By Karan Sharma

India’s renewable energy transition is accelerating, with solar power at the forefront. As of March 2025, the country’s installed solar capacity stood at approximately 105.65 GW, with the government targeting 280 GW by 2030. This growth is being driven by the expansion of ultra-mega solar parks and decentralised solar plants.

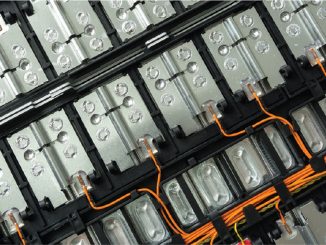

While the focus is primarily on solar modules, inverters and storage technologies, the less visible but equally critical balance of system (BoS) components, such as solar cables and connectors, form the electrical backbone of solar installations. These components ensure efficient electricity transmission, operational reliability and safety. As the sector transitions to 1,500 V systems, performance expectations for cable insulation, thermal stability and connector endurance have increased. Moreover, with the uptake of emerging solar plus storage and floating solar projects, the industry requires cables and connectors that perform reliably under diverse climatic and operational conditions.

Renewable Watch delves into the current status, industry developments and technological advancements across India’s solar cable and connector segment, covering both DC and AC systems.

Solar cables and connectors: DC side

Current status and quality standards

DC cables connect photovoltaic modules to inverters and are rated for up to 1,500 V DC. These cables endure UV radiation, temperature fluctuations and moisture over a lifespan of 25 years or more. Recognising the importance of safety and performance, In August 2023, the Department for Promotion of Industry and Internal Trade issued the Solar DC Cable and Fire Survival Cable (Quality Control) Order, 2023, mandating Bureau of Indian Standards (BIS) certification for solar DC cables. This order prohibited the import or sale of non-compliant products. The move brought uniformity and safety to the Indian solar cable market. It pushed manufacturers to align with stricter quality norms, improved product reliability and helped phase out substandard cables to some extent. To further enforce quality standards, in March 2025, BIS issued guidelines for the implementation of the revised quality control order (QCO) for solar PV modules. The revised standards now mandate the qualification of components such as junction boxes, connectors and cables with specified compliance benchmarks. Cables must meet the IS 17293:2020 or IEC 62930 standards, while DC MC4-type connectors must comply with IS 16781:2018 or IEC 62852. The guidelines have also introduce standard terminology for electrical spacing, such as creepage and clearance distances. They aim to ensure that the modules meet international safety benchmarks, including resistance to ingress, shock and temperature fluctuations

Industry developments

Rapid electrification, infrastructure development and growth in the power transmission and distribution sectors have increased the overall demand for cables. In particular, the rise in utility-scale projects, along with the introduction of clearly defined quality standards, has prompted domestic cable manufacturers to scale up production and modernise their solar cable technology.

APAR Industries Limited has incorporated electron-beam (E-beam) crosslinking technology to produce solar cables with cross-linked polyolefin (XLPO) insulation rated for continuous operation at 105 °C, complying with international standards. Havells commenced commercial production of cables at its new manufacturing facility in Tumakuru, Karnataka, in September 2024. The facility spans over 27,870 square metres and focuses on the production of low voltage, instrumentation and control cables, which are key components for inverter rooms and BoS applications. The company further announced plans to expand the cable manufacturing capacity of this facility from 348,000 km to 462,600 km per annum by September 2026, with an additional investment of Rs 4.5 billion. Moreover, in May 2025, KEC International, through its subsidiary KEC Asian Cables, invested Rs 650 million in the commissioning of an aluminium conductor cable plant in Vadodara and upgrading its low tension cable lines, resulting in increased production capacity for its solar cables.

Connector manufacturers, too, are responding to market needs. MC4-compatible connectors, once dominated by international companies such as Stäubli and Amphenol, are now being produced domestically at scale by several Indian manufacturers, including Elmex and Connectwell. These companies have released upgraded solar connector models featuring IP68 weather proofing, with better contact resistance and support for higher current ratings.

Technology trends

The DC cabling segment is undergoing a phase of rapid innovation to cater to evolving project needs. Aluminium-core solar cables are being increasingly used as a cost-effective alternative to copper in large-scale projects, where material cost efficiency is critical. Pre-terminated DC harnesses are gaining popularity due to their ability to reduce on-site installation time and minimise manual labour, especially in rooftop and utility-scale solar projects. Smart solar cables with embedded thermal and current sensors are another emerging technology, enabling real-time monitoring, predictive diagnostics and early fault detection. This is particularly useful for large solar farms that rely on predictive maintenance strategies. Insulation materials are advancing with the wider adoption of XLPO and halogen-free compounds. These materials provide thermal resistance that can operate at 105 °C and exhibit low smoke and toxicity, enhancing fire safety and environmental compliance.

In response to the rise of floating solar projects, manufacturers like RR Kabel and Helukabel India are introducing waterproof and submersible cables resistant to moisture and humidity, without compromising on the electrical performance. Additionally, the rise of solar plus battery energy storage systems has increased demand for shielded instrumentation and control cables. These cables offer high signal integrity and reduce electromagnetic interference, critical for the safe operation of digital substations and inverter systems.

High voltage transmission cables and connectors: AC side

Current status and quality standards

Once the DC power is converted to AC by inverters, it travels through a cables ranging from low voltage (1.1 kV) to medium (11-33 kV) and high voltage (up to 400 kV) lines, before reaching substations and the grid. These AC cables, critical in inter-array connections and long-distance evaluation, must comply with IS 7098 standards and, at higher voltages, with IEC 60840 and IEC 62067 for cross-linked polyethylene (XLPE)-insulated cables.

India’s expanding solar infrastructure is closely linked to its transmission development. The green energy corridor (GEC) Phase II, plans a transmission network to evacuate around 20 GW of renewable power from solar parks and wind farms, particularly in states like Gujarat, Rajasthan and Tamil Nadu. Since many solar parks are situated in remote areas, substantial investment in high voltage cables is required to efficiently transmit power over long distances to substations and the main grid.

Industry developments

Driven by the expansion of utility-scale solar parks and the government’s GEC plans, Indian cable manufacturers are scaling up their medium voltage/extra high voltage (MV/EHV) production capacity. KEI Industries is expanding its Silvassa and Chopanki units, with ongoing investments throughout FY 2024-25 and FY 2025-26 aimed at boosting the production of cables across the 33-220 kV range. Polycab added new production lines for 33 kV cables during FY 2024-25, in response to high utility demand. Havells, in July 2024, announced the expansion of its cable manufacturing capacity from 3.29 million km per year to 4.12 million km per year at its Alwar plant. Universal Cables Limited, in February 2025, raised its capex from Rs 2.77 billion to Rs 4.82 billion to expand its Satna and Verna facilities. Around 31,575-32,850 km of new MV/EHV capacity is expected to be operational by March 2026.

Technology trends

On the AC side, technological advancements are reshaping the design and execution of high voltage solar transmission infrastructure. E-beam XLPE insulation is being increasingly adopted due to its thermal and mechanical properties. These cables can operate continuously at 90 °C and withstand short-term peaks of 105 °C. This makes them well suited for projects in hot and arid regions, contributing to longer service life in demanding solar park environments.

Outlook

The development of solar cables and connectors is foundational to India’s renewable energy ambitions. As projects scale in complexity and scale, high quality, durable and compliant cables are essential for safe operations, high energy yields and reduced transmission losses. Enhanced quality in both DC and AC cable segments has already led to improvements in fire safety, thermal performance and project bankability.

However, several challenges remain. In rooftop and small-scale solar projects, substandard or uncertified cables continue to be used due to cost constraints and limited awareness. This poses safety risks, leads to premature cable failure and undermines investor confidence. Meanwhile, in large utility-scale projects, developers frequently encounter delays and cost overruns due to the limited domestic availability of EHV cables, XLPE accessories and E-beam-treated components. The lack of in-house manufacturing capacity for insulation compounds and conductors further adds to the challenge. Interoperability remains another significant issue. Connectors and cables from different manufacturers may vary in crimping profiles, insulation thickness or contact resistance. These mismatches can cause DC losses and higher maintenance costs, particularly in 1,500 V systems where higher currents amplify inefficiencies.

Addressing these gaps will require a coordinated effort. First, a stricter enforcement of quality norms under QCOs is needed, particularly for the rooftop and distributed solar segments. Second, India must expand its domestic manufacturing capacity for advanced cable types, including EHV and sensor-integrated smart cables. Financial incentives like the production-linked incentive scheme or custom duty rationalisation tailored for cable components could catalyse these investments. Third, targeted training programmes for engineering, procurement and construction contractors, discoms, and state nodal agencies are necessary to ensure correct installation practices, connector compatibility and compliance monitoring.

Going forward, industry-wide adoption of quality norms, better inter-manufacturer coordination and a push for indigenous technology development will be critical. As India its 280 GW solar goal, a reliable cabling infrastructure will be the invisible yet indispensable that powers the country’s energy transition.