expected to drive renewable energy capacity additions and impact energy supply. Other causes of disruptions in energy investments include country-specific risks in terms of rigid contract structures, policy uncertainties, changing governance and the geopolitical climate of the region.

Addressing uncertainties

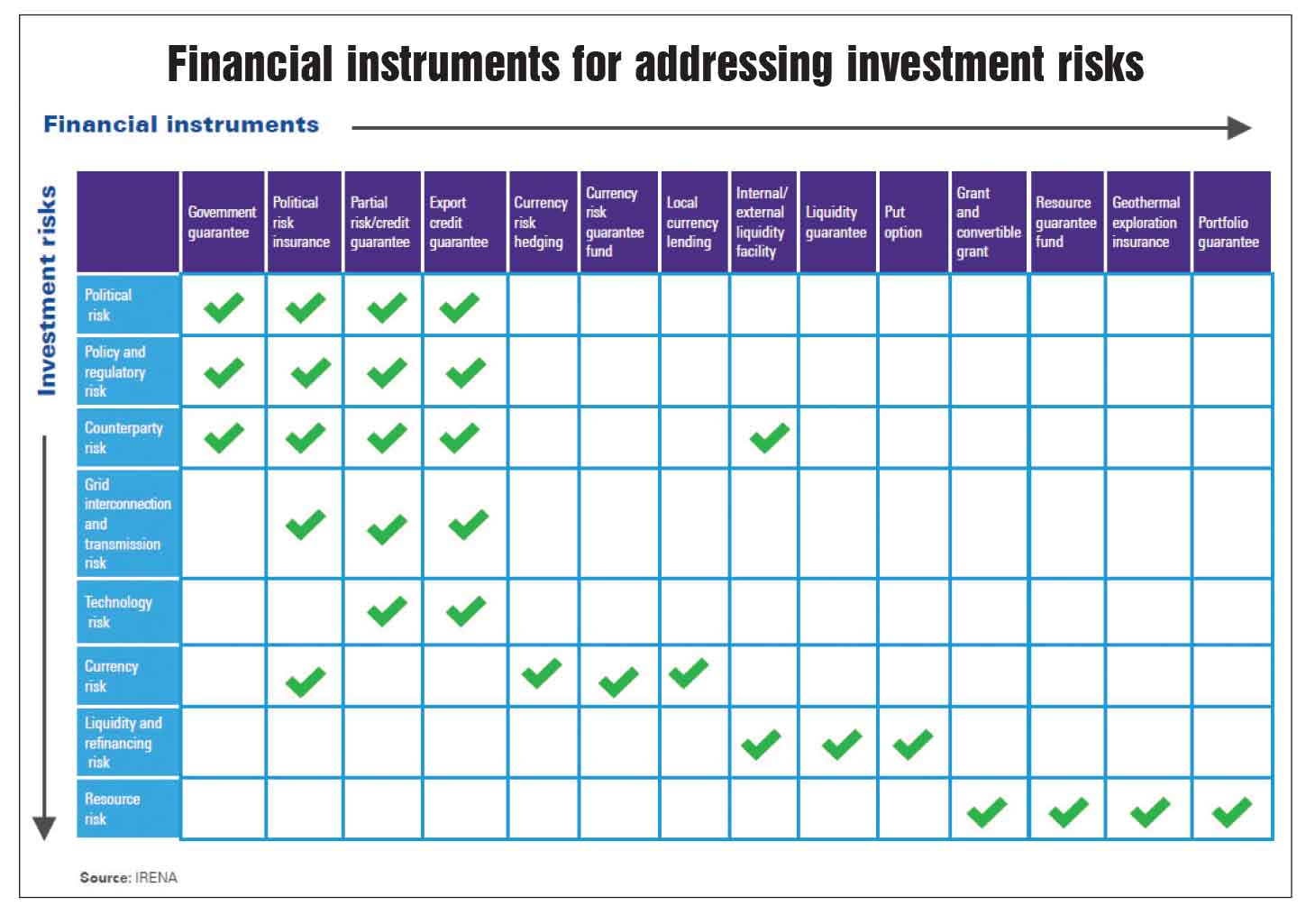

With increasing complications surrounding the decision-making process of energy investments, stakeholders need to move beyond the assessment of immediate opportunities and risks. Instead, a long-term assessment of likely risks, their impact and mitigation should be carried out to safeguard investments. This should be coupled with continuous monitoring of any possible complications arising in the energy pathways and flexible business models to manage such risks effectively. To manage any emerging risk, government support should be guaranteed through strengthened and flexible contractual structures, enabling market structures, a conducive policy and regulatory environment, and de-risking of financial instruments.

In case an energy investment is for the public good, certain market risks can be shifted to governments instead of investors, as too many risks might drive away private sector investments. For instance, the contractual framework for the Rewa Ultra Mega Solar Power Project in Madhya Pradesh has an inbuilt three-tiered payment security mechanism to address counterparty risks and allay investor concerns on payment delays. Meanwhile, the application of the goods and services tax in India and the various uncertainties surrounding the taxation rates for various energy equipment and services have been a cause of major complications for all stakeholders in the energy sector. This, along with the renegotiation of solar and wind power purchase agreements by discoms for achieving lower power tariffs, has led to unrest amongst the developers and investors.

To manage the dynamic environment and associated market risks, short-term markets should be developed. This will increase competition and promote economic efficiency. However, the price volatility of these short-term markets should be addressed through suitable contractual frameworks for price differences. Other important markets are ancillary services and energy balancing, especially with respect to greater renewable energy penetration. Financing risks can be addressed through credit enhancements using guarantees, international capital, and liquidity facilities to address payment delays. However, a combination of non-financial measures in the form of robust contractual frameworks and long-term visibility is required along with these financial measures to address the financial risks.

Outlook

With improved risk mitigation tools, reorientation of business models and improvements in flexibility of existing frameworks, various countries are attempting to adapt to the increasing disruptions in the energy sector. Innovative financing strategies and business models are being adopted by investors for addressing the uncertainties associated with energy investments. However, greater government interventions are required to encourage private sector investments for meeting the total investment requirement of this sector. Going forward, governments need to develop stable policies and regulations to provide long-term visibility to investors. In addition, there is a need to create enabling market structures with appropriate risk sharing mechanisms and flexible contractual frameworks to deal with disruptions in energy investments.