This is an extract from a recent report “The Age of storage: Batteries primed for India’s power markets” by EMBER.

Role of batteries in India’s power market

Extreme price swings in wholesale electricity markets and growing concerns around grid instability are opening up new markets for energy storage. Batteries are now a critical solution to drive value for both capital and consumers. Battery participation in power markets, without long-term contracts, has often been viewed as a low-return business riddled with uncertain revenue streams. But India’s evolving electricity landscape has created an environment where battery energy storage systems (BESS) can earn strong returns from power exchanges, while offering critical system-level support to the grid.

Batteries are increasingly recognised as the multitool of the power sector transition. A flexible solution capable of addressing various challenges emanating from a high-renewables grid, from storing low-cost renewable energy to ensuring real-time grid stability, batteries solve several problems. Yet their large-scale deployment has, until recently, been constrained by high upfront costs and uncertain revenue streams.

As more variable renewable energy enters India’s electricity grid, coinciding with sharp declines in battery costs, new business cases are emerging for BESS. One particularly promising opportunity is battery participation in India’s wholesale power and ancillary services market. Price volatility in the day-ahead market segment of the power exchanges is becoming the norm. Electricity prices are now regularly crashing during solar hours and surging during the evenings and nights. BESS can buy electricity, charge when prices are low and sell when the rates surge. This unique ability allows them to not only generate revenue from the market inefficiency but also reduce the volatility over time. The report finds that this kind of arbitrage alone is enough to recover the full lifecycle costs of BESS. Add ancillary (grid balancing) services, and the scenario improves further. Batteries’ ability to store energy and ramp quickly can fundamentally reshape how grid balancing reserves have worked in India. With the regulatory groundwork in place and the economics making sense, BESS, even without long-term power purchase agreements, appears poised to balance a renewables-heavy grid while delivering strong returns.

Market challenges

The ability of BESS to charge during low-price surplus periods and discharge during high-price peaks makes it well-suited to manage price volatility. However, the core principle remains: the revenue opportunity of merchant BESS is proportional to the magnitude of the problem it addresses—in this case, the extent of price volatility.

The ability of BESS to charge during low-price surplus periods and discharge during high-price peaks makes it well-suited to manage price volatility. However, the core principle remains: the revenue opportunity of merchant BESS is proportional to the magnitude of the problem it addresses—in this case, the extent of price volatility.

Price volatility in the day-ahead market segment of the power exchanges is becoming the norm. Electricity prices are now regularly crashing during solar hours and surging during the evenings and nights. In 2025, there have been several mid-day price crashes across market segments. Unexpectedly low demand due to unseasonal rains, combined with surplus mid-day generation, particularly from solar, were the key drivers of the crashes. On many of the same days, prices surged in the evening, often touching the market price cap.

In January 2025, the gap between the average mid-day and late evening prices rose from Rs 1.5 per kWh in 2019 to Rs 5.5 per kWh in 2025, a 24 per cent annual increase. In June 2025, this gap jumped from Rs 2.5 per kWh to Rs 7.5 per kWh, reflecting a 17 per cent rise. Since 2022, peak prices above Rs 9 per kWh have occurred around 6,500 times annually, nearly 18 per cent of all time blocks. Meanwhile, ultra-low prices below Rs 1 per kWh are rising quickly, from 375 instances in 2024 to 514 in just the first half of 2025. One thing is clear: such market swings are no longer isolated events; they are becoming a regular feature on India’s power exchanges.

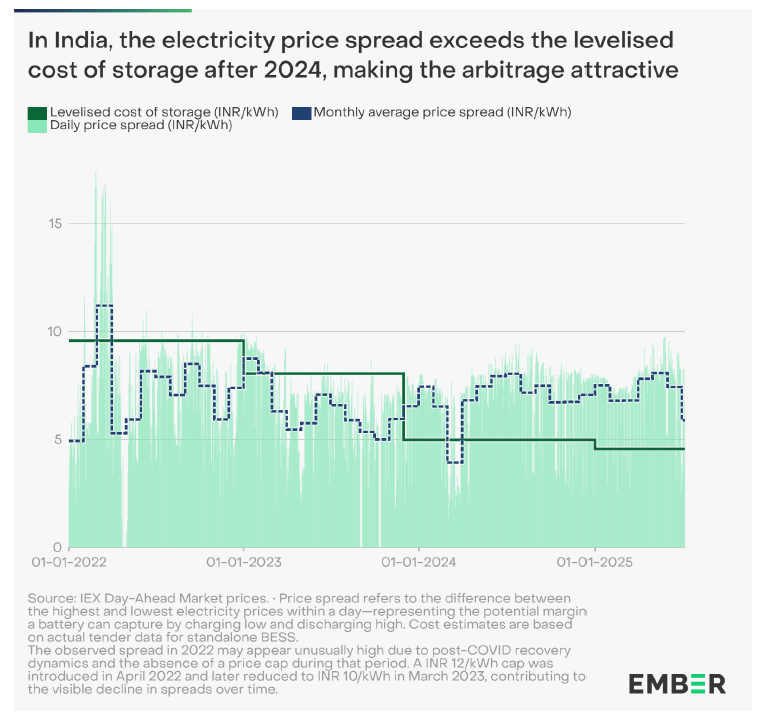

Large fluctuations or volatility in prices can disrupt any market. The figure above shows the daily hourly gap between the highest and lowest DAM prices across each 24-hour cycle, the average spread across each month and the LCOS. Frequent price crashes can severely impact the cash flows of existing merchant generators and discourage new capacity from entering the power markets. In India, solar’s share in total generation rose from 3.3 per cent in 2019 to 7.4 per cent in 2024, while the estimated average annual capture rate on the IEX Day ahead market (DAM) dropped from 93 per cent to 70 per cent in the same interval. Clearly, falling capture rates affect the profitability of merchant solar, which is primarily designed to operate in power exchanges.

Grid frequency is also a critical indicator of the health of the power system. As per the Indian Electricity Grid Code, the acceptable frequency range is 49.90 Hz to 50.05 Hz, with 50 Hz as the national reference frequency. Deviations beyond acceptable limits can compromise reliability. On 26 May 2025, both upward and downward spinning reserves were inadequate. Downward reserves were near zero for five mid-day hours, while upward reserves were zero for three hours late at night. Such conditions expose the grid to unexpected outages, with limited capacity to restore balance quickly. Such instances have become more frequent and now represent systemic issues.

Economics of merchant BESS

Merchant batteries are poised for attractive returns in India. Battery storage in India has moved from a promising technology to a fully bankable grid asset. A significant drop in battery costs and widening wholesale-price spreads mean a well-operated system can cover its expenses and still deliver attractive profits.

Over the past decade, battery costs have declined significantly from around Rs 7.9 million per MWh in 2015 to Rs 1.7 million per MWh in 2025 (an average year-on-year decline of 14 per cent). In parallel, revenues from market participation have increased fivefold, from Rs 0.5 million per MWh in 2015 to Rs 2.4 million per MWh in 2025. In 2024, estimated revenues surpassed costs for the first time, marking a fundamental shift in the business case for Merchant BESS.

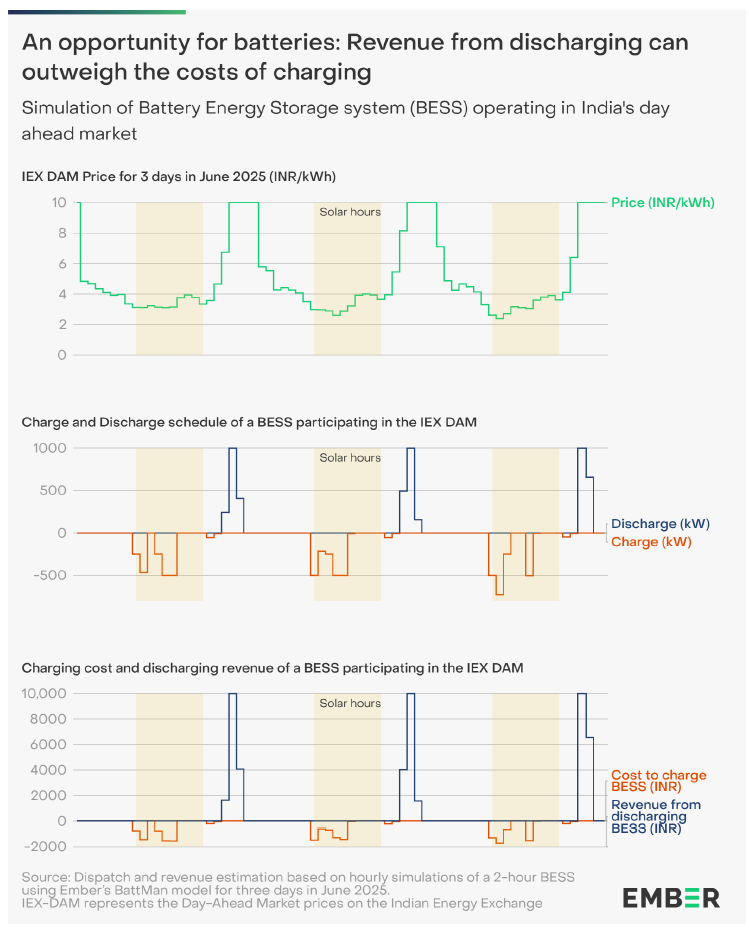

A system installed in 2025 can earn around Rs 2.7 million per MWh per year from day-ahead market arbitrage, plus Rs 0.7 million per MWh per year from ancillary services, averaged over its lifetime. Arbitrage in the DAM contributes nearly 80–85 per cent of total earnings, while ancillary services account for the remaining 15–20 per cent. Under optimistic assumptions, annual revenues reach Rs 3.3 million per MWh, pushing project internal rate of returns (IRRs) to around 24 per cent. Even under conservative price spreads, returns remain strong at 21 per cent. Merchant BESS with 1–2 hour durations earn higher IRRs (15–22 per cent) than 4-hour systems (13–18 per cent) because of their ability to exploit greater price arbitrage through faster charge-discharge cycles. The chart below illustrates how a 2-hour battery can capture DAM price spreads over three days in June 2025, using 2024 IEX-DAM prices. When price spreads in the DAM consistently surpass LCOS, it signals that batteries can earn enough from pure arbitrage to recover their full lifecycle costs.

Different variables, both financial and technical, can significantly affect the returns of a BESS project. Yet the overall uncertainty introduced remains limited, with IRR fluctuating by only ±2 per cent. This indicates that BESS projects can maintain attractive returns despite variability across cost and technical parameters.

Conclusion

The strong business case for merchant BESS offers the chance for batteries to fulfil their long-held promise of being critical to support a high-renewables grid. With rising price volatility and the growing need for fast-acting reserves, the case for battery storage is clear. They deliver critical system-level value in two key areas:

- Reducing price volatility and improving liquidity in short-term markets.

- Enabling fast response for real-time grid balancing.

Recently, India hit a milestone of 50 per cent non-fossil fuel power generation capacity. The ability of its electricity grid to keep accommodating more variable renewable energy will depend on whether developers, investors and stakeholders are able to accelerate the dawn of the age of battery storage.

Acces the report here.