By Preeti Wadhwa

India’s energy storage market is entering a phase of accelerated growth as the power sector grapples with rising peak demand and the increasing integration of variable renewable energy. Battery energy storage systems (BESSs) are emerging as a critical grid resource, supporting renewable firming, peak shifting and system reliability across generation, transmission and distribution. Backed by a strong policy push and expanding competitive procurement, storage deployment in India has moved beyond pilot projects to utility-scale adoption. In the second half of 2025, India’s standalone BESS market witnessed a scale-up, marked by a surge in competitive bidding activity, expanding participation by central and state agencies, and a downward trajectory in tariff discovery. This article provides an overview of India’s standalone BESS market, covering the policy environment, tariff trends and the way forward…

Policy environment

The rapid growth of BESS deployment in India has been underpinned by a series of coordinated policy and regulatory interventions aimed at improving project viability, reducing risks and attracting private investment. Energy storage has been recognised as an integral part of the power system through amendments to the Electricity Rules in December 2022, enabling storage systems to participate across generation, transmission and distribution domains. This recognition has laid the foundation for treating storage as a mainstream infrastructure asset rather than an ancillary technology.

Before that, in October 2022, energy storage systems were also included in the Harmonised Master List of Infrastructure by the Ministry of Finance, facilitating access to long-tenor and lower-cost financing. This was followed by the issuance of guidelines for the preparation of resource adequacy plans in June 2023, under which energy storage has been incorporated as a key planning resource for meeting peak demand and ensuring system reliability. The National Framework for Promotion of Energy Storage Systems, released in September 2023, provides a comprehensive roadmap covering deployment targets, market integration and regulatory facilitation.

On the demand side, several measures have been introduced to improve the commercial attractiveness of storage projects. Tariff-based competitive bidding guidelines for the procurement of BESSs by distribution licensees were notified in March 2022, creating a transparent and standardised procurement mechanism. The Central Electricity Regulatory Commission has allowed storage-based resources to participate in ancillary services markets, enabling BESSs to provide secondary and tertiary reserves, and support real-time grid balancing.

A major boost has come from the government’s viability gap funding (VGF) programme. The Ministry of Power has expanded the VGF target to 13.2 GWh by 2027-28 and approved an additional 30 GWh of BESS capacity under an expanded scheme. The ministry has also issued advisories mandating the inclusion of a minimum of two hours of co-located energy storage equivalent to 10 per cent of installed capacity in upcoming solar tenders.

Further, a 100 per cent waiver of interstate transmission system charges has been granted for co-located BESS projects commissioned on or before June 30, 2028, provided the power is consumed outside the host state. Amendments to the Electricity Rules in September 2025 have allowed energy storage systems to be developed, owned, leased or operated by consumers, opening up new ownership and business models. Further, the draft safety and technical standards for BESSs, issued by the Central Electricity Authority (CEA) in 2025, aim to standardise design and construction practices, and enhance safety and reliability.

Tariff trends

The last six months of 2025 marked a decisive scale-up phase for India’s standalone BESS market, with around 10 auctions being conducted by a mix of central and state procuring agencies. This surge in procurement activity was accompanied by a declining tariff discovery, reflecting intensifying competition, improving bidder confidence and growing maturity in standalone BESS procurement frameworks.

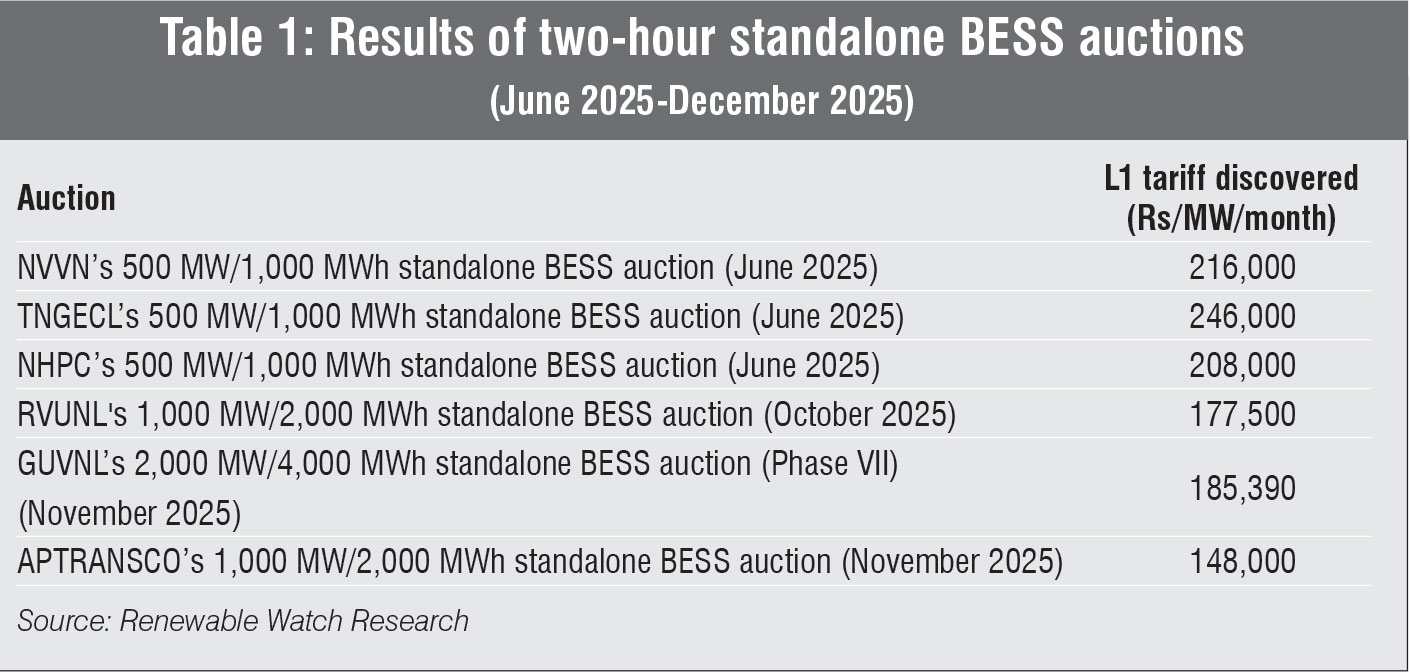

Across the last six months of 2025, the lowest (L1) tariffs discovered for two-hour standalone BESS systems ranged from Rs 148,000 to Rs 246,000 per MW per month. Higher-capacity tenders witnessed comparatively lower per MW/month tariffs (as shown in Table 1). The L1 tariff for two-hour duration storage was discovered in APTRANSCO’s 1,000 MW/2,000 MWh auction, while the highest tariff was seen in TNGECL’s 500 MW/1,000 MWh tender. Other major procurements by NVVN, NHPC, RVUNL and GUVNL discovered tariffs clustered between Rs 177,500 per MW per month and Rs 216,000 per MW per month.

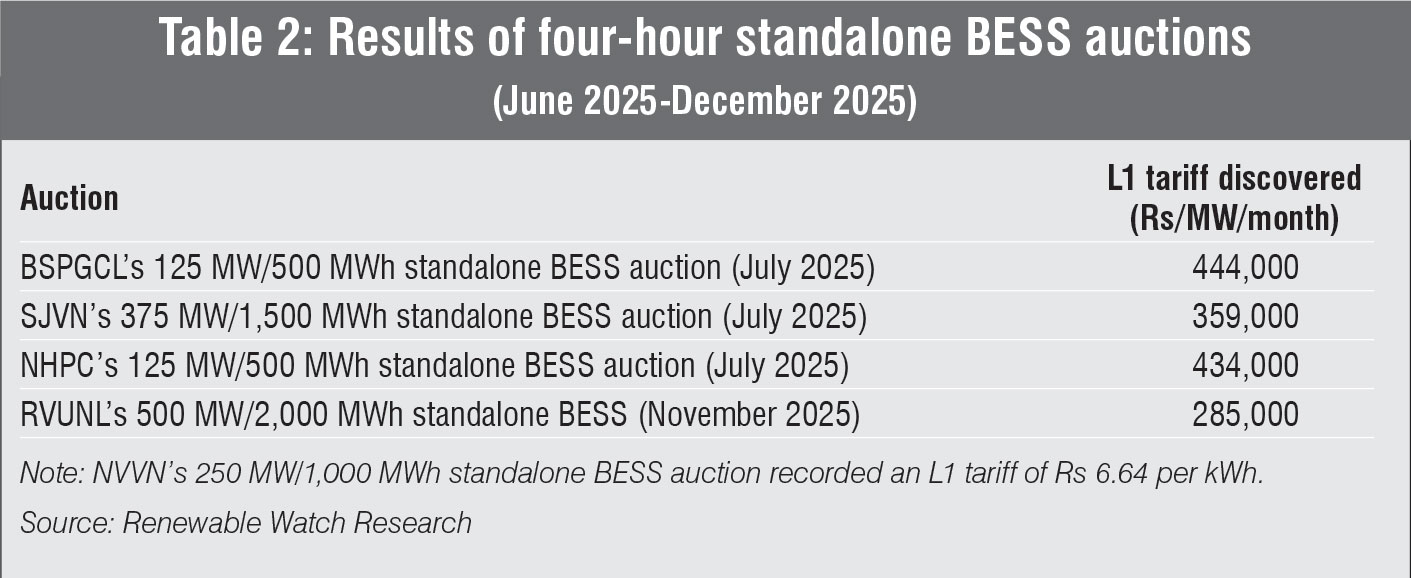

For four-hour standalone BESSs the auction outcomes in the last six months of 2025 similarly reflect that higher capacity tenders witnessed comparatively lower per MW per month tariff (as shown in Table 2). Overall, L1 tariffs for four-hour duration storage ranged from Rs 285,000 to Rs 444,000 per MW per month during the period. The L1 tariff was discovered in RVUNL’s 500 MW/2,000 MWh auction, while the highest tariff emerged in BSPGCL’s 125 MW/500 MWh tender. Other four-hour procurements by agencies such as SJVN and NHPC Limited discovered tariffs largely in the range of Rs 359,000 to Rs 434,000 per MW per month.

Variations across nodal agencies and states do exist. Tenders backed by clearer payment security mechanisms, central or financially stronger state utilities and alignment with VGF frameworks appear to have attracted more aggressive bidding. Overall, the auction trajectory in the last six months of 2025 suggests that India’s standalone BESS market has moved decisively from pilot-scale experimentation towards utility-scale deployment. The key factors driving this momentum include the VGF framework, which has reduced upfront cost barriers, accelerated state-led procurement and the emergence of standardised bidding structures.

Future outlook

Despite the strong policy push and rapid scale-up in procurement, several challenges remain. One of the most pressing issues is the absence of a clear framework for end-of-life management of grid-scale batteries. Uncertainty around battery disposal, recycling obligations and ownership of residual assets at the end of power purchase agreements continues to create risk for developers and financiers. High recycling costs and the limited availability of certified recycling facilities for advanced battery chemistries further complicate project economics.

Continued efforts will also be required to reduce technology costs, strengthen domestic manufacturing and supply chains, and standardise safety and performance benchmarks. The CEA estimates that India will require 336 GWh of energy storage capacity by 2029-30 and 411 GWh by 2031-32 to support reliable renewable energy integration, underscoring the scale of the opportunity ahead.

Going forward, with a growing pipeline of awarded standalone BESS projects, timely financial closures, equipment procurement, construction and commissioning will become critical to sustaining investor confidence and validating recent tariff discoveries. In this phase, consistent implementation of policy measures and adherence to project timelines will matter far more than fresh declarations, shaping the credibility and long-term scalability of India’s energy storage ecosystem.