This is an extract from a recent report “The Climate Response: Tapping into India’s climate and energy transition opportunity” by Deloitte. It covers the investment landscape of India’s climate and energy transition, highlighting sectoral opportunities, financing pathways, and the scale of capital required to meet national climate targets.

Scaling capital for climate goals

With countries placing greater emphasis on building a low-carbon economy, the importance of climate finance has never been more pronounced. As economies evolve, energy demands shift, and climate risks intensify, financial mechanisms lie at the heart of navigatiethanong this transformation. India, one of the fastest-growing economies in the world, is aligning its development goals alongside its climate commitments, with energy demand set to triple by 2050. While fossil fuels, particularly coal, currently make up 59 per cent of its energy mix, India is taking bold steps toward decarbonisation with targets like 500 GW of non-fossil fuel energy by 2030, a 45 per cent reduction in emissions intensity from 2005 levels, and a net-zero emissions goal by 2070.

To support this transition, a significant financial boost is needed. The country will require an estimated $1.5 trillion by 2030 to fund climate mitigation and resilience efforts. This investment will not only reduce emissions but also boost job creation, enhance energy security, and protect vulnerable communities from climate risks. Financial instruments, such as green bonds, climate funds, and blended finance models, are playing an increasingly important role in mobilising capital for sustainability initiatives. Unlocking investment at scale and ensuring equitable access to climate finance, will help drive long-term resilience in India’s most climate-sensitive sectors. By strategically harnessing climate finance, India can accelerate its decarbonisation efforts, offering immense investment potential in sectors poised for sustainable growth and innovation.

India’s climate vision, policies and opportunities

In December 2015, 194 states and the European Union adopted the Paris Agreement to limit the rise in global temperature to well below 1.5°C. India presented five nectar elements (Panchamrit) at COP26: Reduce emissions intensity by 45 per cent by 2030 (base year 2005); meet 50 per cent of its energy requirements from renewable sources by 2030; cut total projected carbon emissions by 1 billion tonnes by 2030; take non-fossil energy capacity to 500 GW by 2030; and achieve net-zero emissions by 2070. India also co-founded the International Solar Alliance to attract $1 trillion of investment in solar projects by 2030 and launched the Global Biofuels Alliance at the G20 Summit in 2023.

Currently, the investment opportunities in the renewable energy sector are categorised into Advanced components manufacturing; Power generation with investment of around $200–250 billion by 2030; and Power transmission & distribution supported by grid expansion, adding 180,000 kilometres in the past decade (a 60 per cent increase).

India’s National Action Plan on Climate Change covers mitigation, adaptation and strategic knowledge. Key policies include Perform, Achieve and Trade; Renewable Purchase Obligation; alternate fuel mandates; biofuel policy; Green Hydrogen Consumption Obligation; and Extended Producer Responsibility. India aims to reduce emissions intensity by 45 per cent by 2030, achieve about 50 per cent installed electricity capacity from non-fossil fuel by 2030, and create an additional carbon sink of 2.5–3 billion tonnes of carbon emissions by 2030.

Sectoral investment opportunities

Sectoral investment opportunities

By 2030, India aims to achieve 500 GW of installed renewable energy capacity. India needs to add 300 GW over the next six years to bridge the gap between the announced target of 500 GW and the current 209.44 GW installed capacity. Capacity addition, associated grid integration and expansion requirements will require significant investments.

PLI scheme for Solar PV (2021) has an outlay of Rs 240 billion, offering Production Linked Incentives to selected solar PV module manufacturers. The PM Surya Ghar-Muft Bijli Yojana (2024) is designed to offer free electricity to households across India, with an outlay of around $9 billion. Other policies include Green open access (2022) and General network access regulations (2023).

In FY 2023-24, India had an installed ethanol production capacity of around 10.9 million metric tonnes per annum (MMTPA), with sugar accounting for 65 per cent of this capacity and grain-based production accounting for 35 per cent. The capacity is forecasted to increase to 15 MMTPA by 2030 to maintain the 20 per cent blending mandate with electric vehicle penetration increasing to 30 per cent. This will translate into an investment outlay of $2–4 billion over the next five years. Bioethanol production capacity is forecast to reach 19.5 MMTPA by 2035, with a total investment outlay of $4–6 billion.

India has the potential to produce 8–10 million tonnes of sustainable aviation fuel (SAF) based on its feedstock availability by 2040, of which India can aim to produce 2–3 million tonnes by 2030. These 2–3 million tons of production capacity will far exceed the potential domestic demand of 0.7–0.8 million tonnes of SAF at a 5 per cent SAF blending, resulting in a significant export opportunity. Such capacity addition by FY 2029-30 will require a capital outlay of $18–22 billion. For India to achieve its full potential of 8–10 million tons of SAF, overall capital investment of $70–85 Billion would be required.

The investment landscape for compressed biogas (CBG) production in India is promising, driven by robust government initiatives. This sector offers substantial economic potential, with an estimated investment requirement of $25–30 billion by 2030 and $45–60 billion by 2035. CBG production presents a stable and attractive investment opportunity, and is supported by long-term revenue contracts and priority sector lending benefits.

Moreover, the country aims for 5 MMTPA of green hydrogen production by FY 2029-30 under the National Green Hydrogen Mission. The national government has earmarked $2.2 billion for the mission, with $1.6 billion to incentivise green hydrogen production and $600 million for electrolyser manufacturing. It is estimated that India will need 60–100 GW electrolsyer capacity by FY 2029-30, which can potentially lead to an investment opportunity of $20–25 billion rising up to $35–40 billion in FY 2034-35. The investment required to set up the complementary ammonia production and storage capacity is estimated to be $9 billion by FY 2029-30. The renewable energy needed to sustain this infrastructure will cost $67 billion in FY 2029-30 and rise to $99–120 billion in FY 2034-35. Potential investment opportunity across the green hydrogen value chain in India in the areas reviewed could be $100 billion by 2030 and $145–170 billion by 2035, including investment required for setting up renewable energy.

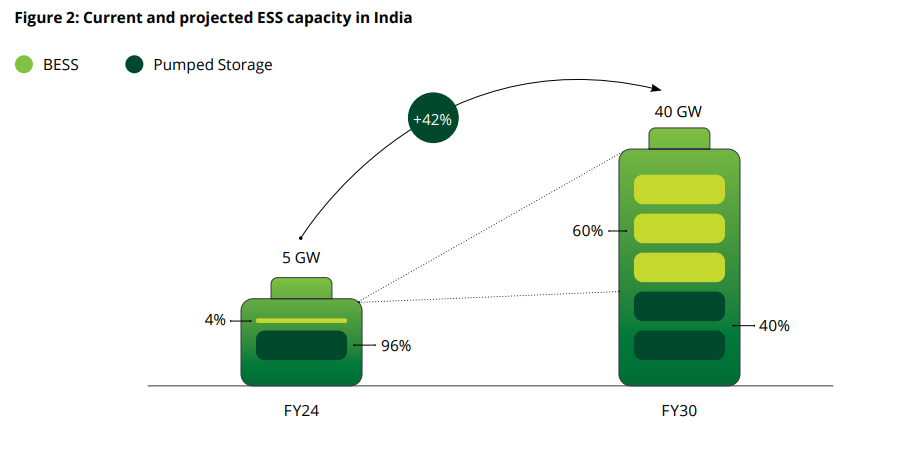

India’s current energy storage solutions capacity is around 5 GW and is estimated to post a 42 per cent current anaual growth rate to reach 40 GW by FY 2029-30. The capital expenditure (capex) required averages around $6.5 million per MW for pumped hydro storage and around $7 million per MW for battery energy storage system. The total capex needed to achieve the FY 2029-30 target aggregates to around $270 billion, and will be worth $600 billion in FY 2034-35.

Financing channels and policy enablers: public, private, blended capital

Multiple investments in the sector have come in through various routes: Direct investments, joint venturess and acquisitions. Various policy initiatives introduced by the Indian government have propelled private players to enter the renewable energy space, including Indian conglomerates, multinational corporations and private equity funds. Public sector enterprises are also playing a significant role in forging energy collaborations through necessary technical and financial support by the government for projects in these areas.

India has already issued several green bonds, raising billions of dollars for renewable energy and other sustainability projects. As of 2023, India had issued a total of $21 billion in green bonds, including significant fund allocations to water management projects. Water-related projects have become increasingly important, representing about 12 per cent of the total green bond issuance in India by 2023.

The Global Innovation Lab for Climate Finance has developed several blended finance instruments that have mobilised over $2 billion in private investment for climate-related projects worldwide. These instruments are being adapted to the water sector in India to attract the necessary capital for large-scale water infrastructure projects and technological innovations. More than 55–60 per cent of the private capital invested in the Indian water management market is through public-private partnership projects.

Towards a low-carbon future

A circular economy and waste management approach shifts from a linear “take-make-dispose” model to recycling, reusing and regenerating materials, lowering emissions and reducing resource extraction. Sustainable transport infrastructure including electrified public transport, high-speed rail, smart cities and urban mobility solutions will cut transport-related emissions. Sustainable agriculture can improve soil health, enhance carbon sequestration and reduce resource use. Digital systems and platforms such as AI monitoring, climate forecasting and blockchain-based carbon tracking will enhance decision-making.

Sectors like steel, cement, power, refining, chemicals, mining and aluminium require operational efficiency, low-carbon power or fuels, advanced electrification, bio-based feedstocks, green hydrogen and carbon capture utilisation and storage to decarbonise. Decarbonising these hard-to-abate sectors requires substantial capital investment, industry collaboration and innovation.

India’s ambitious climate and energy targets present significant opportunities. By strategically mobilising capital and harnessing policy frameworks, India can transition to a resilient, low-carbon economy, offering immense investment potential and leading a global paradigm shift towards sustainability.

Access the full report here.