By Debmalya Sen, President, India Energy Storage Alliance

The global rise of battery storage has often been associated with the uptake of hybrid solar projects incorporating battery components. Energy arbitrage has been one of the major use cases of such projects, alongside additional use cases such as frequency response, ancillary services and peak management.

At present, the largest solar project coupled with battery storage is California’s Edwards & Sanborn project, comprising 875 MW of solar capacity with a 3.3 GWh battery energy storage system (BESS). This will soon be surpassed by the Terra Solar project in the Philippines, which, once commissioned, will become the world’s largest integrated solar and battery project consisting of 3.5 GW of solar PV with 4.5 GWh of BESS capacity. Solar and storage accounted for 84 per cent of new power added in 2024 in the US. Over the past couple of years, the size of such solar-plus-BESS projects has gradually increased, with the average BESS capacity now ranging between 100 MWh and 120 MWh and storage duration slowly increasing from one hour initially to an average of two to three hours. What has also been interesting to see is the increasing penetration of the storage component in such projects, from 5-10 per cent a couple of years back to 25-30 per cent at present.

The year 2024-25 is marked by significant solar-plus-BESS adoption in India. The Ministry of Power (MoP) shared an advisory on co-locating energy storage with solar to enhance grid reliability. As per the advisory to renewable energy implementing agencies and state utilities, a minimum of two hours of energy storage, equivalent to 10 per cent of the installed solar capacity, should be incorporated. Distribution companies can also incorporate two hours of storage with rooftop solar plants. The potential of energy storage in this segment is estimated at 14 GW/28 GWh by 2030. This mandate is encouraging as it makes solar more responsible and accelerates energy storage deployment in India.

While such tenders have been in place since 2018, when the first competitive bid tender associated with batteries was shared, they were mostly assigned for applications to offset diesel generator usage in remote locations and islands.

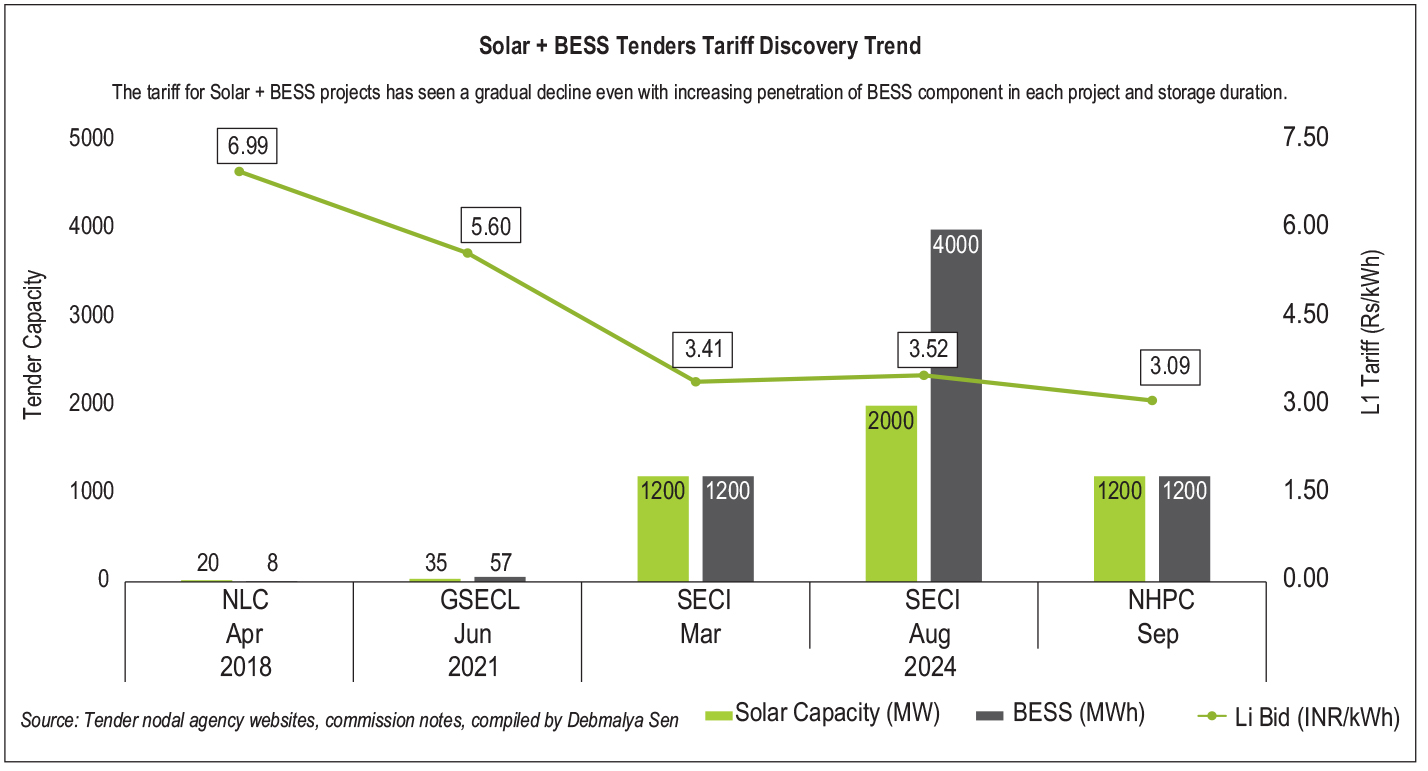

The first tender for solar plus storage was floated by NLC for the Andaman & Nicobar Islands in 2018, for a capacity of 20 MW solar with 8 MWh of battery storage. The project was won by L&T and was commissioned in 2020. Between 2019 and 2023, 11 more such tenders, totalling 80 MW of solar with 150 MWh of BESS capacity, were launched by the Solar Energy Corporation of India (SECI), Karnataka Renewable Energy Development Limited and TANGEDCO.

The other large tenders apart from the above-mentioned ones included SECI’s tender for 100 MW of solar PV with 120 MWh of BESS capacity at Ranjangaon, Chhattisgarh, won by Tata Power and commissioned in 2024; and Bihar’s tender for 185 MW of solar with 254 MWh of BESS capacity, which was launched in 2023 and awarded to L&T in June 2024.

In 2024, the scenario changed significantly for the solar-plus-BESS segment in India. In March 2024, SECI shared the first large-scale build-own-operate (BOO) tender for 1.2 GW of solar PV with 0.6 GW/1.2 GWh of BESS capacity. The tender was very well received by the industry and saw the lowest tariff discovery of Rs 3.41 per kWh. This was followed by seven more tenders, totalling 7.8 GW of solar with 8.9 GWh of battery capacity in a span of eight months. Of these, three were in the bidding stage, three had been awarded and two were in the execution stage as of November 2024.

Graph 1 shows the journey of solar PV plus BESS development in India, highlighting why 2024 has witnessed a rise of this combination of technologies in India’s battery storage journey. The use cases for such tenders have been peak management, diesel generator offset and overall renewable energy integration. The larger proportion of engineering, procurement and construction tenders is primarily due to the majority of initial tenders being of small capacities designed for remote applications. However, there has been a shift in trends, with larger utility-scale tenders increasingly opting for the BOO model. India completed bidding for one of the world’s largest solar-plus BESS tenders in 2024. SECI’s 2 GW solar project with 4 GWh of BESS (four hours of peak supply) was awarded at a discovered tariff of Rs 3.52 per kWh to Reliance ADA, BluPine, Hero Future Energies, Sembcorp and NTPC. Later, NHPC’s 1,2 GW solar plus 1.2 GWh of BESS was awarded at a new L1 of Rs 3.09 per kWh. Just for comparison, the tariff for plain vanilla wind is Rs 3.70-Rs 3.8 per kWh, solar is Rs 2.50-Rs 2.60 per kWh, wind-solar hybrid is Rs 3.42 per kWh, renewable energy plus BESS is Rs 4.25-Rs 4.72 per kWh, peak power (FDRE) is Rs 8.50 per kWh and standalone BESS is Rs 2.50 per kWh (with viability gap funding). The tariff for solar plus BESS is quite competitive to cater to peak power demand. As of February 2025, 10.6 GW of solar with 12.5 GWh of BESS capacity has already been tendered with 4.3 GW of solar-plus-7 GWh BESS opportunities still open.

Table 1 provides a detailed update on all solar-with-BESS tenders issued till date by various nodal agencies in India.

India’s target to achieve 500 GW of installed capacity from non-fossil fuel sources by 2030 requires solar PV capacity to reach 292 GW by 2029-30, that is, around 200 GW of additional solar capacity requirement in a span of five years. With the Ministry of Power’s recent advisory mandating 10 per cent ESS penetration in all future solar projects, around 30-60 GWh of BESS opportunity is projected. The growing interest in solar with storage tenders does not mean that they will be the only kind of tenders going forward, although more activity will be seen around such tenders in 2025 and beyond. With 1 GWh of BESS capacity expected to come online in 2025, India’s energy storage market is expected to become increasingly busier every year. n

All data points in graphs and tables are updated as of February 17, 2025