India’s energy transition requires energy storage infrastructure to integrate renewable energy sources efficiently. The country aims to achieve 500 GW of non-fossil-fuel-based capacity by 2030, requiring extensive deployment of energy storage systems (ESS) – particularly pumped storage projects (PSPs), battery energy storage systems (BESS), and green hydrogen – to ensure grid stability and mitigate the intermittency issues of renewable energy. As of December 2024, India had 4.86 GW of ESS capacity, comprising 4.75 GW from PSPs and 0.11 GW from BESS. There is immense scope of capacity expansion in this space. The National Electricity Plan 2023 projects that by 2031-32, the country will require 73.93 GW/411.4 GWh of storage capacity, with 26.69 GW/175.18 GWh from PSPs and 47.24 GW/236.22 GWh from BESSs to accommodate 364 GW of solar and 121 GW of wind energy.

Renewable Watch delves into the current status, policy interventions, technological advancements, challenges and future outlook across the BESS, PSP and green hydrogen segments as well as emerging storage technologies such as gravity energy storage, compressed air energy storage and solid gravity energy storage…

Policy frameworks around ESS

Long-term trajectory on energy storage obligations

The government has been playing a proactive role in the ESS space. A long-term trajectory for the energy storage obligation (ESO) has been notified by the Ministry of Power (MoP) to ensure that sufficient storage capacity is available with obligated entities. As per the trajectory, the ESO will gradually increase from 1 per cent in 2023-24 to 4 per cent by 2029-30, an annual increase of 0.5 per cent. Further, the ESO mandates that at least 85 per cent of stored energy be derived from renewables.

Advisory notice on co-locating ESS with solar power projects

While the ESO was mandated by the MoP, the ministry recently issued an advisory notice on co-locating ESS with solar power projects, advising all renewable energy implementing agencies and state utilities to integrate two-hour ESS, equivalent to 10 per cent of installed solar capacity, in all solar tenders. If implemented, this is expected to result in 14 GW/28 GWh of storage by 2030.

BESS

Current status

The uptake of BESS in India is slowly growing, driven by tender auctions and regulatory mandates. Renewable Watch Research has tracked four standalone BESS auctions conducted by central/state agencies over the past year (April 2024-March 2025), totalling up to 1,375 MW/3,000 MWh, with an average viability gap funding of Rs 315,240 per MW per month. Gujarat Urja Vikas Nigam Limited (GUVNL) conducted two of these auctions, the highest. The auctions have showcased a downward trend in storage tariffs. Additionally, Renewable Watch Research has tracked over 15 standalone BESS tenders, totalling up to 4,350 MW/12,200 MWh, that have been floated by central/state agencies over the past year (April 2024-March 2025), mostly across Kerala, Gujarat and Rajasthan. GUVNL floated three such tenders – the highest.

In terms of commercials, the cost of lithium- ion batteries, currently ranging between Rs 13,600 per kWh and Rs 20,000 per kWh, is expected to decrease to Rs 5,500 per kWh by 2030, according to BNEF and NITI Aayog.

Recent policy initiatives

The Union Budget 2025-26 has incentivised domestic lithium-ion battery manufacturing by expanding the list of capital goods eligible for customs tax exemptions. The government has added 35 capital goods for EV battery production and 28 for mobile battery manufacturing. Additionally, the PLI scheme has been expanded to add 55 GWh of advanced cell battery capacity. These initiatives will further contribute to localising component manufacturing and reducing the reliance on imports.

PSPs

Current status

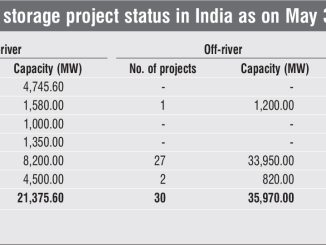

Pumped storage remains the most dominant grid-scale energy storage solution due to its large capacity and ability to provide long-duration storage. As per the CEA, as of December 2024, India had eight on-river PSPs with a combined capacity of 4,745.6 MW, spread across Telangana, Maharashtra, Gujarat, Tamil Nadu and West Bengal. However, only six plants with a total capacity of 3,305.6 MW operate in pumped mode, while 1,440 MW of capacity across two sites in Gujarat remain non-operational in pumped mode. Additionally, 4,850 MW of on-river and 3,120 MW of off-river PSPs are under construction, with another 2,500 MW of on-river and 1,600 MW of off-river PSPs at advanced planning stages. Survey and investigation activities are under way for 47 PSPs with a total capacity of 62,510 MW.

As per ICRA Limited, the levellised tariff for PSPs is Rs 4.40 per kWh at a capital cost of Rs 50 million per MW and a roundtrip efficiency of 77.5 per cent. The levellised tariff increases to Rs 6.80 per kWh when capital cost is set at Rs 75 million per MW and the round-trip efficiency at 65 per cent. This calculation is based on several assumptions – a debt and equity mix of 70:30, with the cost of debt at 9 per cent, free energy considered as 12 per cent of generation, eight hours of storage capacity and the cost of input energy considered as Rs 2.70 per unit, as well as other assumptions as per the Central Electricity Regulatory Commission Regulations for 2024-29.

Recent policy initiatives

The MoP, in February 2025, issued tariff- based competitive bidding guidelines to procure stored energy from existing, under-construction, or new PSPs. The procurement process includes projects identified by the procurer on a build-own-operate- transfer basis and those proposed by developers. A special purpose vehicle will be required for pre-feasibility activities, and successful bidders will sign power purchase agreements within six months of the letter of award.

Several states have implemented their own policies as well for implementing PSPs. For instance, Tamil Nadu, in September 2024, introduced the Pumped Storage Projects [PSP] Policy 2024. The policy mandates PSP completion within seven years and supports both on-river and off-river projects to balance grid fluctuations caused by intermittent renewable energy sources. In December 2024, Meghalaya issued its power policy, aiming to promote renewable energy development, with a significant focus on expanding hydro and PSP capacity. In March 2025, the Madhya Pradesh government issued guidelines for implementing PSPs with incentives announced under the state’s renewable energy policy. The state’s “Scheme for Implementation of Pumped Hydro Storage Project in Madhya Pradesh” will be implemented in tandem with its renewable energy policy issued in 2022. The policy will be valid for 10 years. The guidelines include incentives such as exemptions on electricity duty and energy development cess for 10 years, a 50 per cent waiver on wheeling charges for five years, and up to 65 per cent reimbursement of stamp duty.

Green hydrogen

Current status

According to an update, from March 2025, the government has awarded 412,000 TPA of green hydrogen production and approved 3 GW of electrolyser manufacturing capacity per year.

Furthermore, in March 2025, SECI announced the result of its auction under the Strategic Interventions for Green Hydrogen Transition programme (Mode-1, Tranche-II) to select producers for setting up green hydrogen production facilities in India. The programme aims to promote large-scale green hydrogen production, improve cost competitiveness and facilitate rapid expansion. A total annual production capacity of 450,000 metric tonnes was awarded to various companies under two buckets, with a maximum allocated incentive of Rs 22.39 billion.

Recent policy initiatives

The green hydrogen market in India is witnessing increased momentum, with major investments, amounting to Rs 8 trillion, being announced under the National Green Hydrogen Mission. In November 2024, the MNRE launched a programme under the NGHM to establish centres of excellence focused on hydrogen production, storage and utilisation. Selected entities will receive up to 50 per cent financial support for R&D projects. In the same month, the MNRE announced implementation guidelines, aiming to support pilot projects exploring novel methods and pathways for green hydrogen production and use, particularly in residential, commercial and decentralised applications. Moreover, government incentives announced during Budget 2025-26, such as customs duty exemptions on electrolysis equipment and subsidies for green hydrogen production, are expected to improve cost competitiveness and scale production.

Technological advancements

Technological advancements in energy storage are critical for achieving India’s clean energy goals. Over the years, there have been noticeable technological advancements in the BESS, PSP and green hydrogen segments. Within PSPs, the technology is evolving from traditional fixed speed PSPs to variable speed and ternary PSPs, which enhance efficiency and flexibility. Although ternary PSPs have not yet been implemented in India, they present significant potential for future projects. BESS technology is transitioning beyond conventional lithium-ion batteries to include vanadium redox flow batteries (VRFBs), molten-sodium batteries, and other alternatives. VRFBs are gaining traction for extended cycle life and scalability while advancements in Li-ion batteries such as lithium iron phosphate (LFP) focus on cost reduction and efficiency enhancement. Meanwhile, in the green hydrogen space, solid oxide electrolysis is an upcoming technology.

Besides conventional BESSs, PSPs and green hydrogen, new storage technologies are emerging such as gravity energy storage, thermal energy storage, flywheel energy storage, compressed air energy storage (CAES) and solid gravity energy storage (SGES). Gravity energy storage involves lifting heavy masses to store energy, while thermal energy storage utilises phase change materials and supercritical CO2 power cycles to store and release energy efficiently. Flywheel energy storage uses high-speed rotating discs to store kinetic energy, which can be rapidly converted into electricity. CAES utilises compressed air stored in natural caverns to generate electricity, although India lacks suitable geological formations. SGES, which relies on electromechanical lifting mechanisms, provides long-duration storage with minimal maintenance and site flexibility. It is at an early deployment stage, with pilots being conducted by Gravitricity in collaboration with NTPC in 2023 at NTPC’s Talcher thermal power station in Odisha.

Challenges and future outlook

Despite technological progress and the policy push from the government, several challenges hinder the widespread adoption of energy storage systems. The lack of a unified regulatory framework for energy storage across different states, especially in the BESS segment, adds to the problems faced in project implementation. High initial capital costs, supply chain dependencies and regulatory disparities between different energy storage technologies create financial and operational constraints. BESS projects, for example, rely heavily on imported lithium and cobalt (80 per cent of the component cost), raising concerns over long-term sustainability. Furthermore, BESS deployment faces challenges related to grid integration and battery disposal. However, efforts to localise battery manufacturing through PLI incentives by the government and R&D investments in sodium-ion and solid-state batteries will help in mitigating the dependence on imports. PSPs face long gestation periods and environmental concerns, and require extensive land and water resources, limiting their scalability. Green hydrogen pricing remains a key challenge, with per kg cost almost double that of grey hydrogen. Going forward, it is expected that with declining electrolyser costs and increased renewable energy penetration, green hydrogen costs will drop significantly by 2030.

The future outlook for energy storage in India remains optimistic, given increased policy support, growing investments and technological advancements. An SBICAPS report estimates that the PSP market will grow fourfold to 19 GW by FY 2031-32, complementing BESS expansion to 42 GW. Investments in domestic battery manufacturing, hydrogen electrolysis and advanced storage solutions will be crucial in meeting these targets. The adoption of smart grid solutions, vehicle-to-grid integration and hybrid renewable storage projects will further enhance grid stability and energy security. As storage costs decline and energy storage technologies mature, India’s transition towards a sustainable and resilient energy ecosystem is expected to accelerate significantly.