By Nidhi Dua

Round-the-clock (RTC) renewables, firm and despatchable renewable energy (FDRE), and hybrid projects with battery energy storage systems (BESS) form the backbone of a reliable and resilient renewable-powered grid. While renewable energy has made remarkable progress in India with over 247 GW of installed capacity as of September 2025, its intermittent nature remains a major challenge. To address this issue, the country is increasingly focusing on RTC, FDRE and BESS projects.

Renewable Watch presents a round-up of the key developments in the wind-solar hybrid, RTC, FDRE and BESS segments.

Wind-solar hybrids

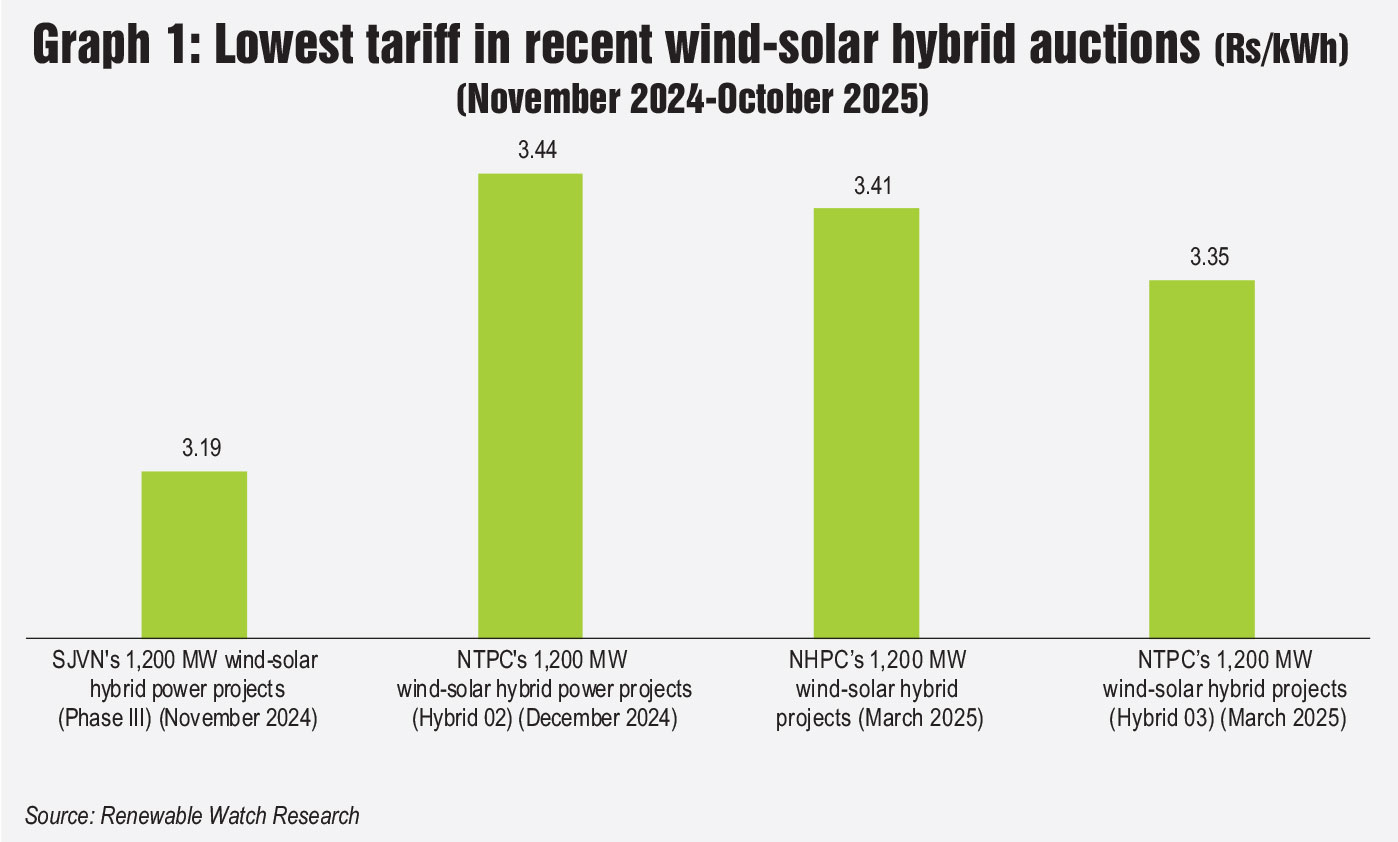

The government issued the national wind-solar hybrid policy in May 2018. The main objective of the policy was to promote large grid-connected wind-solar PV hybrid systems for optimal and efficient utilisation of wind and solar resources, transmission infrastructure and land. The positive impact of the policy is evident in recent tenders and auctions in this space (see Graph 1).

During the period November 2024 to October 2025, four major wind-solar hybrid auctions were conducted by SJVN, NTPC Limited and NHPC Limited. Several companies participated in these auctions, with some winning multiple bids. Leading the pack was Adani Renewable Energy Holding Twelve, a subsidiary of Adani Green Energy Limited, which emerged as the most successful bidder, with wins in three separate auctions. Close behind were Adyant Enersol and Enfinity Global (through EG Energy Development), both of which won bids in two auctions each.

The lowest discovered tariffs in the wind-solar hybrid segment ranged from Rs 3.19 per kWh in SJVN’s 1,200 MW Phase-III auction to Rs 3.44 per kWh in NTPC’s 1,200 MW wind-solar hybrid power projects (Hybrid 02) auction. In comparison, tariffs for utility-scale solar power auctions were notably lower, ranging from Rs 2.50 per kWh (NTPC’s 1,200 MW solar auction, October 2024) and Rs 3.52 per kWh (Solar Energy Corporation of India’s [SECI] Tranche XVII 2,000 MW solar power auction in December 2024). Meanwhile, wind power auctions recorded comparatively higher tariffs, varying from Rs 3.56 per kWh (GUVNL’s 200 MW Phase VIII auction, October 2024) to Rs 3.98 per kWh (SJVN’s 600 MW ISTS-connected wind power projects auction, January 2025).

Overall, the tariff trends indicate that hybrid projects are currently positioned between solar and wind projects in terms of cost competitiveness. For wider adoption of wind-solar hybrid projects, tariffs must reduce in order to narrow the gap with stand-alone solar and wind projects. Greater price competitiveness will be key to enhancing investor confidence and driving large-scale deployment in the hybrid segment.

FDRE and RTC

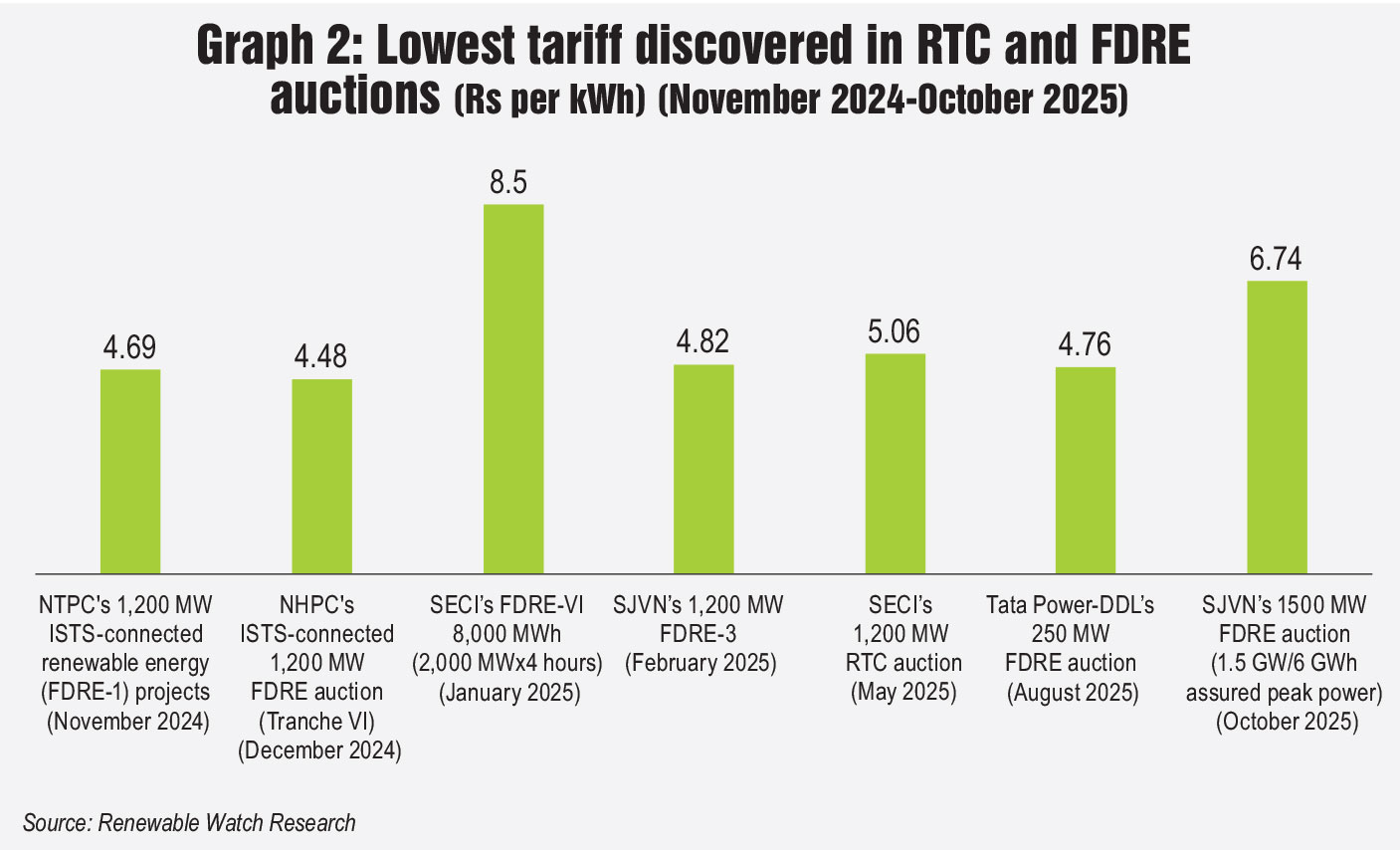

During the period November 2024 to October 2025, India witnessed only a single RTC auction by SECI, in May 2025, with tariffs being slightly above Rs 5 per kWh. During the same time period, key companies such as SJVN, NTPC, NHPC, SECI and Tata Power conducted several FDRE auctions. Multiple players secured projects across these auctions, with ACME Solar Holdings securing capacities in four separate auctions. Furthermore, Hexa Climate Solutions, Avaada Energy and Tata Power Renewable Energy won two auctions each.

As is evident in Graph 2, the lowest discovered tariffs for FDRE projects ranged from Rs 4.48 per kWh in NHPC’s ISTS-connected 1,200 MW FDRE auction (Tranche VI) to Rs 6.74 per kWh in SJVN’s 1.5 GW FDRE auction (1.5 GW/6 GWh assured peak power), depending on the mode of procurement and application served, except for SECI’s peak fixed hour-based procurement. In January 2025, SECI’s first fixed hour-based FDRE project discovered a tariff of Rs 8.50 per kWh. The tender witnessed an underwhelming response from bidders, likely due to the complex nature of the power configuration, and thus commanded a high premium.

Overall, FDRE tariffs have shown an upward trend, increasing from Rs 4.69 per kWh in November 2024 to Rs 6.74 per kWh by October 2025. Despite this upward tariff trend, FDRE project tenders and auctions are expected to see significant growth in the coming years, as consumers increasingly demand reliable and consistent power supply.

Energy storage

Policies and programmes

The need for BESS has been growing rapidly, prompting significant government action. Key policy updates over the past year reflect this momentum. The Ministry of Power (MoP) issued an advisory to all renewable energy implementation agencies and state governments, instructing them to include a minimum of two hours of co-located energy storage systems, equivalent to 10 per cent of the installed capacity, in all upcoming solar tenders. The ministry has also expanded the target capacity under the viability gap funding (VGF) programme to 13.2 GWh by 2027-28. Additionally, the MoP approved an expanded VGF scheme for 30 GWh of BESS, in addition to the increased 13.2 GWh of capacity. Of this, 25 GWh has been allocated across 15 states, and 5 GWh  has been allocated to NTPC Limited. To further incentivise deployment, the MoP has granted a 100 per cent waiver on ISTS charges for co-located BESS projects commissioned on or before June 30, 2028, provided that power from these projects is consumed outside the state where these systems are commissioned.

has been allocated to NTPC Limited. To further incentivise deployment, the MoP has granted a 100 per cent waiver on ISTS charges for co-located BESS projects commissioned on or before June 30, 2028, provided that power from these projects is consumed outside the state where these systems are commissioned.

Auctions

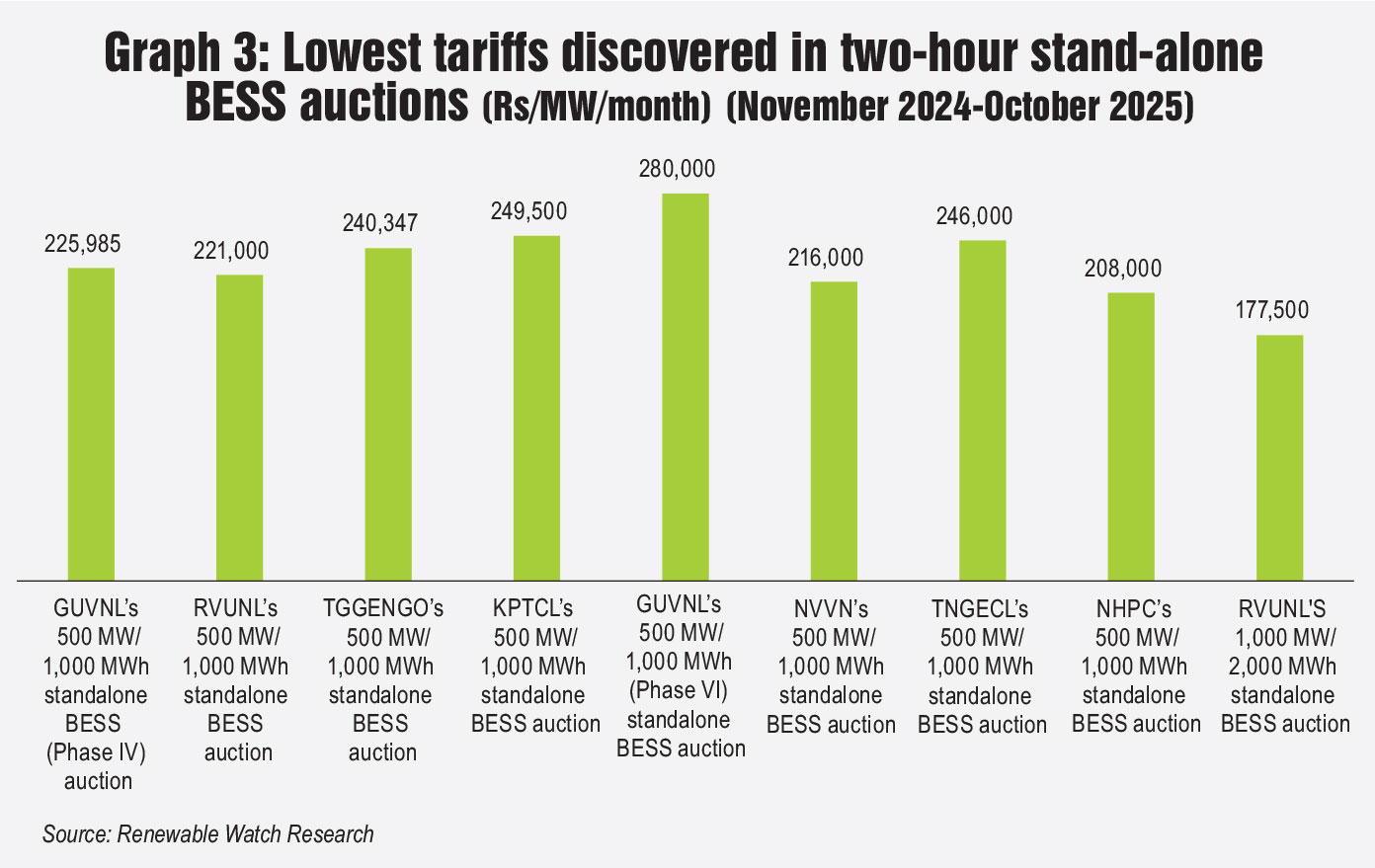

Between November 2024 and October 2025, multiple solar-plus-storage and stand-alone BESS auctions were conducted by various organisations including Gujarat Urja Vikas Nigam Limited (GUVNL), NHPC, SECI, SJVN, NTPC Vidyut Vyapar Nigam (NVVN), Rewa Ultra Mega Solar Limited (RUMSL), Rajya Vidyut Utpadan Nigam Limited (RVUNL), Telangana  Power Generation Corporation Limited (TGGENCO), and Karnataka Power Transmission Corporation Limited (KPTCL). These auctions saw participation from several players and highlighted distinct tariff patterns influenced by VGF support and storage design. As evident in Graph 3, the lowest tariffs discovered for two-hour storage projects ranged from Rs 177,500 per MW per month (RVUNL’s 1,000 MW/2,000 MWh stand-alone BESS auction) to Rs 280,000 per MW per month (GUVNL’s 500 MW/1,000 MWh stand-alone BESS Phase VI).

Power Generation Corporation Limited (TGGENCO), and Karnataka Power Transmission Corporation Limited (KPTCL). These auctions saw participation from several players and highlighted distinct tariff patterns influenced by VGF support and storage design. As evident in Graph 3, the lowest tariffs discovered for two-hour storage projects ranged from Rs 177,500 per MW per month (RVUNL’s 1,000 MW/2,000 MWh stand-alone BESS auction) to Rs 280,000 per MW per month (GUVNL’s 500 MW/1,000 MWh stand-alone BESS Phase VI).

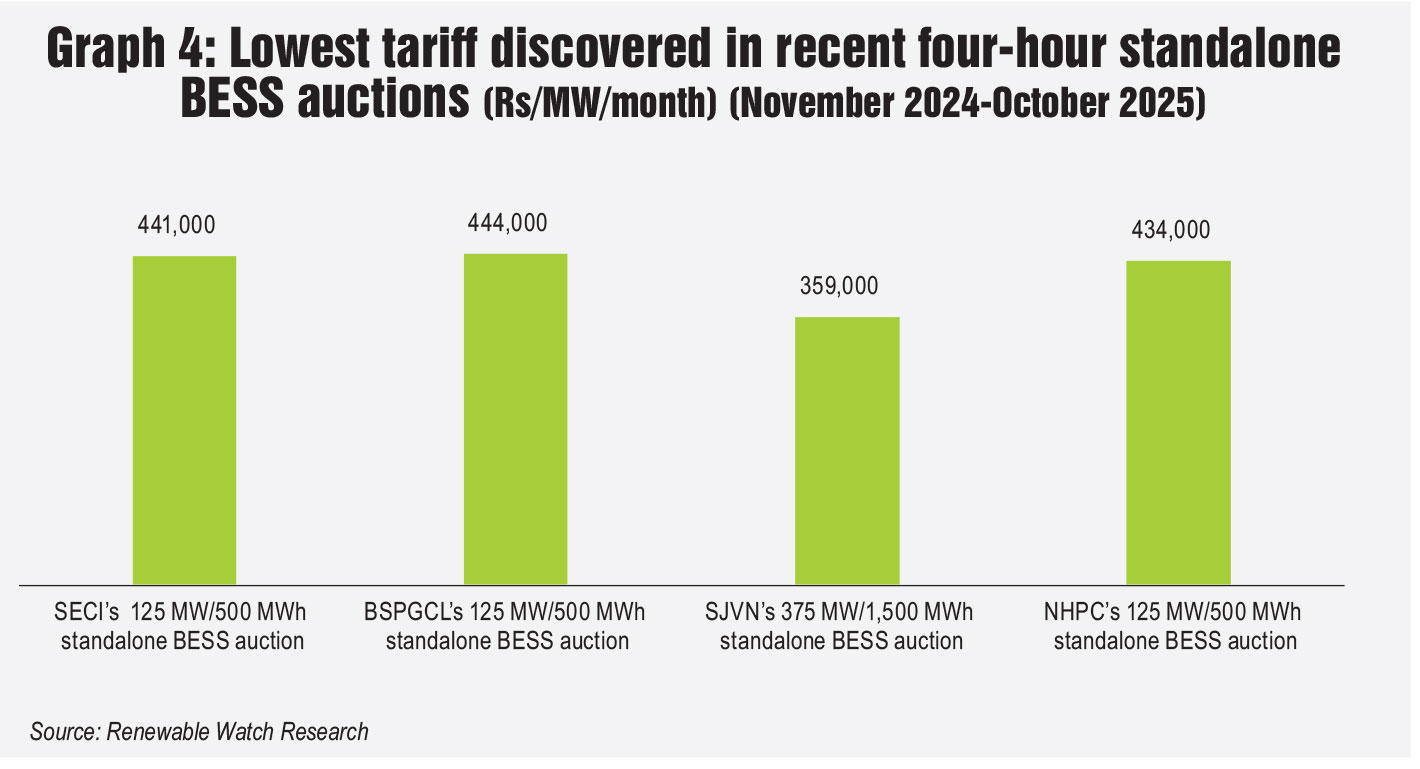

Longer-duration projects with four-hour storage capacity were also auctioned during the year. The tariff trends of these projects are highlighted in Graph 4. The lowest discovered tariffs for such projects ranged from Rs 359,000 per MW per month (SJVN’s 375 MW/1,500 MWh) to Rs 444,000 per MW per month (BSPGCL’s 125 MW/500 MWh).

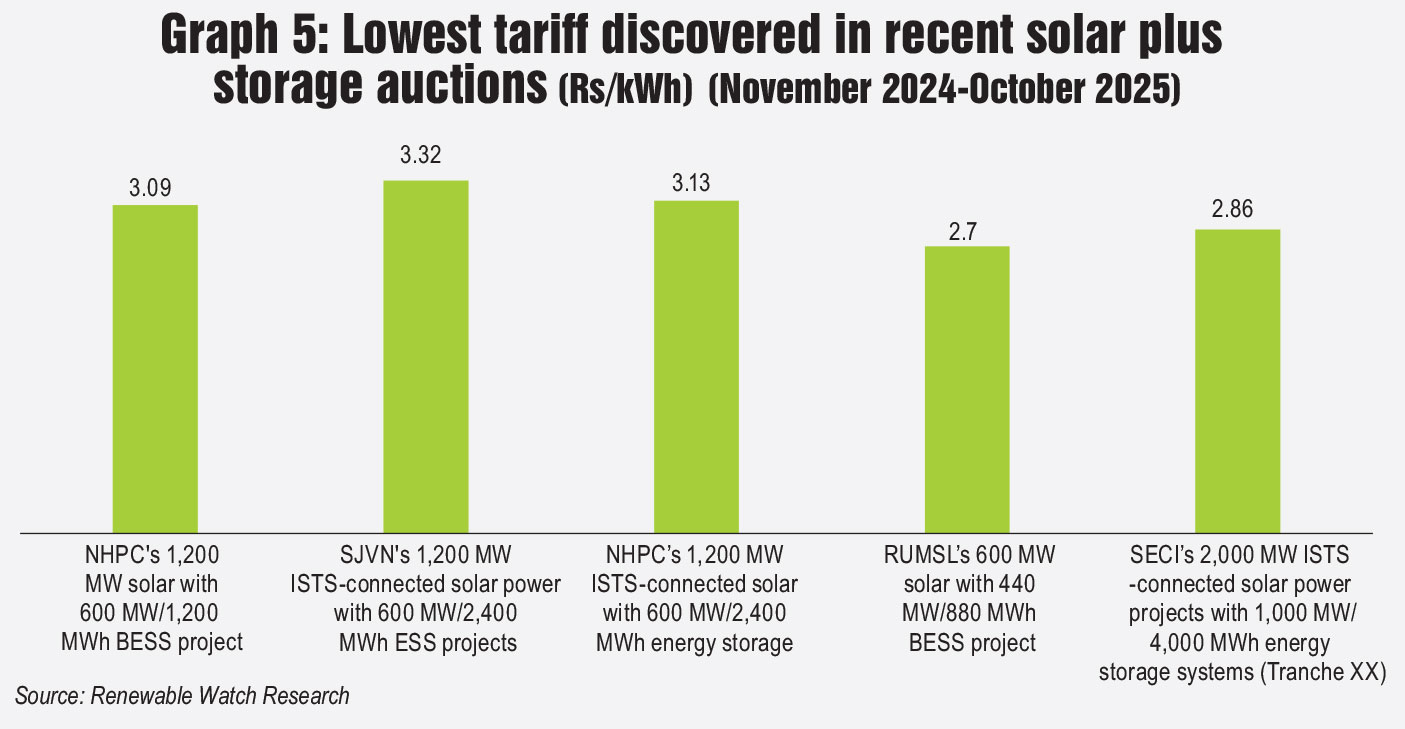

The year also witnessed several solar-plus-storage auctions, as depicted in Graph 5. The tariffs for these auctions ranged from Rs 2.70 per kWh (RSUML’s 600 MW solar with 440 MW/880 MWh BESS) to Rs 3.32 per kWh (SJVN’s 1,200 MW ISTS-connected solar power project with 600 MW/2,400 MWh ESS projects).

Challenges and the way forward

India’s renewable energy landscape has undergone a remarkable transformation, driven by a growing emphasis on RTC renewables, FDRE projects, wind-solar hybrids, and BESS. As 2025 draws to a close, the sector stands at an inflection point, marked by notable achievements. However, significant challenges must be addressed to maintain the momentum.

While RTC, FDRE and hybrid projects hold immense promise for providing stable and despatchable clean energy, their path to large-scale deployment remains complex. Furthermore, there is a perception that storage remains expensive, although recent auctions indicate rising competitiveness. However, costs for longer-duration systems are still high.

Transmission and grid connectivity challenges further complicate implementation, as hybrid and RTC projects are often spread across multiple locations, leading to higher grid integration costs and coordination complexities.

Furthermore, BESS, although pivotal for balancing renewable energy intermittency, continues to face financing and bankability constraints. High upfront investment requirements, limited domestic manufacturing, and perceived technological risks hinder their scalability.

To unlock the full potential of these technologies, stronger policy and financial interventions are needed. Measures such as targeted subsidies, tax exemptions and VGF can help offset the high capital costs and attract greater private investment. Expanding the production-linked incentive scheme for advanced battery manufacturing would enhance domestic capabilities, reduce import dependence and gradually bring down storage costs. Additionally, access to green financing through instruments such as green bonds, concessional credit and blended finance will be vital to bridge the funding gap. Partnerships with international climate finance institutions can further de-risk investments and catalyse large-scale deployment.

Net, net, the outlook for RTC, FDRE, solar-wind hybrids and BESS remains optimistic. Falling battery prices, increased investor participation and a maturing auction ecosystem indicate growing market confidence. With sustained policy support and continued technological advancements, this segment is poised to become the cornerstone of India’s renewable energy future.