By Sakshi Bansal

India’s hydropower sector has witnessed a strong revival in capacity addition and generation over the past year, driven by the commissioning of key projects and the accelerated development of pumped storage projects (PSPs). As of October 31, 2025, the country’s installed capacity stood at over 55 GW, including both large and small-hydro plants. The addition of nearly 3,310 MW since 2024 marks a significant uptick after years of subdued growth. Rising generation levels and the growing role of PSPs highlight hydropower’s critical contribution to grid stability, renewable integration and India’s broader clean energy transition. With a large number of projects under implementation and substantial capacity in the pipeline, the hydropower sector is expected to experience significant growth in the near to medium term.

Renewable Watch presents an overview of the current status of the hydropower sector, key developments, policy updates and the way forward…

Current status

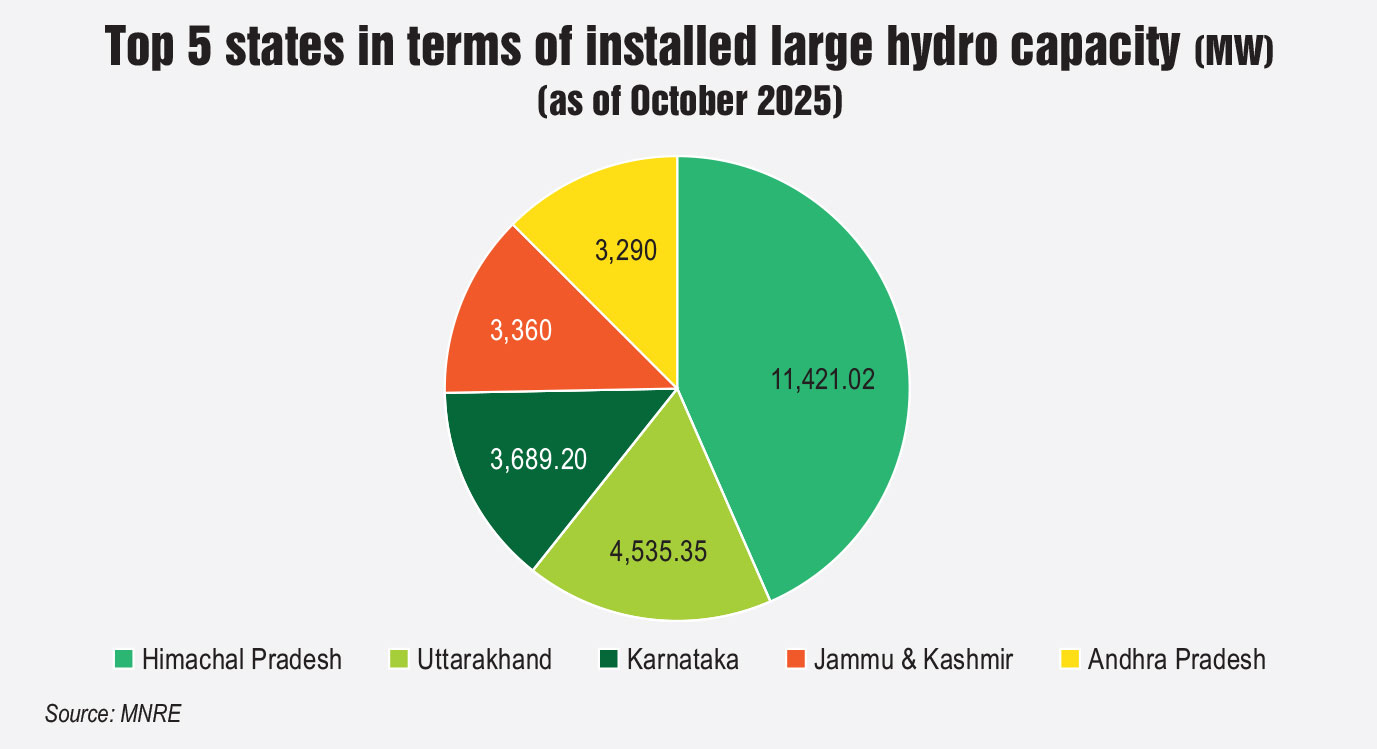

According to the Ministry of New and Renewable Energy (MNRE), the installed large hydropower and small-hydro capacities in the country stand at 50.3 GW and 5.2 GW, respectively, as of October 31, 2025, reflecting steady growth from 41 GW and 4.06 GW in March 2015. However, the contribution of large hydro to the total installed power capacity has declined from 16 per cent to around 10 per cent during the same period. Of the total installed renewable energy capacity (250.6 GW), hydro comprises over 55 GW, or around 22 per cent. As per the Central Electricity Authority (CEA), large hydro generation reached 107,165.5 MUs during April-September 2025, reflecting a 13.2 per cent increase over the same period in the previous year. Meanwhile, small-hydro generation rose by 11.1 per cent to 7,377.88 MUs.

Amid tepid growth, PSP uptake has shown renewed momentum. Although pumped storage is a mature technology and has been around for several years, demand for such projects has surged in recent years as India moves towards integrating 500 GW of non-fossil fuel capacity into its grid by 2030. PSPs, with long-duration storage capabilities, have become an important part of the country’s clean energy landscape, particularly with the increasing demand for round-the-clock renewables by both utilities, and commercial and industrial consumers.

As per the CEA, as of October 31, 2025, India has a total of 76 PSPs aggregating 96.4 GW at various stages of development. These include nine on-river PSPs in operation with a total capacity of 5,246 MW, with two each in Telangana, Maharashtra and Gujarat, and one each in Uttarakhand, Tamil Nadu and West Bengal. Meanwhile, there is only one off-stream operational PSP with a capacity of 1,680 MW. However, only eight plants with a total capacity of 5,485.6 MW are operating in pumped mode, whereas 1,440 MW of capacity across two sites in Gujarat remains non-operational in pumped mode. Further, four on-stream (4,350 MW) and six off-river (7,520 MW) PSPs are under construction. Meanwhile, one on-stream and four off-stream PSPs, with a capacity of 1,000 MW and 5,580 MW, respectively, have received the CEA’s approval for their detailed project reports (DPRs), but are yet to be taken up for construction. One on-stream PSP of 640 MW is currently under examination. Survey and investigation (S&I) activities are underway for 18 projects totalling 28,240 MW. Of these, one is an on-river project of 1,000 MW and 17 are off-river projects totalling 27,240 MW. Additionally, one on-river 500 MW PSP and 30 off-river PSPs with a total capacity of 41,650 MW are under S&I but not in the CEA.

Key developments

The hydropower landscape remained dynamic in 2025, marked by several MoUs, tender bids, auctions and commissioned projects. In March 2025, SJVN Limited signed an MoU with the Chhattisgarh government and Chhattisgarh State Power Generation Company Limited to develop an 1,800 MW pumped hydro storage project (PHSP) in Balrampur district. The total investment for the project is estimated at Rs 95 billion. Furthermore, Uttar Pradesh Power Corporation Limited (UPPCL), in April 2025, issued tenders for 2 GW of PHSPs to increase the state’s energy storage capacity. In April 2025, the CEA approved DPRs for six PHSPs totalling 7.5 GW. In September 2025, Madhya Pradesh Power Management Company Limited, on behalf of Madhya Pradesh discoms and UPPCL, issued a tender to procure 500 MW of energy storage capacity from interstate transmission system (ISTS)-connected PSPs. In November 2025, Adani Green Energy Limited announced plans to invest Rs 150 billion for the installation of two PSPs with a combined capacity of 2,700 MW in Assam. In the same month, the Maharashtra government signed a Rs 80 billion MoU with Haryana’s GSC PSP Maha Private Limited for the development of the 1,500 MW Panchmauli-Devalipada PHSP in Dhule and Nandurbar districts.

Several key power purchase agreements (PPAs) have been signed in this space. In April 2025, Adani Green Energy Limited signed a PPA with UPPCL to supply 1,250 MW of energy storage capacity through a PHSP. The PPA covers supply from the Panaura PSP located in the Sonbhadra district of Uttar Pradesh. Furthermore, JSW Neo Energy Limited, in May 2025, signed a PPA with UPPCL for the supply of 1,500 MW (12,000 MWh) of PHSP capacity in Sonbhadra district, Uttar Pradesh. As per the agreement, JSW Neo Energy will receive a fixed capacity charge of Rs 7.72 million per MW per annum.

The sector has also witnessed a recent wave of project commissioning. During 2025-26, 2,380 MW of large hydropower capacity has been added as of September 30, 2025. This includes NHPC Limited’s Parbati II hydroelectric project (HEP) Unit 4 (200 MW), THDC India Limited’s Tehri PSP Units 1 and 2 (2×250 MW), JSW Energy’s Kutehr HEP Units 1-3 (3×80 MW), Greenko’s Pinnapuram HEP Units 1-5 (5×240 MW), and Greenko’s Pinnapuram Units 7 and 8 (2×120).

Cross-border projects

Apart from domestic projects, Indian hydro players are actively investing in cross-border projects. In November 2024, Tata Power entered the Bhutanese hydropower sector through a partnership with Druk Green Power Corporation Limited (Bhutan’s state-owned generation utility). The collaboration aims to develop 5,000 MW of clean energy capacity, including 4,500 MW from hydropower sources. The projects to be developed in phases include the 1,125 MW Dorjilung HEP, the 740 MW Gongri reservoir project, the 1,800 MW Jeri PSP and the 364 MW Chamkharchhu IV project. Additionally, in September 2025, Adani Power and Druk Green Power signed the shareholders’ agreement for setting up the 570 MW Wangchhu HEP in the Himalayan Kingdom of Bhutan. Further, the 1,020 MW Punatsangchhu-II HEP was inaugurated in November 2025, while work resumed on the 1,200 MW Punatsangchhu-I hydro project, which will be the largest joint India-Bhutan hydropower project.

Apart from these projects, NHPC Limited is involved in three major HEPs – West Seti (750 MW), Seti River-6 (450 MW) and Phukot Karnali (480 MW). NHPC is also in advanced discussions with the Bhutanese government for the potential development of a hydropower project on the Puna Tsang Chu river. SJVN Limited has also been actively expanding its hydropower portfolio in Nepal. The company is currently engaged in three major projects – the 900 MW Arun-3 HEP, which is under construction; the 669 MW Lower Arun HEP, which is in the pre-construction phase; and the 490 MW Arun-4 HEP, which is at the S&I stage.

Policy updates

The central government has renewed its focus on hydropower and PSP development by launching various reforms. In February 2025, the Ministry of Power (MoP) released tariff-based competitive bidding guidelines for procuring stored energy from existing, under-construction or new PSPs, providing a standardised framework for discoms to issue competitive bid tenders. The procurement process is divided into two modes. Mode 1 involves developing PSPs on sites identified by the procurer, operating on a build-own-operate-transfer model for 25-40 years, while Mode 2 allows procurement from PSPs either identified by the bidder or already commissioned, operating on a build-own-operate basis for 15-40 years.

Further, in May 2025, the MNRE issued revised guidelines for small-hydro power schemes. The revised guidelines apply to all small -hydro projects sanctioned under previous schemes and aim to address ongoing sectoral challenges faced by stakeholders. For the release of the remaining central financial assistance, projects must now achieve at least 80 per cent of the projected generation for any one corresponding month as per the DPR. If not, the second CFA instalment will be proportionally reduced. If a project achieves 73 per cent of the projected generation for three consecutive months or cumulative annual generation for one year as envisaged in the DPR, the second CFA instalment will be calculated on a pro-rata basis, with the methodology being provided in the policy document.

In June 2025, the MoP issued amended specific provisions for hydro PSPs. Under the revised provisions, a 100 per cent ISTS charges waiver will be granted to hydro PSP projects for which construction is awarded on or before June 30, 2028. However, hydro PSP projects awarded after June 30, 2028, will not be eligible for the waiver. Further, in August 2025, the power ministry issued a notification for the revision of the capex limit for hydro projects requiring CEA concurrence for PSPs. Projects for setting up hydro generating stations with an estimated capital cost above Rs 30 billion require the CEA’s approval. However, off-stream closed-loop PSPs, regardless of their capital cost, will be exempt from the requirement of CEA concurrence. For projects under the exempted category, developers may seek technical guidance from the authority.

In June 2025, the MoP issued amended specific provisions for hydro PSPs. Under the revised provisions, a 100 per cent ISTS charges waiver will be granted to hydro PSP projects for which construction is awarded on or before June 30, 2028. However, hydro PSP projects awarded after June 30, 2028, will not be eligible for the waiver. Further, in August 2025, the power ministry issued a notification for the revision of the capex limit for hydro projects requiring CEA concurrence for PSPs. Projects for setting up hydro generating stations with an estimated capital cost above Rs 30 billion require the CEA’s approval. However, off-stream closed-loop PSPs, regardless of their capital cost, will be exempt from the requirement of CEA concurrence. For projects under the exempted category, developers may seek technical guidance from the authority.

The way forward

As India accelerates its energy transition, hydropower is emerging as a critical resource for enhancing grid flexibility and reliability. Supported by favourable policies and active project development, the segment is positioned for substantial growth. PSPs are expected to drive the next phase of growth, given their technological maturity, long-duration storage capability and rising interest from both public and private players. Off-river PSPs, in particular, are gaining traction due to their relatively shorter gestation periods and lower implementation risks.

As per the CEA’s National Electricity Plan 2023, the installed hydropower capacity is projected to reach 88 GW by 2031-32, including 26 GW from PSPs, requiring an estimated investment of Rs 3.2 trillion. Further, around 133 GW of hydroelectric potential has been identified across India. The evaluated potential for small hydro is about 21,133 MW across 7,133 identified sites, as per a study by IIT Roorkee. Meanwhile, PSPs have an identified potential of 181.35 GW, with significant opportunities of 68.19 GW and 60.47 GW in the western and southern states respectively. To realise this potential, it is crucial to address persistent challenges such as long construction timelines, delays in environmental clearances and land acquisition hurdles. In addition, policy measures such as a dedicated remuneration mechanism for hydropower (particularly PSPs), access to affordable financing and the modernisation of ageing assets will be key to sustaining growth in the segment.

Net, net, as India moves forward on its clean energy journey, the coming years will be crucial in determining whether the government can turn its large hydro potential into reality. With the right mix of policy support, financial backing and strategic implementation, the hydropower sector could emerge as a cornerstone of India’s energy security.